SumUp and Square are two of the UK’s most popular payment processors. They’re used by physical businesses big and small every day in favour of a traditional and expensive POS machine. But which card reader is right for you and your business?

In this SumUp vs Square review, we put both card readers to the test. We look at their terminals, features, fees, security and more to help you find the perfect match.

Ready, then let’s begin.

| SumUp | Square | |

|---|---|---|

| Reader Price | From £29 + VAT | From £19 + VAT |

| Transaction fees | 1.69% | 1.75% |

| Monthly Fee | None | None |

| Supported Cards | Visa, Mastercard, American Express, Apple Pay, Google Pay, Diners Club, Discover, UnionPay | Visa, MasterCard, American Express, Maestro, Visa Electron, Vpay, Apple Pay, Google Pay, Samsung Pay |

| Contactless | Yes | Yes |

| Settlement Delay | 1-3 days | None (with a fee) |

| Receipts | Yes | Yes |

| Operating Systems | iOS and Android | iOS and Android |

Terminals and Features

SumUp and Square both offer business owners a range of card readers and POS terminals to suit businesses of any size.

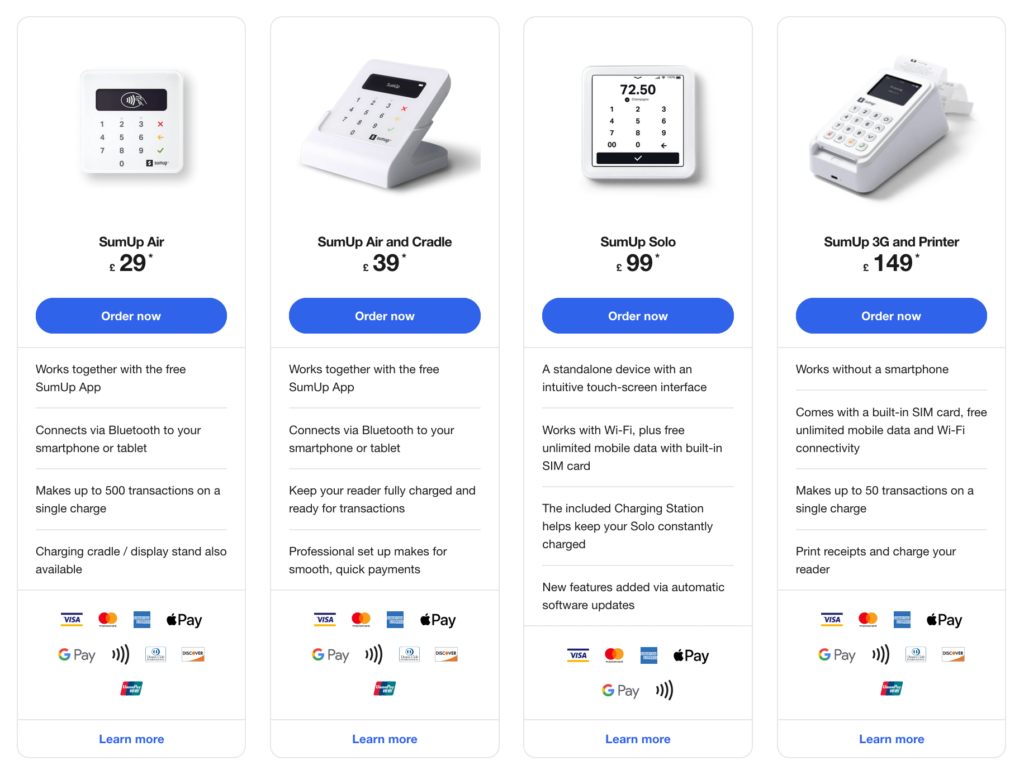

SumUp has three card readers to choose from:

- SumUp Air

- SumUp Solo

- SumUp 3G and Printer

The cheapest option is the SumUp Air, a small, compact card reader that comes with or without a cradle. The cradle keeps the device upright and fully charged. The SumUp Air uses Bluetooth to connect with your smartphone or tablet and processes 500 transactions per charge.

The SumUp Solo offers store owners a standalone device that doesn’t need to be connected to a smartphone. Instead, it uses WiFi and a built-in SIM card with unlimited data to connect to the internet. It comes with a Charging Station that keeps the device fully charged.

The SumUp 3G and Printer is SumUp’s top-of-the-range card reader. It works without a smartphone and uses a WiFi connection or data from the built-in SIM card. The SumUp 3G and Printer can process 50 transactions in one charge, but it’s kept fully charged by the device’s accompanying printer.

