Braintree is a payment gateway that, in their own words, is the simplest way to get paid. The company’s primary focus is on processing online payments so businesses can accept credit and debit card payments both online and via mobile devices. Moreover, it offers upfront pricing and a variety of payment methods.

Braintree is owned by PayPal, and to use the service, you will need a PayPal Business account.

Prices/Fees

The fees for using a credit card, debit card, or digital wallet are 1.9% + £0.20 for each transaction.

Other fees that apply are as follows:

- Transactions made with cards issued in countries other than the UK are subject to an extra charge of 1%.

- European merchants also have the option of using an interchange plus pricing structure.

- For multi-currency transactions, an extra charge of 1.5% applies.

- Transactions involving several exotic currencies incur an extra cost of 3%.

- Transactions made with American Express will incur a fee of 2.4% plus £0.20.

- Braintree can pass through American Express transactions for a price of $0.20 per transaction for merchants who already have their own American Express accounts.

- If your company processes more than £50,000 each month, you are eligible for a fee discount.

- Chargebacks are subject to a one-time cost of twenty pounds.

- Transactions that are refunded do not have their processing costs repaid.

You can also get customised pricing by submitting a request at the following link.

Products

There are two types of Braintree products: Braintree Direct and Braintree Extend.

Let’s see what they are about.

1. Braintree Direct

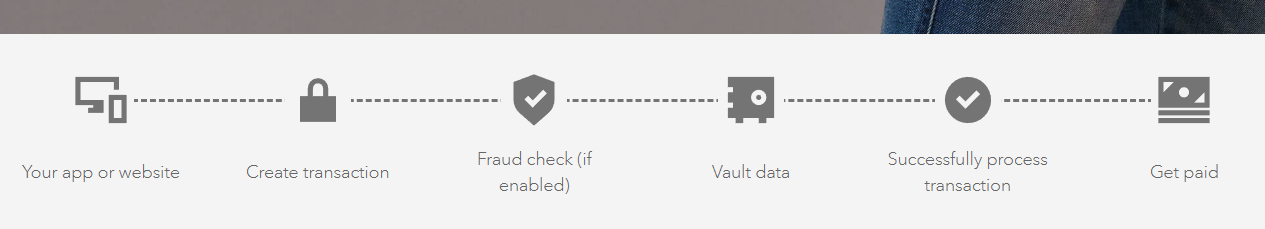

Braintree Direct is available on Android, iOS, and on the web in all countries that Braintree supports. You can accept payments made by credit cards, PayPal, and digital wallets like Google Pay, Apple Pay, and Venmo (only available in the United States) in one easy integration.

In addition, you will be provided with industry-leading solutions to assist in the prevention of fraudulent transactions, the management of data security, and the streamlining of business processes, that we’ll elaborate on later on.

