Want the best card reader for your small business?

The 11 mobile credit card machines listed below make it easier than ever for UK small businesses to accept card payments almost anywhere.

No need for a dedicated merchant account or expensive rental contract or any of the other hassles that come from more traditional payment processing companies.

Short on time?

Current Best Card Machine Deals

|

Here’s what you need to know:

- Cheapest card payment machine: The Square Reader is normally the cheapest on the market at just £19 + VAT. (Although currently the Tide Reader is just £19.99 + VAT) You can buy it directly on the Square website.

- Best iPhone App: The Square and Revolut card readers have the highest rated iPhone apps.

- Best Android app: Square and Revolut also both have the best Android apps.

- Best small business solution: The Tide Card Reader integrates with Tide’s business bank account to give you both a card reader and bank account all in one. You can get yours by clicking here.

- Lowest Transaction Fees: This will depend on your business type and monthly revenue. Both Worldpay and Dojo Go offers bespoke rates to businesses processing over £150k a year.

- Best for customer service: Worldpay is currently the only company that offers customer support 24/7 365 days a year (including Christmas Day) primarily from their UK based call centre.

- But your best bet is to click and get quotes from our partners. They will offer you lower rates than the companies below for businesses that process £10k a month or more in card payments.

Need more information? Then keep reading for a detailed breakdown of each option:

The table below compares the companies on their key features:

| Card Machine | Price* | Transaction fees | Deal |

|---|---|---|---|

| Square Reader | £19 | 1.75% | Visit Site |

| Tide Card Reader | Visit Site | ||

| SumUp Air Card Reader | £34 | 1.69% | Visit Site |

| myPOS Go 2 | £29 | 1.10% + £0.07 | Visit Site |

| Dojo Go | Monthly Rental | 1.4% + 5p or less | Visit Site |

| WorldPay | Monthly Rental | Bespoke | Visit Site |

| Revolut Reader | £49 | 0.8% - 2.6% + £0.02 | Visit Site |

| Shopify WisePad 3 Reader | £49 | 1.7% or less | Visit Site |

| Zettle Reader | £29 | 1.75% | Visit Site |

| Barclaycard Anywhere | £29 | 1.6% | Visit Site |

| Takepayments Mobile | Monthly Rental | Varies | Visit Site |

| Tyl (by Natwest) PAX A50 | Buy: £75.00 Rent: £6.99 per month | 1.5% (excluding Amex) | Visit Site |

* Prices exclude VAT and are accurate as of July 2025.

These card readers can be great for small businesses just getting started. But the trade-off is that they often charge higher fees compared to dedicated payment processing companies, usually do not offer the full flexibility of accepting card payments online or over the phone and may not look quite as professional as dedicated PDQ machines.

Therefore, while you should definitely have a look at all the companies below, you should also consider comparing card reader companies using our form at the top of the page as well.

For more about what each companies offers in greater detail have a look at our full company profiles below.

1. Square

- Take chip and PIN and contactless...Show More

- Take chip and PIN and contactless payments for one flat rate: 1.75%.

- Accept all major credit cards including American Express and mobile payments.

- Receive funds next business day

Square is an American company and is the largest provider of mobile credit card machines and readers in the world. Although they’re still somewhat new in the UK, they have quickly become the second most popular option among small businesses searching online.

It was co-founded by Jack Dorsey who also co-founded Twitter and currently handles over £84 billion ($112 USD Billion) worth of payments globally each year.

Below we look at the costs along with some of the pros and cons of using the Square Reader (now in it’s 2nd generation) to handle your payments.

Square Reader Features

- Square lets you take chip and PIN cards, contactless cards, and other mobile payments like Apple Pay and Google Pay.

- Accept Visa, Mastercard and American Express all for one low rate.

- See deposits in your bank account as soon as the next business day.

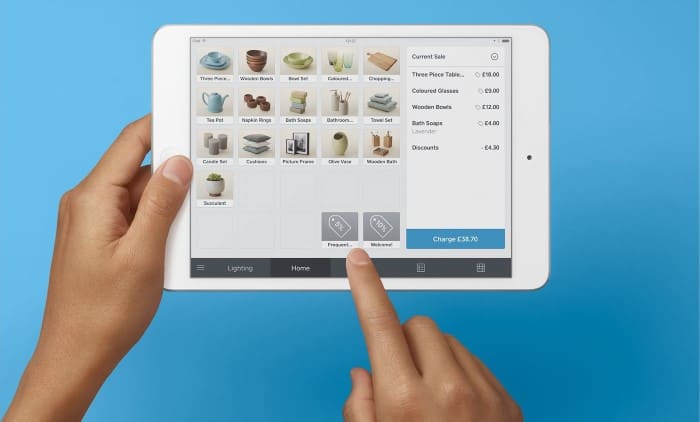

- Includes a a free point-of-sale app (Works on Apple and Android devices including both Smartphones and Tablets).

- Option to save cards on file

- Can also be used to sell online, by phone and collect payments via invoices

- Connects wirelessly to your Apple or Android device via Bluetooth.

- Battery lasts all day

- Huge range of optional add-ons

- Card reader is currently priced at just £19 (+ VAT)

To see all features visit the Square website.

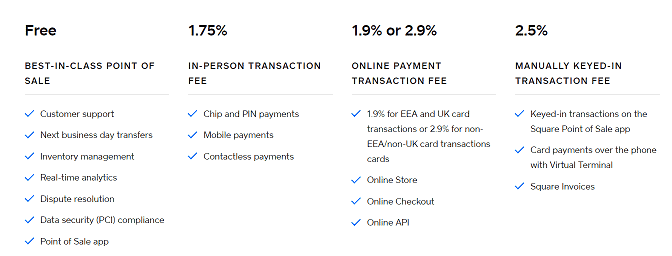

Square Reader Cost

The Square Reader is now priced below the Zettle Reader, at just £19 + VAT, making it the cheapest option on the market.

You can buy it directly on the Square website.

Square Reader Transaction Fees

Square’s transaction fees are pretty much exactly the same as Zettle’s just 1.75% for chip & pin or contactless payments (for all cards including Amex).

For keyed-in (e.g. phone orders), online or invoice payments they charge 2.5% due to the slightly higher risks involved.

Other fees include:

- Online payment fees: 1.4% +25p (for UK card transactions) or 2.5% + 25p (non-UK card transactions cards)

And unlike Zettle there are no minimum transaction value.

