Cash donations, once the norm for supporting humanitarian initiatives and charities, are increasingly being replaced by card and digital wallet payments.

Most card readers work fine for any type of business out there, including non-profits, churches, charities, and other fundraising organisations. However, there are strict security policies against money laundering mechanisms and illegal activities in the UK that not all card reader providers comply with. On top of that, not all devices offer necessary features for donations, limiting the options for NGOs and charities.

The good news is that several internationally known card reader providers do offer services for charities. We selected the best card readers for charities, so let’s review them.

Which Card Readers Are Suitable For UK-Based Charities?

Some of the best-known card readers for charities, fundraisers, and NGOs that can be used in the UK include the following:

Keep in mind that individuals raising money for a particular cause through a private bank account are not allowed to use card readers. Therefore, to become eligible to use a card reader, charities must show proof of their registration.

Once the card reader is certified and recorded for the unique purposes of the charity, it can only be used for the organisation’s purposes. In case it’s used for other funds and transactions, the bank account can automatically become frozen.

Lastly, not to state the obvious, but the payment services and card reader devices provided by any of the companies we review cannot be used for illegal fundraising activities. Otherwise, the charity will be sanctioned by the UK government. In addition, charities are not allowed to raise money and transfer funds from the card reader to their bank account for the purposes of terrorist activities or for countries that are internationally sanctioned.

Now, let’s see how our selection of card readers can benefit charities, starting with Square.

