The SumUp Air card reader is one of the the top credit card machines for small businesses in the UK. It offers low fees of just 1.69% per transactions, with no fixed costs or complicated pricing structures.

SumUp Air Card Reader

The SumUp Air card reader is one of several innovative new mobile credit card machines available to UK businesses. Similar to the Zettle card reader, the SumUp Air works in conjunction with the SumUp App on your smartphone. or tablet.

And unlike more traditional PDQ machines, there’s no need to sign up with a separate merchant account provider or pay any additional credit card processing fees above their standard fee of 1.69%.

Here are some of the key features and benefits of the SumUp card machine:

- Accept payments via contactless, Chip & PIN or magnetic swipe.

- Equipped with NFC, Bluetooth

- Rechargeable integrated Li-ion battery god for 500+ transactions per charge.

- Micro-USB charging port

Accepted Cards

Accept any credit or debit card (including international cards) that displays the following logos:

- Visa

- VPay

- MasterCard

- Maestro

- American Express

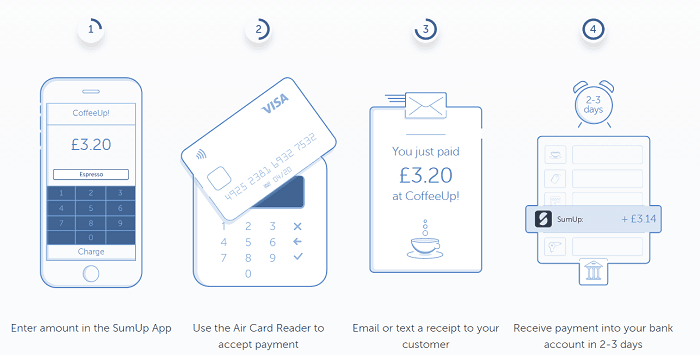

How Taking Payment Works

Simple, 4 step process:

- Enter amount in the SumUp App

- Use the Air Card Reader to accept payment

- Email or text a receipt to your customer

- Receive payment into your bank account in 2-3 days

Card Reader Security

SumUp operates under the following card payment industry security standards:

- PCI-DSS (Payment Card Industry Data Security Standard)

- SSL (Secure Sockets Layer) and TLS (Transport Layer Security)

- PGP (Pretty Good Privacy)

SumUp Card Reader Score: 4/5, the SumUp card reader accepts fewer cards than the Zettle reader but besides that offers exactly the same functionality.

SumUp Fees, Charges & Pricing

SumUp offers very clear and easy to understand fees and pricing. They are:

- Reader Cost: Normally £59 (+VAT) but currently only £39 (+VAT)

- Transaction Fees: Flat 1.69%

- Monthly Costs: £0

- Delivery: Free

- iOS / Android app: Free

- Dashboard and reporting: Free

- Telephone & email support: Free

- Payouts to your bank account: 2-3 days

- Minimum card payment: £1

Transaction fees compared

SumUp is very cheap to set-up, but how do their transaction fess stack-up?

SumUp has a very clear pricing structure, you pay 1.69% for all transactions (both credit card and debit), whether you process £1 or £100,000 in a month.

This is lower than Zettle’s flat fee of 1.75%.

However, both solutions have higher transaction fees than many merchant accounts. Most credit card processing solutions will charge around 2% to handle credit cards, but many merchant accounts will charge 0.75% of less to process debit cards, due to the lower risk.

Therefore, if half your card transactions are debit rather than credit cards you could be paying way over the odds.

To learn more have a look at our UK Merchant Account & Credit Card Processing Fee Comparison.

Also keep in mind most merchant accounts come with other hidden fess, for example PDQ machine rental can sometimes run over £20/month, nearly the same as the one-time price of the SumUp Air reader.

Reader Cost Score: 4.5/5 – Currently among the cheapest options on the market.

Ongoing Cost Score: 5/5 – no ongoing monthly costs, what’s not to like?

Transaction Fee Score: 3.5/5 – Clear, easy to understand pricing is nice to see. Plus their fees are lower than Zettle. However, both of these can be far higher than merchant accounts for businesses that handle substantial volumes of transactions.

SumUp Pro & Cons

- No monthly contract or fee

- Low 1.69% transaction fee

- 3 machines to choose from

- 100% online application with no contract and no paperwork

- Accept Visa, VPay, Mastercard, Maestro, American Express, Diners Club, Discover, and Union Pay

- SumUp Air is twice the price of Square

- Limited number of addons

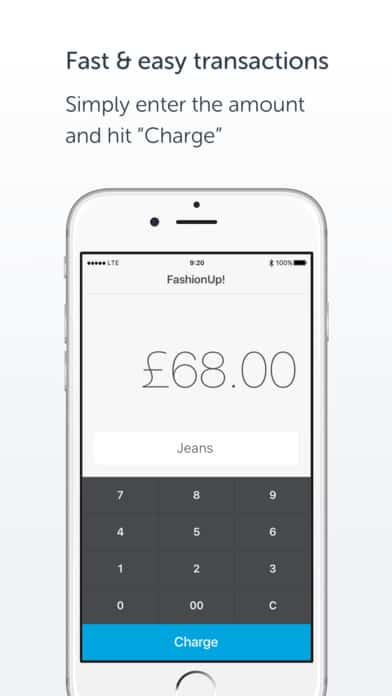

SumUp App

For the SumUp Air card reader to work you’ll also need to install the App on a compatible smartphone and/or tablet. You can download the Android App on Google Play and the iOS App on the Apple App Store.

