SumUp is one of the best-known UK tech companies that offer POS software and hardware solutions with multiple payment methods. The company recently introduced a tap-to-pay feature for processing contactless payments on iPhone devices.

We’ve prepared this guide to introduce you to SumUp Tap to Pay, so let’s start by going over the key shared features of all their POS solutions.

SumUp POS Solutions

SumUp sells multiple POS software solutions for restaurants, quick and self-service venues, and retail shops:

- Card payment readers: SumUp Air and SumUp Solo models

- POS Pro and Lite

- Self-service POS for hospitality businesses

- Tap-to-pay feature for iPhones

Here’s a brief list of SumUp’s main POS features:

User-friendly interface: SumUp’s POS has a straightforward and minimal interface that you’ll learn to navigate quickly. The company offers free onboarding assistance for businesses that need help learning the software’s tools and features.

High-level security: SumUp processes all personal customer and business data through their servers, encrypting it during transfer to the transaction server. Customer data is immediately deleted once the transaction is approved.

PCI DSS compliant: The POS is PCI DSS, TLS, and SSL compliant. The company uses 256-bit encryption, which is considered standard for businesses that process payment data. Additionally, customer data transmitted online is encrypted and PGP compliant.

Technical support: SumUp users can ask for technical support from the company 24/7 via the website’s questionnaire.

Delivery management: Businesses that offer delivery services can use the click-and-collect and delivery tools available on SumUp’s dashboard. By accessing this tool, they can track and review orders created in multiple locations, all from one place.

Multiple payment options: Customers can pay for products, orders, and services using a credit or debit card or a digital wallet such as Google, Samsung, or Apple. SumUp’s software accepts most major debit and credit cards issued in the UK or internationally, such as Discover, Visa, MasterCard, V Pay, Diners, and AMEX.

Accounting and finance management: SumUp’s POS can be linked to Xero, an external accounting integration that allows businesses to manage their finances from the dashboard.

Multiple integrations: In addition to Xero, businesses can sync various third-party accounting, eCommerce, and delivery integrations, such as Otter, Wix, or Shopify, to their tailor-made POS software.

Sales management: Businesses can manage and monitor their daily sales revenue and download sale reports anytime. The in-depth reports are automatically created daily, and you can filter the exact time and dates you’d like to download.

Smart and fast invoicing: With SumUp’s invoice tool, you can automatically create invoices and calculate amounts without using additional integrations or software, such as Excel. This tool not only saves time but also reduces manual errors.

Payment links: Businesses that want to offer online payment options can create links through SumUp’s dashboard. This feature can come in handy for businesses that don’t have a traditional e-commerce setup since it allows them to easily process transactions online. These payment links can be shared via email, social media, or messaging platforms such as WhatsApp.

SumUp POS Pros

- SumUp’s transaction rates and fees are lower than those of other UK-based POS software and hardware providers. The company also provides transparent information on their fixed transaction fees.

- Businesses don’t need to pay additional subscription fees to use the tailor-made or no-contract monthly subscriptions.

- SumUp’s card payment readers can process UK-issued and international credit and debit cards. The devices also accept most major digital wallets, such as Google, Samsung, and Apple.

- Businesses can apply for a one-month trial of SumUp’s POS software and the tap-to-pay payment feature to decide whether to proceed with a monthly subscription.

SumUp POS Cons

- The tap-to-pay method is available only for iPhone devices. However, other businesses in the same niche, such as Revolut or Adyen, offer this feature for both iPhone and Android devices.

- The company’s website doesn’t provide a phone number, so businesses will have to either send questions and ask for help via email or look for a solution on SumUp’s Help Centre web page. The company doesn’t allow merchants and freelancers working in high-risk industries to use any of SumUp’s subscription plans.

- The company doesn’t allow merchants and freelancers working in high-risk industries to use any of SumUp’s subscription plans.

What Businesses Are Not Allowed To Use SumUp & Why

SumUp is a regulated business entity obliged to operate according to requirements and rules imposed by its partners, such as their primary card issuers, Visa, American Express, and MasterCard. The company also collaborates with banks that are gateways for card issuing and management.