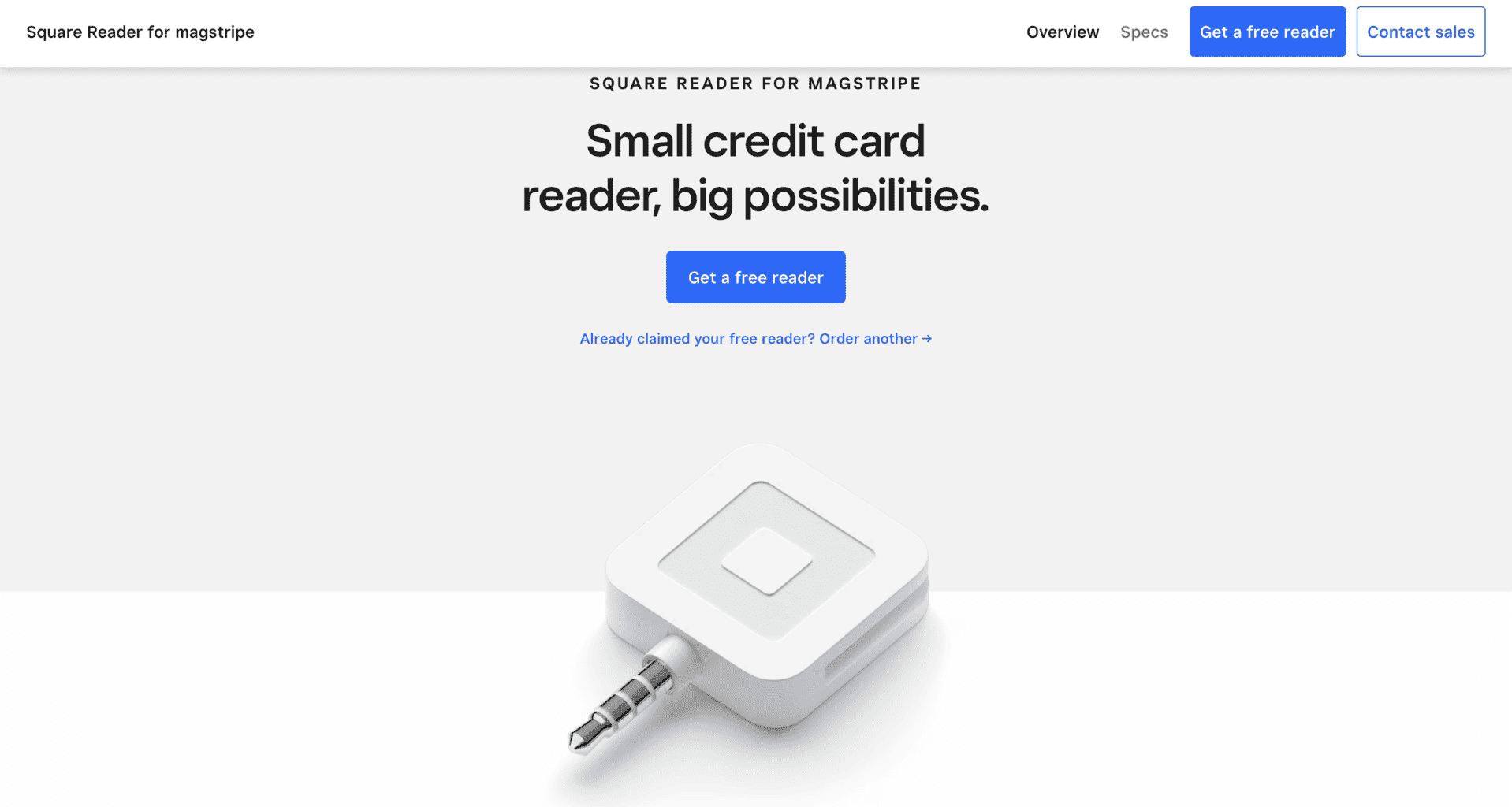

Square

Square is one of the leading card reader providers in the UK. Their primary clients are solo merchants and businesses. Still, the company is also eligible to provide UK-based charities and NGOs with a free-of-charge card reader that works in sync with their Square Point of Sale mobile app.

For the company to find out if the charity is eligible to own a Square card reader, an authorised person by the charity has to sign up and submit an application that includes their personal details and information about the charity.

The authorised individual who signs up for a Square card reader will have access to a Square account if the application is successful. The charity will not be able to change the person in charge of the Square account, which is why it’s essential to choose a trustworthy individual.

Square’s card reader can receive and process donations only if it’s synced to the charity organisation’s bank account. Charities are allowed to add a bank account owned by the authorised person who applied for the card reader or a private bank account owned by the authorised person that was opened in the UK and allows Direct Debit transactions.

With Square’s card reader, charities can process digital and card payments via credit and debit cards, which include:

- Mastercard

- American Express (AMEX)

- Visa

- Discover

The rate per transaction is fixed at 2.6%, and charities must pay an additional 10 cents for each money transaction. All payments are processed and transferred to the charity’s bank account after a 24-hour period during workdays.

Charities can use the smartphone application on their Android and iOS-based devices to track and monitor each donation. The application also collects analytics about each donation, so charities will have access to the basic information about each donor and the amount of money they transferred to the charity’s bank account.

If you’re interested in learning more about Square’s card readers and their features, you can contact the sales team by submitting your inquiries via the form on their website.

