Please note NetPay is now owned by Clover UK. Therefore, the data below is no longer up to date but is being kept as a historic record

Founded in 2012, NetPay is a merchant services company offering coverage to both large and small businesses in a range of industries.

Although operating as the NetPay brand, the company was acquired by Fiserv in 2021. This is following a long-lasting partnership and previous acquisition of a 40% stake in the NetPay brand.

NetPay offers services including face-to-face payments, online payments and mail/telephone orders. Find out everything you need to know about NetPay from the prices and fees to products and services below.

Prices/Fees

The prices and fees of NetPay are, unfortunately, not published online. To receive an accurate quote for a tailored business service, merchants should request this from the NetPay website.

Product/Service Overview

NetPay offers a wide range of products and services ranging from face-to-face and online payments to mail/telephone orders and terminal care packages.

To find out more about any of the products or services offered by the company, merchants should contact the NetPay brand via the online contact form or via the contact number published.

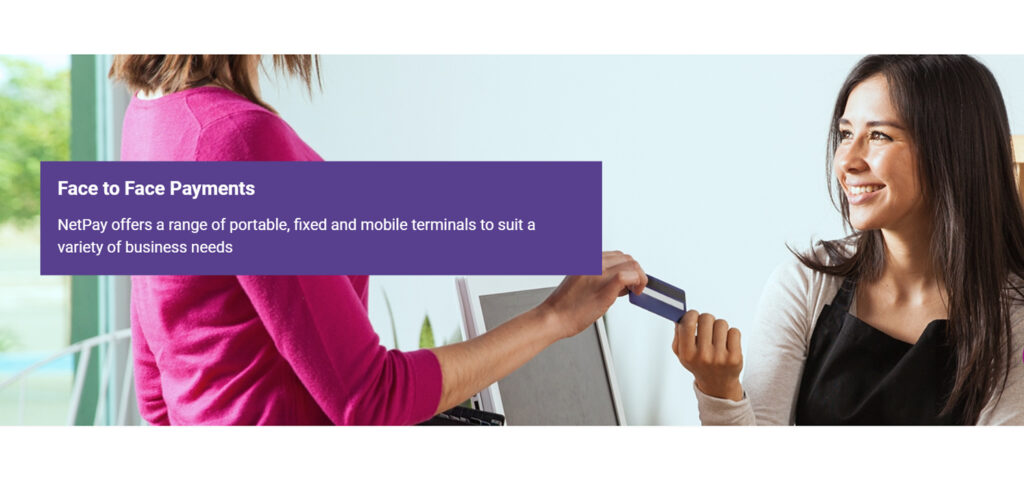

Face-to-face payments

Traditional face-to-face payment methods are one of the main services offered by NetPay.

The payment terminals offered can be organised into three main categories in wired, wireless and mobile point of sale (POS) systems.

Wired

A wired terminal is a solution chosen for a single, dedicated point of sale in a brick-and-mortar business such as a hotel or restaurant.

The wired terminals are a reliable and robust option for merchants and connect to the internet with either an existing dial-up telephone or a broadband connection. The systems are able to accept all major credit and debit cards alongside contactless and mobile payment solutions.

The wired system can be available as either a single terminal or can be used as a separate terminal with a keypad. With a safe, easy-to-use solution – customers can make payments effortlessly.

Wireless

A wireless terminal offers more freedom than a wired terminal, allowing merchants to move around their business premises to accept payments.

Wireless terminals are perfect solutions in the restaurant business, allowing payments to be accepted at tables rather than at a dedicated point of sale. The systems can also be used outdoors with a clever display that can be clearly viewed in sunlight.

Similar to the wired terminals, these wireless terminals operate with a connection to either an existing dial-up telephone connection or a modern broadband connection when working away from the wired hub. All major debit and credit cards are accepted alongside contactless and mobile payment solutions for a seamless, efficient transaction.

Mobile

For merchants and businesses looking for the most flexible terminal solutions, a mobile terminal may prove the best choice.

Mobile terminals access the internet with roaming SIMs, allowing coverage throughout the UK providing that a mobile network connection can be established. The way that customers can pay remains the same, offering credit and debit card payments, contactless payment and mobile payment options.

The terminals are quick and easy to set up and offer a long-lasting battery life to ensure that payments can be accepted at any time. Sales are paid into the account within 3-4 days of payment for a fast turnaround time.

