The 7 mobile card machines below are all great choices if you’re looking for something a bit more advanced than simply the cheapest card payment machine for your small business.

Each of them comes with a built-in receipt printers along some other interesting features.

| Card Machine | Price* | Transaction fees | Deal |

|---|---|---|---|

| Square Terminal | £149 | 1.75% | Visit Site |

| SumUp Solo & Printer | £139 | 1.69% | Visit Site |

| myPOS Pro | £229 | 1.10% + £0.07 | Visit Site |

| Dojo Go | £20 per month | 1.4% or less | Visit Site |

| Zettle Payment Terminal With Printer | £199 | 1.75% | Visit Site |

| Clover Flex | From £14.99 per month | 1.5% (or less) excl. Amex | Visit Site |

| takepaymentsplus | £25 per month | Varies based on card | Visit Site |

* Prices accurate as of July 2025 and unless otherwise stated exclude VAT.

Generally speaking the card machines below fall into one of two categories. Either you buy the machine outright and pay a flat fee per transaction or you pay a monthly card machine rental charge with variable (although often lower) transaction fees.

In most cases if you process less than £5,000 per month buying the machine outright is the best deal. If you process more than this amount it can be worth getting a quote here.

1. Square Terminal

Main features of the Square Terminal:

- Accept all payment types and print receipts with one compact device

- Payment methods include Chip & Pin, contactless and smartphones and watches with Apple Pay and Google Pay

- Powerful long-lasting battery designed to operate all day

- Get your funds the next business day

- Touchscreen display

- No long-term contracts

- Data security protects you and your customers

- Manage payment disputes to help you avoid costly chargebacks

- Ability to work offline if needed (except for contactless payments)

- 24/7 phone support included

- Accept gift cards, cash payments, or keyed-in card payments (for 2.5%)

- Try Square Terminal risk-free for 30 days

Square Terminal Cost

The Square Terminal costs just £149 + VAT or six interest-free payments of £25. Beyond that there are no ongoing contracts or monthly fees.

This is more expensive than their basic card reader which costs just £19+VAT, but is among the lowest priced models offering a built-in printer.

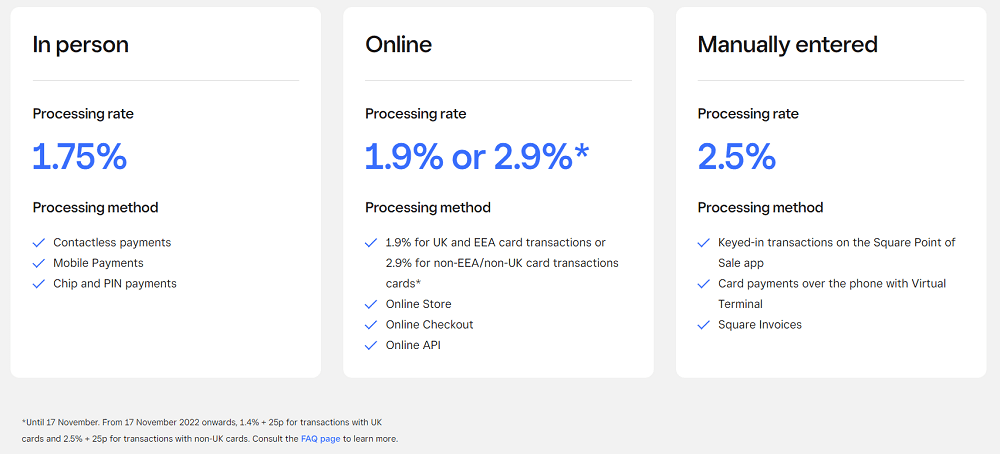

Square Terminal Transaction Fees

Square charges a very transparent 1.75% transaction fee on all Chip & Pin and contactless payments. Moreover, if you process more than £200k a year these fees can be lowered.

They also offer other ways to pay with the following fees:

- Online: 1.4% + 25p for UK and EEA card transactions or 2.5% + 25p for non-EEA/non-UK card transactions cards

- Manually entered (E.g. Phone & Invoice): 2.5%

- BNPL (via Clearpay): 6% + 30p per transaction

Beyond that there are no hidden fees. This means no start-up fees, authorisation fees, statement fees, refund fees, PCI-compliance fees, business card fees, terminal fees, etc.

Click here learn more about the Square Terminal.

2. SumUp Solo & Printer

Main features of the SumUp Solo & Printer:

- Offer receipts on-the-go

- 30 day money back guarantee

- Free, unlimited data with built-in SIM card

- All major credit and Debit cards accepted whether by chip & PIN, contactless or mobile payment

- Includes a Business Account and Mastercard

- Send and receive money instantly in the UK

- Unlimited, free bank transfers, both on incoming and outgoing payments

- No monthly costs

- Get your reader in 2-3 business days after ordering

SumUp Solo & Printer Cost

The SumUp Solo & Printer costs just £139 + VAT which makes it the cheapest card machine with a built-in printer. There no monthly charges or contract requirements.

If the cost is too high SumUp also offers a basic reader for £39+VAT or more advanced Solo model for £79+VAT. You can learn more about both of these models here.

SumUp Solo & Printer Fees

Similar to Square, SumUp has very transparent fees. They charge a flat 1.69% fee on all card machine transactions. For all other transactions (Online Store, Invoices, Payment Links, Gift Cards) you’ll pay a flat 2.5%.