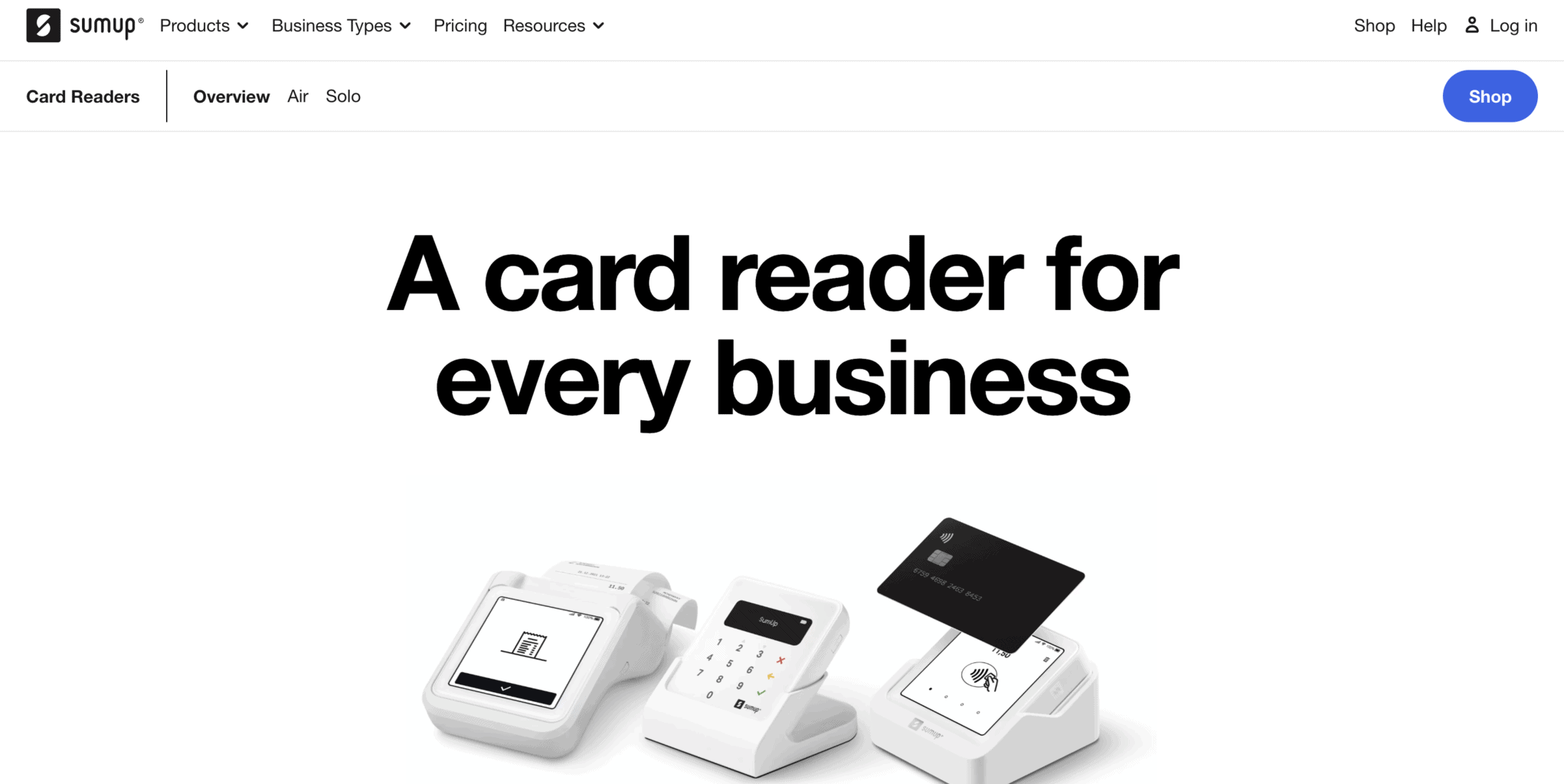

SumUp

SumUp offers card readers for all kinds of businesses, including NGOs, fundraisers, and charities. To be eligible to apply for a SumUp reader, charities must be fully compliant and amenable to all the UK regulations about charities.

Charities can apply for a SumUp card reader online by contacting the company’s Sales department and providing them with all the necessary information. One of the conditions for using SumUp is that charities must have an active bank account registered under their name. If approved, there’s no need to sign an agreement.

Payment Methods

Charities can use various payment methods to raise money, such as:

- Chip & Pin

- Credit cards (all major credit cards)

- Debit cards (all major debit cards)

- Digital wallets (Google Pay and Apple Pay)

Anytime a donor makes a transaction via the reader, it will also automatically appear on the app. The synced app and card reader are quite convenient since they allow charities to keep track of their funds and separate them into groups by day, week, or month.

The links from the payment transactions created with the card reader can be forwarded to the donor via an SMS message or email. The card reader also has a pre-installed QR code scanner that donors can scan, and SumUp will automatically receive the payment in a few seconds. And on top of all that, the reader can be synced with a digital printer via Bluetooth, so charities can print receipts for their donors.

Once the payment is processed via the card reader, it will be transferred to the charity’s bank account in about two to three days. Payment cannot be transferred during the weekend, so if they’re created on Friday, they will be transferred on Monday at the latest.

Charities can also create a SumUp business account. If they are approved for it, they’ll have the advantage of receiving their payment in their bank account in approximately one day, even on weekends.

If users encounter an issue or want to ask for technical support, they can call SumUp or email them and expect an answer during weekdays from 8:00 in the morning until 19:00 or during weekends from 8:00 until 17:00.

Pricing

SumUp’s card reader is one of the most straightforward, easy-to-use, and lightweight card readers available in the United Kingdom. Additionally, the device is quite affordable compared to the other ones on the list since it costs only £39, without the additional VAT expenses. The price is fixed, so there’s no need to ask for a personalised quote from SumUp.

The additional rates are the same for every user, so for each transaction charities are obliged to pay 1.69%, and there are no additional fees.

The rates stay fixed even if donors use an international payment method. Therefore, donors do not need to have a registered bank account in the United Kingdom to donate their money, and charities won’t have to pay a higher fee if that is the case.

The card reader has recently been updated with the most recent software upgrade to be easily synced to the SumUp smartphone app. Charities that use SumUp can download the app through Google or Apple App stores and use it via a mobile or tablet device.

