In addition to cash payments, most taxi companies in the UK today provide contactless and card payment options. Therefore, it’s no surprise that both self-employed and company-based taxi drivers always need high-quality and user-friendly card readers.

Thanks to the latest payment technology, they can choose from various brands offering different software solutions.

This article highlights some of the leading card readers for taxis available, including PayaTaxi, Zettle Reader by PayPal, Takepayments, and others, each offering unique features to meet the demands of both drivers and passengers.

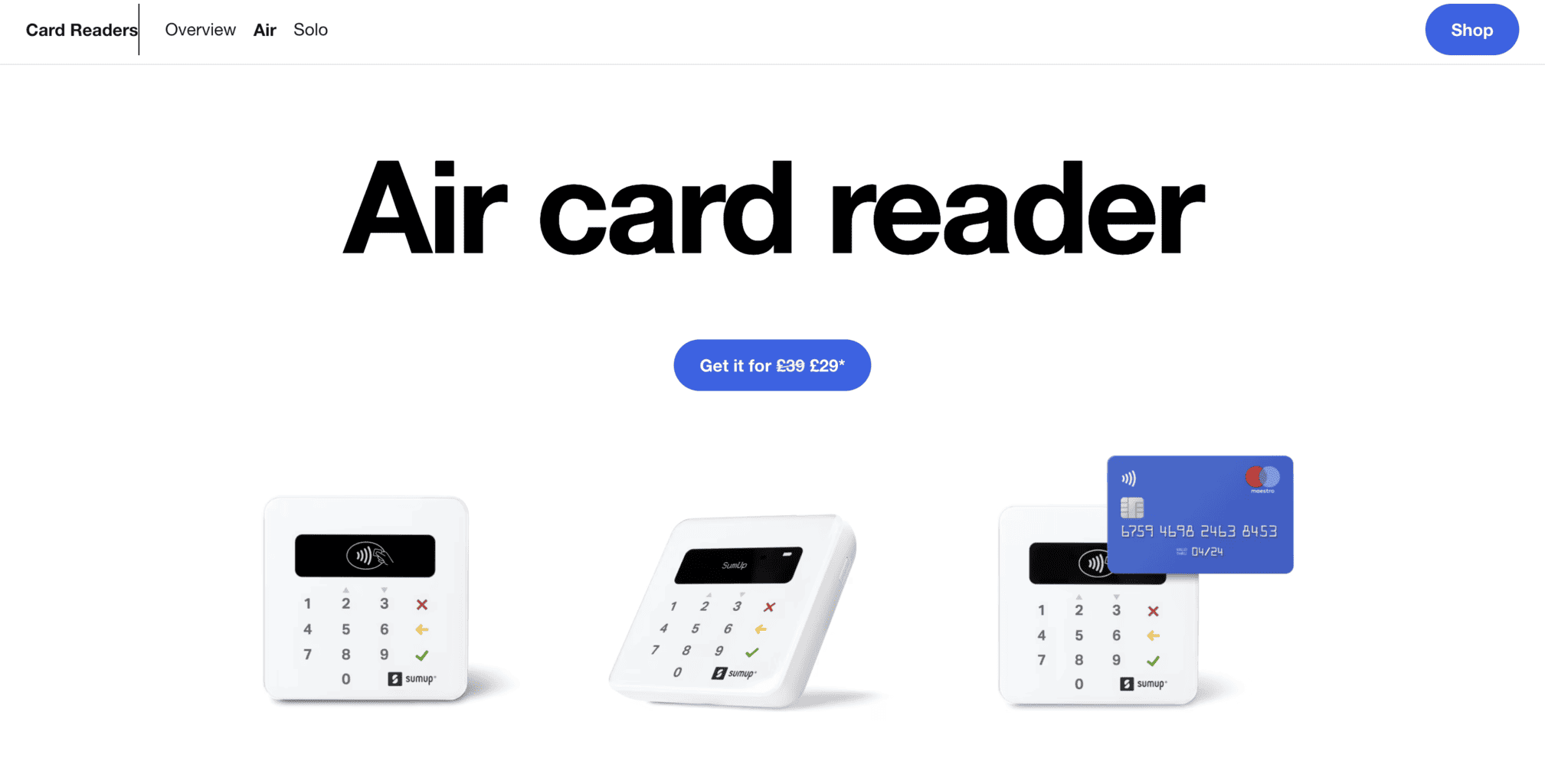

PayaTaxi

PayaTaxi provides taxi businesses with various portable card readers for very affordable prices. To get an exact price for your business, you’ll need to get in touch with Payataxi and ask for a personalised quote.