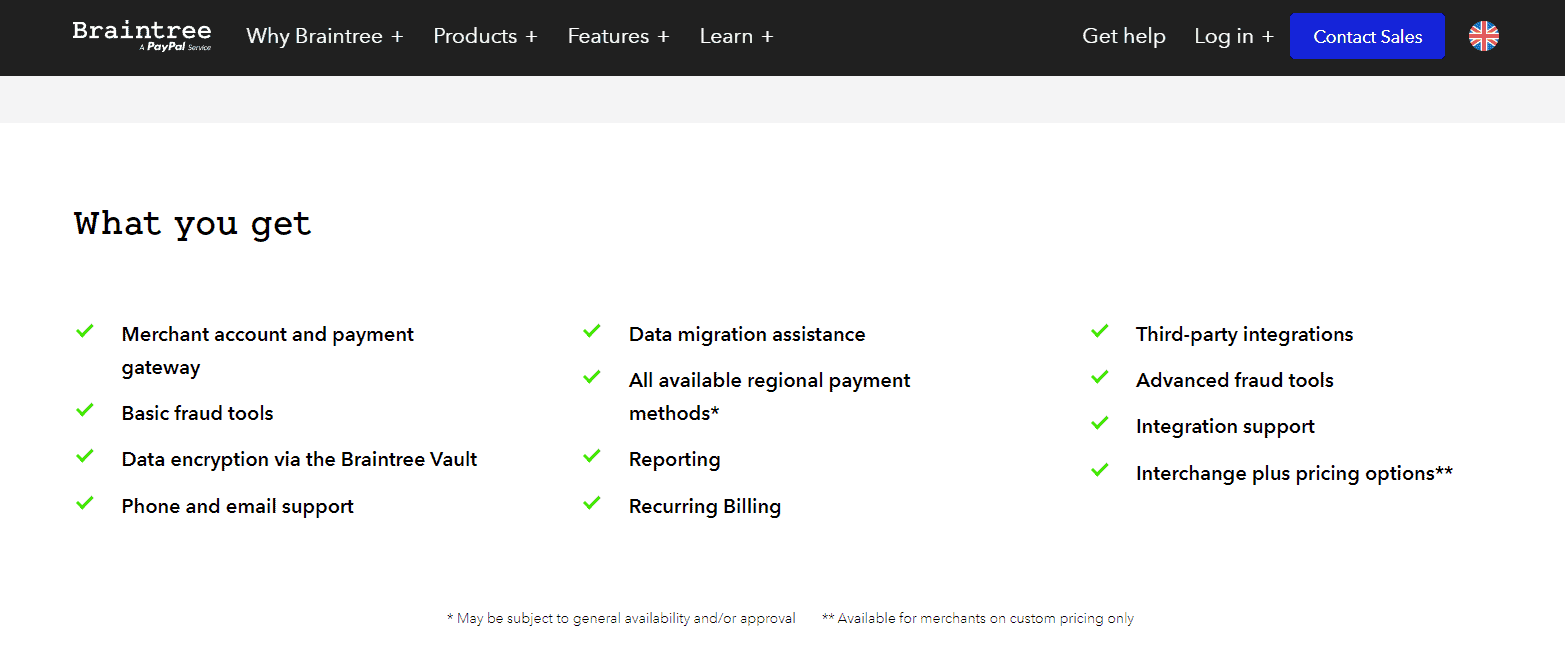

Here are some Braintree Direct benefits and features:

- Level 1 PCI-compliant service provider

- Optimized for web and mobile

- Popular payment methods

- One easy integration

- Built to scale

- Global reach

- Keep your customers’ information safe and secure

- Recurring billing

- Account Updater

- Robust reporting

- Easy third-party integrations

Here are some of the companies that trust Braintree with their payments:

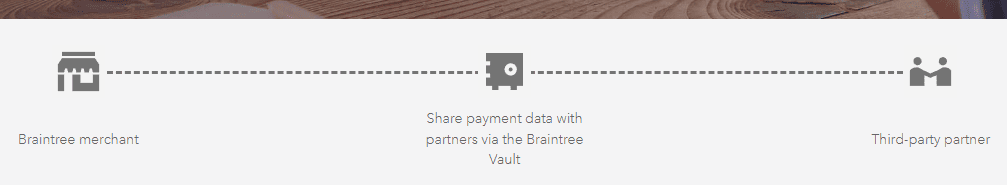

2. Braintree Extend

Braintree Extend allows merchants to easily integrate with third-party services and platforms, allowing you to better manage and grow your company.

With Braintree Extended, you can:

- Develop commerce experiences with partner content that’s trusted by your customers.

- Provide a user-friendly checkout process.

- Include supplementary goods or services in your offering so that customers can make multiple purchases all at once.

Services

Let’s take a closer look at Braintree’s services.

Fraud Prevention Measures

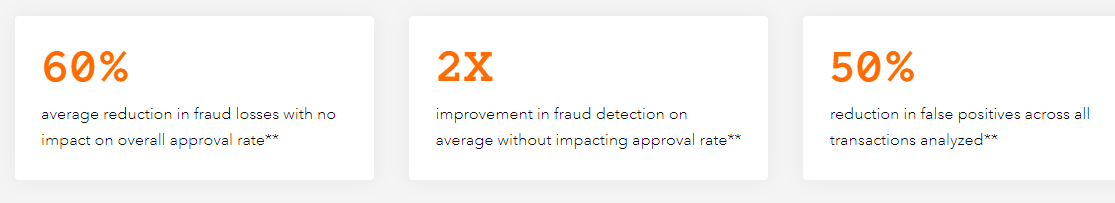

Fraud Protection and Fraud Protection Advanced can help you with the following:

- Cut down on false positives

- Minimize chargebacks

- Minimize work pressure

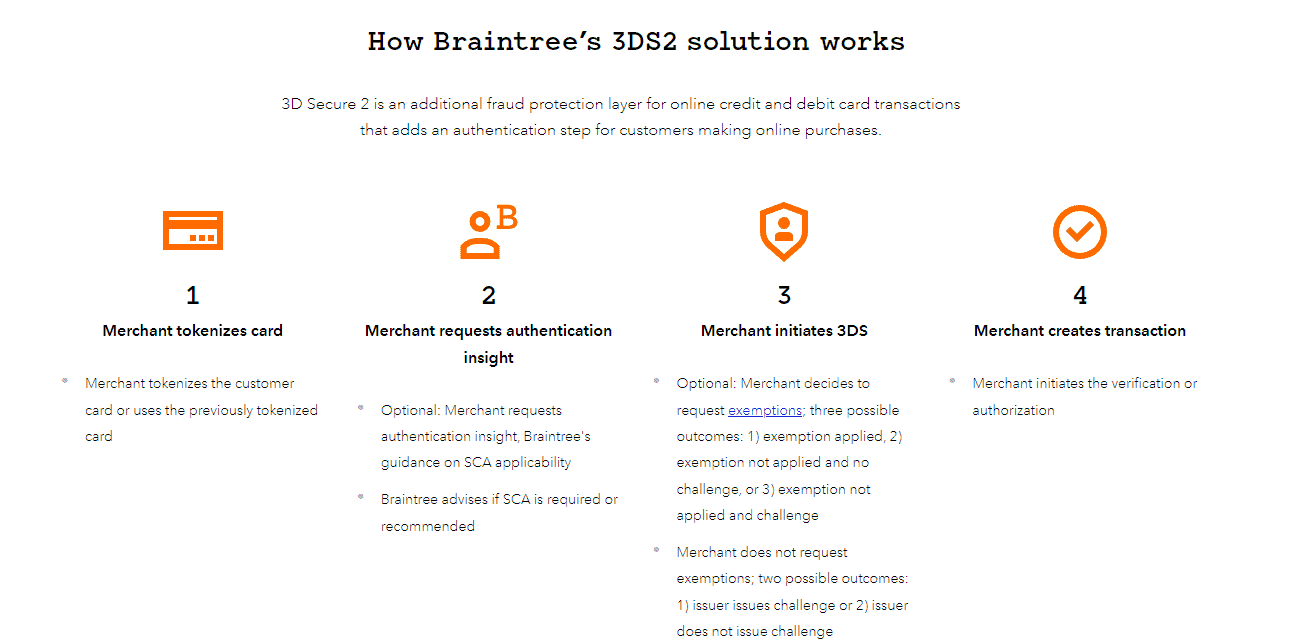

3D Secure 2

Braintree’s 3DS2 solution makes it easy to verify eligible card transactions while giving cardholders a smooth checkout experience.

Here are the benefits of 3DS2:

- When it comes to approved cards, 3DS2 can shift the obligation for chargebacks that are a result of fraudulent activity from the merchant to the card issuer.

- According to the collected data, issuers are likely to approve a greater number of transactions when utilising 3DS2 as opposed to 3DS1.

- A drop of 70% in the number of abandoned carts.

- 85% faster processing of financial transactions.

- Braintree’s built-in support for the 3D Secure 1 and 2 authentication protocols can assist in ensuring that your business’s transactions satisfy the standards set out by the SCA.