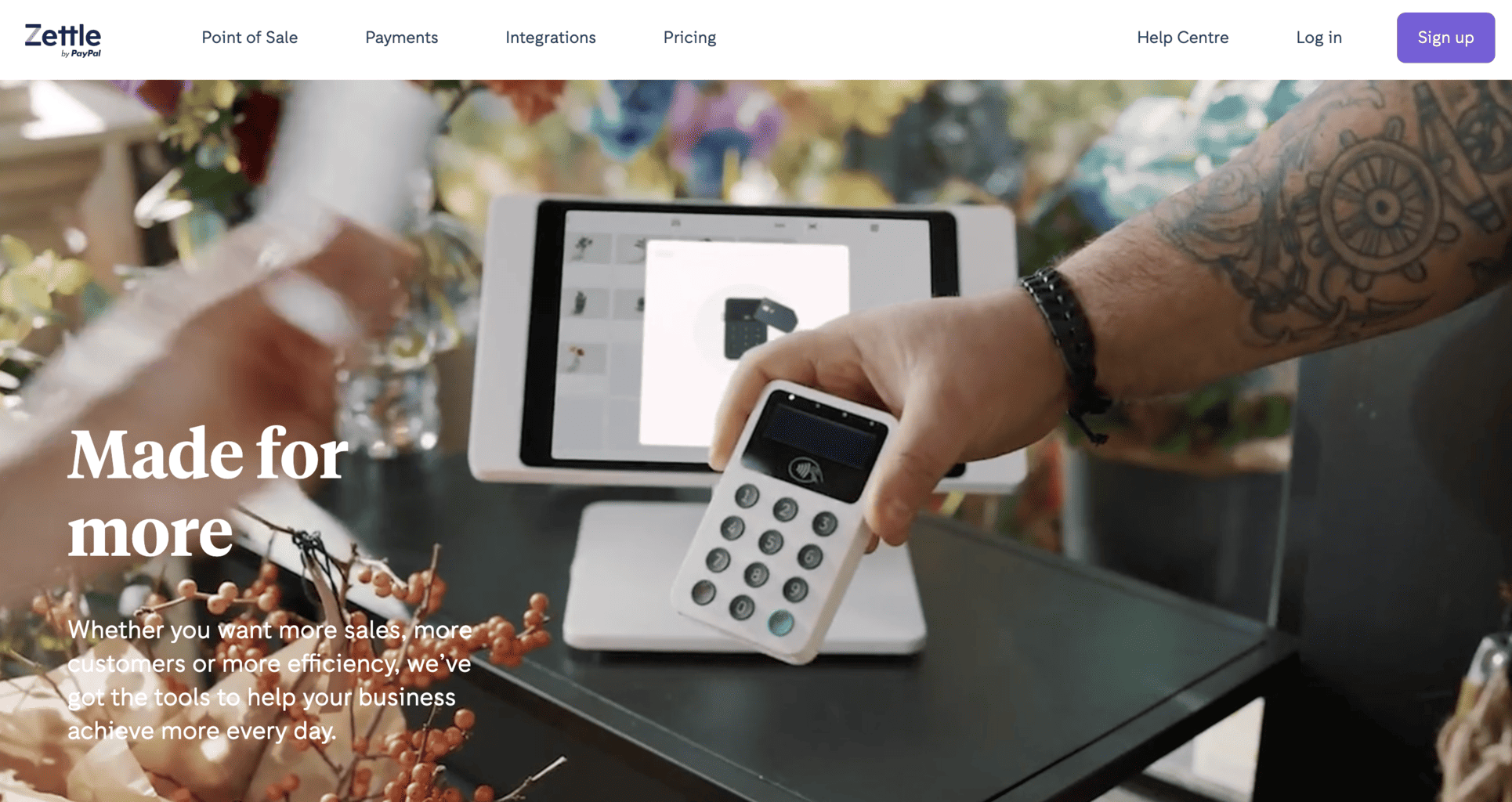

Zettle Reader

Zettle Reader is a user-friendly card-reading device owned by PayPal, one of the most renowned payment facilitators worldwide. Zettle Reader is suitable for all sorts of businesses, including charities and non-profit organisations in the UK.

The card reader is lightweight and can be easily synced with a mobile point-of-sale (POS) app on an Android or iOS-based smartphone via Bluetooth. Once it’s synced with the app, all the transactions created via the card reader will automatically appear on the app, too.

Zettle Reader provides charities with a large selection of payment methods, such as Chip & Pin, digital wallet, and credit or debit bank card payments. Here’s a list of the accepted cards and digital wallets:

- Maestro

- Mastercard

- V Pay

- American Express

- Visa

- Visa Electron

- Diners Club

- Union Pay

- Google Pay

- Samsung Pay

- Apple Pay

- JCB

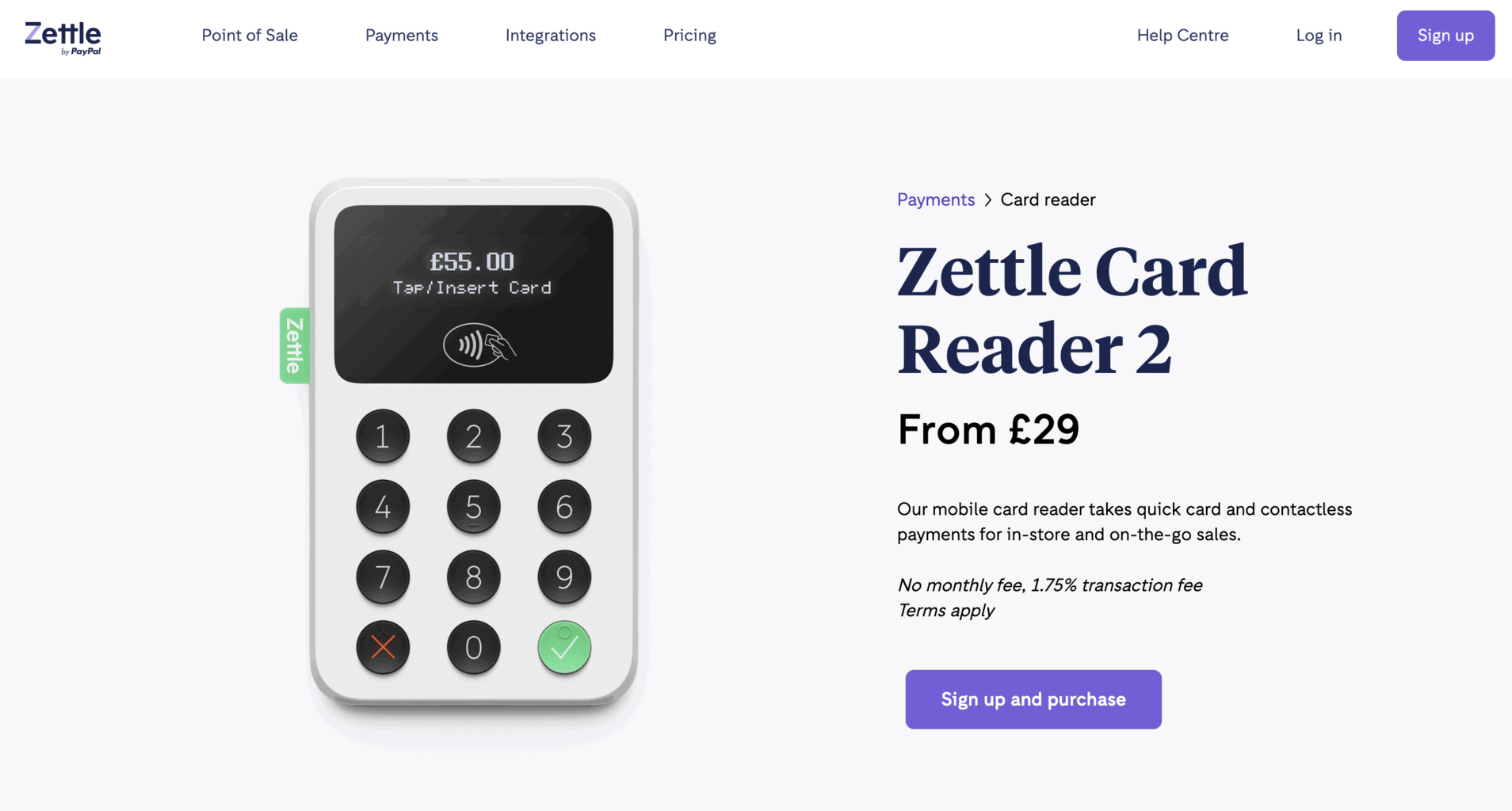

Prices start at £59, and the first card reader comes with a discount, as you’ll only pay £29 the first time. However, charities must submit an application to get a personalised quote from Zettle.

Charities have to pay a 1.75% fee per transaction. The prices are the same for domestic UK-based and foreign credit and debit cards, and, there are no additional monthly fees or an obligatory contractual agreement to use the device. The payments are transferred within 24-48 hours during work days, from Monday to Friday.

Zettle’s card reader can also be synced and connected to an Android or Apple-based smartphone or tablet that has the Zettle Go app via Bluetooth.

There is an option to send digital receipts by text or email directly from Zettle Go or print receipts by syncing the card reader to a thermal printer. Zettle Go resembles a mobile POS solution as it contains many features and integrations, such as invoices, emails, data analytics, tipping, financial payments, etc.

Charities that are approved by the FCA or registered at the Charity Commission for England and Wales are allowed to apply for a card reader on Zettle’s website. The charity must show proof they have a bank account and has to receive regular annual payouts.

Another way to open a Zettle account and use their card reader is to open a business account on PayPal’s official website as a charity or NGO based in the UK. Then, they can apply for Zettle’s card reading device through PayPal’s website.

