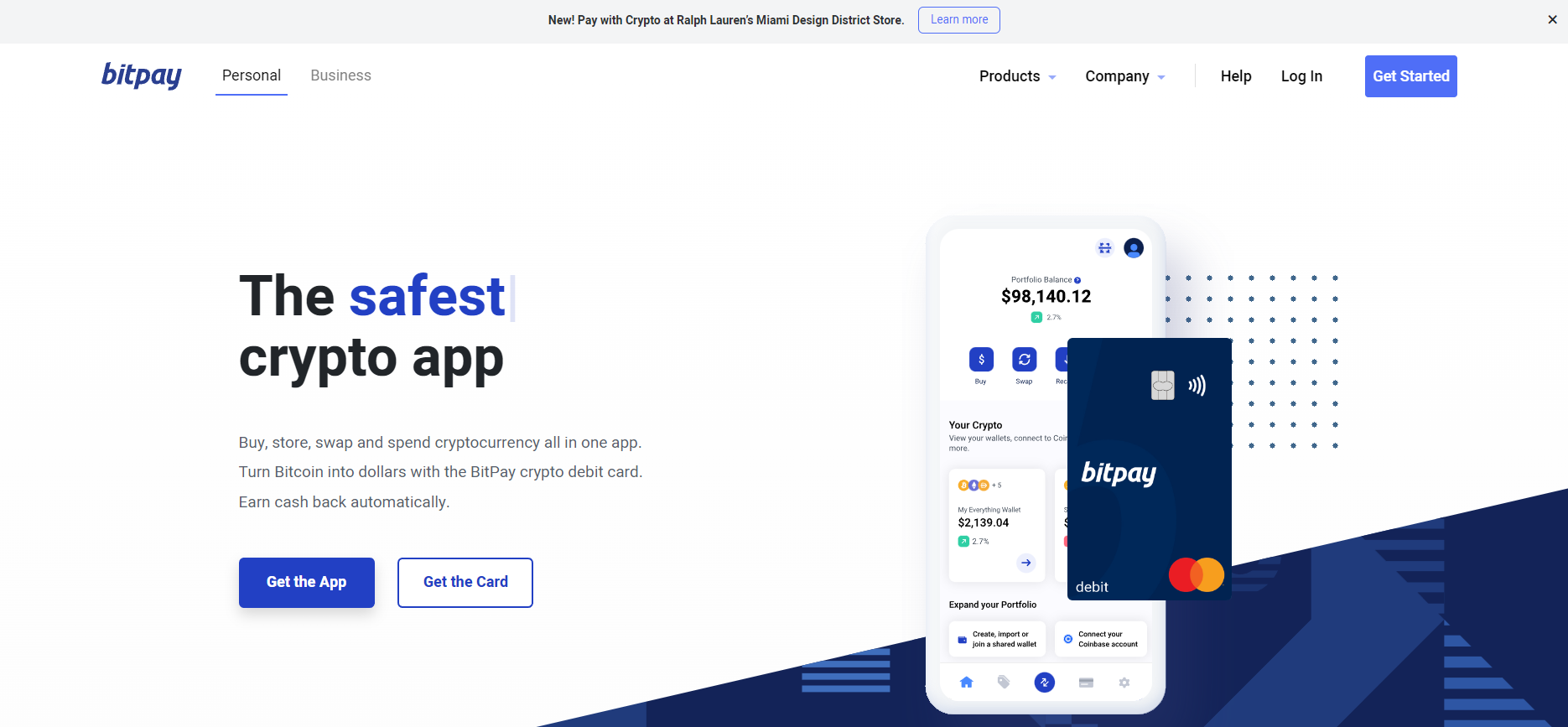

BitPay is created to serve as an intermediary between cryptocurrency transactions. The company offers a range of products designed to cater to both individuals’ and businesses’ digital currency payment processes.

These products allow businesses to accept or send various coin payments globally, without having to deal with the complexities of handling them themselves. Here’s a quick overview of the prices and key features of these products.

Prices/Rates

BitPay offers a tiered pricing structure for its crypto acceptance fees, with rates automatically adjusted based on cumulative monthly transaction volumes. The pricing tiers are as follows:

- For a monthly transaction amount below $500,000 USD, 2% + 25¢.

- For a monthly transaction amount between $500,000 and $999,999 USD, 1.5% + 25¢.

- For a monthly transaction amount of $1,000,000 USD or more, 1% + 25¢.

Note that higher fees may be applicable for high-risk industries.