Online payments

For online businesses and for merchants looking to branch out to offer online services, NetPay is able to support a range of services to streamline the process.

Depending on the requirements of the individual, online payment solutions can cover simple options such as a hosted form to accept payments or more advanced, fully integrated payment solutions.

There is a range of benefits associated with the online payment services offered by NetPay, starting with the payment options offered to customers. The online payment service allows businesses to accept all major credit and debit cards with a simple, secure payment page.

The online payment gateway is PCI DSS Level 1 compliant, ensuring that data is 100% secure at all times. An API and integration for shopping carts allow for website integration, offering international capability, and accepting payments globally.

Mail order/telephone order

Merchants are able to accept mail and telephone orders thanks to the mobile terminal offered by NetPay.

MOTO transactions can be taken by each member of staff with a unique log-in to the virtual terminal. This can be accessed in-browser without the need for any additional specific hardware.

All transactions placed either by mail or by telephone adhere to Payment Card Industry Data Security Standards (PCI DSS). NetPay is PCI DSS Level 1 Compliant, offering the highest available level of compliance.

Terminal care packages

In addition to supplying terminals for in-person businesses, NetPay also offers care packages to ensure that any issues can be quickly addressed.

Managed installation and technical support are the two main options of care from NetPay. A managed installation provides a personalised face-to-face meeting and installation that gives confidence in the system, ready for use.

The technical support allows merchants to address any issues with either a telephone conversation or an in-person appointment with a terminal engineer. This reduces any potential downtime, returning merchants to full operating power as quickly as possible.

Short term rental

For businesses with short-term requirements, a dedicated terminal contract can prove to be an expensive and unnecessary solution.

NetPay, therefore, offers a short-term rental solution for terminals, perfect for seasonal businesses, one-time events or periodic increases in demand.

There are no long-term contracts and instead, businesses can choose a flexible contract with options ranging from 1 day to 6 months. The accounts can be quickly set up with either an existing merchant account or by setting up a new merchant account with NetPay.

Flexible finance

In addition to offering traditional merchant services, NetPay also allows for a solution for flexible finance.

The finance option works with just a single initial cost with no fixed monthly payments, hidden fees or penalties. Finance is instead repaid when customers pay merchants, offering a simple and fair way to repay the finance.

Businesses are able to request finance for up to a maximum of 100% of the average monthly card payments. The quote can then be reviewed in as little as 5 minutes with repayment taken as a percentage of the credit/debit card takings.

Integrated payments

NetPay offers merchants integrated payment solutions with both semi-integrated and full integrated options available.

A semi-integrated payment option allowed for a streamlined approach between chip and pin migration and certification. This limits the communication between both the PIN and the EPOS system, offering improved security with the elimination of any sensitive data from the EPOS.

This form of integration also simplifies PCI compliance, reducing the cardholder data environment.

Dynamic currency conversion (DCC)

Merchants using NetPay terminals are also able to benefit from Dynamic currency conversion (DOC).

This allows for international visiting customers to use both Visa and Mastercard payment solutions with the option of using either their own currency or the currency of the country visiting.

There are countless benefits to offering DOC ranging from transparency and customer experience to improved exchange rates and business travel simplification. With no additional cost to the merchant, DOC allows for top payment options for tourists and travellers.

Company background

Founded in 2012, NetPay is a merchant services company with the goal of empowering its customers with top-quality products and services.

The award-winning merchant services pride themselves on both face-to-face and online payment solutions offered as part of the NetPay Solutions Group. In addition to the traditional merchant services, NetPay also offers a revolution platform, granting access to tools such as automated boarding, transaction reports and additional business insights.

The services offered by NetPay are distributed through more than 100 different strategic partners, spanning a wide range of industries with a variety of both business types and sizes.

Fiserv partnered with NetPay in 2014 before ultimately acquiring a 40 percent stake in the group in 2018. Following the success of the NetPay brand, Fiserv ultimately acquired the remaining 60 percent stake in 2021.

User reviews from around the web

NetPay has been reviewed positively a number of times on the web, assuring that real customers have experienced good service with the company.

- Trustpilot – 4.6 / 5 (based on 343 reviews)

Looking at the Trustpilot reviews, NetPay has earned a rating of 4.6 / 5 from a total of 343 reviews.