The requirements are:

- Bluetooth 4.0 to connect wirelessly with the reader

- Apple/iOS devices: operating system iOS 7.0 or higher

- Android devices: operating system Android 4.4 or higher

For iPhones this means anything newer than the iPhone 5s without an iOS update or anything newer than the iPhone 4s with an iOS update. For iPad’s you can use anything newer than the iPad Air or iPad Mini 2 without an iOS update or anything newer than the iPad (3rd generation) / iPad Mini with an iOs update.

For Android devices you’ll have to check if they have Android 4.4 and Bluetooth 4.0 or higher installed.

App Features:

- Activate your account

- Manage your manage your products

- Create custom shelves

- Send a receipt via email or text message.

- Easily resend receipts

- Optional ability to connect a printer and print receipts (see below)

- Sales history

- Custom Tax/VAT Rates

Android App Score: 4.2/5

iOS App Score: 4.5/5

Other SumUp models

In addtion to the SumUp Air they also offer a standalone Solo device and a 3G printer model. See how they all compare below:

SumUp Printer

The new version of the app currently allows you to print receipts using one of the following printers:

- Star Micronics TSP143LAN

- Star TSP654IIBI Bluetooth Printer

- Star SM-L200 Mobile Bluetooth Printer

- Star Micronics TSP 650 (Not USB version!)

- Star Micronics SM-L200

- Bixolon SPP-R200IIiK

SumUp Point of Sale (POS)

If you’re looking for something a bit more professional than just a card reader, SumUp also offers a complete Point of Sale (POS) solution that can include: tablets, printers, scanners – all compatible and pre-configured right out of the box.

A few of the benefits and options include:

- Integrated Card-Payments

- Cloud-based

- Reporting & Analytics

- Offline-capability

- CRM & Loyalty programs

- Inventory management

- Layaway management

- eCommerce connectivity

- Barcode functionality

- Online booking

- Appointment management

- Swarm / handheld ordering

- Tipping

- Multi-printer

- Table management

Cost: Starting from €999 excl. VAT

To learn more you’ll have to get a quote from the SumUp POS website.

SumUp POS score: 5/5 – all the features most businesses will need at a very competitive price.

SumUp Restricted Businesses

SumUp has quite a few restrictions when it comes to what sorts of businesses will be accepted.

The following high-risk businesses will need to seek special approval before using the SumUp card reader.

- Future business: where the delay between processing a card transaction and handing out the product/service is longer than 7 days.

- Adult entertainment / Pornography

- Airlines

- Business seminars – like real estate seminars, investment programs, business opportunities/strategies, self-help books, etc.

- Collection agencies, refinancing of debt / factoring, mortgage, brokers/reduction services/refinancing, Payday loans

- Cosmetic surgery

- Non-licensed Counselling centers (for example: debt and financial counselling, marriage and family counselling, alcohol and drug abuse counselling, and other personal counselling)

- Detective agencies, protective agencies, security services including armored cars, guard dogs

- Door-to-door sales

- Drug paraphernalia

- Employment agencies, temporary help services

- Escort services

- File sharing services

- Fortune tellers

- Gambling

- Guns, firearms, munitions sale & distribution

- Illegal or legally questionable businesses or products

- Investor services/investment clubs. Sale of stocks, securities, options, binary options, Forex, and other investments

- Male/Female enhancers

- Membership fees

- Modelling/talent agencies

- Not-for-profit organisations

- Pawn shops

- Political organisations

- Products with doubtful efficiency: may include but not limited to weight loss products, hair growth products, products to boost, physical performance.

- Protection services: protection, insurance, or registration, service against things such as identity theft, Internet, fraud, credit card theft or fraud, etc.

- Pyramid sales/multi-level marketing

- Religious organisations & goods stores

- Sexual encounter firms

- Stamp and coin stores

- Telecommunication services including but not limited to prepaid phone services and recurring phone services

- Used cars

If in doubt, visit the speak the SumUp customer service team.

SumUp Alternatives and Competitors

For a full comparison see:

Also see: What Businesses Are Not Allowed To Use SumUp & Why

SumUp User Reviews

Review Summary

Recent Reviews

Tested Zettle, Square and SumUp over 5 years and the winner is currently:

I am now using SumUp

Firstly to my mind there is no reason to use Zettle – it is below Square an Sumup on cost and quality.

I was using 80% Square and Sum Up as a backup, across 2023 however all three Square readers stopped working with my Android. The main reason for using it

I am now 100% SumUp and enjoying it. The Sum Up solo is an excellent device, and with the Sum up reader and my phone as a back up eg if I forget to charge it.

Customers prefer the Sum up Solo device rather than entering a PIN on my phone – it is far more professional as well as being the smallest all in one pocketable solution.

Good customer service

Good customer service! Quick response via email, helpful and understanding over the phone. Managed to solve complicated issue with money I had stuck with sumup… easy to switch accounts with one card reader etc

Submit a Review

Learn more: Visit the SumUp website

Please note: Merchant Machine has an affiliate agreement with SumUp and Square.