Super Payments is revolutionising the conventional online payment and purchasing experience based on the idea that a digital wallet should be accessible to everyone. It provides each client with a tailored, distinctive, and one-of-a-kind shopping experience using cutting-edge data and AI capabilities. The company’s goal is to enable merchants to accept fee-free payments forever and everywhere while improving the purchasing experience for consumers.

Prices/Fees

At this time, Super Payments only enables payments that originate from personal bank accounts, as opposed to company bank accounts.

However, you can still grow your online business with the assistance of Super Payments by reducing payment processing fees, saving both your customers and your company “billions of pounds.” In fact, there are no fees whatsoever associated with their payment solutions.

That said, if using Super Payments doesn’t cost you anything, where does the company get its revenue? Super Payments has a Cash Rewards programme, and when customers make purchases from third parties, the company generates revenue.

Payment Solutions

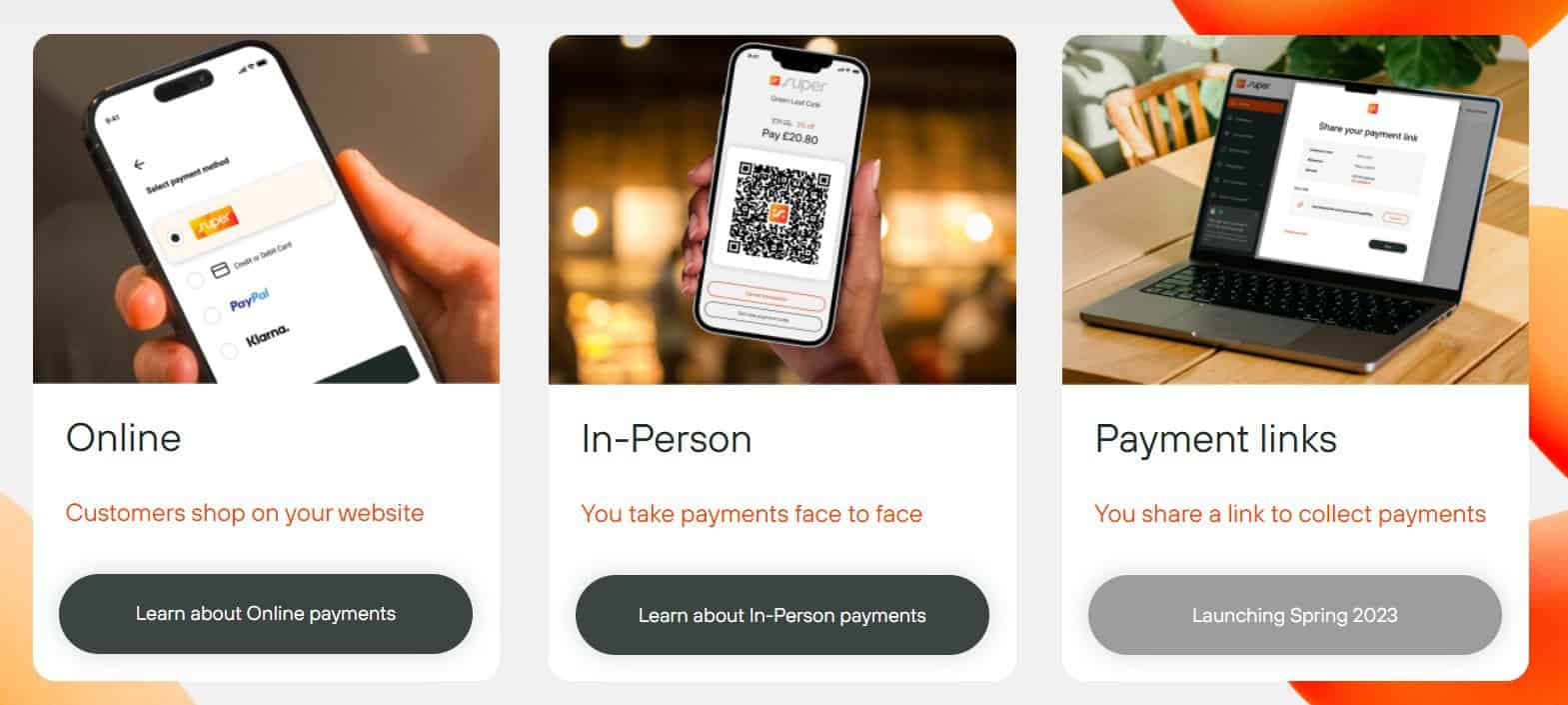

The following three solutions are ways in which merchants can accept payment with Super Payments:

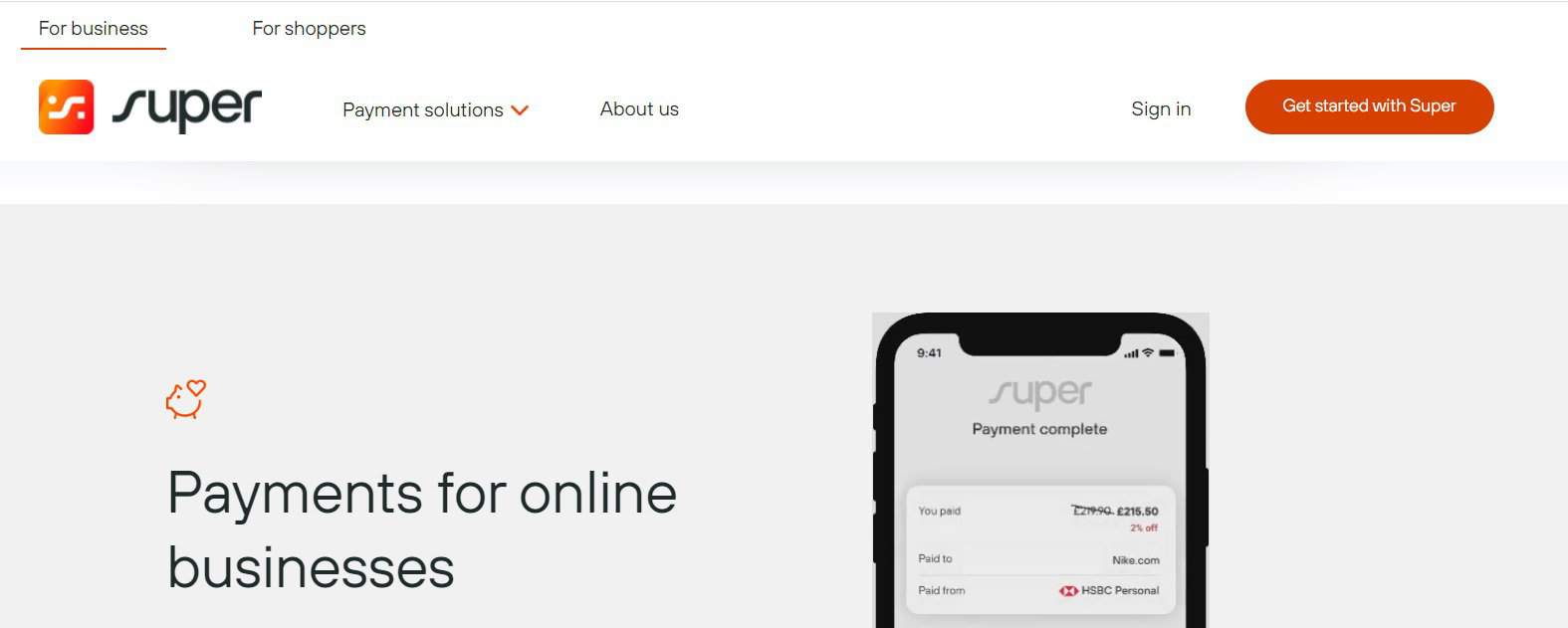

1. Online Payments

Customers can pay for the purchase of goods or services directly through their bank app using Super Payments, allowing them to avoid the costs associated with credit and debit card transactions.