Payataxi offers two types of card readers:

Wisepad 2 Plus: This card reader is sleek, easy to use, and affordable. It contains a pre-built receipt printer and can be connected to a mobile POS via a wireless or hotspot internet connection. This device’s more advanced model is equipped with a 3G internet connection and accepts all kinds of credit and debit cards (AMEX, Visa, Maestro, Mastercard, Diners, etc.) and digital wallet payments (Apple and Google Pay).

PAX A920: This mPOS software and hardware model is more advanced than Wisepad 2 Plus. Like the former, it also accepts contactless and credit or debit card payments, digital wallets, magstripe, and chip & pin payments. It can be connected and used with wireless or a 4G internet connection.

This card reader features Android software, a pre-built thermal receipt printer, and an option for taxi drivers and customers to sign receipts electronically.

To find out the exact price of the card reader, businesses must get a personalised quote since the mPOS is customised to suit the specific needs of the client. Prices start at £19.95, but they can vary.

The payment rates also vary, depending on the tailor-made quote that each customer receives from Payataxi’s sales team. The lowest rate per transaction is 1.99%, with an additional 15p.

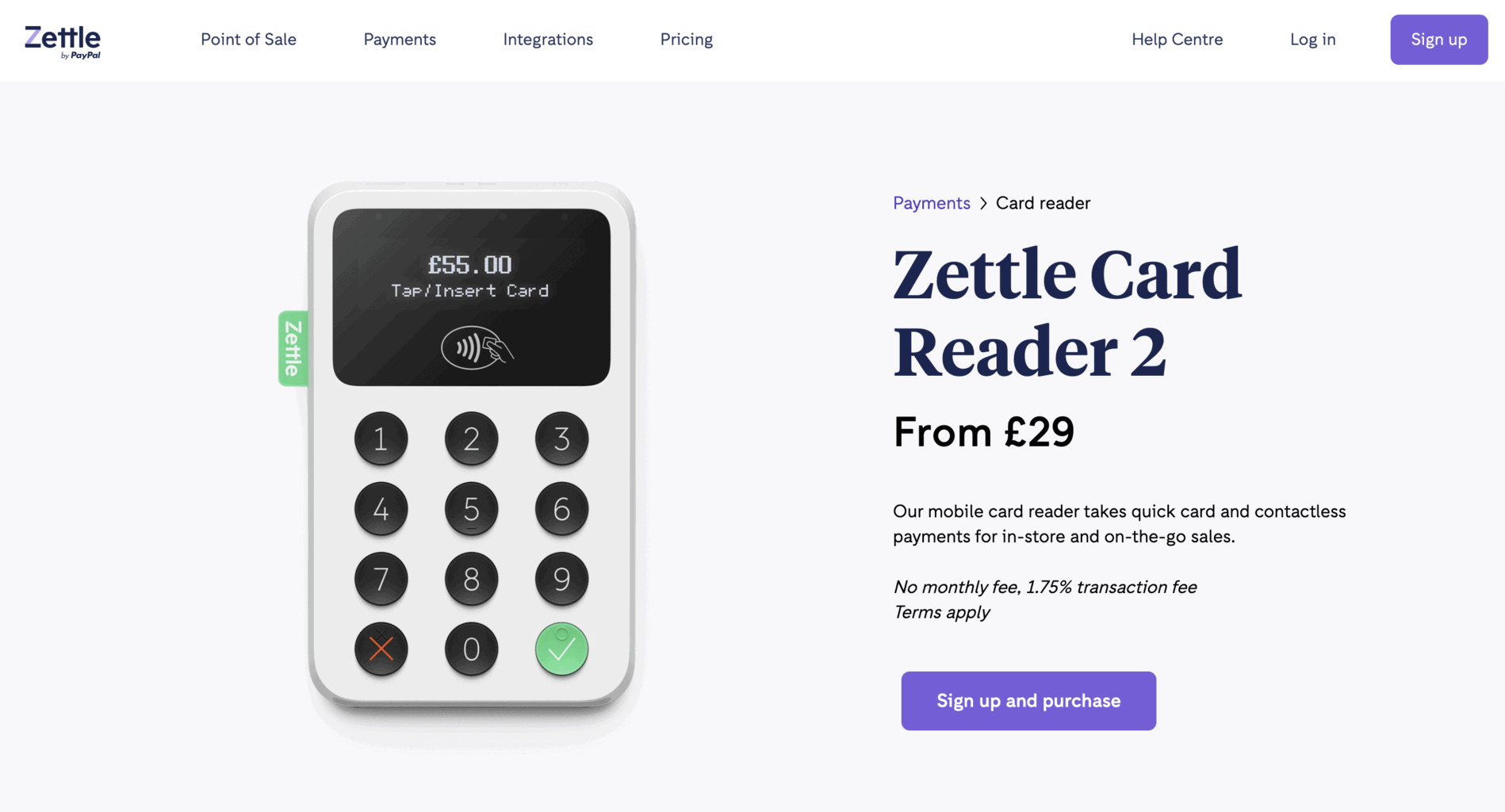

Zettle Reader

Zettle Reader is a card reader developed by the international payment company PayPal. The device can be used by businesses worldwide, including UK-based taxi companies.

This affordable device has a very user-friendly and modern interface design. It can be automatically synced with point-of-sale (POS) software by connecting it to the POS smartphone app.

Zettle Reader’s starting price is £59. However, there’s a discount for the first one, beginning at £29 with additional VAT expenses.

Businesses have to pay a 1.75% fee for each transaction, whether it’s made with UK-based or foreign credit and debit cards. There are no additional monthly fees or an obligatory contractual agreement to use the device. Businesses don’t need to pay any extra payout rates once they receive the transactions in their accounts, which is usually within 24-48 hours during work days.

