WebMoney Transfer is a company established in 1998 in Russia. It is dedicated to creating an environment for businesses to track and attract funds, resolve disputes, and make safe financial transactions.

Their technology is based on interfaces that the users can use to manage their property rights, keep their rights safe by Guarantors, and store their funds in “purses” holding electronic money corresponding to an underlying asset like a currency.

Prices/Fees

The Web Money system currently supports a limited number of the so-called “purses”. Each purse accounts for the property rights of different types of valuable assets and is subject to different system fees.

System fees are charges imposed on each transaction carried out within the Web Money Transfer System. These fees are meant to cover the cost of providing information and technology services required for communication between correspondents in the system. The minimum amount of these fees is 0.01% of the payment amount, while the maximum amount is limited to the figures specified below.

| Purse Type | Equivalent | Fee Charge |

|---|---|---|

| Z-purse | WMZ A US dollar equivalent (proof of a purchase made at www.megastock.com) | 50 |

| E-purse | WME A Euro equivalent (proof of a purchase made at www.megastock.com) | 50 |

| B-purse | WMB Electronic Belarussian Ruble | 100 |

| G-purse | WMG A warrant that there’s gold in a repository. | 2 |

| X-purse | WMX The property rights for storage are transferred by publishing records in the global public database of the bitcoin.org network. | 5 |

| T-purse | WMT Transferred for a deposit in USDT tokens (conditions for accounting units from global public databases: https://tether.to/en/legal) | 50 |

| H-purse | WMH The property rights for storage are transferred by publishing records in the global public database of the bitcoin.org network. | 30 |

| K-purse | WMK Kazakh Tenge equivalent. | 9000 |

| L-purse | WML The property rights for storage are transferred by publishing records in the global public database of the bitcoin.org network. | 150 |

| Y-purse | WMY The rights to make settlements and transfers in compliance with the laws of the Republic of Uzbekistan are granted through claims. | 400000 |

The following transactions are not subject to fees:

- Between the same purse type of the same WebMoney identifier

- Between the same purse type of the same WebMoney Passport

When performing operations with confirmation using the phone number, an additional commission may be charged.

Owners of D-type purses are taxed by the system for carrying out credit transactions in an amount equal to 0.1% of each credit they provide but not less than 0.01 WMZ (Z-purse, US dollar).

Product/Service

The numerous products and services offered by WebMoney help this company remain competitive in the market and popular with its multiple clients.

Services provided by WebMoney are different for personal and business purposes.