So if you’re just going to use it as card machine, you’ll get one of the best rates in the market today with fewer restrictions.

Square Set-Up & Monthly Fees

Beyond paying the £19 for the card reader and the transaction fees above, there are no other hidden or monthly fees from Square.

However, like all the devices listed on this page you’ll need a valid data plan with your mobile phone provider.

Square Contract

There is no contract required for using a Square Reader and no charges for inactivity.

Other Square Card Machines

In addition to the standard Square reader they also offer a more powerful terminal. See how they compare:

Square Add-ons

Of all the mobile credit card readers on this page, Square currently has the most to offer in terms of add-on features and functionality.

Some of these include:

- Square Terminal: All-in-one device that allows you to take payments and print receipts from one machine.

- Square Stand: Turn your iPad into a point of sale.

- Square Register: A powerful till system with integrated POS & payments

- Dock for Square Reader

- Receipt Printers

- Cash Drawers

- Barcode Scanners

- Full hardware kits

- Inventory management via the App.

- Invoicing software that allows people to pay you via card online (2.5% rate applies).

- Ability to sell online via their Ecommerce API. (2.5% rate applies)

- Virtual Terminal so you can take payments by phone or mail (MOTO payments) – 2.5% rate applies.

- Can synch with other apps and software you use for things such as accounting, analytics, e-commerce and more.

- Can track employees performance via the app.

- Can track multiple locations.

Square Reader Summary

- Cheapest card reader at just £19 (+ VAT)

- No contract or monthly fees

- Accept Visa, Mastercard and American Express all for one low rate

- Works with Apple Pay and Google Pay

- Get money as soon as the next business day

- 1.75% transaction fee is not the lowest on the market

- No built-in printer with basic reader

While the Square Reader is the core payment processing product offered by Square, it’s more than just a simple card machine. If you wanted to, you could use Square to manage payments across your entire business.

The basic card reader now costs a little less than Zettle. With their fees being identical, the real choice comes down to how many additional features you need.

If all you need is a card reader and nothing else both Zettle and Square will do the job well. But if you need additional features Square likely has a few more and they also offer the Square Terminal if you need something more.

To get started with the Square visit their website here.

- Take chip and PIN and contactless...Show More

- Take chip and PIN and contactless payments for one flat rate: 1.75%.

- Accept all major credit cards including American Express and mobile payments.

- Receive funds next business day

For more read: 2024 Square Card Reader Review

2. Tide Card Reader

Tide is one of the leading free business bank account providers in the UK. And they’ve just recently launched two new card readers. Their standard model and their Plus model.

Below we look at the key things you need to know about them:

Tide Reader Features

- No monthly contract and low 1.39% + 3p transaction fees

- Includes a free business bank account

- Accept card and mobile payments on the go

- Free unlimited 4G data, no Bluetooth required

- Receive funds in just 1-3 business days

- Offers two different card readers depending on your needs

- Accepts Visa, Mastercard, ApplePay, GooglePay (Corporate, international and UK consumer cards)

- 4 month device warranty as standard

- Tamperproof design complies with anti-fraud security standards

- Full day of battery life

- Receive payments directly into your Tide account

- Monitor your card sales income in the Tide app

Tide Reader Cost

The basic Tide Card Reader costs £59 + VAT Now just £19.99 + VAT for a limited time. They also offer their Plus model which includes a receipt printer and does not require the use of the App for just £79 + VAT £29.99 + VAT for a limited time.

Tide Reader Transaction Fees

Tide charges a flat 1.39% +3p transaction fee. This fee is lower than some competing card readers because Amex cards are not accepted as standard. However, they do accept all Visa, Mastercard, ApplePay, GooglePay including business, international and UK consumer cards.

Tide Set-Up & Monthly Fees

Tide has no set-up or ongoing monthly fees and even includes a free business bank account.

Other Tide Card Machines

Tide offers two different machines, here are some of the key differences between them.

Tide Card Machine Add-ons

At the current time Tide only offers the two machines listed above and does not have any add-ons. This may change in future.

Tide Card Reader Summary

- Includes a free business bank account

- Low of fees of just 1.39% + 5p to start

- Accepts Visa, Mastercard, ApplePay, GooglePay (Corporate, international and UK consumer cards)

- Tide Card Reader Plus is cheaper than similar models from Square and SumUp

- No monthly fees!

- Initial cost of £79 is higher than the cheapest companies, but currently £19.99 for a limited time.

- Amex cards not included as standard

Tide offers a very unique solution when it comes to card machines by including both a business bank account and card reader in one package.

To get started with Tide you just need to follow the following 3 steps:

- Sign up for a free Tide business bank account and download the Tide app

- Order your Card Reader within the Tide app (it’ll arrive within 5 days)

- Charge the battery to full and you’re ready to go!

Click here to get started with Tide

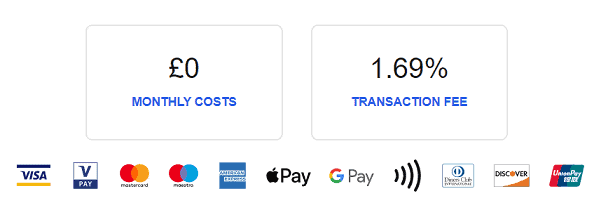

3. SumUp Air

SumUp is a dedicated, standalone credit card machine provider similar to Square and Zettle.

SumUp’s major selling point is that it offers a simple, flat transaction fee of just 1.69%. This is great for businesses that process low volumes of card transactions. However, for businesses that process a higher volume of payments it might not be the right choice.

SumUp Features

- Accept all debit and credit cards via Chip&PIN, contactless, Google Pay and Apple Pay

- Accept Visa, VPay, Mastercard, Maestro, American Express, Diners Club, Discover, and Union Pay.

- Pay with tap of their card or their phone (contactless), Chip & PIN or magnetic swipe

- No fixed monthly costs

- 100% online application with no contract and no paperwork

- Card reader connects via Bluetooth and is compatible with iOS / Android phones and tablets

- Process 500 transactions on a single charge

- Option to sell online

- Also have their own dedicated POS solution: SumUp Point of Sale

- Offer an optional business account with a pre-paid Mastercard

SumUp Machine Cost

The SumUp Air card machine currently costs £39 + VAT (click here to buy). This is lower than Zettle’s normal card reader price, but higher than their current promotion price or Square’s normal price.