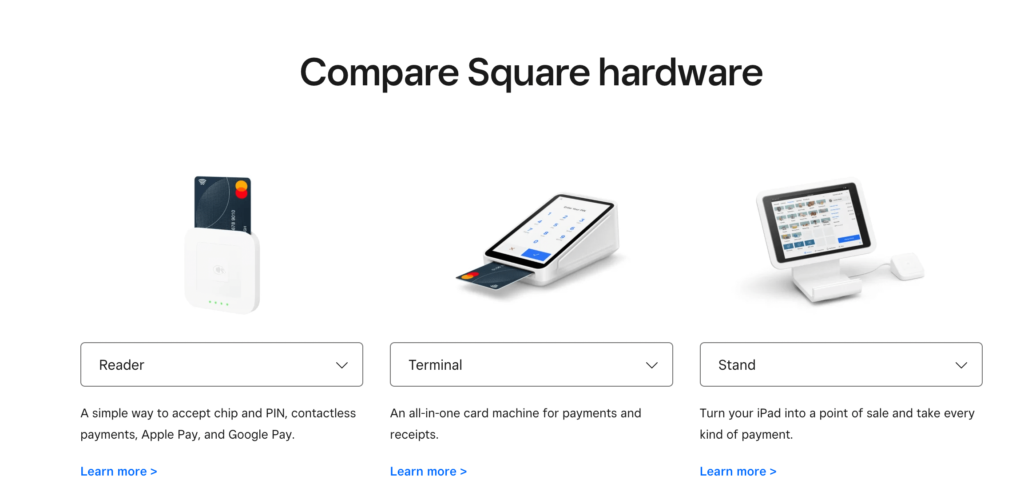

Square boasts four different POS terminals and card readers:

- Square Reader

- Square Terminal

- Square Stand

- Square Register

The Reader will probably be the one you’re most familiar with. It connects to your iOS or Android phone to provide Chip and Pin and contactless transactions. It’s one of the cheapest and easiest to use card readers on the market.

The Terminal is an all-in-one card machine that even prints receipts. It facilitates contactless and chip-and-pin payments. It has a battery that’s powerful enough to last all day, but you can always charge it via a wall outlet.

The Stand offers a nifty way to turn your iPad into a stationary POS device. Open up the Square Point of Sale App and fit your device into the Stand to start accepting payments in minutes. The Stand even swivels so customers can enter their details in privacy.

The Square Register is a complete POS system. It comes with two screens and built-in POS software, so both you and your customers have everything you need to complete transactions.

The App

Both SumUp and Square offer a free POS app to get you started. Both are easy to use, but SumUp edges it thanks to Tap on Phone functionality.

The SumUp app facilitates transactions with the Air Card reader, but it’s also full of great features to help you run your business. Perhaps best of all is the ability to take payment directly on your smartphone using SumUp’s new Tap on Phone technology. Using your phone’s NFC reader, the app makes it possible to collect contactless payments on your phone without a card reader.

The Square Point of Sale app is available on most iOS and Android smartphones and tablets, and Square’s Register. It facilitates payments, lets you manage inventory, run reports and create loyalty programs.

Pricing & Fees

Both SumUp and Square offer fantastic value. Square offers the cheaper card reader, but SumUp has slightly more favourable transaction costs.

SumUp devices are relatively reasonable, starting from just £19 + VAT. A full breakdown of prices is below:

- The SumUp Air costs £19 + VAT

- The SumUp Air and Cradle costs £29 + VAT

- The SumUp Solo costs £79 + VAT

- The SumUp 3G and Printer costs £119 + VAT

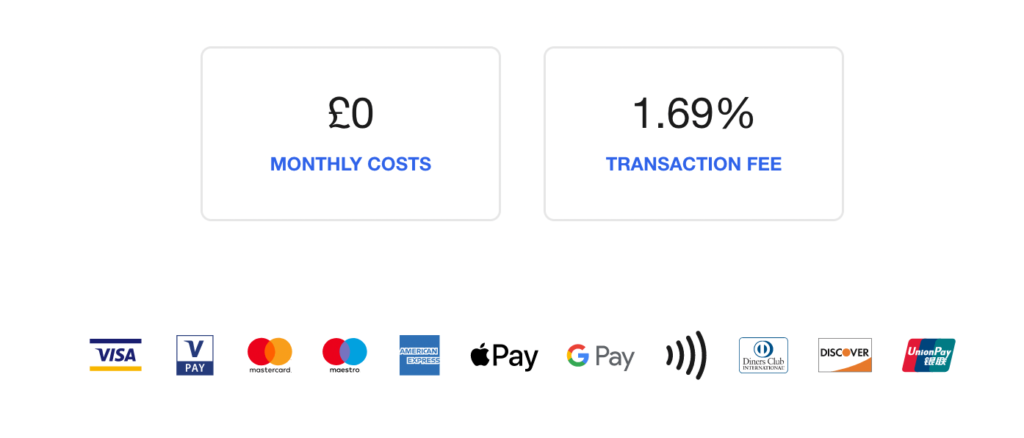

SumUp does not charge a monthly fee to use their devices or app and all local transactions are charged at a low fee of 1.69%.

Additional payment methods (explained below) and card-not-present transactions incur a 2.5% fee.

There’s also a 30-day money-back guarantee and a one-year warranty on all devices.

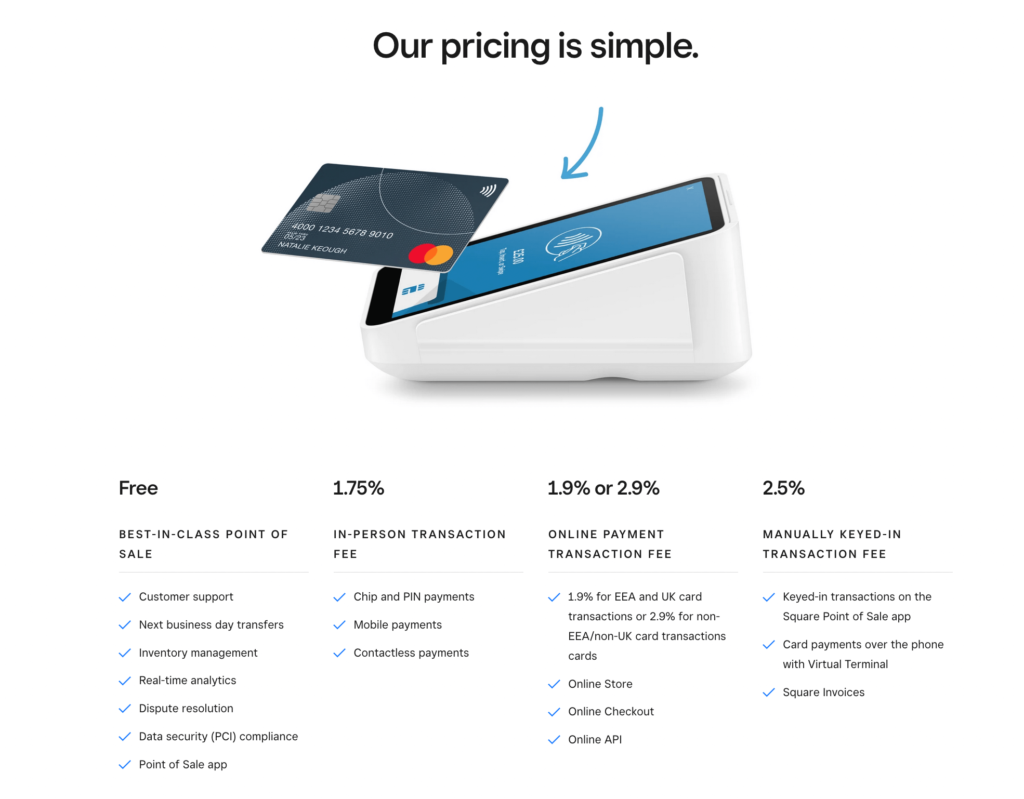

Square has some of the cheapest terminals on the market.

- The Reader costs £19 + VAT

- The Terminal costs £149 + VAT

- The Stand costs £89 + VAT

- The Register costs £599 + VAT

You can get interest-free instalments on all devices except the Reader.

You can use Square’s POS app for free and there’s no monthly fee just like SumUp. Unfortunately, card transactions incur a 1.75% fee, but there are custom plans available for stores doing more than £200,000 annual card sales.

Accepted Cards

Both SumUp and Square accept most major credit and debit cards as well as popular digital wallets. Square just edges it here by accepting Samsung Pay.

SumUp accepts virtually every major card provider, including Visa, Mastercard and American Express. Popular mobile wallets like Apple Pay and Google Pay are also accepted. Contactless payments are available on every terminal.

The SumUp Air and SumUp 3G terminals accept Discover, Diners Club and UnionPay cards as well as those listed above.