Products for Personal Use

Operations

Top-Up/Withdraw

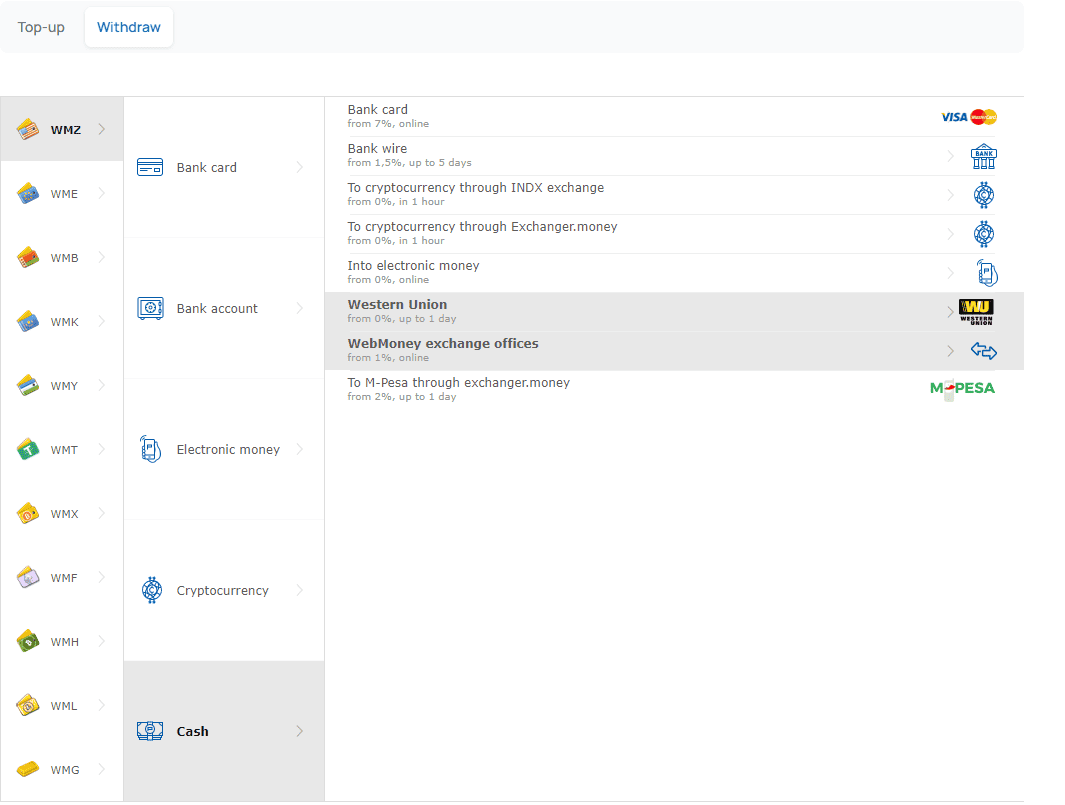

By accessing their page, WebMoney users can find information about the locations of cash top-up and withdrawal spots, as well as information about the online and physical exchange, top-up and withdrawal methods for each purse type (WMZ, WMB, WME, …) and payment type (bank card, electronic money, bank account, and cash.

Exchanger: Exchange

The exchange feature provides users with live information about the exchange rates between purse types to ruble.

Users can observe trends and changes monthly, weekly, daily, and hourly. They can also interact by asking and responding to each other’s questions in the right-side panel. In addition, users see the current WebMoney exchange list, list of new applications, list of counter applications, or switch trader mode or trader view.

By proceeding to the Exchanger.Money page, users can buy and sell WebMoney without intermediaries using over 100 available payment methods and dozens of currencies.

WebMoney offers highly profitable exchange terms to its users. The exchange rate is determined by the participants, thus, the Exchanger.Money allows all parties to make transactions on the most suitable conditions.

The Exchanger.Money doesn’t charge any fees. Commissions are paid only to the payment system or the bank. Furthermore, all transactions are escrow-protected, and the receiver will only get the money once the sender confirms the receipt.

There are also hundreds of options and directions of exchange via WebMoney Exchanger.Money. Users can send funds from card to card, make bank transfers, use money transfer systems, payment systems, crypto, cash, and more.

Check

WebMoney.Check is a simple and convenient method to make purchases or pay other people online using only a personal mobile phone number.

To recharge WebMoney.Check, users need to go to the cash-in kiosk (terminal), pick the WebMoney option, input their mobile phone, and insert the banknotes.

To use WebMoney.Check, users need to click on WebMoney once they are at the store’s website checkout and select WebMoney.Check. Then, they need to enter their phone number and password, wait a few moments, and type a short confirmation code that will arrive via SMS.

Loan

Credit Service

The loan payroll system supported by the WebMoney platform offers WM-purse holders the ability to purchase goods and services on credit or extend loans to other members. The system automatically records the loan amount and repayment term in the transaction history of the lender and debtor while ensuring the timely repayment of loans through subsequent monitoring.

Loans are granted for a duration stipulated by the lender, and upon its expiration, the member is expected to discharge their obligations fully. To facilitate loan transactions, the system utilises WMC and WMD purses.

It is important to note that the loan payroll system is governed by the Loan Service Agreement, which outlines the terms and conditions of the lending and borrowing process.

Loan Provision

WebMoney Transfer users can automate the lending process through Interface X1, allowing online shops and services to invoicing customers for goods and services.

The borrower’s loan status can be checked on the “Certificate” tab under “User properties”, and the lender sets the loan term. The Paymer registers an unconditional debt obligation upon loan transaction, and if the borrower fails to repay, the lender can receive the remaining amount through C- and D-purses. The debt is then managed by Paymer service.

Loan Repayment

To repay a loan in WebMoney Transfer, a borrower needs to access the transaction history of their C-purse, select the loan, and click “Repay the loan”.

Upon specifying the Z-purse number for repayment and the repayment amount in an A form and clicking “Transfer”, the specified amount of WMZ will be transferred from the borrower’s to the lender’s Z-purse. The amounts in WMD and WMC in purses D and C will be reduced. The loan can be repaid in single or multiple transactions but is only considered fully repaid if the borrower pays in full using WMZ title signs.