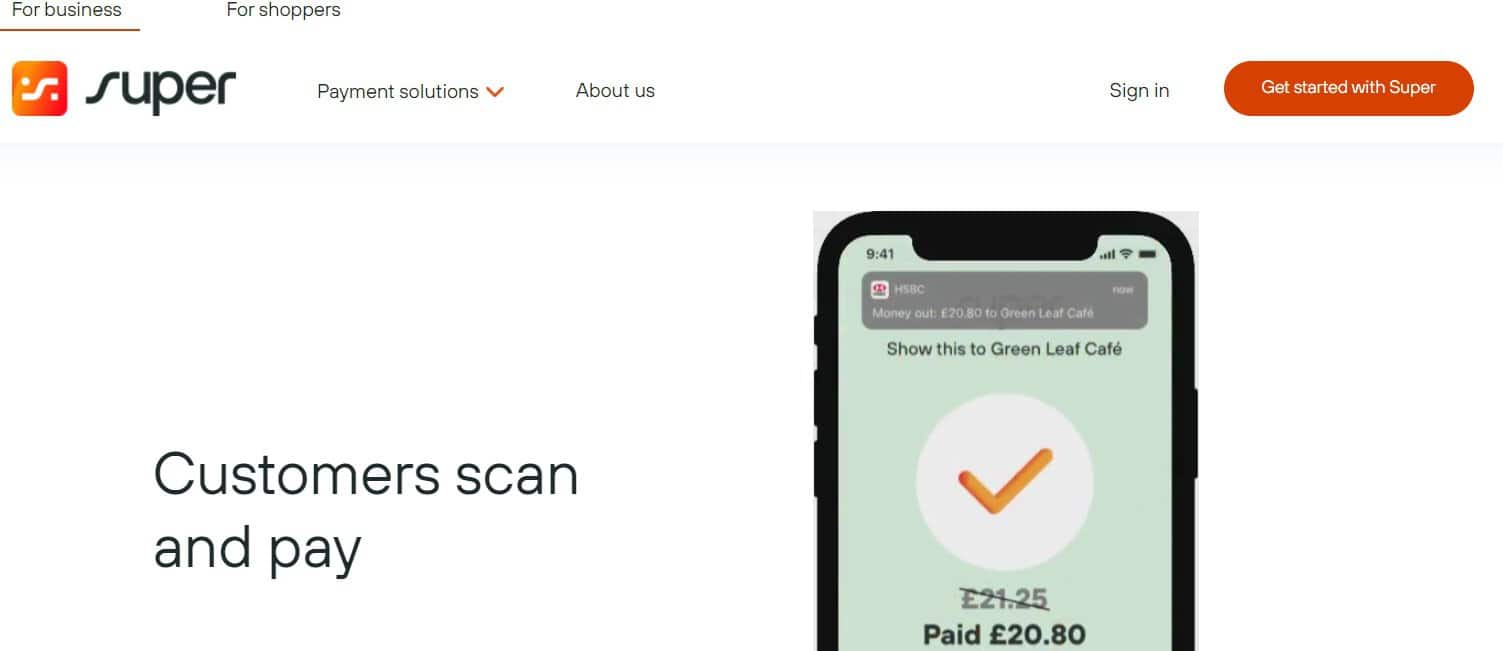

2. In-Person Payments

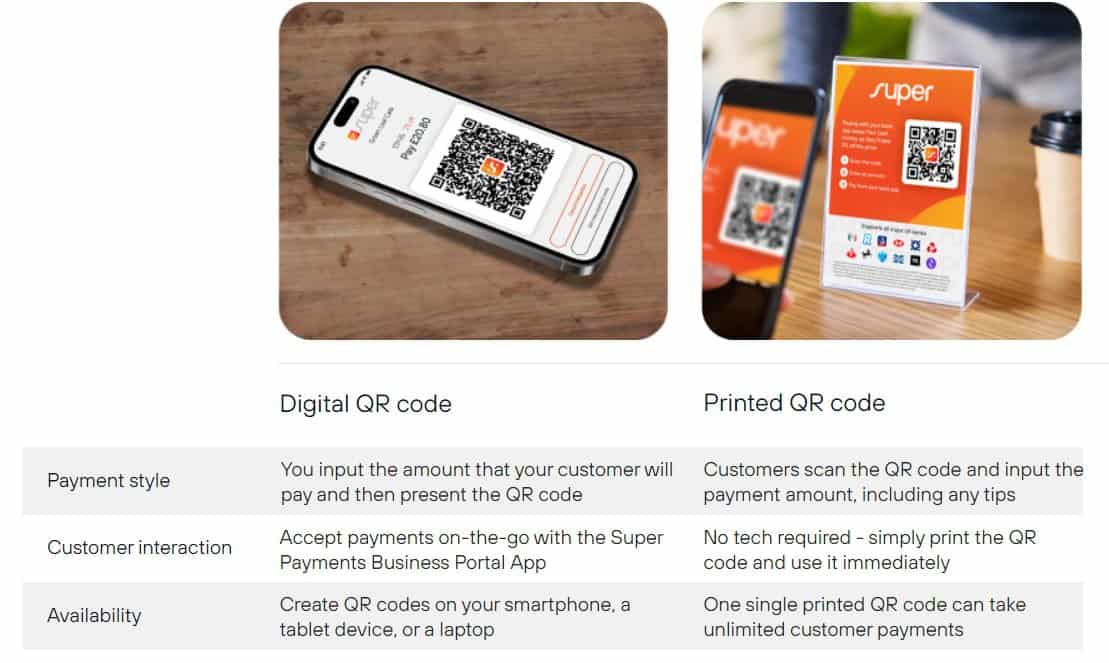

For in-person payments, merchants don’t have to invest in payment processing hardware. They can simply print their QR code or produce a digital QR code by using the software provided by Super Payments. Customers can then pay using their banking app by authenticating themselves with their fingerprint or face.

As a merchant, you give your customer your QR code, and once they scan it using the camera on their phone, they can make a safe payment with the banking app on their device. No codes are required, no cash is involved, and there are no associated fees.

The image below illustrates the difference between using a Digital QR code and a printed QR code.

3. Payment Links

Apart from online and in-person payments, customers will soon be able to pay using Super Payments’ payment links. This type of payment solution will be available in spring 2023.

Services

Cash Rewards

We already mentioned the Cash Rewards programme, but how does it actually work? As Super Payments allows you to foster customer loyalty by offering cash rewards to your existing clientele, customers will accumulate rewards with each purchase they make from your business.

If customers make their next purchase with you using Super Payments, they will be able to deduct the value of their Cash Rewards from the total price of the item.

Super Payments Business Portal App

Through the use of the Super Payments Business Portal app, merchants have immediate access to the following features that’ll help them manage their balance and payments:

- Get immediate updates on payment status

- Browse through and look up past transactions

- Make instantaneous refunds

- Share your payment link or code

- Safe authentication procedures

The app is currently paused until further notice.

Fraud Protection

When a shopper makes a payment using Super Payments, each transaction is verified with either Face ID or a fingerprint, in addition to a secure PIN.

Integrations

It couldn’t be easier to get started with Super Payments, regardless of whether your company is an e-commerce business that accepts payments online or a brick-and-mortar business that accepts in-person payments. You can get started in less than an hour by taking advantage of the unique integrations for e-commerce platforms and the straightforward sign-up procedure for in-person enterprises.