For additional questions, you can check out the contact information and answers provided on the Help Center page on Zettle’s website or contact customer support.

Stripe

Stripe is one of the most user-friendly and straightforward card reader devices, suitable both for charities and NGOs based in the United Kingdom. The card reader has a plethora of features and accepts various types of payments, such as:

- Digital wallets

- Debit cards

- Credit cards

- EMV (Chip & Pin)

- NFC

With Stripe, charities can manage and track all their payments through a mobile application suitable for both Android and Apple devices.

Charities don’t need to pay any additional fees once they purchase the card reader. The only obligatory rate is the 2.7% fee per transaction. In case there’s a large number of transactions, charities can ask for a tailor-made quote by Stripe.

The card reader can be synced with a third-party integration called Stripe Terminal. With this tool, charities can keep an eye on all of their transactions and download reports. The integration also allows users to send payment invoices via email.

The transactions will be automatically transferred to the charity’s account in a period of 48 hours. However, the first payment payout often takes a little bit longer, but usually not more than ten days. Stripe also offers an option for businesses and charities to receive payments on their bank accounts in just a few minutes.

However, to do so, charities must own a debit bank card and contact Stripe’s technical support team to set up this option. In case they have a debit bank card, they’ll be able to receive donations fast and access all transactions any time they want throughout the year.

The company offers the following card reader models:

Charities can always contact Stripe whenever they encounter an issue since the company offers technical support via live online chat, telephone, or email. Here you can find Stripe’s contact information.

LibertyPay

LibertyPay offers different types of card readers with software that’s specifically tailored to the applicant’s purposes. Their devices are suitable for businesses and organisations of all sizes, including retail and hospitality businesses, non-profits, foundations, and charities.

The company doesn’t produce its own card reader models but sells devices from several tech companies. Charities can choose a card reader of their preference and use it via:

- Wireless network

- Mobile

- Bluetooth

- Countertop

Like any other business, charities must apply for a LibertyPay card reader via the company’s application.

To be an eligible candidate for a LibertyPay payment device, the charity organisation must be based and registered in the UK. To get approved for a card reader, they’ll have to create an online account and submit their application, where they’ll need to show proof of an existing bank account in the charity’s name.