Loan Service – Contract a Debt

The Debt Service offered by WebMoney allows system members to lend their funds to users and manage loan records and repayment schedules.

Loans are granted in WMZ, WMH, WMX, WML, WMF, and WMT units, subject to the lender’s specified conditions.

Access to the Debt Service functions is available to WebMoney system members with a formal certification or higher.

It is important to note that all debt transactions, including loan disbursement and repayment, must be conducted exclusively through the Debt Service. Direct transfers between Keeper accounts are not considered part of the lending process.

How to Contract a Debt?

The Paymer service allows lenders to request a trust limit from users, granting access to funds based on predetermined conditions.

Loan guarantees in the Paymer service consist of unconditional obligations that can be paid to the bearer twice the debt amount, serving as a safety net in case of repayment default.

WebMoney Transfer system members with a formal and business-level certificate of 15 points or higher can easily secure immediate loans through the automated Debt service. Each member’s debt amount, term, and percentage rate are calculated based on individual qualifications, with a maximum debt limit of 300 WMZ.

How to Grant a Loan?

Lenders possessing idle funds may want to lend their assets to unknown borrowers who have submitted applications for loans on the Debt service. Lenders can then search for suitable applications and contact potential borrowers who have provided all the necessary information.

If they don’t find a suitable loan application, lenders can then place an offer with their loan conditions and wait for borrowers to contact them.

The process of lending through Debt service involves several stages. Once the lender selects a borrower, the lender must open a credit line (trust limit) specifying the percentage for using the loan, maximum amount, and loan term. The borrower then needs to consent to these conditions.

Once the credit line is opened, the borrower can access funds within the specified trust limit. After the loan term expiration, the borrower must repay the funds with interest.

Arbitrage

The arbitrage feature includes forms for submitting complaints, submitting claims, and registering contracts. These services are only available to registered members of WebMoney.

Fundraising

WebMoney also has a feature that helps people raise funds for various purposes. The feature is accessible only to registered members. The fundraising service is available in the form of charity, crowdfunding, group buying, and event tickets.

Security

Escrow: Secure Transactions

WebMoney’s Escrow service provides a trusted intermediary for transactions and protects buyers and sellers through collateral. Here are the transaction stages:

Proposal:

- The seller or Buyer creates an offer to a user on their WebMoney contact list.

- Terms of the offer are saved, and the other party is notified.

- The other party can accept, refuse, or modify the offer.

- If the offer is accepted, both parties must pay security deposits to create the deal.

Deal:

- During the transaction, both parties must confirm its successful completion or any violation of its conditions.

- If both parties confirm success, the deposited funds are returned.

- If both parties mutually cancel, the deposited funds are returned.

- If a dispute arises, the security deposit is held until a mutual agreement is reached or a claim is filed in arbitration.

Dispute Resolution:

- If the parties cannot agree within 10 days, either party can file a claim in arbitration.

- The deposits are transferred to the winning party based on the arbitration decision (excluding the commission).

E-Num: Secure Authorisation

E-Num is a service designed for website owners to authorise their users. There are currently 11,580,887 active E-Num users.

The feature exists for both iOS and Android operating systems. Its process is the following:

- First, a challenge question is displayed on the website’s authentication form.

- Then, the mobile E-Num application receives a PUSH confirmation and displays the challenge response.

- Users then click “send challenge-response” in the mobile E-Num app or enter the challenge response in the form themselves.

- Upon completion of these the previous three steps, they are authenticated.

Technical information, a description of different methods, and an explanation of what E-Num is exactly can be found on the E-num page.

Operation Notification

WebMoney Notify is an automatic notification service that provides users with alerts regarding the launch of their WM Keeper (Classic or Light) and any incoming funds, accounts, or messages from other users on their WM-ID. Users can receive these notifications via email, SMS, or Telegram. The system sends notifications in real-time as soon as new information is received.

Regarding security, WebMoney also offers to set up limitations for purse access to its registered users, a wizard for WM-identifier restoration, and an advisor tool for analysing traffic, finding reviews, and determining the ratings of various websites.