They also offer a Solo & Printer which costs £139 + VAT and their more advanced Solo card reader (£79 + VAT) both of which eliminates the need for a smart phone.

SumUp Transaction Fees

SumUp’s major selling point is the low initial transaction fee of just 1.69%. This is the marginally lower than either Zettle or Square who charge 1.75%.

This makes them the cheapest flat fee option in the UK market. This is great for businesses that are unsure how much they’re going to be processing each month or businesses that process variable amounts per month (e.g. seasonal businesses).

However, if you process a high volume of payments you might want to look into solutions from companies like Takepayments which can offer even lower transaction fees.

Similar to both Zettle and Square you can also accept payments in the following ways:

- Payment links: 2.50%

- Invoices: 2.50%

- QR codes: 0%

SumUp Set-Up & Monthly Fees

Similar to all the other companies featured here, there are no set-up (beyond buying a card reader) and monthly fees to use SumUp Air. You also get free delivery of your card reader, free Android / iOS app, free dashboard with reporting, and free telephone and e-mail support.

SumUp Contract

You do not need to sign any long-term contract to use SumUp.

Other SumUp Machines

In addition to the Air SumUp also offers two additional models. Have a look below:

SumUp Add-ons

Unlike Zettle and Square, SumUp has relatively few official official addons the main being a charging dock for the Air reader.

SumUp Summary

- No monthly contract or fee

- Low 1.69% transaction fee

- 3 machines to choose from

- 100% online application with no contract and no paperwork

- Accept Visa, VPay, Mastercard, Maestro, American Express, Diners Club, Discover, and Union Pay

- SumUp Air is twice the price of Square

- Limited number of addons

SumUp is currently a strong alternative to Zettle and Square for businesses with lower transaction fees, but without all the bells and whistles of their competitors.

To get started with SumUp visit their website here.

Or to learn more read our 2024 SumUp Review.

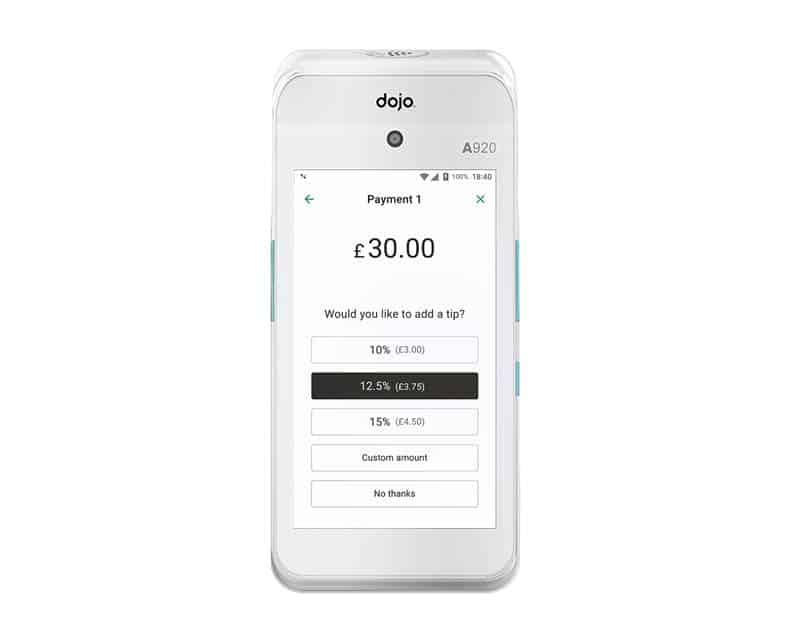

4. Dojo Go

Dojo Go is a recent entrant to the UK card machine market. They are owned by Paymentsense one of the UK’s largest payment processors.

Dojo Go Features

- Built-in thermal printer

- 10-hour battery life

- Integrated payments enabled

- Point-to-point encryption

- 5-inch HD touchscreen

- Wi-Fi connectivity

- Mobile Connectivity

Dojo Go Cost & Monthly Fees

The Dojo Go reader costs a flat £20 per month with Free next working day delivery.

Dojo Go Transaction Fees

Dojo Go charges 1.4%+ 5p for businesses that do under £150k per year in card turnover per year and even lower bespoke pricing for those doing over £150k in card turnover per year.

Dojo Go Contract

They offer a monthly rolling contract for businesses earning over £150,000 per year. For businesses earning under £150,000 per year, you’ll need to sign-up for a 6 month contract, which turns to a monthly rolling one after that date. Interestingly, they claim that if you Switch to them from another provider and they could pay your cancellation fees up to £3,000.

Dojo Go Addons & Accessories</h3

They do seem to list any official accessories on their website, but the Dojo GO comes with its own app and the card reader includes a thermal printer.

Dojo Go Summary

- Bespoke rates for businesses doing over £150k per year

- Low transaction fees of just 1.4% + 5p for credit and debit cards for smaller businesses

- Card machine comes with built-in printer

- Next-day transfers

- 7-day UK tech support, 8am – 11pm

- Only 1 model to choose from

- Terminal rental fee of £20 per month

The Dojo Go mobile card machine is an interesting choice for larger small businesses, especially those that process more than £150k worth of card transactions per year. They may be able to offer you lower rates than those offer by some of the other providers above.

5. Worldpay

Worldpay which is now owned by FIS is one of the biggest payment processors in the UK. They offer a range of card machines for pretty much any use case.

Worldpay Mobile Features

- Terminal can be connected through Bluetooth or Wi-Fi

- Accepts contactless payments including Apple Pay, Android Pay, and Samsung Pay as well as credit and debit cards

- Connectivity through built in SIM providing coverage over O2, Vodafone and EE. WiFi is also built in

- Extendable battery life and separate charging station

- Processes sales, refunds, cashback and gratuities

- Includes Receipt roll

Worldpay Mobile Cost

Worldpay offers two main pricing plans. Fixed Monthly and Custom. The Fixed Monthly plan costs at least £49.99 per month, but includes transactions up to a set limit. Under the custom plan you pay at least £17.95 per terminal rental in addition to transaction fees which vary based on volume.

Worldpay Mobile Transaction Fees

Varies based on volume and plan.

Worldpay Mobile Setup, Monthly Fees & Contract

Worldpay Mobile offers no joining fees on both the Fixed Monthly and Custom plans, but ties you in to an 18 month agreement.