Compared with other devices, this one offers many more payment options. Customers can pay with the following cards and contactless digital wallets:

- V Pay

- Maestro

- AMEX

- Visa

- Mastercard

- Diners

- Discover

- JCB

- Union Pay

- Samsung, Google, and Apple Pay

Zettle’s card reader can be synced and connected to an Android or Apple-based smartphone device or tablet with a Bluetooth connection. The devices must have the Zettle Go smartphone app already installed to connect both devices.

There’s an option to send digital receipts by text or email directly from Zettle Go or print receipts by syncing the card reader to a thermal printer. As you can see, Zettle Go resembles a mobile POS solution as it contains many features and integrations, such as invoices, emails, data analytics, tipping, financial payments, etc.

For further inquiries or technical issues, customers can contact Zettle’s technical and customer support from Monday to Friday between 9:00 and 17:00.

Takepayments

UK-based Takepayments is a payment software and hardware provider for small businesses and solo merchants. To use one of their mobile and contactless card readers, companies must sign an agreement with one year of validity. Anyone who purchases one of the Ingenico devices will also get an installation and setup guide and, of course, customer support.

The company sells lightweight and compact Ingenico card readers for taxis that contain a pre-built SIM and require a Bluetooth connection to operate. The user interface is straightforward, so neither the drivers nor the passengers will have trouble using the devices.

In addition to accepting PIN debit and credit cards (Visa, AMEX, Maestro, Mastercard), Takepayments’ readers also accept contactless forms of payment, such as payment via digital wallet (Android or Apple Pay). The card readers also come with a pre-installed printer that drivers can use to create receipts for their customers.