Purse Management

WebMoney Keeper for the Browser

WebMoney Keeper Standard is an online wallet that can be accessed easily via the web after registering at mini.wmtransfer.com.

This wallet is compatible with all browsers, including mobile, making it very convenient for users.

Access to WebMoney Keeper is secured with a login and password, ensuring the safety and security of the user’s funds.

The download link is available on WebMoney’s website.

Verification

A passport is a digital certificate issued to users of the WebMoney Transfer system and is authenticated with a signature. The passport includes personal details like the owner’s full name, passport, and contact information. The trust level and privileges within the system increase with a higher level of certification.

There are three types of passports, formal, elementary, and personal, each with a different features.

The formal passport has the most strict transaction limits for funds in each purse (wallet) type (e.g. up to 10.000 WME) and daily transactions (up to 3000 WME). This passport allows operating with cryptocurrencies (with a delay of up to 48 hours) and access to loan services. Transfer commission is up to 0.8% of the payment amount. Interested parties can obtain this passport by entering their personal details, providing a personal identification document photo, and going through a VideoID identification, all on the WebMoney website for free.

The elementary passport allows for higher fund limits (e.g. 30,000 WME) stored in wallets and higher limits for daily debit transactions (e.g. 12,000 WME). The rest of the conditions and accessibilities are the same as for the formal passport. To obtain this passport, interested parties need to record a VideoID and pay 1 WMZ.

The personal passport allows for even fewer fund limits in the purse (e.g. 60,000 WME, limitless WMZ and WMT) and daily transactions (limitless WME, WMZ, and WMT). This passport also includes a number of perks beyond the previous two. The perks of holding a personal passport include Paymer service, credit exchange, doing business (automated payment acceptance from WebMoney.Merchant, Megastock catalogue registration, XML interface access, etc.), additional income (issuance of certificates for guaranteed remuneration), and participation in system management (having a vote in the development). To obtain this passport interested parties need to meet with one of WebMoney’s agents, apply and pay for certification in the certification centre office (there are offices in Belarus, Kazakhstan, Russia, Uzbekistan, China, Germany, Latvia, Moldova, Ukraine, Estonia, Czech Republic, and Vietnam). Finally, they must record their VideoID and pass an interview with WebMoney representatives.

The passport webpage contains a list of offices (Registrars) issuing certificates in different countries.

Business

Merchants and Retailers

Merchant: Accept Payments

The Web Merchant Interface is a suitable option for stores that accept payments and utilise automated order accounting, particularly for digital goods delivery. Its advantages include straightforward integration, which requires the creation of only three web pages and customisation of payment and service settings through Merchant.Webmoney.

In addition, the interface offers a diverse range of payment modes such as WM-purses, WM-cards, WebMoney Check, bank cards, online banking, payment terminals, and money transfer systems. It also provides ample payment system setup options. More detail about the Web Merchant Interface is available on Web Money’s wiki.

Payments to Bank Accounts

Even if they are not WebMoney members nor purse owners, businesses can still accept payments via WebMoney Transfer. Payment Gateways facilitate payment reception and bank transfer of funds. These gateways also support popular payment modes like credit and debit cards, e-wallets, and money transfers.

Interested parties can sign a contract with a Payment Gateway corresponding to their bank account currency. Russian firms can use paymaster.ru or platron.ru for Russian Ruble accounts, while Technobank OAO and wmtransfer.by are suitable for Belarusian Ruble accounts. Brio OOO and paymaster.uz serve Uzbekistan soms, while Hermes Garant group and webmoney.kz cater to Kazakhstan tenge.

MegaStock: Directory of Sites

MegaStock is an extensive catalogue of online shops and services that accept WebMoney as a payment method. Shops are split into a variety of categories, such as payment for services, trips, purchases, finance, internet, entertainment, advertising, digital goods, and services.

Digiseller: Create a Digital Goods Store

Digiseller digital store wizard is a handy tool for selling digital goods. Its primary focus is on activation codes, files, virtual currency, and e-book sales.

What clients can expect from this feature are various payment methods, more than 50,000 agents ready to advertise products as affiliate marketers, broad functionality in terms of promo codes, discounts, pre-orders, custom price products, APIs, and full automation of the website.

Websites

Funding: Fundraising

On the WebMoney Funding platform, individuals, organisations, and companies can raise funds to implement their creative, scientific, industrial, and other projects. This platform can also be used for organisation and making collective purchases.