The Fixed Monthly plan costs at least £49.99 per month whereas the custom plan costs £17.95 per month per terminal. In addition, if you want to accept payments by phone you’ll need to pay an extra £9.99 per month.

Finally, there is also an extra charge for accepting AMEX cards.

Worldpay Mobile Addons & Accessories

None listed on the website, but they are compatible with many epos solutions.

Worldpay Mobile Summary

- Customer Support 24/7, 365 days a year.

- Bespoke rates available for larger businesses doing over £100k per year in card transactions

- Lower rates the more you transact

- One of the world's largest payment companies

- Ability to integrate with other payment methods including online and by phone

- Exclusive rewards for merchants

- Rated 4.6 out 5 on Trustpilot

- Non-transparent pricing

- Requires a contract

- Can only rent your card terminal

- Not suitable for very small businesses

The Worldpay Mobile, along with other Worldpay card terminals is really designed for businesses doing at least £10,000 per month in card transactions. And while their fees may seem high on the surface, they can often offer substantially lower rates on processing fees.

Therefore, they remain a good option to consider for certain types of larger small businesses.

6. Revolut Reader

The Revolut Reader is one of the newest readers on the market. It comes from Revolut which is best known for their business bank accounts.

The reader itself is rather basic, but benefits from offering some of the lowest fees on the market.

Revolut Reader Features

- Simple, pay-per-transaction pricing (see below)

- Access funds the next day

- Accept credit and debit cards along with Apple Pay and Google Pay

- Create a catalogue of all your products to ring through customer carts

- 30-day money back guarantee

- Integrates with Nobly POS

Revolut Reader Cost & Monthly Fees

The Revolut Reader itself costs £49 (+VAT).

But to get a Revolut reader you also need to have a Revolut business bank account. Fortunately the basic account is totally free.

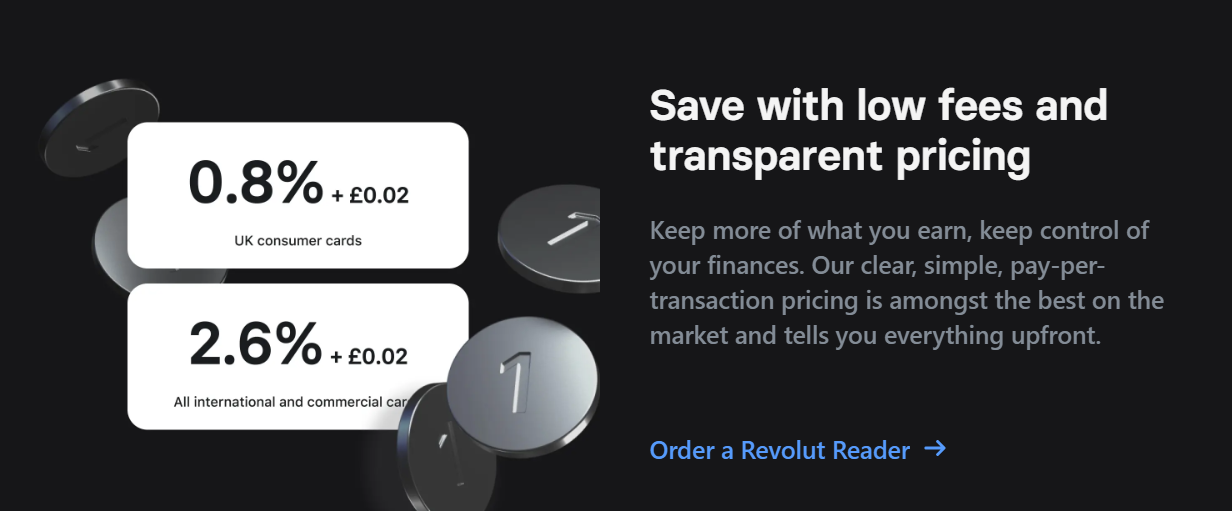

Revolut Reader Transaction Fees

The main benefit of the Revolut reader is that the transaction fees are substantially lower than some of the competitors. Here are they are below:

- UK Consumer Cards (in-person): 0.8% + £0.02

- International & Commercial Cards (in-person): 2.6% + £0.02

- UK Consumer Cards (online): 1.0% + £0.02

- International & Commercial Cards (online): 2.8% + £0.02

Revolut Reader Contract

The Revolut reader does not require a contract, but you do have to remain a Revolut business banking customer.

Revolut Reader Addons & Accessories

At the current time the Revolut Reader is pretty basic with no addons beyond being able to integrate with Nobly POS. If you need advanced features like printers, bar code scanners, etc you’re probably better off with a different machine.

Revolut Reader Summary

- Low transaction fees of just 0.8% + £0.02 for UK consumer cards

- Access funds the next day

- 30-day money back guarantee

- Only available if you have a Revolut Business bank account

- Only offer 1 basic model

- High rates for International & Commercial Cards

The Revolut reader is a nice low-cost option to get started accepting payments, especially since the Revolut business bank account offers a lot of additional benefits. However, limited addons and accessories means it won’t be right for businesses that need more advanced features and functions.

Visit the Revolut Reader website

7. MyPOS Go 2

MyPOS is one of the newest entrant to the card machine market in the UK, and offer a much wider range of readers than the companies above.

MyPOS Card Go Reader Features

- Pocket-sized, lightweight, sturdy

- Digital receipts via SMS or email

- Free data SIM card

- No monthly fee

- No contract

- 1 year warranty

- 30 day money back guarantee

- A free e-money merchant account with dedicated IBANs in 14 currencies

- Instant access to accepted funds

- Free access to the myPOS mobile app, available for Android and iOS

- A VISA Business card for instant access to funds and full control of corporate expenses with individual spending limits

MyPOS Card Reader Cost

Unlike most of the other companies on the list, MyPOS offers a wide range of machines. The cheapest is the MyPOS GO 2 at just £29 + VAT.

Other machines

- myPOS Go Combo: Standalone card reader with a charging and printing dock (£169 + VAT)

- myPOS Pro: Their most powerful POS device with a built-in receipt printer. (£229 + VAT)

You see their full range here.

This means price of a GO 2 reader is inline with SumUP and slightly more expensive than either Zettle or Square.

MyPOS Transaction Fees

MyPOS charges 1.10% + £0.07 per transaction for Domestic, EEA and UK consumer cards. All other consumer and commercial cards are charged at 2.85% + £0.07.

