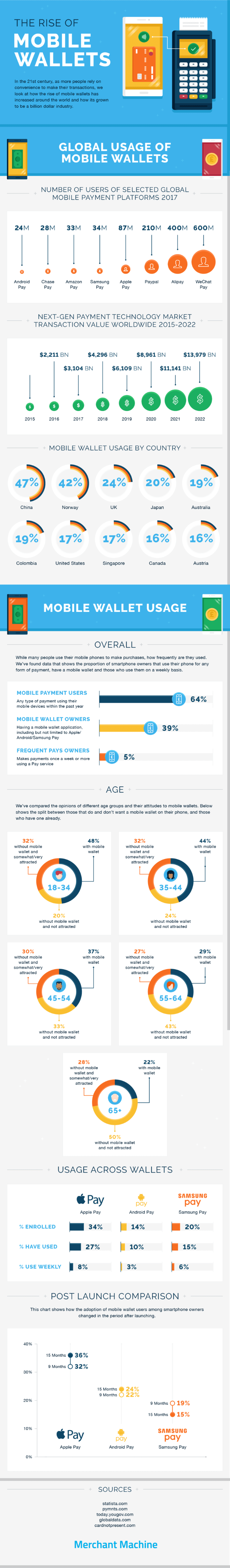

In the 21st century as more people rely on on convenience to make their transactions we look at how the rise of digital and mobile wallets has increased around the world and grown into a multi-billion dollar industry.

Number of users of leading mobile payment platforms worldwide

| Wallet | Users in millions |

|---|---|

| WeChat Pay | 600 |

| Alipay | 400 |

| PayPal | 210 |

| Apple Pay | 87 |

| Samsung Pay | 34 |

| Amazon Pay | 33 |

| Chase Pay | 28 |

| Android Pay | 24 |

Mobile & Digital Wallet Usage By Country

| Country | Percentage |

|---|---|

| China | 47% |

| Norway | 42% |

| UK | 24% |

| Japan | 20% |

| Australia | 19% |

| Colombia | 19% |

| Country average | 18% |

| United States | 17% |

| Singapore | 17% |

| Canada | 16% |

| Austria | 16% |

Next-gen payment technology market transaction value worldwide 2015-2022

| Year | Transaction value in billion U.S. dollars |

|---|---|

| 2015 | $1,592.20 |

| 2016 | $2,211.25 |

| 2017* | $3,104.33 |

| 2018* | $4,296.67 |

| 2019* | $6,109.64 |

| 2020* | $8,961.22 |

| 2021* | $11,141.55 |

| 2022* | $13,979.85 |

* estimated

Also see: UK online payment systems, card readers, and other payment processing companies.

Overall Usage

| User Group | Description | Percent |

|---|---|---|

| Mobile Payment Users | Any type of payment using their mobile devices within the past year | 64% |

| Mobile Wallet Owners | Having a mobile wallet application, including but not limited to Apple/Android/Samsung Pay | 39% |

| Frequent Pays Owners | Makes payments once a week or more using a Pay service | 5% |

Mobile & Digital Wallet Usage By Age Group

| Age Group | % with mobile wallet | % without mobile wallet and not attracted | % without mobile wallet and somewhat/very attracted |