Although SumUp is licensed to cater to various industry niches, there are specific industry categories that are strictly prohibited. Here’s a list of the businesses/services that SumUp is not authorised to support:

- Repayment, funding, or financial services

- Companies that are deemed illegal by international law

- Companies that are not regulated by law

- Marketing, travelling, and sales

- Auto and home businesses

- Companies that offer any kind of Insurance, guarantees, and product or service discounts

- Internet, media outlets, and telecommunications

- Counseling, training, mentoring, and coaching services

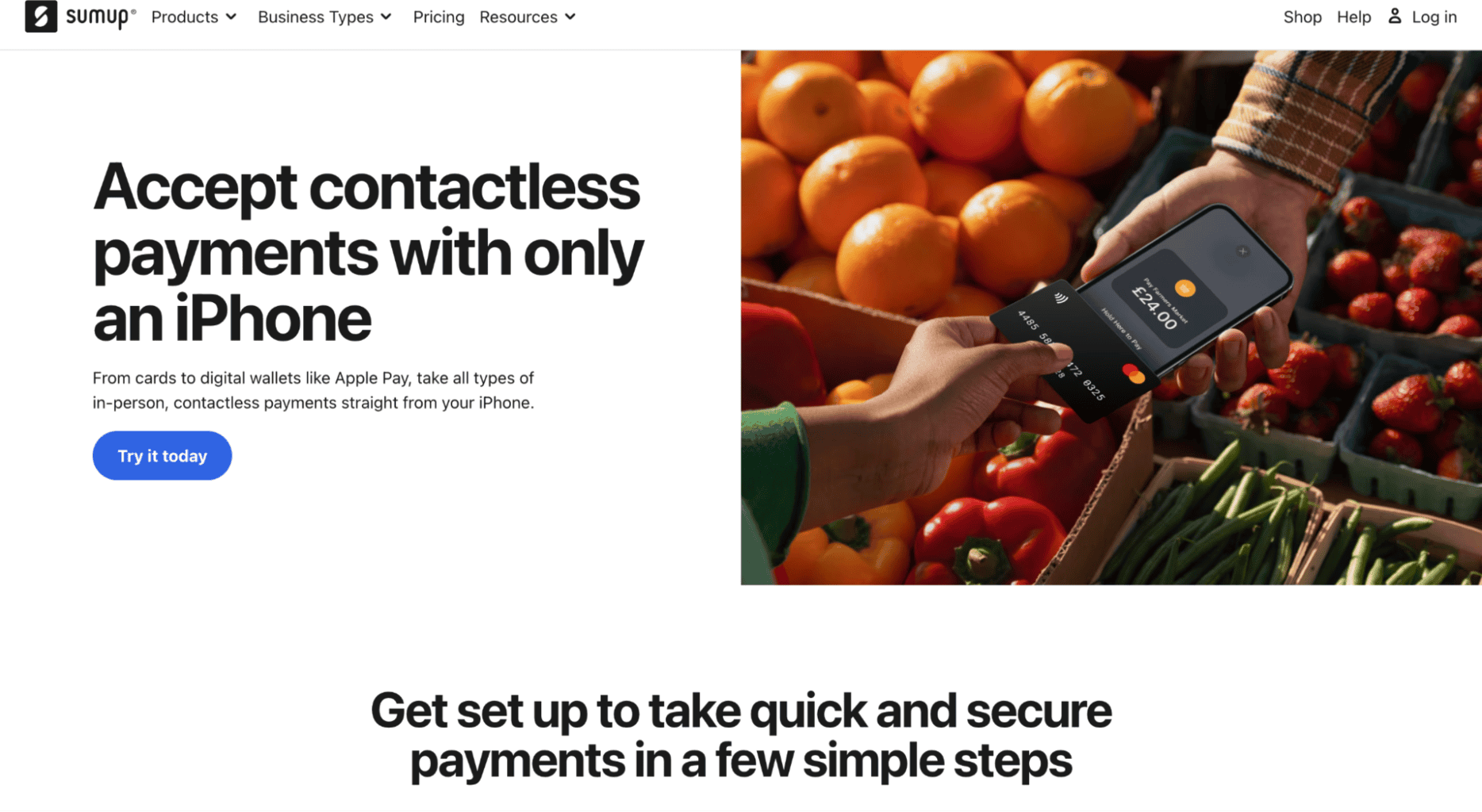

SumUp Tap To Pay Feature

SumUp’s tap-to-pay feature was launched in the summer of 2023. Right now, the feature is available only for UK and Netherlands businesses in the hospitality, entertainment, and retail industries.