Cashbox: Purchase Website Activities

Cashbox is a tool convenient for social media. It helps businesses attract more customers on social networks, explore the audience’s opinions about their products or brand, increase their brand awareness and popularity, and build a good reputation.

Cashbox guarantees quick access to audiences from various social media like Twitter, YouTube, or Telegram, modest expenses for reaching broad audiences, combined functionalities in a single personal account, and the ability to work with a group of jobs and receive reports on demand.

Mestcom: Sellings Ads

Mestcom is a place for selling advertisement space by simply connecting to the WebMoney Transfer system and signing up for the DigiSeller merchant service. Some of Mestcom’s peculiarities are banner moderation, limiting the number of impressions by IP address, and adjustable banner size.

Login: WMID Authorisation

WMID Authorisation system was built for developers and Webmasters who want to use all kinds of authentication methods that WebMoney Transfer offers.

The system allows a simple way to complete the authentication of WebMoney users. It’s supported by WebMoney Keeper WebPro (Light) and WinPro (Classic), WebMoney Keeper Standard (Mini) and Keeper Mobile.

General

Masspayment

This service is designed to make a large number of batch payments. The payments are automatically made from the users’ purses to other WebMoney users or the personal accounts of mobile operators or Internet providers.

Contracts

WebMoney Transfer system users can create electronic contracts published on the arbitration service’s website and specify the rights and responsibilities of participants in trade transactions using the WebMoney Transfer system.

The contract must comply with existing agreements of the WebMoney Transfer system. If both parties in a transaction have previously agreed to the terms of a contract, the Arbitration of the WebMoney Transfer system will use the agreement to resolve any disputes.

There are two types of arrangements: open and limited access contracts. The author of a contract can attach a file to it but cannot change or delete the contract once it has been published on the website. Only members with formal passports or higher can create contracts which are not accepted by suspended or former members.

Exchanger

As described in the section on Personal features of WebMoney, the exchanger feature contains live exchange rates for all currencies and wallets that WebMoney works with.

Arbitrage

Arbitrage is a permanent WebMoney service for solving disputes between WebMoney Transfer users. The whole process and supporting documents are available on the Arbitrage webpage.

Escrow

The escrow service acts as a trusted party during the transaction between the seller and the buyer and ensures that all of the conditions for the trade are being met.

The procedure works as described in the section on Personal WebMoney features.

Credit Market

The WebMoney Transfer exchange is open to all participants with a minimum passport level, allowing for loans in WMZ. Lenders with available funds can offer loans at favourable rates, while borrowers can obtain necessary funds with a fixed repayment period.

However, loans must be repaid on time, or the debtor’s WM Keeper will be blocked. Passport data is required for loan applications, which potential lenders can access.

Reporting

The WebMoney Report is an online tool that generates reports on purse transactions. These reports provide information on transactions, starting and ending balances for a specific period. Details about this service are available on Web Money’s wiki.

Financial Support

Parties interested in finding out more about Web Money’s financial support should contact WebMoney Guarantor’s support teams:

- For WMZ: financial@wmtransfer.com WMID: 749238964258

- For WME: finance@webmoney.eu

- For WMB: support@wmtransfer.by

- For WMG: financial@metdeal.com

- For WMK: support@webmoney.kz

- For WMX, WMH, WML, WMF, and WMT: wmx@wmtransfer.com

Dealers and Payment Systems

Biz.web.money is a platform for making and accepting WebMoney payments. The company offers a detailed guide for legal entities.

WebMoney Features

Task Management

The Task Management Service for WebMoney users is designed to control and complete their tasks more efficiently. Customers can create tasks to be completed by Executors and assign an Inspector to verify completion.

Each task has a set award for the Executor and Inspector upon completion. Funds are transferred once the Executor and Inspector agree to begin work and are protected by a unique code sent after the Inspector confirms task fulfilment.

Secure Mail

WebMoney and WebMoney Transfer users can use the special email service called WebMoney Mail for their operations.

WebMoney Files

This feature helps upload, store, manage, sell, and transfer files. The files are usually packed in zip archives and can be published or downloaded using a hyperlink.

Files can be up to 1 Gb in size, user file storage size is up to 40 Gb, and users can have up to 40,000 files in their storage.