Square accepts slightly fewer cards as standard. It accepts debit, credit and prepaid cards with the Visa, MasterCard, American Express, Maestro, Visa Electron or Vpay logos. But it does accept Samsung Pay, alongside Apple Pay and Google Pay.

Other Ways to Get Paid

It’s neck and neck between SumUp and Square regarding additional payment features. Both offer several other solutions as well as online store builders.

SumUp offers the following ways to get paid in addition to its card readers:

- Multi-channel payment links with a 2.5% fee

- Invoices with a 2.5% fee

- QR codes with no transaction fee

SumUp also boasts an online store builder with which store owners can tip their toes into the world of e-commerce. You don’t need to know how to code to use the platform and you can have your store set up in a matter of hours. There are no ongoing fees or setup costs, either. All transactions are charged at 2.5%.

SumUp also offers store owners a comprehensive POS system, which comes with everything you need to run every aspect of your retail store.

Square also provides several additional payment options, which include:

All of these methods incur a 2.5% transaction fee.

Like SumUp, Square has an e-commerce store builder that you can use to get your store online in a day. It has no monthly fee or set up costs and all transactions are charged at a favourable rate of 1.9%.

Payout Times

Square processes transactions faster than SumUp, whether you pay for expedited transfers or not.

SumUp takes 1-3 business days to transfer funds, minus their transaction fee, to your business bank account. It can take several days longer to transfer payments made using American Express and international cards.

Payouts are set to daily by default. This setting can be changed in the SumUp app where you can also track payouts.

Square aims to transfer funds just after 4 pm the next working today. If cash flow is tight, you can request an instant transfer. It costs 1% of the transfer amount but will arrive in 20 minutes.

Receipts

Both SumUp and Square let stores email and print receipts.

SumUp lets you provide receipts using two methods. One option is to buy the SumUp 3G and Printer, which prints receipts automatically once you enable auto-print.

The second is to send them to customers using email or text at the end of a transaction. By entering the customer’s contact information on the payment confirmation screen, a receipt will automatically be sent.

With Square, you can email or text receipts to customers at the end of each transaction. Or, if you have the Terminal or Register, receipts can be set to print automatically.

Security

You don’t have to worry about security with either card reader, but Square goes above and beyond to fight fraudulent payments on your behalf.

SumUp is completely PCI-DSS compliant. Any data sent to and stored on their services is automatically encrypted, regardless of whether it’s sent from a public or private WiFi. All hardware and software either meets or exceeds PCI-DSS standards.

Square is also completely POCI-compliant with end-to-end encryption as standard. What sets Square apart from most other card readers is its commitment to fight fraudulent payments for you and manage disputes without an additional fee.

Reporting

You’ll get the reports and insights you need to grow your business with either card reader.

SumUp is big on reporting, giving everything entrepreneurs need to grow their businesses. Reports include:

- Sales reports

- Revenue reports

- Payout reports

- Fee invoices

- Transaction reports

- Online store reports

All of these are available on the SumUp app for free.

Square’s dashboard is excellent. Viewed via the app or online, it gives you all the data, reports and insights you need to run your business. These include:

- Key Statistics

- Sales Summary

- Payment Methods

- Item Sales

- Category Sales

- Team Member Sales

- Discounts

- Modifier Sales

- Taxes

Customer Support

Square slightly edges SumUp when it comes to support on offer. But it’s a close call and you’ll definitely get the help you need from the SumUp team either way.

SumUp boasts a comprehensive support setup. The starting place for most queries will be the online support centre, which has answers to the most common questions. If you’re still stuck or just prefer to speak to someone, then you can email or phone customer support. Lines open between 8 am and 7 pm on weekdays and 8 am to 5 pm on Saturdays.

Square offers even more support channels than Zettle. As well as a support centre filled with guides, there’s also a seller community forum where you can get support from fellow merchants. Square also offers support via the app, on social media, by email and by phone. Lines are open Monday to Friday 9.00 to 17.00.

And the Winner Is…

Both SumUp and Square are well recommended by merchants, but Square has the higher rating of the two.

SumUp scores 3.3/5 on TrustPilot and 4.9/5 on Capterra.

Square scores 4.0/5 on TrustPilot and 4.7/5 on Capterra.

In a tightly fought race, Square just about has the edge over SumUp. Square’s devices are slightly cheaper even if their rates are higher. They also accept slightly more payment options (like Samsung Pay) and provide faster payouts.

If you do a large amount of transactions, however, you may be better off choosing SumUp for their lower transaction fees.