Tide is a fintech company founded in 2015 in London, UK. Their financial platform offers bank accounts, loans, and various tools that help small and medium-sized companies manage their finances and business. In addition to the cloud-based financial platform, Tide sells expense cards and card readers for companies in the retail and hospitality industries.

Let’s learn more about their products and pricing.

Tide Business Tools

Take control of your finances with Tide’s suite of business tools designed to streamline your financial management and transactions.

Payment Tools

Invoices

You can use Tide’s mobile app to create and track invoices. You can also add VAT expenses and select a rate beforehand. The app offers invoice templates, so you don’t need to create invoices from scratch, which is pretty convenient.

Tide Card Reader

In addition to the finance management platform and the debit cards, Tide sells two types of card readers suitable for small retail or hospitality businesses. You can choose between the basic Tide card reader and the Plus model. Both card readers can be used on the move, but they have to be connected to the internet.

By connecting the POS of the card reader to your Tide account, you can receive all payments automatically in your preferred business account.

The transaction money will be directly transferred to your company’s account in a period of 24 to 72 hours during work days. There’s no need to sign a monthly or yearly contract in order to use one of the card readers.

You can order the Tide card reader on the following page.

Payment Links

If you subscribe to one of Tide’s plans, you can create online links to process payments via Apple Pay, Mastercard, or Visa. You don’t need an already developed eCommerce shop or website to make a payment link via Tide’s dashboard on the mobile app.

Once you create the link, you can track and monitor all payments from your Tide account. There’s an option to add notifications to your smartphone whenever you receive a payment via the link. The payments will arrive in your bank account in one to three days.

You can also add a preferred payment method to the link if you’d like to accept payments only with Mastercard or Visa.

The transaction rate is 1.5% for cards issued in the UK and 2.5% for international cards.

Direct Debit

The Direct Debit and GoCardless solutions allow you to monitor and track all your invoices. With this solution, you can receive one-time or repeated invoice payments. If you’d like to use Direct Debit, you’ll have to accept the terms and conditions via Tide, and you’ll be good to go.

The GoCardless tool automatically emails all your customers who pay via invoices before the transaction is processed.

If you’d like to use DirectDebit and GoCardless, you’ll have to pay a fixed rate of 1% and an additional 20p for customers based in the UK. If the payment exceeds £2,000, you’ll have to pay an extra 0.1% per transaction, with additional VAT expenses. The fees can vary and depend on the Tide subscription plan you choose.

Accounting Software

In addition to the expense management platform, Tide can provide you with accounting software designed to help you keep track of all your finances from one platform.

The software allows you to track all of your payments in real time, monitor your business performance, keep track of your taxes, submit VAT expenses, create invoices and optionally add one or more online payment links, and more. It also creates estimates of future expenses and overall turnover.

You can categorise all of your payments and transactions from the mobile app or the cloud-based platform.

Third-Party Integrations

You can connect your accounting software to multiple finance and accounting integrations, such as Sage, Quickbooks, Free Agent, Crunch, ClearBooks, Coconut, Reckon, KashFlow, and Xero.

Expense Cards

Each Tide subscriber will receive an expense debit card issued by Mastercard. Regardless of the plan you choose to subscribe to, you can order additional cards for the price of £5 plus additional VAT expenses for each card. All money transactions will automatically appear on your account, separated under different categories.

You can create individual limits for each debit card to make sure your employees stay within the daily or monthly spending limit. Here’s a video on how to create spending limits for each expense card via your account.

Also, there’s no need to claim proof on each transaction separately. Employees who have access to the expense cards can also scan the payment receipts and share them on the account. Each receipt will be automatically attached to the specific money transaction.

You can order Tide Expense Cards’ reader on the following page.

Loan Application

You can apply for business, start-up, and credit loans via Tide’s mobile app or cloud-based platform. Some of their partners that offer loans for Tide users include:

- Uncapped

- British Business Bank

- Liberis

- Lendinvest

- YouLend

- Iwoca

- Funding Circle

First, connect an existing bank account to your Tide account. There, you can fill out an application to learn what type of loans you can apply for.

Here are the criteria you must fulfill to be considered as a potential loan candidate by Tide’s business partners:

- The applicant company has to have headquarters in the United Kingdom

- The company must be registered as a partnership, limited business, or sole merchant

- The company has to provide bank proof, i.e. transaction statements from the last 12 months

Before sending your application, you can use the loan calculator to check whether you fulfill the necessary criteria for the loan you’re interested in.

You will receive a customized quote a day after sending the application via your Tide account. If you decide to accept the quote, you will receive the funds in your company’s bank account in approximately 24 hours.

Business Registration

In addition to managing your expenses and using card readers, you can also register your business via Tide. Before you apply for an official registration, you can find out if the name you set your mind on is currently available. You can use Tide’s Name Checker tool and type eight different names to see if you can use them or not.

If the name you want is available, you can register your company in several minutes. Once the process is successful, you will receive a registration certificate in several hours.

Anyone who registers their company via Tide will get to use the cloud-based accounting platform for free in the next half a year.