WebMoney Letters

This service enables sending regular, physical letters anywhere in the world without an envelope, stamp, paper, etc. Internet connection and membership at WebMoney are sufficient to send a letter. Within Russia, the price is 0.43 WMZ, while in other countries, it’s 0.85 WMZ.

Newsline Subscription

Interested parties can leave their information and receive a newsletter from WebMoney.

Capital

Shareholder Investments

Shareholder Investments service allows WebMoney users to buy shares in budget automation tools and co-manage them with other shareholders. They also get to vote on strategic initiatives and development, budget allocation, dividends payment, and replacement of the administrator.

INDX Internet Exchange

Traders registering with INDX can trade instruments without opening accounts in the broker’s office. INDX doesn’t participate in the trade and only provides technical support to guarantee that the transactions will be carried out.

INDX users can trade derivative securities, also known as NOTES. These are secured by Russian Joint Stocking Companies’ shares, foreign companies’ shares, and other assets.

The full service includes no fees or commissions except the WebMoney commission of 0.8% for adding funds to the Trader’s account, as described earlier.

It’s possible to add or withdraw funds at any time during the trading session. The trader can access all the accumulated funds except if the trader has a debt.

Debt Market

Debt Mart is a platform that facilitates the buying and selling of delinquent debt obligations from Webmoney Debt. The debts can be purchased for a significantly discounted price, ranging from as low as 1% to as high as 100% of their original value.

Capitaller – Capital Management via WebMoney Transfer

Capitaller is a unique version of WebMoney Keeper that enables shared access to purses and fund management through customisable algorithms for automated transaction processing. With this service, users can create automation tools for budgeting, tracking incoming payments, and managing their purses to keep their finances on track.

However, to use Capitaller, certain conditions must be met, such as possessing a personal or higher-level WebMoney passport.

Business Operations

Along with a wide selection of products and services, WebMoney also stands behind business operations that have significantly improved their market operations.

Security and Privacy

WebMoney Transfer was developed to meet the current security requirements for online information management systems. They offer three primary authentication methods: login and password, files with secret keys, and personal digital certificates.

In addition, they offer two forms of additional transaction confirmation: sending verification codes to the phone and using E-Num, a service for generating one-time passwords.

The system architecture is designed to provide secure access to WM wallets for users and prevent settlements using WM wallets with insufficient funds. The system also offers resistance to connection faults on the system level, ensuring that funds are always either on the sender’s or receiver’s WM wallet. This approach eliminates the possibility of losing WM funds.

During the registration, users are assigned a unique 12-symbol WM identifier, which they will use further to log into the system. The WM identifier cannot be used to learn WM wallet numbers. Users can install unlimited WebMoney Keeper versions on their computers and sign into the system using different WM identifiers.

WM Keeper feature enables users to configure the display of personal information, which will be shown to other participants. During transactions, the second party can access only the selected data.

Company Background

Founded in 1998, WebMoney became a global settlement system over the 25 years spent on the market. They mainly cater to businesses working online. Their tools and services help users track their funds, obtain funding, resolve disputes, and make secure transactions.

WebMoney’s technology is based on a standardised interface through which users can manage their property rights and valuables.

Users’ valuables are kept safe by specialised companies called Guarantors. Users can register multiple WM purses with any Guarantor, with all purses owned by a single user conveniently kept within a Keeper assigned to their WMID registration number.

The internal currency used for transactions within the system is measured in WebMoney units (WM). To interact with the system, all participants must provide verified personal information through the Certification service.

Every participant in the system is automatically assigned a public Business Level parameter based on the number of transactions completed with other system users.

User Reviews From Around the Web

Unfortunately, there are not many user reviews of WebMoney, making it a bit harder to build a complete image of the company.

- Trust Pilot: 1.6/5 (72 total reviews):

- 18% rated with 5 stars

- 3% rated with 4 stars

- 3% rated with 3 stars

- 7% rated with 2 stars

- 69% rated with 1 star

- AskWallet: 2.2/5

- Scam Advisor:

- 100/100 trust score (the company is not a scam)

- No user reviews are available

User Reviews

Review Summary

Recent Reviews

There are no reviews yet. Be the first one to write one.

Eer says

How can i transfer my webmoney to Singapore bank account.