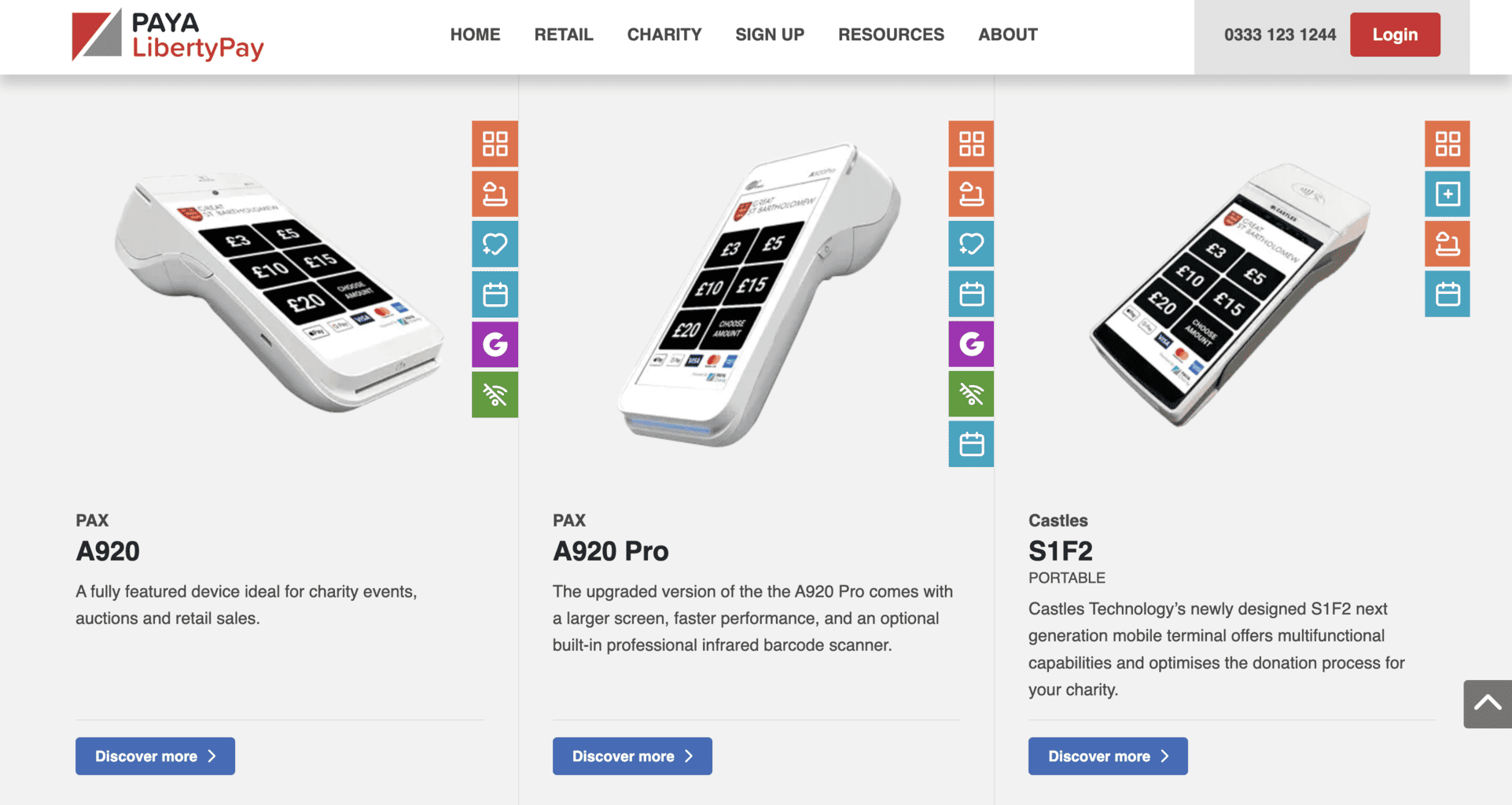

The company offers three card reader models designed explicitly for the purposes of charity organisations:

- PAX A920: Sleek and easy-to-use portable device with 4G or WiFi connectivity features. The A920 model can be connected and synced to a mobile application on an Android or Apple device. Once the device is synced, all the payments will automatically appear on the application, and charities will have instant access to each transaction and donor details.

- PAX A920 Pro: This is the second edition of the A920 model. The biggest difference between the A920 and A920 Pro models is that the latter has a bigger display screen, improved UX/UI design, quicker software, and can be ordered with or without a pre-built QR code scanner.

- S1F2 Portable: Straightforward and user-friendly portable device with a simple interface design. The device can be used via 3G, 4G, WiFi, and Bluetooth. It comes equipped with a pre-built microphone, QR code scanner, stylus, and a miniature camera.

LibertyPay’s magstripe card reader can provide charities with various payment methods, such as:

- Chip & Pin

- Contactless transactions with credit or debit cards from all major banks (both domestic and international)

- Digital wallet payments (Android or Google Pay)

In case you’re interested in finding out more about LibertyPay’s card reading devices, you can message the company at info@libertypay.co.uk or call customer support at the following number: 03331231244.