For Card-Not-Present Transactions the fees are as follows:

- Domestic and EEA consumer cards: 1.30% + £0.15

- All other consumer and commercial cards: 2.90% + £0.15

- MO/TO payments: POS payment fee + 1.00%

MyPOS Setup & Monthly Fees

Besides buying one of their credit card machines, MyPOS advertise no monthly costs.

MyPOS contract

You don’t need to sign a long-term contract to use MyPOS and there are no requirements for minimum turnover. Moreover, your account can be set-up in 5 minutes as is free.

MyPOS Addons & Accessories

MyPOS offers a huge range of addons and accessories. These include:

- Charing dock

- Cases

- Car Chargers

- Privacy screens

- Bundles

- And full EPOS systems

You can see the full range on their website.

MyPOS Summary

- No contract or monthly fees

- Rates as low as 1.10% + 7p

- Large range of machines

- More complex fee structure

- No built-in printer on MyPOS Go

- More expensive than Square Reader

MyPOS are an interesting option when it comes to mobile card readers, since they offer something slightly different from Zettle, Square and SumUP. With a larger range of features and an account that works almost like a bank account they can act as an all-in-one solution to your payment needs.

Moreover, their fees can be lower than both Zettle and Square at just 1.10% + £0.07.

With a wide range of machines and lots of unique accessories that allow you to customise your machine they are at least worth a look.

Visit the MyPOS website to learn more

8. Shopify WisePad 3 Reader

The Shopify WisePad 3 Reader is slightly more expensive than the other card machines listed above. However, it comes with the power of the Shopify eco-system so might be a great option if you have a Shopify store.

Shopify WisePad 3 Features

- Accepts chip & PIN and contactless payments

- Supports Visa, MasterCard, American Express, Apple Pay and Google Pay

- Shopify POS protects card data per PCI DSS requirements

- EMV certified to keep both you and your customers safe

- Connects wirelessly to your iPad or iPhone using Bluetooth

- Uses a customer-facing display to help your customers through the payment flow

- Features an integrated PIN pad to provide full EMV chip card support

- Designed to be comfortable to hold and take with you wherever you’re selling

- Compatible iPad or iPhone that is running iOS 12.5.1 or higher

Shopify WisePad 3 Cost

The WisePad 3 reader costs £49 + VAT which is somewhat more than the other options above. Plus, you’ll need to be signed-up to a Shopify plan to use it.

Shopify WisePad 3 Transaction Fees

The good news is that Shopify’s transaction fees can be among the lowest out there. They vary based on your Shopify plan as follows:

- Basic plan (£19/month): 1.7% + 0p

- Shopify plan (£49/month): 1.6% + 0p

- Advanced plan (£259/month): 1.5% + 0p

Shopify WisePad 3 Setup & Monthly Fees

As mentioned above the WisePad 3 only works with a Shopify plan. These range in price from £19-£259 per month. You can try Shopify free for 14 days with no credit card required.

Shopify WisePad 3 Contract

Shopify’s plans are month to month, although they do offer annual or biennial plans. They offer a 10% discount on annual plans and a 20% discount on biennial plans, when they are paid upfront.

Shopify WisePad 3 Addons & Accessories

Shopify’s main business is ecommerce. Therefore, the majority of their offerings are designed to help you sell online. However, in terms of in-person sales they offer the following addons and accessories.

- A retail bundle, which includes both the card reader and stand for £149 + VAT.

- Stands

- Barcode scanners (both 1D and 2D)

- Label Printer

- Receipt Printers

- Cash Drawer

Shopify WisePad 3 Summary

- Integrates with Shopify

- Rates as low as 1.5% + 0p

- No additional fee if you're a Shopify customer

- Only 1 reader model in the UK

- Requires a Shopify subscription

- Costs £259 per month for lowest rates

The Shopify WisePad 3 makes the most sense for businesses who want to use Shopify to sell online. Shopify probably offers the best ecommerce solution on the market today.

However, their POS offering is a fair bit more expensive than the competition. Therefore, it only makes sense to buy the WisePad 3 reader if you’re already a Shopify customer or plan to be one in the future.

Visit the Shopify POS website to learn more

9. Zettle Card Reader

The Zettle card reader has quickly become one the most popular mobile credit card machines options for UK small businesses.

Below we outline the major pros and cons of the Zettle system, but for a more in-depth look have a look at our complete Zettle review.

Zettle Credit Card Machine Features

- No monthly fee

- Set up fast, sell straight away

- Charge quickly for long-lasting battery

- Accept VISA, Mastercard, American Express, Diners Club, JCB, Discover, all major debit cards, Apple Pay, Android Pay, Google Pay

- Take contactless payments in under 5 seconds

- Send online invoices

- Accept cash payments with no daily limit

- Send digital receipts and store them all on the cloud

- Deposit earnings from app to bank within 2 business days

- One charge can last for 8 hours (or around 100 transactions)

- Free 12-month warranty

- Owned by Paypal and can easily connect to your existing Paypal account

Zettle Card Machine Cost

While there have been a few versions of the Zettle card reader, the current Reader 2 retails for £59 + VAT. However, they do have a promotion that allows new customers to their first reader for £29+ VAT.

This makes the Zettle card reader one of the more competitively priced in UK market at this time, but not as cheap as Square.

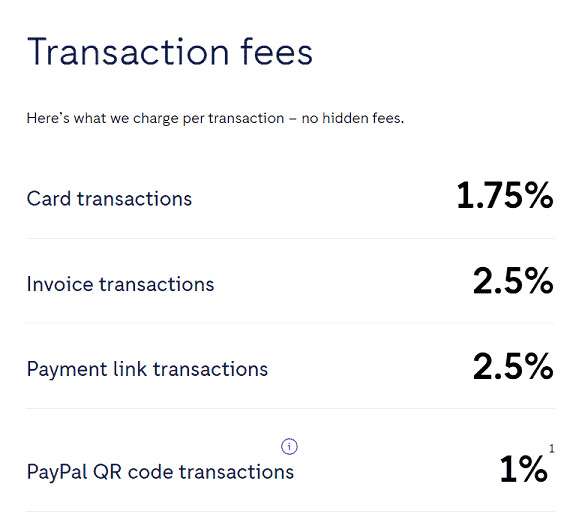

Zettle Transaction Fees

Zettle by PayPal now only charges a flat 1.75% fee per transaction for card payments regardless of which type of card you process (including AmEx).

