SmarterPay provides a range of payment solutions. As a private, family-owned company, they pride themselves on prioritising customer satisfaction over satisfying external investors. If you are looking for payment services from a company that values customer service and fair pricing, SmarterPay may be the solution for you.

The company offers payment solutions to companies of all sizes, ranging from large utilities and payroll providers to local sports clubs.

Their range of payment solutions includes Direct Debits and Direct Credits (Bacs approved, of course), Direct Debit Management, Card Payments, PayPal, and multiple other payment methods.

Customers have the flexibility to choose between cloud-based or on-premise services and standalone or integrated solutions. SmarterPay also integrates with various partners, such as Salesforce, Sage, ENSEK, and Zuora.

Prices/Fees

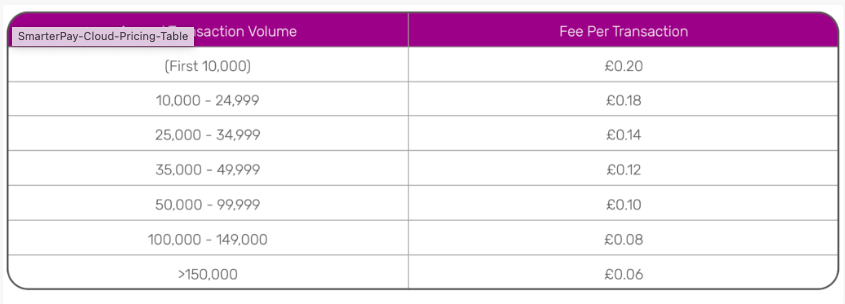

The fee for SmarterPay changes according to the volume of transactions you make annually. Fees for Bacs Transactions using standard services are as follows:

The minimum monthly fee you pay is £30. SmarterPay also offers fixed-cost packages for high-volume submissions. However, card transactions are excluded, and payment gateway fees and merchant service fees will apply if you use the card payment function. If you’re using Opayo Gateway, you can benefit from favourable rates.

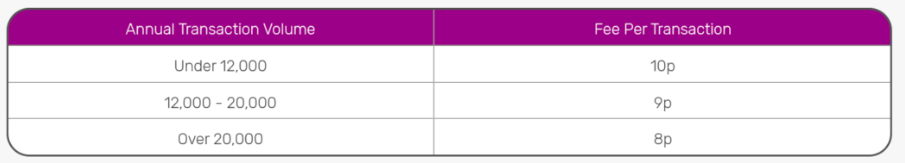

The card payment module Licence costs £50.

The Opayo Payment Gateway fees are as follows:

Services

Smarter Pay Cloud

SmarterPay Cloud enables you to make and receive payments, by integrating your account with various payment schemes online. You can make payments to your suppliers and staff, while also receiving payments from your customers on the same platform.

The SmarterPay Cloud is accessible through any web browser and protected by multi-factor authentication or memorable word verification.

Getting Payments

Direct Debit

Direct Debits have been a popular method of revenue collection in the UK for over five decades and continue to be a favoured choice for businesses.

SmarterPay offers Bacs-approved platforms that allow for the direct and indirect submission of Direct Debits through various channels, including software, SaaS (cloud), and bureau.

SmarterPay also provides payment processing, integration, and reconciliation services that can be directly linked to a customer’s CRM, accounting system, or billing platform.

Card Payments

SmarterPay has established partnerships with Opayo and Elavon, which provide fully compliant Level 1 PCI DSS solutions and competitive fees for customers.

On top of that, SmarterPay offers various options for collecting single or recurring payments through different mediums, including face-to-face, telephone, virtual terminal, and integrated payment gateway solutions.

Making Payments

Bacs Direct Credit

SmarterPay offers the Bacs Direct Credit process for businesses to make payments to suppliers or staff in a timely and accurate manner. With a 3 day payment cycle, payments can be made using the software, SaaS (cloud) or bureau services.

You can easily upload a file export from your accounting or payroll system or use the API to automate the process.

All the services are fully compatible with all payroll systems and accommodate RTI feed within the transmitted file structure, ensuring easy payments and accurate financial records.

Integrations

Salesforce

SmarterPay is a Salesforce ISV partner, which means it offers expertise in integrating Direct Debits and Card Payments directly into Salesforce.

With SmarterPay’s Direct Debit Management System (DDMS), you can set up direct debits within the Salesforce application or link the sign-up to an external signup process, such as your website. The application manages the entire direct debit lifecycle and provides a full audit trail of the process.

In addition, SmarterPay can integrate with any payment gateway to process card payments, including Paya, PayPal, Cardstream, Global Payments, and Stripe. This allows you to take a card payment and link it to any object within Salesforce, either directly or via an external process, such as a payment link or website.

SmarterPay also has a partnership with Opayo and they extend favourable transaction charges to their customers if needed.

API

SmarterPay’s open API integrates different payment platforms to your existing system. This allows you to customise and choose the services for your business like payment processing, reconciliation, and reporting.

Accounting Seed

SmarterPay has a partnership with Accounting Seed, an accounting application on the Salesforce Platform.

You can fully integrate your system to Accounting Seed’s billings and payables through a managed package. This way you can receive and pay invoices electronically from Accounting Seed.

Abacus Financials

Abacus Financials is a cloud-based financial management platform that is exclusively built on Salesforce Lightening. It is designed to provide maximum efficiency and transparency by eliminating the need for integration.

With Abacus, you can access any financial information real time on all platforms 24/7. The platform is easy to use and comes with sophisticated dashboards that allow for easy analysis of financial data.

Bacs Services

Bacs Software

SmarterPay Bacs Software is a Bacs-approved payment solution that integrates with your existing accounting, payroll or membership management software to electronically send payment instructions to Bacs.

With multiple user access, it allows you to manage business payments, pay staff and suppliers and collect customer payments.

The Bacs Software also offers various features such as modulus checking and ECISD lookup to verify submission dates, or make indirect submissions for clients.

Bureau Software

SmarterPay offers a Bacs-approved Bureau software that enables indirect file processing with the flexibility to assign an unlimited volume of service user numbers to their BSUN.

The software can be installed on-premise or hosted in the cloud and comes with standard features such as modulus checking, processing date validation, and file submission through card readers or HSM.

The software also has configurable security and access rights, two-factor authentication for login, and fully encrypted files for submission. Additional features include the ability to submit RTI information within payroll files.

Bureau Services

SmarterPay’s Bacs Bureau service is a pay-as-you-go solution. It aims to simplify payment processes and ensure full compliance with all Bacs processes.

To process Bacs payment files, you need to be registered with Bacs and have a Service User Number (SUN) from your bank. After your initial file submission, SmarterPay completes your Bacs payments and provides a full audit history and Bacs reports that are available to view online at any time.

Contingency

Contingency service helps you manage unforeseen issues that may prevent you from submitting payment instructions to Bacs.

The service uses SmarterPay’s Bureau to safeguard the Bacs environment to function, and is a safety net in case of events such as lost, damaged, or expired smartcards, hard disk failure, virus attacks, or accidental server wipes.

Extra Care On Customer Support

The company’s customer service team comprises UK-based payment specialists who are DBS-checked and GDPR-trained. They are committed to providing effective and professional service, ensuring that customer queries are dealt with quickly.

Company History

SmarterPay was born out of Data Interchange, a leading B2B integration provider, as a payment services provider in 2017 in the UK.

The company was formerly operating under the name of Income Systems since 2010.

User Reviews

SmarterPay User Reviews

Review Summary

Recent Reviews

There are no reviews yet. Be the first one to write one.

Leave a Reply