|---|---|---|---|

| 18-34 | 48% | 20% | 32% |

| 35-44 | 44% | 24% | 32% |

| 45-54 | 37% | 33% | 30% |

| 55-64 | 29% | 43% | 27% |

| 65+ | 22% | 50% | 28% |

Usage of Various Digital Wallets

| Usage | Apple Pay | Android Pay | Samsung Pay |

|---|---|---|---|

| Penetration - % Enrolled | 34% | 14% | 20% |

| Activation - % Have Used | 27% | 10% | 15% |

| Usage - % Use Weekly | 8% | 3% | 6% |

Support of Popular Mobile Wallets By Country

| Apple Pay | Google Pay | Samsung Pay |

|---|---|---|

| Australia | Australia | Australia |

| Brazil | Belgium | Belarus |

| Canada | Brazil | Brazil |

| China | Canada | Canada |

| Denmark | Croatia | China |

| Finland | Czech Republic | France |

| France | Germany | Hong Kong |

| Guernsey | Hong Kong | India |

| Hong Kong | India | Italy |

| Ireland | Ireland | Malaysia |

| Isle of Man | Italy | Mexico |

| Italy | Japan | Puerto Rico |

| Japan | New Zealand | Russia |

| Jersey | Poland | Singapore |

| Norway | Russia | South Africa |

| Poland | Singapore | South Korea |

| San Marino | Slovakia | Spain |

| Singapore | Spain | Sweden |

| Spain | Taiwan | Switzerland |

| Sweden | Ukraine | Taiwan |

| Switzerland | United Kingdom | Thailand |

| Taiwan | United States | United Arab Emirates |

| Ukraine | United Kingdom | |

| United Arab Emirates | United States | |

| United Kingdom | Vietnam | |

| United States | ||

| Vatican City |

Usage Post Launch

| Wallet | 9 MONTHS | 15 MONTHS |

|---|---|---|

| Apple Pay | 32% | 36% |

| Android Pay | 22% | 24% |

| Samsung Pay | 19% | 15% |

Devices That Support Popular Mobile Wallets

| Apple Pay | Google Pay: | Samsung Pay |

|---|---|---|

| iPhone SE | S3, S3 LTE | Samsung Galaxy S3 |

| iPhone 5, 5C, 5S (Only if connected to Apple Watch) | S4, S4 LTE | Samsung Galaxy S4 |

| iPhone 6, 6 Plus, 6S | S5, S5 LTE | Samsung Galaxy S5 |

| iPhone 7, 7 Plus | S6 edge, S6 | Samsung Galaxy S6 edge |

| iPhone 8, 8 Plus | A7 | Samsung Galaxy A7 |

| iPhone X | Gear S2, S3 | Samsung Galaxy Note Edge |

| Apple Watch | Z, Z Ultra, Z Ultra LTE | Samsung Gear S2 |

| Z1, Z1 Ultra LTE, Z1 Compact | Note 3 LTE | |

| Z2, Z2 Tablet, T2 Ultra | Note 3 | |

| Z3, Z3 Compact, Z3 Tablet Compact, C3 | Note 4 LTE | |

| Z4+, Z4 Tablet | Note 4 | |

| Z5, Z5 Compact, Z5 Premium, E5 | Note 5 LTE | |

| X, X Compact, X Performance | Note 5 | |

| XA, XA Ultra | MEGA | |

| XZ | S3 LTE | |

| G Flex, Optimus G Pro | S4 LTE | |

| G2, G2 Mini | S5 LTE | |

| G3, G3 Beat | S6 | |

| G4 | S3 | |

| G5 | ||

| G Pro 2, Xpower 2 | ||

| LG Watch style, LG Watch Sport, LG Watch Urbane 2nd Edition LTE | ||

| HTC One M7, M8, M9, Max, E8 | ||

| Desire EYE, 601, 626, 816 | ||

| Nexus 9 | ||

| TAG Heuer Connected Modular 45 | ||

| Huawei Watch 2 | ||

| Verizon24 | ||

| One Plus 6 | ||

| Note Edge, Note 3 LTE, Note 3, Note 4 LTE, Note 4, Note 5 LTE, Note 5, MEGA |

Sources:

https://www.statista.com/

https://www.pymnts.com/

https://today.yougov.com/

https://www.globaldata.com/

https://www.cnpexpo.com

Our Most Popular Guides

- UK Merchant Account & Credit Card Processing Fee Comparison

- How to Accept Card Payments Online, In-Store, & By Phone

- Payment Gateways In The UK: What You Need To Know

- Square Card Reader Reviews: UK Payment Fees & Pricing Compared

- SumUp Card Reader Reviews: UK Fees & Pricing

- Dojo Go Card Machine Reviews, Pricing & Fees

- Worldpay Reviews: UK Fees & Pricing

- Top 10 UK Direct Debit Bureau & Recurring Payments Companies

- Contactless Mobile Card Payment Readers: Which Is Cheapest?

- PDQ Machines: Cheap Chip & Pin Card Payment Terminals From £19

- 7 Best Mobile Card Readers With Built-In Receipt Printers

- Credit Card & PDQ Machine Rental Cost: Hire From Just £19

- Square vs Zettle Vs Worldpay & Sumup: Card Reader Comparison

Bill Young says

Yes. In China, we all use QR-code payment on Alipay and WeChat Pay. Why? Every mobile phone, even very old android phones can use QR-Code payment.