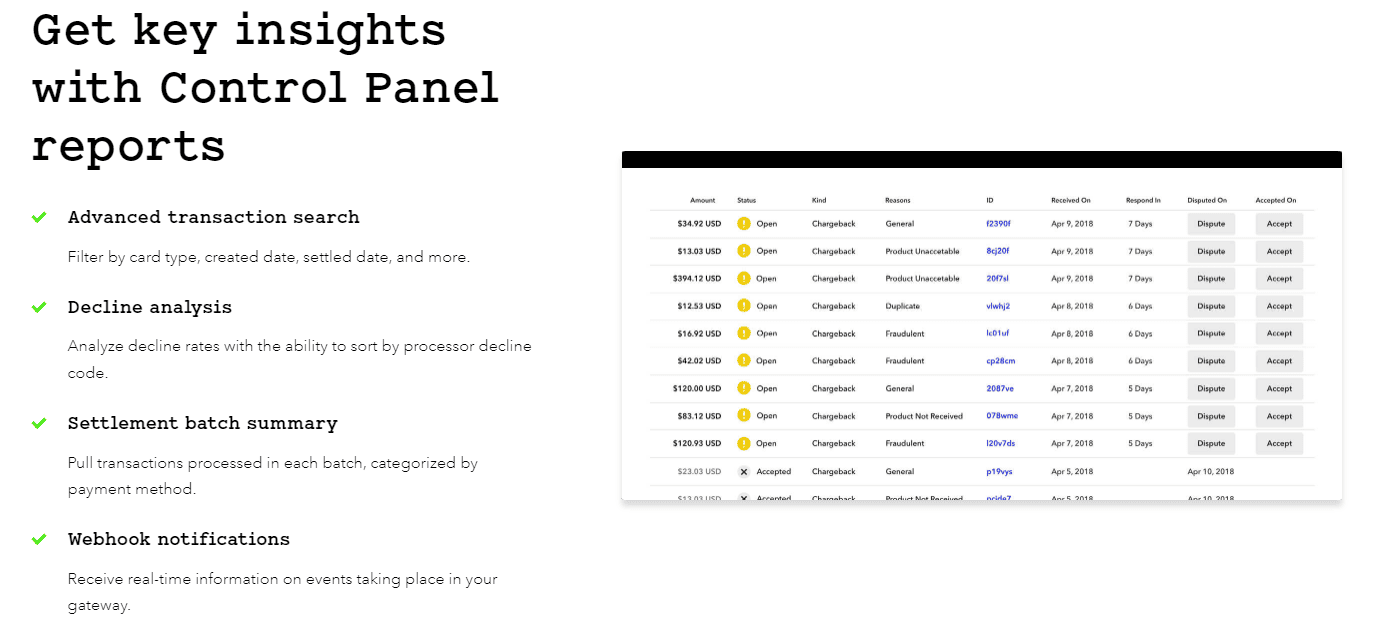

Reporting

Braintree provides the necessary insights on your company’s payment activity and transactions so you can make data-driven decisions.

You can gain essential understanding using the reports available in the Control Panel,

filter by card type, the date it was generated, the date it was settled, and more, analyze decline rates, retrieve the completed transactions for each batch, arranged according to the payment type, and more. You will also be updated in real-time with information on the events that are occurring in your gateway.

Payment Methods

Braintree supports the following payment methods:

- Local payment methods

- Credit/Debit cards

- Digital wallets

- PayPal

- Venmo (only in the US)

Integrations

The Braintree payment gateway is compatible with a wide variety of invoicing apps, e-commerce platforms, analytics services, and shopping carts, making it an ideal choice for businesses looking to streamline their payment processing.

The following is a list of Braintree’s integration partners. Each company has a devoted team at PayPal for maintenance and support:

- Woocommerce

- BigCommerce

- Yodley

- 3dcart

- Primer

Here are Braintree’s enterprise plug-ins:

- IBM Sterling Commerce

- Oracle ATG Commerce

- Oracle E-Business

- Demandware

- SAP Hybris

- Salesforce

- Magento

- Netsuite

- SAP

Vetted by Braintree:

- Chargehound

- Recurly

- Spree

- Zuora

Shopping carts:

- 3dcart

- Acart

- ASecureCart

- BigCommerce

- Bizapps

- Cartfunnel

- CoreCommerce

- Demandware

- Drupal Commerce

- Ecommerce Templates

- Fleapay

- Foodstorm

- Formsite

- FoxyCart

- LemonStand

- Magento

- Miva

- OpenCart

- RazorCart

- ShopSite

- Spree

- U-Commerce

- Ubercart

- UltraCart

- WooCommerce

- PayPal powered by Braintree

- Yahoo! Small Business

- X-cart PHP

- WooCommerce

Recurring billing:

- Chargebee

- Chargify

- Churn Buster

- Metricsco

- Recurly

- TeamUp

- Wallee

- Wallkit

- Zuora

Accounting, invoicing, and tax solutions:

- Avalara

- Bolt

- ChargeDesk

- Elorus

- Hiveage

- HostBill

- Invoiced

- Quaderno

- Taxamo

- TaxCloud

Analytics:

- Baremetrics

- BTMetrics

- ChartMogul

- Main Metrics

- Putler

- Slemma

- Stride

Misc:

- ActiveCollab

- Project management tool

- Agilcommerce

- Agile CRM

- Easy Digital Downloads

- FlexBooker

- JotForm

- GrowSumo

- MemberGate

- Nonprofit CMS

- ProfitWell

- Social Taste

- Stitch

- SurchX

- Thundertix

- ThunderTix

- Wufoo

- Yodle

- Zapier

Moreover, misc, analytics, accounting, invoicing, tax solutions, recurring billing, and shopping carts companies have developed integrations that are compatible with certain Braintree products and work very well together. On the following link, you will find a detailed guide from Braintree regarding all integrations.

Extra Care On Customer Support

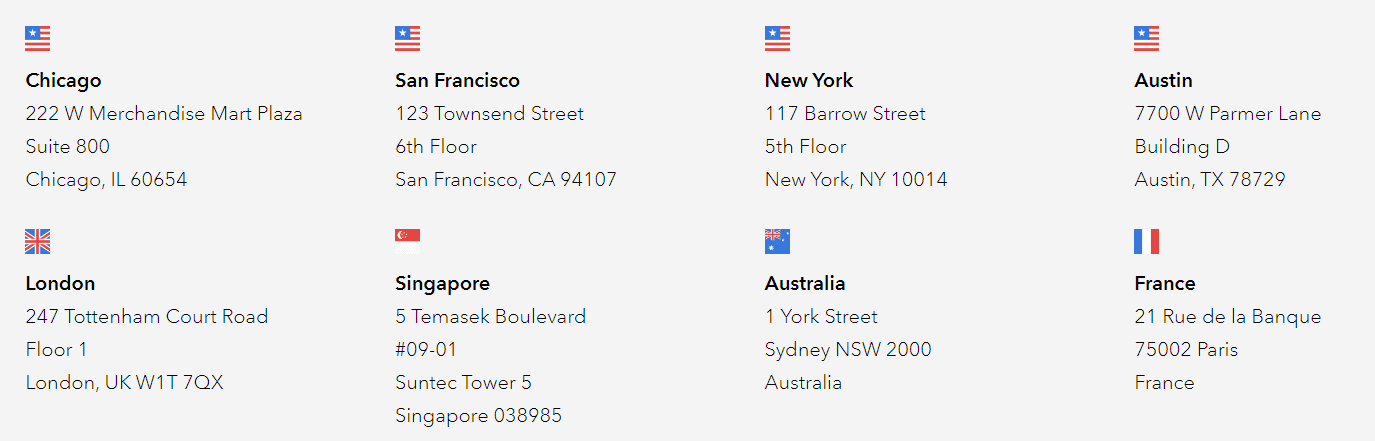

You can submit a request or contact customer support at the following Braintree offices worldwide:

For merchant support, sales, or account management, Braintree provides white-glove support.

Company History

E-commerce enterprises’ mobile and online payment needs are the primary focus of the Chicago-based startup Braintree, which specialises largely in mobile and web payment solutions. On September 26, 2013, PayPal completed its acquisition of the business.

Click here to go to the About Us page on the Braintree website.

User Reviews

Braintree user ratings are as follows:

- Capterra: 4.0 stars out of 5.

- G2 Crowd: 3.4 stars out of 5.

- TrustPilot: 1.3 stars out of 5.

- Sitejabber: 1.6 stars out of 5.

The average score for Braintree, according to the above-listed sites, is 2.6 out of 5 stars.

User Reviews

Review Summary

Recent Reviews

There are no reviews yet. Be the first one to write one.