Other transaction fees are as follows:

- Invoice transactions: 2.5%

- Payment link transactions: 2.5%

- PayPal QR code transactions: 1.75%

- E-commerce: 2.5%

Previously, its transaction fees were charged on a sliding scale. Merchants with low payment volumes were charged 2.75% per transaction. This fell to as low as 1% per transaction for businesses processing more than £40,000 worth of payments per month.

The minimum amount per transaction is £1 for all accounts with the maximum amount being £5,000 for Chip-card (incl. contactless) & PIN processed by business account holders. Total daily transactions can not exceed £500,000 limit per 24 hours.

Overall, Zettle’s fees are among the lowest in the industry. However, you’re still advised to compare them against the other options including more traditional machines.

Zettle Set-Up & Monthly Fees

One of Zettle’s greatest selling points is that there are no set-up fees (beyond buying a card reader) and no monthly fees either for their regular GO account. This makes them an attractive option for new businesses and those that are unsure how much they’ll use their machine.

Zettle Contract

Another major selling point for the Zettle card reader is the fact that you are not required to sign a contract, unlike most traditional merchant account providers. This means you can use them for as long or short a period as you like.

Zettle Add-ons

The Zettle card reader requires the Zettle by PayPal app (available for both iPhone and Android) to function properly. Beyond that there are a whole host of add-ons that can turn the card reader into a full fledged point of sale system.

These include:

- Terminals

- Stands & Docks

- Receipt Printers

- Barcode Scanners

- Cash Drawer

- Store Kits

Overall, these add-ons greatly extend the functionality of the Zettle reader, but be aware the costs for some of the items may be more than equivalent price you’d pay for the same item on a standard EPOS system.

Zettle Summary

- No monthly cost or contract

- One of the cheaper card readers on the market

- Flat fee for all cards including Amex

- Easily integrates with Paypal

- Minimum amount per transaction is £1

- Other companies offer lower transaction fees

- Requires an iPhone with iOS 12 or higher or Android phone with 5 or higher (Android 8 or higher recommended)

- Only gets 2.4 out of 5 on Trustpilot

Overall, the Zettle credit card machine is great option for businesses looking to get started taking card payments. While their fees are not the lowest in the industry they are very transparent.

Moreover, the fact you do not need a contract to get started and there are no ongoing costs besides transaction fees, makes Zettle a top choice when it comes to mobile credit card machines for small businesses.

If you’re ready to give them a try, get started by visiting the Zettle by PayPal website here.

If you’d like to learn a bit more about them, read out full: Zettle by PayPal Review.

10. Barclaycard Anywhere

The Barclaycard Anywhere card reader is a solid choice from Barclaycard, which is part of Barclays Bank. Although it lacks many of the addons from other companies they do offer among the lowest transaction fees out there.

Barclaycard Anywhere Features

- Accepts contactless payments

- Works with Mastercard, Visa, Apple Pay and Google Pay

- Works with free Barclaycard Anywhere app

- Optional digital receipts via email

- Real-time transaction data

- Ability to give refunds

- Can export all data to a spreadsheet

Barclaycard Anywhere Cost

The Barclaycard Anywhere normally costs £29 + VAT, which puts it in-line with SumUP and a bit more expensive than Square or Zettle. However, they do occasionally run promotions so it might be worth checking their website.

Barclaycard Anywhere Transaction Fees

The Barclaycard Anywhere card reader has some of the lowest transaction fees out there at just 1.6%. However, it should be noted they do not accept AMEX cards.

Barclaycard Anywhere Setup & Monthly Fees

They operate a pay as you go model, so there are no monthly fees or contract.

Barclaycard Anywhere Addons & Accessories

There are none listed on their website.

Barclaycard Anywhere Summary

- Card machine is among the cheapest on the market

- Low fixed transaction fees

- Does not accept AMEX cards

- No built-in printer or other addons

The Barclaycard Anywhere is a good cheap option, so long as you don’t need any of the additional functionality of rivals such as Zettle, Square or SumUP.

Visit the Barclaycard Anywhere website

11. Takepayments Mobile

Takepayments offer a huge range of payment solutions for small businesses. One of these is their Mobile card machine.

Takepayments Mobile Features

- Built-in GPRS SIM card

- Long lasting charge

- Light and durable

- Easy to set up

- Fast thermal receipt printer

- Works anywhere in the UK

Takepayments Mobile Cost

There is a monthly terminal rental fee to use a Takepayments Mobile machine.

Takepayments Mobile Transaction Fees

These vary by card type and method along with the processing volumes and the type of small business you run. For some debit cards processing fees can be as low as 0.3%.

Takepayments Mobile Setup & Monthly Fees

There are no fees to join or leave once your contract is finished. However, there is a monthly terminal rental fee.

Takepayments Mobile Contract

They offer a standard 12 month contract.

Takepayments Mobile Addons & Accessories

They offer a range of EPOS solutions along with the ability to sell online.

Takepayments Mobile Summary

- Next day settlement

- Dedicated joining team

- Rated 4.8 out of 5 on Trustpilot

- Offer bespoke rates

- Non-transparent pricing

- Contract required

- Monthly fees

Takepayments Mobile is more of a traditional card terminal. However, because the offer lower rates on some card transactions they can be a cheaper solution for businesses that process a significant volume of transactions.

Visit the Takepayments Mobile website

12. Tyl (by Natwest) PAX A50

Tyl (by Natwest) offers a range of card machines. The PAX A50 is their cheapest model but they also offer the Clover Flex, Ingenico Move 3500, and Ingenico Desk 3500 depending on your needs.

Tyl (by Natwest) PAX A50 Features

- Standalone, all-in-one payment device – no app or mobile phone required.

- 4.5″ full colour touchscreen

- Connect by Wi-Fi, 3G/4G and/or Bluetooth

- Up to 8 hours of battery life

- Purchase and hire options available

- Only issues paperless receipts via email

Tyl (by Natwest) PAX A50 Cost

The PAX 50 is the cheapest Tyl (by Natwest) card machine. It can be purchased for just £75 + VAT or hired for £6.99 per month.