The tap-to-pay option is especially useful for companies that want to limit their hardware device usage since it can be used only on iPhones with iOS 16.4 or any of the newer operating system versions.

Businesses that use SumUp’s Tap to Pay can process payments made by Mastercard, Maestro, and Visa debit and credit cards, or Google, Apple, and Samsung digital wallets.

This payment feature doesn’t have a specific limit amount. Therefore, businesses are allowed to process any amount straight from their iPhone device.

Businesses interested in testing out the tap-to-pay feature before paying for a monthly subscription can submit their applications and create a free SumUp account using the following link.

Tap to Pay Security

SumUp Tap to Pay has pre-built privacy, verification, and security features created by Apple and SumUp to keep cardholders and businesses’ personal data safe and encrypted.

Apple won’t keep any personal cardholder data on the company’s servers or iPhone devices. All data stays encrypted and is automatically deleted when SumUp’s software processes the transaction via the mobile app.

Tap to Pay Receipts

The tap-to-pay feature allows businesses to create digital and printed receipts for their customers.

- Digital receipts: To send an e-receipt, select the option to create an SMS or email receipt. Once you choose the receipt type, type the cardholder’s data and click the “Confirm” button.

- Printed receipts: Businesses that use printers connected with SumUp’s POS software can also choose printed receipts.

How to Use Sum Up Tap To Pay

Here’s a list of the steps you need to take to use SumUp’s tap-to-pay feature:

- Create a personal SumUp account.

- Download the SumUp mobile application from the Apple Store. To use this feature, your iPhone should run on iOS 16.4 or a newer OS version. If you’re using an older iOS version, you will be able to use the mobile app but not the tap-to-pay feature.

- Once you download the app, set the feature by clicking on the “Tap-to-pay” button.

- Enter a specific amount that your customers should pay via the feature.

- Click on the “Charge” button.

- Click on the “Tap to Pay on iPhone” button.

- Once you’re redirected to a new page, customers can use a debit or credit card, or digital wallet to pay the amount. They should hold their device or card near the contactless payment symbol at the top of the screen.