WorldPay

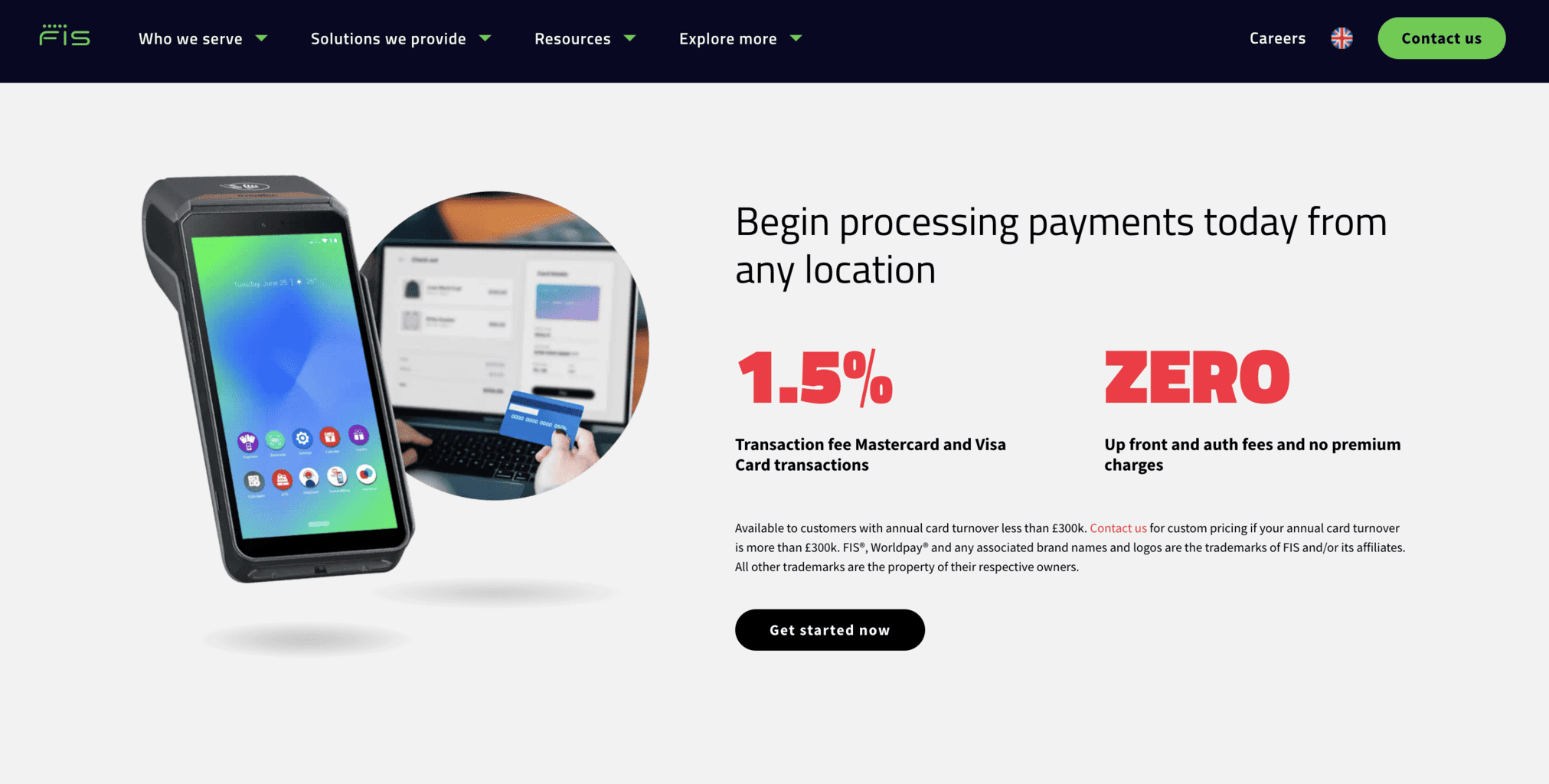

WorldPay, owned by FisGlobal, offers card readers that can be used by various types of businesses and organisations, including charities and non-profits.

WorldPay’s card reader can be synced with a point-of-sale (POS) platform, which charities can open from their smartphone or tablet device.

Once the card reader is synced with the platform, charities can create an account and use the POS’s tools and features. The platform has a dashboard to keep track of their transactions and donor information. The POS platform can be used for free, and charities will get access to it once they subscribe to use the card reader.

Charities must ask for a tailor-made quote from WorldPay regarding costs, but the starting subscription price is £19 monthly. Charities must also sign a contract if they’re approved to use WorldPay’s card reader.

Another beneficial thing about WorldPay’s card reader is that charities don’t need to pay any extra fees and rates to use it, except for the monthly subscription and the transaction rate. The rate is 1.5% per transaction created by a Visa or Mastercard credit or debit card.

Only businesses and charities with a yearly turnover lower than £300.000 are eligible to use the card reader. Charities that want to find out if WorldPay’s card reader is a good match for their organisation will have to fill out an application via the company’s official website.

If charities encounter an issue or need assistance, they can contact WorldPay’s technical support, available 24/7.

If you’re interested in learning more about WorldPay’s offers, you can contact the company’s Sales department and ask for customised prices and fees.

Additional Donation Methods

In addition to using card readers, charities can also consider several options for raising funds online. Some of the most popular alternative ways to collect donations are:

- Sending donations via SMS text with InstaGiv or Donr

- Transferring a sum of money by scanning QR codes with SumUp

- Forwarding links for processing payments with Square or PayaCharity

- Creating a web page for raising funds with PayPal or JustGiving

Online donation methods are more expensive than payments processed by card readers. However, both options can work together, so the easiest and quickest way to raise a more significant sum of money for charity purposes is both by raising donations online and using a card reader device.

Recap

Collecting donations with the help of a card reader device can be beneficial for any type of charity based in the UK since, nowadays, many people prefer paying by card or with their Android or Apple Wallet instead of by cash. All of the card readers on this list are user-friendly and have a straightforward and intuitive interface design, so charity volunteers won’t have trouble mastering the devices.

The most affordable and user-friendly card reader devices for UK-based charities are:

- Zettle

- SumUp

- Square

All three companies offer card readers with fixed fees and rates, so charities will know the exact percentage they must pay the card reader providers in advance.

Finally, established and well-known charity organisations and initiatives can also benefit from charity kiosks by Elavon or Worldplay, which are usually more expensive than card readers.