You can quickly and easily integrate Super Payments into your website by utilising plugins that are designed to work with your platform. Alternatively, you also have access to the Super API to create bespoke integrations.

The Super Payments system can integrate with a multitude of online store builders, including:

- Shopify

- Woo Commerce

- Magento

- Big Commerce

- Squarespace

- commercetools

- Wix

- Salesforce

- Shopify Plus

API

If you’d like to integrate Super Payments via its API, you’ll be glad to know that the process is not at all difficult.

Here’s everything you need to get your business up and running with Super Payments’ API in just a few minutes.

Extra Care On Customer Support

If you’re still unsure about how certain facets of Super Payments work, you can refer to their support page, which provides FAQs and answers on the following topics:

- General business questions

- Online businesses

- In-person payments

- Tech support for business

- Support and guidance

- Share a link to collect payments – launching spring 2023

- Cashback and savings app ( currently paused)

If you don’t find what you’re looking for, you can also submit a request, providing your enquiry, and Super Payments will contact you with an answer as soon as possible.

Company History

In 2022, Samir Desai CBE, the creator of Funding Circle, and a team of senior executives came up with the idea to start Super Payments. The reason behind this was to innovate a new method of payment and purchasing that would revolutionise the experience of buying online, which they succeeded in doing.

Super Payments is now operational and supported by many investors who are also behind Twitter, Facebook, Spotify, Monzo, and Stripe, including Accel, Union Square Ventures, Localglobe, and others.

User Reviews

The following is a list of Super Payments’ user ratings:

- Software Advice: 4.7 out of 5 stars

- Capterra: 4.7 out of 5 stars

- Trustpilot: 4.1 out of 5 stars

User Reviews

Review Summary

Recent Reviews

There are no reviews yet. Be the first one to write one.