You can see how this compares to their other machines below:

Tyl (by Natwest) PAX A50 Transaction Fees

Tyl (by Natwest) charges transaction fees vary depending on your card revenue. For businesses doing under £50k per year, you get charged the following:

1.5% transaction charge (excluding American Express) + card machine monthly rental charge

For businesses doing over £50k per year in card revenue they charge the following:

5 tailored transaction rates + card machine monthly rental charge + Authorisation fees + PCI DSS fees (£4 per month (+VAT) per store) + Amex (optional):

Tyl (by Natwest) PAX A50 Setup & Monthly Fees

If you buy your PAX A50 outright and process less than £50k per year you should pay additional no monthly fees beyond your transaction charges. If you choose a different card payment terminal and/or process more than £50k per month you’ll face the fees listed above.

Tyl (by Natwest) PAX A50 Contract

Tyl (by Natwest) is only offered on a 12 month contract basis.

Tyl (by Natwest) PAX A50 Addons & Accessories

None are listed on the website.

Tyl (by Natwest) PAX A50 Summary

- Can be hired from only £6.99 per month

- Low 1.5% transaction charge for smaller businesses

- Bespoke pricing for larger businesses

- Requires a 12 month contract

- No additional addons available

- American Express cards only available for an additional fee

- Non-transparent pricing for larger businesses

Tyl (by Natwest) PAX A50 is an interesting solution since it’s a standalone reader offering relatively low transaction fees. Moreover, the fact you can hire from just £6.99 per month, means your upfront cost is even less than Square. The main downside is that their low rates don’t include Amex cards unlike many of their competitors.

Visit the Tyl (by Natwest) website

Other Card Machine Options in the UK

The card machine companies listed above are the biggest and best options for most UK small businesses. However, because we love to be complete here at Merchant Machine so here are a few other alternatives you can also consider.

- Viva.com Terminal: Offers a Tap to Pay on iPhone solution without the need for a card reader.

- SimplyPayMe: Offers a fully software-based alternative to traditional payment terminals by scanning customer cards with fees from 1.40%.

- Paymentsense: Offers a range of portable, mobile and countertop card machines with free set-up and competive rates for larger business.

- Elavon: Their cheapest option is the Tetra Desk 5000 at just £15/month and transaction fees from 0.99%.

- Handepay: Offers a range of machines and has 4.9 out of 5 ranting on Truspilot.

Mobile Card Machine Manufacturing Companies

Many of the the companies listed above sell their own brand card machines. However, a few also sell or rent machines built by the following companies.

- Ingenico: The biggest card machine manufacturer makes everything from the simplest card readers to countertop models to complex fully mobile card machines.

- PAX: Another manufacturer of a wide range of payment terminals including the PAX A50 (see above)

- Verifone: Makes a limited range of very popular machines.

- Castles: Makes several different payment machine models from mobile POS to unattended terminals.

Discontinued Small Business Card Machines In The UK

Here are a few of the card readers that are no longer sold in the UK:

- PayPal Here: Paypal owns Zettle and now no longer offers their own branded solution.

- Worldpay Zinc & Worldpay Reader: Worldpay has tried twice to enter the small business card machine market, but no longer offers either solution.

- Payleven: They were bought by SumUP several years ago and have since moved everyone over to their platform.

Things to look for when choosing a mobile card machine

With so many great choices it can be difficult to narrow it down and actually choose a machine. Here are a few things to consider before you choose.

- Transaction fees: Most of the card machines above charge between 1.5% and 1.75% per transaction. However, some companies like Worldpay and Takepayments offer substantially lower fees, but may require a contract and/or monthly rental fee. If you process more than £2,000 per month it may be worth comparing options here.

- Business type: If you run a hospitality business you likely want to choose a card machine that offers additional POS functionality and/or integrates with your existing systems.

- Card payment types: All the machines listed above can take VISA and Mastercard credit and debit cards. And most can also accept Google and Apple Pay. However, not all accept AMEX cards and other foreign payment options. This is not a problem for most small businesses, but could be an issue if you operate in a tourist heavy area.

- Add-ons: Some of the card readers listed above are rather basic and others have a lot of optional add-ons. Make sure you consider you entire payment needs before choosing. For example, Shopify is an expensive option, unless you already have an online store with them, in which case they may be your best option.

- Connection type: Some mobile card readers use WiFi and some use build-in SIM cards, which one is best will depend on where your business is located and the relative strength of you mobile vs WiFi connections.

Frequently Asked Questions

How much does a card machine cost?

Card machines costs are now surprisingly affordable. The Square card reader is just £19 and the SumUP reader is just £39. And these are one-time costs per machine.

However, you shouldn’t look at machine cost alone when considering your options. Both Tide and Dojo offer lower transaction fees than Square and Zettle despite having slightly more expensive card machines. This means you’ll keep more money from each each transaction.

The real difference though is between the cheap card machines above and more traditional payment processing companies.

Worldpay and Takepayments for example will charge a monthly terminal hire fee of around £20 per month and require a contract. But they offer substantially lower fees (as low as 0.3%) on some payment types (e.g. debit cards).

Therefore, you’ll have to look at your payment volume to see what option makes sense.

Generally speaking you’ll need to processing at least £2,000 per month to see any savings with the more traditional payment companies. But the savings do start to mount up the more you process.

What is the cheapest way to take card payments?

As mentioned above the cheapest way to take card payments varies by payment volume.

Process less than £2,000 per month and Tide or Dojo Go is the cheapest option in terms of processing fees at just 1.5% or 1.4%+ 5p respectively.

The Square card reader is the cheapest in terms of purchase price at just £19.

However, once you start processing more than that amount per month it gets a little tricky to figure out exactly who offers the best rates. That’s because it will come down to what types of cards you process, average order value, and business type amount other things. Your best bet is to compare companies here.

How to take payment over the phone on a card machine?

Many of the machines above allow you to phone payments using your card machine but they work in slightly different ways. Here are a few examples:

- Zettle: Offers a payment link. This is a one-time link via the Zettle app that you can send to your customer by text message, Whatsapp, social media or email. They then follow the link and enter their card details. You’ll be charged 2.5% instead of the normal 1.75%. They also offer an Invoice option with a 2.5% fee.

- Square: Offer a Virtual Terminal that allows you manually key-in a payment to take payment instantly. Also offer an invoice option for payments that don’t need to be made right away. Both of these are have a 2.5% fee.

- SumUP: Offers Payment links, invoices and a virtual terminal solution. Invoices and payment links come with a 2.50% transaction fee, and the virtual terminal has a 2.95% + £0.25 fee.