Plus, for individuals, the BitPay Card allows users to load their cards with crypto and spend in dollars, earning cashback rewards. BitPay Wallet users can buy and swap cryptocurrencies at competitive rates, and the wallet app is free to use.

Services Overview

For Individuals

BitPay Card

This crypto debit card is issued by Metropolitan Commercial Bank and operates under a Mastercard license. Users can load their card with crypto, spend in dollars, and earn cashback rewards. It’s also compatible with Android, iOS, Mac, Windows, and Linux devices.

BitPay Wallet

This secure, non-custodial wallet lets users store, buy, swap, and spend cryptocurrencies like Bitcoin, Ripple, Ethereum, and more. The wallet supports multi-factor security and enables users to load the BitPay Card, make contactless payments, and buy gift cards.

BitPay Extension

With this browser extension, users can spend crypto instantly at hundreds of brands, both online and in-person.

For Businesses

BitPay enables businesses to receive crypto settlements in cash, so you don’t have to manage cryptocurrencies directly. This has a few advantages compared to receiving transactions via fiat money through banking systems. Let’s see how it works.

Accepting Blockchain Payments

Blockchain payments remove the need for collecting and storing confidential customer data, as customers directly send cryptocurrencies (e.g., Bitcoin, Ripple, Shiba…) to a payment address.

After the customer sends the cryptocurrency to the payment address, BitPay takes care of the conversion into your preferred currency and adds it to the next account settlement in your BitPay account.

You can then choose to receive the funds in your bank account or cryptocurrency wallet. This allows you to accept cryptocurrency payments in various settings, including online, in-store, or even as donations.

Online Payments

BitPay provides a hassle-free and convenient online payment experience that can be accessed from any device. And it doesn’t require sensitive personal information from customers.

E-Commerce Plugins: BitPay’s partner platforms, such as Shopify, Ubercart, Wix, and more, make it easy to integrate cryptocurrency payments.

Code Libraries: With the BitPay code libraries, developers can focus on the payment flow and e-commerce integration rather than dealing with the technicalities of client-server interaction using the API.

Direct API Implementation: You can easily incorporate blockchain payments into your online checkout system by utilizing BitPay’s REST API for direct API implementation.

Website Payment Buttons: Generate payment buttons for your business’ website via your merchant dashboard without any coding required.

In-Store Payments

BitPay offers retail payment tools that merchants can use in conjunction with their conventional point of sale systems, resulting in a smooth checkout experience for both customers and staff in physical retail locations.

BitPay Checkout App: Merchants can accept digital currency payments on Android or iOS devices using the BitPay Checkout app.

Donations

Nonprofit organizations can accept digital currency contributions using BitPay’s donation buttons or hosted donation pages.

Hosted Donation Pages: BitPay can create and host a customizable donation webpage for your organization.

Donation Buttons: Easily accept donations on your organization’s website with BitPay’s donation buttons.

Billing

With BitPay’s email billing service, you can receive crypto payments while avoiding excessive costs, complications, and risks associated with traditional billing methods. This solution allows you to send bills directly to your customers using BitPay’s platform.

You can send and receive blockchain payments through BitPay invoices in just minutes.

BitPay also protects you from the price volatility of cryptocurrencies like Bitcoin. You’ll receive the full amount you charge, minus a low transaction fee, in your preferred currency.

Lastly, BitPay can settle your funds via local bank transfer methods such as ACH, SEPA, and FPS.

To use the billing feature, create a bill from your merchant dashboard and send it to your client. Your customer pays the BitPay invoice at a locked-in exchange rate. BitPay then converts the customer’s payment into your local currency and initiates a bank settlement to transfer the funds to you the next business day.

BitPay Send

BitPay Send is a service that enables users to send crypto payments to anyone, anywhere. Users can start sending payments within hours instead of days or weeks. The service charges a fee of just 1% of the transaction amount, and users don’t need to hold, handle, or manage crypto themselves.

BitPay Send is ideal for companies seeking a fast, efficient, and secure way to send mass payouts worldwide, on any day, and at any time. It can be used for various purposes, such as payroll payments, settling with marketplace sellers, paying contractors or affiliates, fulfilling customer cashout requests, and issuing rewards or rebates.

To set up BitPay Send, you need to create a business account, get verified, and add funds to your account.

Integrations

REST API

BitPay offers a REST API that allows developers to interact securely and effectively with their BitPay account. Using this API, clients can manage invoices, issue refunds, access real-time rate information, view merchant ledger entries, and more. Developers can either call the API directly over HTTPS or utilize BitPay’s code libraries in various programming languages.