Click Here to Learn More About the SumUp Solo & Printer

3. myPOS Pro

Main features of the myPOS Pro:

- High-pressure thermal printer

- Cloud-based cash register

- 3G/4G – Free data SIM, Wi-Fi, Bluetooth

- 1 year warranty

- 30 Day money back guarantee

- Shock-proof

- Seamlessly track all incoming payments through your mobile app

- Optional tipping functionality

- Custom Receipts

myPOS Pro Cost

The myPOS Pro costs £229 + VAT. Beyond that there are no ongoing fees beyond transaction fees and it does not require a contract.

myPOS Pro Fees

Unlike some of the competitors above myPOS has a tied fee structure. They breakdown as follows:

Card Present Transactions

- Domestic and EEA consumer cards: 1.10% + £0.07

- American Express: 2.45% + £0.07

- All other consumer and commercial cards: 2.85% + £0.07

Card-Not-Present Transactions

- Domestic and EEA consumer cards: 1.30% + £0.15

- American Express: 2.50% + £0.15

- All other consumer and commercial cards: 2.90% + £0.15

- MO/TO payments: POS payment fee + 1.00%

Click here to learn more about the myPOS Pro.

4. Dojo Go

Main features of the Dojo Go:

- Built-in receipt printer

- They’ll pay your exit fees up to £3,000

- Accept all major card types using contactless, chip and PIN, and magstripe – plus mobile payments like Apple Pay and Google Pay

- 10-hour battery life

- Take card payments 80% faster than the industry average

- Mobile connectivity comes as standard

- Get your takings the very next day for free (even on weekends and bank holidays)

- UK-based support team is on hand to help 24/7

- Dojo Go seamlessly connects with over 600 major EPOS systems

- Next-day delivery

- Short-term contracts

Dojo Go Cost

The Dojo Go costs either £20/month (Under £150k in annual card turnover) or £15/month (Over £150k in annual card turnover). Unlike the other companies above this comes with a monthly contract. In the case of those doing under £150k a year, this a 6 month contract and for those doing more it’s a monthly rolling contract.

On the plus side the monthly fee means Dojo charges significantly lower transaction fees compared to Square or SumUp.

Click here to get started with Dojo Go

Dojo Go Fees

Dojo Go charges the following transaction fees for accounts that process less than £150k per year. If you process more than that each year you can expect to pay less than the below:

- Visa: 1.4% + 5p

- Maestro: 1.4% + 5p

- Mastercard: 1.4% + 5p

- American Express: Variable% + 5p

- All other debit & credit cards: 1.4% + 5p

- Card not present – debit & credit cards: 1.9% + 5p

Click here to learn more about Dojo Go

5. Zettle Payment Terminal

Main features of the Zettle Payment Terminal:

- Optional Printer add-on (not included with the standard model)

- All-in-one touchscreen POS and payment terminal

- Connect straight out of the box with the Terminal’s preloaded SIM card

- Zettle’s point-of-sale app is already built in

- Optional built-in barcode scanner

- The Terminal takes Paypal QRC, Payment Links and all popular forms of payment like contactless, Apple and Google Pay, and major credit cards

- Get bank deposits within 1-2 business days

Zettle Payment Terminal Cost

The Zettle Payment Terminal without a printer costs £149 + VAT with no monthly contract required. The Zettle Terminal with Printer & Dock costs £199 + VAT, the Terminal with barcode scanner costs £199 + VAT and Terminal with barcode scanner and Printer & Dock costs £249 + VAT.

Zettle Payment Terminal Fees

Zettle charges the following fees for their all their card readers:

- Card transactions: 1.75%

- Invoice transactions: 2.5%

- Payment link transactions: 2.5%

- PayPal QR code transactions: 1.75%

Visit the Zettle Payment Terminal website

6. Clover Flex

Main features of the Clover Flex:

- Built in receipt printer and barcode scanner

- Both Wi-Fi and 4G LTE connectivity

- 5-inch hi-res antimicrobial touchscreen

- Charges in an hour, lasts up to 8 hours

- Built-in fingerprint reader security

- Ready to go and simple to use straight out of the box

- Access to the Clover App Market

- Ability to take all kinds of payments

- Ability to create loyalty programmes

- End-to-end encryption

Clover Flex Terminal Cost

Clover does not list the prices for the Flex on their website. Instead they direct users to Tyl by Natwest and Lloyds Cardnet. Cardnet does not list their price for Flex, but Tyl does. For the Wi-Fi-only model they charge £14.99 + VAT per month and the Wi-Fi + 4G model is £16.99 + VAT per month.

At the time of writing we couldn’t see how long of a contract you need to sign to start using Tyl.

Clover Flex Fees

Tyl charges a simple 1.5% transaction fee on all card transactions using the Clover Flex with the exception of Amex cards. If you want to accept Amex cards they can create a custom quote.

To qualify your business must be doing under £50,000 a year in card transactions.

Businesses doing more than this amount can get an even lower bespoke rate.

7. takepaymentsplus

Main features of the takepaymentsplus:

- Print receipts or send them via SMS or email

- Issue receipts with VAT and other product details

- Real-time reporting

- Track cash received

- Up-to-date inventory reporting

- Rapid checkout process

- Get money next working day

- Contracts from just 30 days

- UK based Account Management team

takepaymentsplus Cost

The takepaymentsplus card machine currently costs £25 plus VAT per month for terminal hire, software functionality and SIM card. This reuqires on ongoing contract, although these can be as short as a 30 day rolling contract.

takepaymentsplus Fees

takepayment does not list their fees on their website. If you’d like to get a quote for similar services please click here.

Visit the takepaymentsplus website

*Please note we have affiliate relationships with Square, SumUP, MyPOS, Dojo and takepayments.