SumUp Hardware

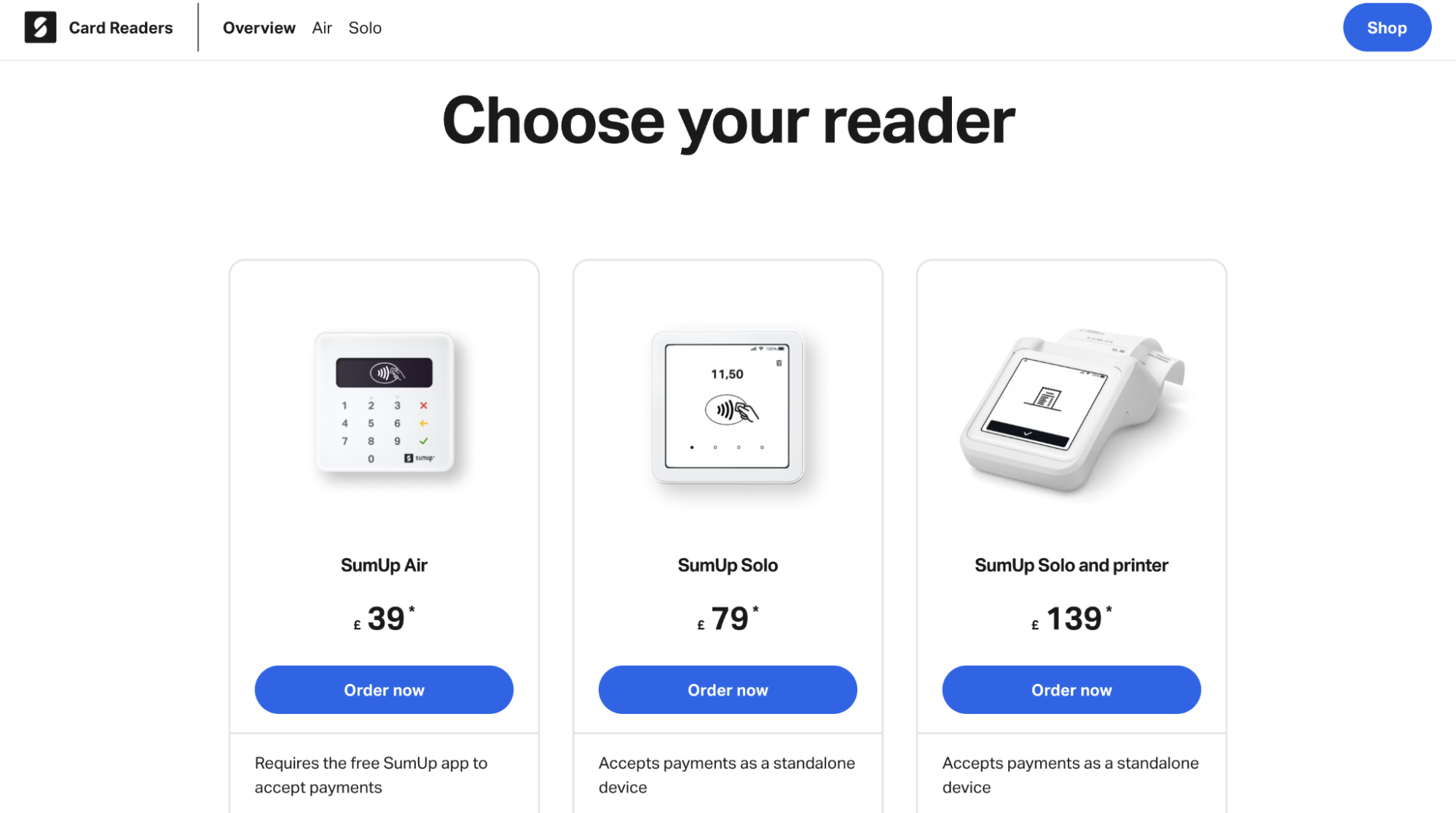

SumUp sells two types of card readers, Air and Solo, and one package that includes the Solo card reader + a digital printer. Let’s learn more about the devices.

SumUp Air

SumUp Air is a portable, user-friendly, and efficient payment device specifically designed to be compatible with the following devices:

- iPad tablets

- iPhone smartphones

- Android smartphones

This lightweight reader is known for its sleek design with a glass-covered display where customers can enter their PIN. It supports both chip and contactless payments, including Apple, Samsung, and Google Pay.

When integrated with the SumUp app, the card reader enables invoicing, email receipts, and transaction links. It also allows you to create a straightforward eCommerce storefront, generate unique QR codes, and handle transactions directly through the app.

Once it’s integrated, businesses can navigate and optimise the card reader to:

- Edit and adjust a product library

- Create multiple user account options

- Download detailed business payout reports

- Choose from a variety of digital payment methods

Additionally, SumUp Air offers gift voucher cards redeemable through the smartphone app along with a complimentary MasterCard. This card can be linked to your official bank account, allowing next-day access to payment transactions. Payments are typically processed within 24 hours to three days.

SumUp Air Integrations

The POS solution can be synchronised with the Air card reader and other hardware devices, which is often a necessity for large hospitality or retail companies. While the card reader doesn’t directly support finance and accounting software, it’s compatible with various plugin integrations, including Wix, PrestaShop, Xero, Shopify, and WooCommerce.

To learn more about the card reader, visit SumUp’s help centre. If you need help setting up SumUp’s devices, watch this video.

SumUp Air

SumUp Air is the latest card reader model known for its fast payment options. This pocket-sized reader is lightweight and an excellent choice for businesses that offer table service since employees can use it on the move. Due to its smart design interface, the card reader can be used to take orders and make payments.

Payments processed with SumUp Air will be processed in the business’s bank account the next day, at around 7 am, any day of the year, including holidays and weekends.

The card has a pre-built SIM and can connect to 3G/4G or Wireless network. Payments will be automatically saved offline whenever the internet goes down, and the POS software will be updated as soon as the connection returns.

Due to its innovative software model, SumUp Air allows customers to add tips while paying. The reader also enables businesses to become sustainable and create receipts without using a digital printer. Employees can create e-receipts and send them to customers via SMS or email.

SumUp Solo + Printer

Businesses that would instead stick to using a traditional digital printer for receipts can opt for this hardware package.