Wallet API

BitPay’s JSON Payment Protocol helps reduce payment errors and enhances user experience. This interface allows wallets and exchanges to implement security improvements with a familiar serialization format, making it easier for developers. The JSON Payment Protocol is also currency-agnostic, which ensures compatibility with other currencies accepted by BitPay invoices in the future.

The interface provides direct communication between a wallet and BitPay’s servers. If a wallet submits an incorrect payment, BitPay’s servers will reject the transaction, preventing failed payments from reaching the blockchain and saving users from unnecessary miner fees. This is expected to reduce payment errors to zero.

Wallet developers and exchanges can use the corresponding library to build support for the BitPay JSON Payment Protocol, ensuring an optimal payment experience for their users when shopping online with merchants supporting BitPay.

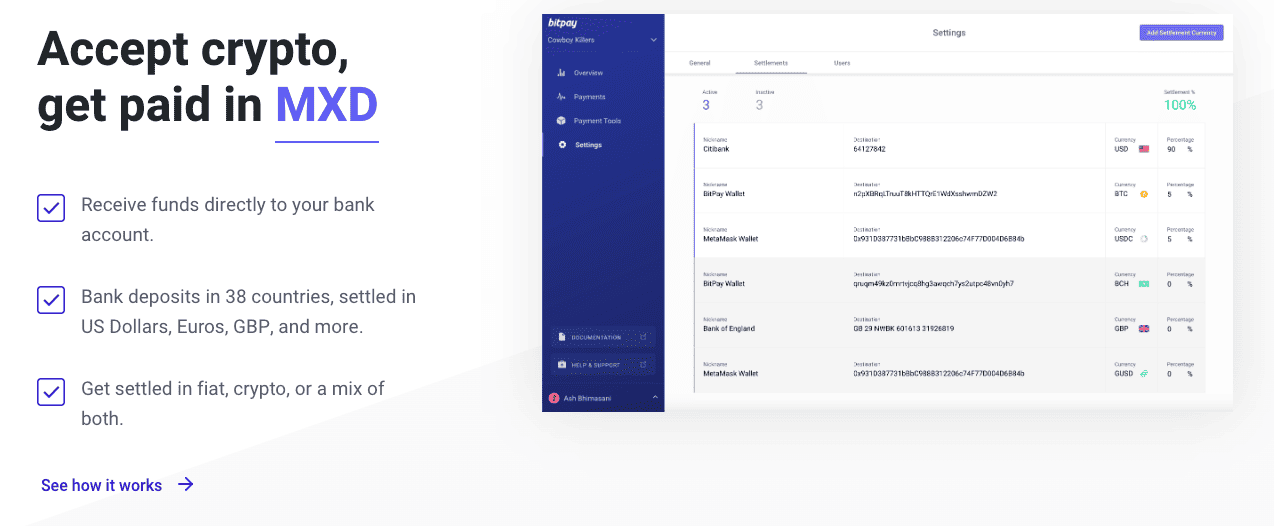

Banking and Settlements

BitPay offers a streamlined banking and settlement process for merchants, automatically depositing payments into their bank or cryptocurrency wallet every business day. The platform maintains legal and compliance standards to protect merchants, with tiered processing limits based on verification levels.

BitPay supports settlement in 8 currencies and direct bank deposits in 38 countries. Cryptocurrency settlements are available in 233 countries. Settlement timings and minimum amounts vary depending on the location and currency. In the United States, for example, USD settlement via ACH takes 2 business days, with a minimum settlement amount of 20 USD.

Settlements are paid daily to the registered cryptocurrency address, with varying minimum settlement amounts based on the cryptocurrency used.

For merchants generating invoices in a different currency than their settlement currency, the exchange rate is calculated at the time of invoice generation using rates from openexchangerates.org. Merchants can update their settlement settings, bank account, and cryptocurrency address preferences through the BitPay merchant dashboard.

For Non-Profits

BitPay offers a solution for non-profit organizations to accept crypto donations, allowing them to reach affluent donors worldwide with lower fees. Nonprofits can accept crypto donations without directly handling cryptocurrency, eliminating concerns about price volatility or market timing. This lets nonprofits instantly reach high-income donors in 229 countries and territories.

Donors contribute through a BitPay-hosted page or custom donation button, BitPay converts cryptocurrency to fiat currency, and the non-profit organization receives the cash settlement the next business day.

BitPay integrates with your existing website platform, offering a hosted donation page, full website integration, or a no-code email billing option.

You can customize, copy, and embed the donation button directly on your fundraising page. Alternatively, BitPay can host a donation page for your organization, which can be generated and edited in minutes through your merchant dashboard.