Taxi drivers or companies that would like to use a Takepayments card reader are obliged to sign a contract where the exact charges and rates per transaction will be determined. If the taxi driver doesn’t process the minimum payment transactions daily, they’ll have to pay a monthly fee of approximately £10 plus additional VAT expenses.

Luckily, Takepayments doesn’t require an additional setup price. However, if businesses would like to cancel the contract before it expires, they’ll have to pay a unique fee.

The pricing plans are not fixed and vary depending on the payment method and the quote application. The transaction fees are somewhere in between 0.3% and 2.5%. UK-based Visa and Mastercard debit or credit cards have significantly lower rates and fees compared to cards whose origin is outside of the UK. All of the payments that are created via a card reader terminal are processed into the user’s bank account after a 24-hour period on workdays.

If businesses require help, they can contact Takepayments via phone in the following timeframe:

- Monday to Friday: From 8:00 to 19:00

- Saturday: From 9:00 to 17:00

- Sunday: From 9:00 to 13:00

SumUp Air

Known as one of the most affordable and secure card readers available in the United Kingdom, SumUp Air is a user-friendly, portable device that’s perfect for taxi companies and solo taxi drivers.

The transaction rates are fixed, so passengers will always know that they need to pay precisely 1.69% per transaction. There are no additional rates that taxi drivers need to pay once they receive the transaction.

Users don’t need to sign a contract and pay additional rates and fees to use the card reader. The device is equipped with the latest software technology and can be connected and synced to the smartphone application developed by SumUp, available both at the Apple and Android App stores. Drivers can process transactions once they sync their smartphone or tablet to the device via an internet connection.

The mobile application is as straightforward as it gets and contains all the necessary tools and features that can benefit taxi drivers. Here are some of the things that taxi drivers can do while using the smartphone application:

- Add tips

- Add additional VAT expenses

- Track and monitor all transactions per period (daily, weekly, monthly, etc.)

- Forward links from digital transactions via text or email

- Process payments by scanning a unique code

The card reader offers various payment methods, such as:

- Chip & PIN

- Debir or credit cards (Mastercard, Discover, Visa, AMEX, UnionPay, V Pay)

- Digital wallets (Google or Apple Pay)

The fixed prices and rates do not change for any type of card, regardless if it’s a premium, domestic, or international card. This, combined with the accessible devices and inexpensive rates, makes SumUp the most affordable card reader on our list.

The payments are processed and transferred to the user’s account in a period of 24 to 72 hours, Monday to Friday, and 24 hours if drivers also have a business admin SumUp account.

The reader can also connect to a thermal printer, so drivers have the option to give physical receipts to their customers in addition to digital ones. Printers can be connected to the device via Bluetooth.

SumUp Air has a pre-built option for SIM cards and can function even if the internet connection is not solid or stable.

In addition to the SumUp Air model, another great option for taxi drivers is the independent device by SumUp, known as SumUp 3G. This device offers all the payment preferences and the option to connect it to a printer. As the name suggests, users need a 3G or 4G internet connection to use it.

The company provides technical support in the following timeframe:

- Monday to Friday: From 8:00 until 19:00

- Saturday and Sunday: From 8:00 until 17:00

VivaWallet

Viva Wallet provides portable card readers designed explicitly for black cabs. The card reader bundle for taxi purposes is called Viva Wallet Black Cab Solution. The device is equipped with a case that holds it in place while driving and can be installed near the customer’s seat. The solution includes a printer that works with a wifi connection.

Viva Wallet’s device is an excellent choice for London-based taxi drivers and companies since it’s approved by the London Assembly and its legislation on black cabs. To use the reader, taxi drivers must download and sync the smartphone application that also goes by Viva Wallet. Once the card reader is synced with the app, drivers can manually enter the payment sum in the mobile app, and the sum will automatically sync to the card reader.

With the device, customers can pay with a chip & pin, digital wallets, and credit or debit bank cards. Here’s a list of all the credit and debit cards accepted by Viva Wallet’s card reader:

- Electron

- Maestro

- AMEX

- Diners Club

- Visa

- Google Pay

- Samsung Pay

- Apple Pay

- JCB

- Union Pay

- Discover

At the moment, there are no fixed prices for the card readers. To get a quote, you’ll have to send a request to Viva Wallet. Customers have the option to either pay the entire price of the card reader upfront or pay a customised fee each month.