This option allows businesses to print up to 800 receipts on a single charge. Both the card reader and the digital printer are portable and easy to take on the go, making them ideal for both stationary countertop use and mobile operations.

The printer doubles as a power bank for SumUp Solo, automatically switching to charging mode whenever the card reader’s battery runs low. Luckily, the battery lasts a long time and can quickly be charged. Both the card reader and the printer can be recharged in approximately one hour.

Prices and Fees

SumUp Tap to Pay can be included in any subscription plan. The fixed rate per transaction processed with this feature is 1.69% for any type of credit or debit card reader or digital wallet payment. Businesses don’t need to pay any additional monthly rates and fees to use this feature.

SumUp offers the following subscription plans:

SumUp One

SumUp One is a budget-friendly monthly subscription for businesses of all sizes. There are two obligatory fixed rates that companies need to pay monthly:

- £29 monthly subscription price

- A 0.79% fee per transaction for any type of contactless or online debit/credit card and digital wallet payment

Businesses that choose this subscription will receive payouts on their bank accounts around 7 am the day after the transaction has been successfully processed.

Another benefit of this subscription is that businesses will get a 50% discount on any SumUp card payment reader they’d like to purchase and an even more significant discount on SumUp’s latest device, the SumUp Solo card payment reader. The reader costs £39.50 if the business subscribes to the SumUp One plan.

With this subscription, businesses will have full access to SumUp’s Invoices to use various pre-maid invoice templates and automated payment tools and features.

Tailor-Made Subscription

Large businesses interested in creating a customised subscription can submit an inquiry and contact the sales department via SumUp’s website.

There’s no fixed price for the tailor-made subscription as businesses can choose their preferred features. However, a fixed monthly fee of £49 applies for each client using SumUp’s customised subscription.

No Contract

As the name suggests, businesses don’t need to sign a monthly contract using this subscription. There are no extra monthly fees except the fixed transaction fee of 1.69%. This subscription is especially suitable for small and mid-sized companies looking for a cost-effective monthly subscription offer.

Anyone interested in the one-month trial version of this subscription can apply using this link.

SumUp Hardware Prices and Fees

Here’s a list of SumUp’s hardware prices:

- SumUp Air: £39 one-time price and 1.69% transaction rate.

- SumUpSolo: £79 one-time price. The transaction rates and the ongoing sales are the same for both SumUp Air and Solo card readers.

- SumUp Solo + digital printer: £139 one-time price.

Company Summary

Launched in 2012 in London, SumUp is a tech company that provides various payment and POS software and hardware solutions for hospitality and retail businesses of all sizes.

Their services and devices are used in 34 countries by more than 4 million businesses in Europe, the United States, South America, and Australia. Around 2000 companies use one or more of SumUp’s services daily.

SumUp’s headquarters are located at 16-20 Shorts Gardens, London. The company has six additional branches in the following cities.

- Vilnius, Lithuania

- Santiago, Chile

- São Paulo, Brazil

- Bogotá, Colombia

- Dublin, Ireland

- Wilmington, United States

The company was founded by Daniel Klein, who is also the managing CEO, Stefan Jeschonnek, Mark-Alexander Christ, and Jan Deepen.

You can get in touch with SumUp’s customer support via the website or message them on the following emails:

- Questions from customers on data security and verification: dpo@sumup.com

- Questions from governmental or law enforcement bodies: investigations@sumup.com

The company also has a Help Centre where you can find multiple articles and guidelines on frequently asked questions by customers.

To keep up with SumUp’s latest news and updates on social media, you can follow their LinkedIn, Instagram, and Facebook pages.

Online Reviews

SumUp has 14,893 reviews on Trustpilot and an average score of 4.1 out of 5.0 stars.

Most reviewers left positive comments on the company’s quick and easy-to-use software and hardware solutions and praised their friendly and helpful customer support.

The company also has 100 reviews and a median rating of 4.4 out of 5.0 stars on GetApp, and the same number of reviews and an average of 4.4 out of 5.0 stars on Capterra.

SumUp’s mobile app for Android smartphones has over 82,800 reviews on Google Play and an average score of 3.2 out of 5.0 stars. The median score on the mobile app for iPhone devices is higher – 4.8 out of 5.0 stars from over 12,100 reviewers.