To be eligible to register your business, your company has to be based and registered in the United Kingdom. Additionally, you’ll have to share information about the company’s managing director, such as their name and surname, DOB, nationality, home address, etc.

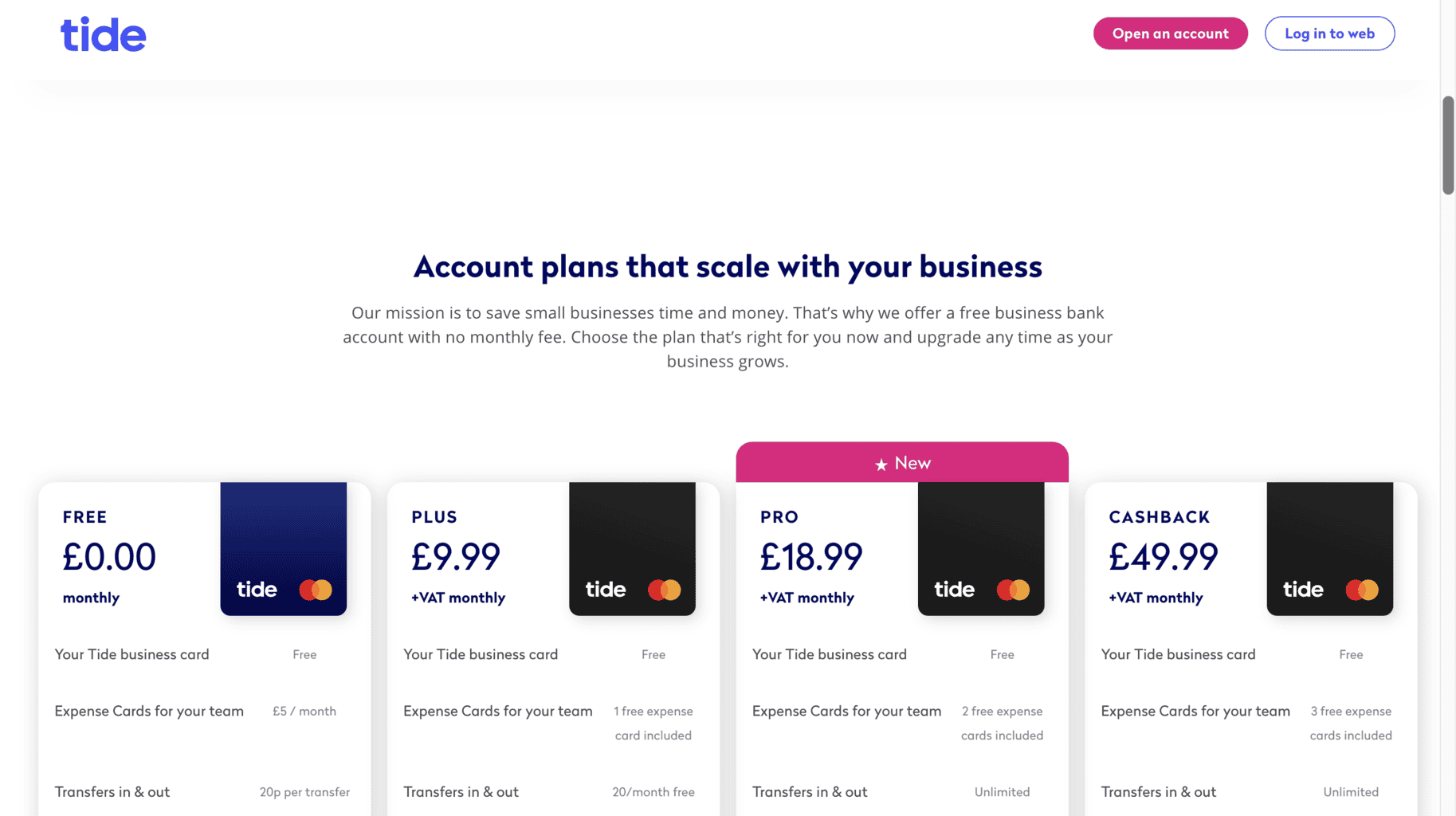

Tide Prices and Fees

Tide offers four subscription plans, one of which is free. The monthly plans have no extra rates and fees except the regular monthly subscription cost. Payments processed by card are free of charge for UK and international credit and debit cards.

Money deposits are processed at 0.5% when processed via post or 3% via PayPoint. If your expense card is lost or stolen, you can order a replacement for free. If you’re interested in finding out more about each plan, the company’s website offers additional information on the tools and features.

Now that we’ve covered the basics, let’s learn more about each plan and what you’ll get by subscribing to any of them.

Free Plan

The free plan is ideal for small businesses that don’t require multiple finance management tools and features.

After creating an account, you can connect a software integration for finance and accounting. Their technical team will monitor your account 24/7 to ensure safety from theft and unwanted transactions from third parties.

Free Tide Account Features

These are the main features of the free Tide account:

Payment links: Send multiple links and process online payments via credit and debit cards in several seconds.

Automated expense categorisation: The platform automatically categorises expenses in separate lists with labels.