BitPay supports crypto donations in various top cryptocurrencies, including Bitcoin, Litecoin, Ethereum, Bitcoin Cash, Pax Dollar, Dogecoin, Gemini Dollar, Shiba Inu, Polygon, XRP, ApeCoin, Dai, Binance USD, USD Coin, Wrapped Bitcoin, and Euro Coin.

Cryptocurrency donations are tax-deductible, with the deduction equal to the fair market value of the donated cryptocurrency. Moreover, donors are not subject to capital gains taxes on the appreciation of donated cryptocurrency.

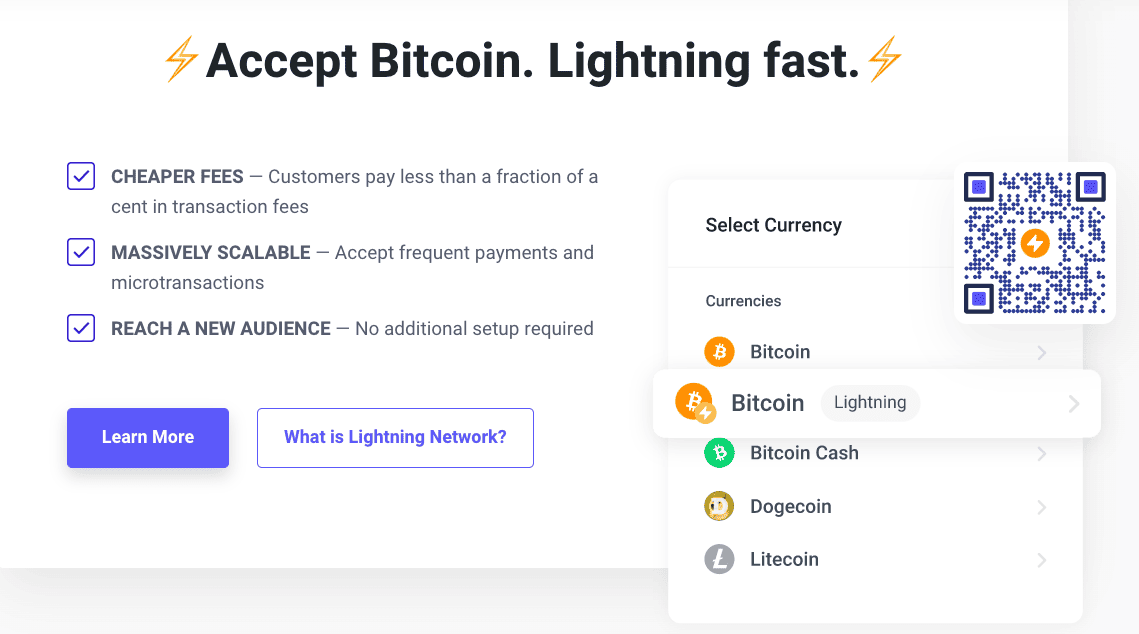

Lightning Network Integration

BitPay has integrated support for Lightning Network payments, which is a secondary layer of the blockchain designed to enable fast, low-cost, and scalable transactions. This integration allows BitPay users to make off-chain transactions without congesting the main blockchain while still benefiting from the same security and convenience of Bitcoin payments. This means faster and cheaper transactions on the blockchain.

Security

BitPay is headquartered in the United States and is regulated by FinCEN and various states where it holds licenses. The company also maintains a comprehensive anti-money laundering, anti-terrorist financing, and OFAC sanctions program.

Company Background

BitPay was founded in 2011 when Bitcoin was still a relatively new concept. The company’s mission is to revolutionize the financial industry through blockchain payment technology, making transactions faster, more secure, and less expensive globally.

BitPay continues to innovate and create new tools and services for everyone to use in unique ways. They’re headquartered in the United States and regulated by FinCEN and other relevant state agencies, ensuring compliance with financial regulations.

User Reviews From Around the Web

There are a large number of reviews available on the web for Stripe, painting a picture by the users of the payment company.

- Trustpilot – 1.3 / 5 (based on 175 reviews)

- Capterra – 4.5 / 5 (based on 15 reviews)

- G2 – 4.1 / 5 (based on 21 reviews)

- Better Business Bureau – 1 / 5 (based on 4 reviews)

Based on a total of 9,414 reviews, BitPay has received a score of 1.8 / 5, taking all reviews into account.

User Reviews

Review Summary

Recent Reviews

There are no reviews yet. Be the first one to write one.