- MyPOS: Offer a full MO/TO virtual terminal payment option with a fee of their standard POS payment fee + 1.00%.

- Shopify: Allows you to manually enter card details and with the same charges as their normal online rates.

Do you need a business bank account for a card machine?

No, but it is a good idea.

Tide and Revolut offer fully integrated solutions.

While several companies such as Square, Zettle, and SumUP work with sole traders in addition to limited companies. Therefore, you’ll need a bank account that either matches the name of the person on the card reader account and/or matches your company name.

You also don’t need a merchant account if you sign-up with companies like Tide, Square and SumUP. They handle all the payment processing and PCI compliance issues for you, so you can focus on selling.

Payment processing companies such as Worldpay and Takepayments can help set you up with a merchant account, which brings many additional benefits along with some additional costs.

What is the best card machine for small business?

Honestly, each of the card machines listed above are a great choice for a certain types of small business. So there’s no one “best” option. Below we give our verdict on the type of business each solution is good for.

- Square: Offers the cheapest card machine on the market. Perfect for small businesses that don’t want to spend a lot of money.

- SumUp: Best range of machines for almost any type of small business. Also offers lower processing rate of just 1.69%.

- WorldPay: Bespoke rates for larger businesses and also offers 24/7 customer service 365 days a year

- Tide: Offers the best fully-integrated business solution including both a card reader and business bank account.

- Dojo Go: Offers bespoke rates to larger businesses. Also has a built-in printer on their basic model.

- myPOS Go: Great choice if you also need a business card and also offers a good range of machines.

- Shopify WisePad 3 Reader: Perfect for businesses that already have an online Shopify store.

- Barclaycard Anywhere: Great if you only need a card reader and nothing else.

- Takepayments Mobile: Perfect if you want a more professional look

What features should I look for in a card reader?

When choosing a card machine for your small business, there are several features and factors you should consider. Here’s a comprehensive list:

- Acceptance of Payment Types: Look for a machine that accepts a wide range of payment types, including contactless card payments, contactless (NFC) payments (such as Apple Pay, Google Pay), Chip and Pin and magnetic stripe cards. The more options you have, the easier it is for customers to pay.

- Connectivity: Consider the types of connectivity the machine offers, such as Wi-Fi, Bluetooth, or mobile (GPRS, 3G, 4G). A machine with multiple connectivity options can be more reliable and flexible in different environments.

- Fees and Costs: Understand the fee structure associated with the card machine, including transaction fees, monthly rental or purchase costs, and any additional fees for services like chargebacks or customer support.

- Ease of Use: The machine should be user-friendly for both your staff and your customers. A simple interface, quick transaction processing, and clear instructions can enhance the customer experience.

- Portability: If you need to take payments at different locations (e.g., restaurants, outdoor markets), a portable or mobile card machine could be essential. Check the battery life for portable models.

- Security: Ensure the card machine complies with the latest security standards (such as PCI DSS) to protect customer data. Features like end-to-end encryption and tokenization can provide additional security.

- Integration: Consider how well the card machine integrates with your current business systems, such as your point of sale (POS) system, accounting software, or inventory management system. Smooth integration can streamline operations and reduce manual work.

- Customer Support: Good customer support is crucial, especially if you encounter issues with your machine. Look for providers that offer 24/7 support through multiple channels (phone, email, chat).

- Receipt Printing: Decide if you need the machine to print physical receipts or if digital receipts sent via email or text message are sufficient for your business and your customers.

- Scalability: Consider whether the card machine and its associated services can scale with your business. This includes being able to handle higher volumes of transactions and supporting additional machines as your business grows.

- Brand Reputation: Look into the brand’s reputation, including customer reviews and testimonials. A reputable provider can offer reliability and peace of mind.

- Contract Terms: Be aware of the length of any contracts or agreements, as well as any early termination fees or penalties.

Is it easy to switch card machine providers in the UK?

Switching card machine providers in the UK is relatively straightforward, but the ease of doing so can vary depending on several factors.

These include the terms of your current contract, the compatibility of existing hardware with new providers, and the specific requirements of your business.

Here’s a breakdown of what to consider when thinking about switching card machine providers:

- Contract Terms: Review the terms of your current contract to understand any obligations, notice periods, and potential early termination fees. Some contracts may lock you in for a certain period, and leaving early could incur costs. However, machines like Square, SumUp and Tide don’t have any long-term contracts.

- Notice Period: Most providers with a contract require a notice period if you intend to switch. Make sure to provide this notice in writing within the timeframe specified in your contract to avoid automatic renewal or additional charges.

- Early Termination Fees: If you’re still within your contract term, check if there are any early termination fees. These fees can sometimes be significant, so it’s important to weigh the cost against the benefits of switching to a new provider.

- Hardware Compatibility: If you already own card machines, check whether they are locked to your current provider or if they are compatible with other providers. Some machines can be reprogrammed, while others might need to be replaced, leading to additional costs.

- Settlement Times: Consider how quickly you need funds to be available in your account after a transaction. Settlement times can vary between providers, so choose one that meets your cash flow requirements.

- Fees and Charges: Compare the fees and charges of different providers, including transaction fees, monthly fees, and any additional costs for services like customer support or next-day funding.

- Integration with Existing Systems: If you use a point-of-sale (POS) system or accounting software, ensure the new provider’s card machines are compatible with your existing setup to ensure a smooth transition and maintain efficiency in your operations.

- Support and Service: Consider the level of customer support provided. Reliable support can be crucial, especially if you encounter issues with your card machine.

To switch providers, you’ll typically need to:

- Notify your current provider according to your contract terms.

- Choose a new provider and apply for their service, which may include a credit check.

- Set up the new card machine and integrate it with your systems.

- Train your staff on using the new equipment.

While the process can be straightforward, planning and consideration are key to ensuring a smooth transition. It’s also beneficial to shop around and negotiate with potential new providers to get the best deal for your business.

For a quick comparison you can also have a look at: Zettle vs Paypal, Worldpay, Square & Sumup: 2024 Reader Comparison

The rankings above are based on monthly online searches, and do not reflect the quality of the products themselves.

Note: We have partnership agreements with Square, SumUp, MyPOS, Worldpay, Shopify, Revolut and Tide. They each pay us a commission if you sign-up and start using their services. We genuinely think they offer great mobile credit card machines and processing solutions for UK small business, but we leave the final judgement up to you.