The company doesn’t require Viva Wallet users to sign an additional agreement. There’s no information on the rates per transaction since they’re also tailor-made for each customer. However, there’s an option to get the money back from the transaction rates if the customer using Viva Wallet also has a Viva Debit Card that can be used for company transactions and expenses.

The card reader can also process payments if the internet connection is not working. This is an excellent addition for taxi drivers who operate in the countryside or backcountry areas that usually don’t have a strong internet connection. The transaction will be processed offline and saved in the card reader and mobile application. However, it will be completed once the card reader is connected to the internet again.

Payments made with Viva Wallet will be processed in a 24-hour period in the account managed by Viva Wallet. If taxi companies or drivers would like to deposit the payments into a separate account, the process can take a bit longer, but at most in about 48 hours, any day from Monday to Friday. There’s also an option to chat with Viva Wallet’s customer support via the company’s website.

Ingenico

Although it’s based in France, Ingenico offers payment solutions for businesses worldwide. They have a variety of hardware and software solutions, including smart terminals, mobile software solutions, and card readers for transportation purposes.

The card readers that the company provides can be synced with mobile point-of-sale software solutions via an Apple or Android-based smartphone or tablet device. Customers can pay in various ways since the reader supports chip & pin, credit and debit cards, and digital wallet payments. The device recognises both UK-based (domestic) and international card payments.

There are four card reader devices that Ingenico currently sells:

- Moby/5500: This device is compact and user-friendly and supports NFC, contactless, EMV, or Chip & Pin payments. The device can be connected and synced with an Android or Apple smartphone or tablet via Bluetooth or USB cable. Moby/5500 is entirely in line with PCI PTS V6 security regulations. It also contains a module that can be tailor-made and integrated to face the customers.

- Moby/6500: This device is bigger than Moby/5500, but very lightweight (under 90 grams) and easy to use. The main difference is the design of the device, as this one has a display screen where users can see the transaction details. Just like Moby/5500, this device is secure and in line with the same regulations, and accepts the same type of payments.

- Moby/8500: Similar to 6500, the Moby/8500 has a display screen and offers the same features as the former device. The main difference is that, in addition to Android and Apple, it can be connected to Windows devices.

- Moby/9500: The 9500 model is the latest addition to Ingenico’s card readers collection. It offers the same features just like the other readers, but unlike the other three devices, Moby/9500 has a larger glass screen display that can be sanitized.

Ingenico doesn’t provide any information on their prices and fees. Therefore, if you’re interested in getting a tailor-made offer, you can contact their customer support via their website, while, here you can check if there’s a reseller of their devices in the region of your choice.

Frequently Asked Questions

Why are card readers essential for individuals who provide taxi transportation services?

Nowadays, cashless transactions are often the chosen payment option for passengers worldwide. Owning a high-quality card reader has various advantages for drivers, such as:

- Real-time fund transaction

- Speedy payment delivery

- Contactless payment with Apple or Android digital wallets

- Automated payment process = no manual error

- Increased number of passengers

- Automatically saved transaction data

Which one is the best card reader for taxi drivers?

There is no one single reader that will benefit all taxi drivers equally. The first thing you need to consider before purchasing a card reader is whether the device is within your budget. Then, you can look into their features and see if they suit your unique business needs. All of the above-mentioned devices are excellent options for UK-based taxi drivers, starting from Zettle, which offers the most affordable payment plans.

Do payment fees vary?

Yes – each company has different prices, rates, and fees. In general, most card reader fees and rates are not higher than 2% and are somewhere between 1% and no more than 2%. In some cases, the payment volume daily determines the rates and fees that taxi companies need to pay.

Do all card readers for taxis have additional monthly fees?

No, not all card readers have additional monthly rates and fees. For example, taxi companies can purchase Zetttle and SumUp card readers without paying a monthly fee. However, all of them will charge users a specific fee per transaction.