Digital wallet: Connect your business account to a Google or Apple digital wallet.

Payment exports: Export your payments in several formats, such as CSV or PDF. You can download expense reports in specific timeframes to help you keep track of your business spending.

Direct debit payments: Manage your direct debit payments from Tide’s app. By accessing your direct debit archive, you can see all of your previous payments and filter out specific dates to see the amount of direct debit payments processed during that period.

Expense debit cards: Order expense debit cards for multiple employees; each costs £5 monthly.

In and out transfers: Transfer multiple funds within minutes daily. One money transfer costs 20p. You can also schedule fund payments in advance for recurring transfers, such as subscriptions.

Money withdrawals: Withdraw money from Tide’s cards from ATMs worldwide. Each withdrawal costs £1.

Multiple accounts: Open up to five business accounts for your employees.

Invoices: Receive or send multiple invoices per month.

Customer support: Tide offers 24/7 support in case of fraud or account misuse. You can contact them via the website whenever you encounter an unwanted problem or if your card gets lost or stolen.

Plus Plan

The Plus account is ideal for small and mid-sized businesses with stable monthly revenue. The subscription plan costs £9.99 monthly plus additional VAT fees. It contains all of the features included in the free plan, plus support from Tide regarding trademark filing or various dispute types, a few extra perks for Plus members, and one expense debit card.

By creating a Plus account, you can make up to 20 money transfers monthly for free. Members also receive occasional member discounts on certain services and free legal advice from the support team 24/7.

You’ll also receive an expense debit card and can order more for a fixed price.

Pro Plan

Similar to the Plus account, Pro is suitable for small and mid-sized businesses that are scaling up and have a larger staff team. With the Pro account, you can make as many money transfers as you’d like without paying more than the regular monthly subscription.

The Pro subscription plan costs £18.99 monthly plus additional VAT fees. It consists of all the tools and features included in the Free and Plus subscription plans, the difference being you’ll get two expense debit cards.

Cashback Plan

The Cashback account is suitable for large businesses that make multiple money transfers daily and have many employees. This account allows you to make unlimited money transfers, and you’ll receive up to three expense debit cards.

The Cashback plan is the most expensive, at £49.99 plus additional VAT rates per month.

In addition to containing all the tools and features in the Free, Plus, and Pro plans, you’ll get an expert team to manage your Tide account and a fixed 0.5% cashback per card transaction. Plus, you’ll have a dedicated account manager to handle your payments and expenses.

Instant Saver Tide Account

If you want to get an interest rate, you can open an Instant Saver Tide account. You will get access to all of the tools and features included in the free account and will receive a fixed interest of 4.33% of your annual equivalent rate.

After creating an account on the website or app, you will have to deposit at least £1 to activate your account and receive the interest fixed rate.

The account is protected by the FSCS scheme, and in case of fraud, you’ll receive a compensation of up to £85,000.

Tide Card Readers Prices

In addition to the subscription plans, you can purchase Tide card readers for the following prices:

- Tide Card Reader (basic): This reader’s fixed price is £159 (with additional VAT expenses). However, there’s an ongoing sale, so it currently costs £89 plus VAT.

- Tide Card Reader (plus): The fixed price of this reader is £199 (with additional VAT expenses). This reader is also on sale at the moment, so you can order it for the price of £99, plus VAT expenses.

Company Background

Founded in London in 2015, Tide is one of the leading UK fintech companies offering multiple financial management solutions. Their services are specifically created to suit the wants and needs of freelancers, small and mid-range businesses, and startups. In 2023, Tide was the number one choice of 10% of the SMEs located in the UK.

So far, approximately 700.000 businesses have used the finance management platform and expense cards.

The company’s headquarters are in London, UK. It also has three branches in Hyderabad, Delhi, India, and Sofia, Bulgaria. Oliver Prill is the managing CEO, and over 1500 individuals work for the company.

One of the company’s main goals is to support women-led businesses, significantly scaling companies and startups. Since 2023, their services have been used by over 100.000 women. Their current goal is to have about 200.000 women-led companies on board until 2027.

You can contact the London Office’s customer support line by dialling 159. For further inquiries, log in to your Tide mobile app and start a live chat with an employee by clicking the “Support” button and selecting “Messages.” You’ll be redirected to a new window where you can talk to a staff member.

The company is registered in Wales and England, and its official phone number is 09595646. The address of the London office is The Featherstone Building, 66 City Road, London, UK, EC1Y 2AL.

If you’d like to keep up with the latest news about Tide, you can follow them on LinkedIn, Facebook, and Instagram.

Online Reviews

Tide has over 19.000 reviews on Trustpilot and an average score of 4.2 out of 5.0 stars. Many reviewers mentioned they received helpful onboarding advice from the company’s customer support team while setting up their business accounts.

Additionally, they have over 5600 reviews on Smart Money People and an overall average score of 4.8 out of 5.0 stars.

They also have 164 reviews and 4.7 out of 5.0 stars on Ambition Box, and only 9 reviews on Capterra and a median score of 4.7 out of 5.0 stars.