Flutterwave is a financial technology business based in Nigeria. The company offers a payment infrastructure to worldwide merchants and payment service providers located all over Africa.

Some of the companies that have invested in Flutterwave are:

- Y-Combinator

- Visa Ventures

- Mastercard

- Avenir Growth Capital

- Tiger Global Management

Prices/Fees

Businesses that have high-volume transactions can request pricing that’s tailored to their needs. Get in touch with their sales team to find out more.

Pricing and fees that apply to residents in the UK are as follows:

- For local transactions using Visa or Mastercard: 3.5% per transaction

- Transactions to various bank accounts in the UK: £35 per transfer

After creating a free account in a matter of minutes and adding your bank account, you can immediately start receiving payments in a secure manner.

Safety and Security

Flutterwave has the following third-party accreditations:

- ISO 27001 and 22301 accreditation, proof that its business procedures and practices are up to industry standards.

- Compliance with PA DSS and PCI DSS serves as evidence that Flutterwave has successfully passed the most stringent degree of security audits and received the appropriate authorizations.

Services

Collect Payments

With the APIs and business tools provided by Flutterwave, you can collect payments from customers all over the world in more than 30 different currencies. You also have the ability to offer services and products wherever your consumers are, whether they are online, in another country, or anywhere in between.

What you get:

- Multiple payment methods

- Receive payments in over 150 different currencies and through multiple channels

- Activate the account in a matter of minutes

- Maintain a healthy increase in earnings

- As your revenue increases, you can take advantage of a trustworthy payment system that guards both your money and your data against theft

You can also make in-person financial transactions using Flutterwave’s point-of-sale system (POS). What you get:

- Operation via battery or electrical outlet

- PCI-certified end-to-end encryption technology

- Chip and QR payment options

- Provide your consumers with all of the available local payment choices

- Components for charging are included

- Direct assistance and assistance with anything else you require

Send Money

With Flutterwave, you can send money to any individual or company globally, and make payments to your suppliers and your freelancers.

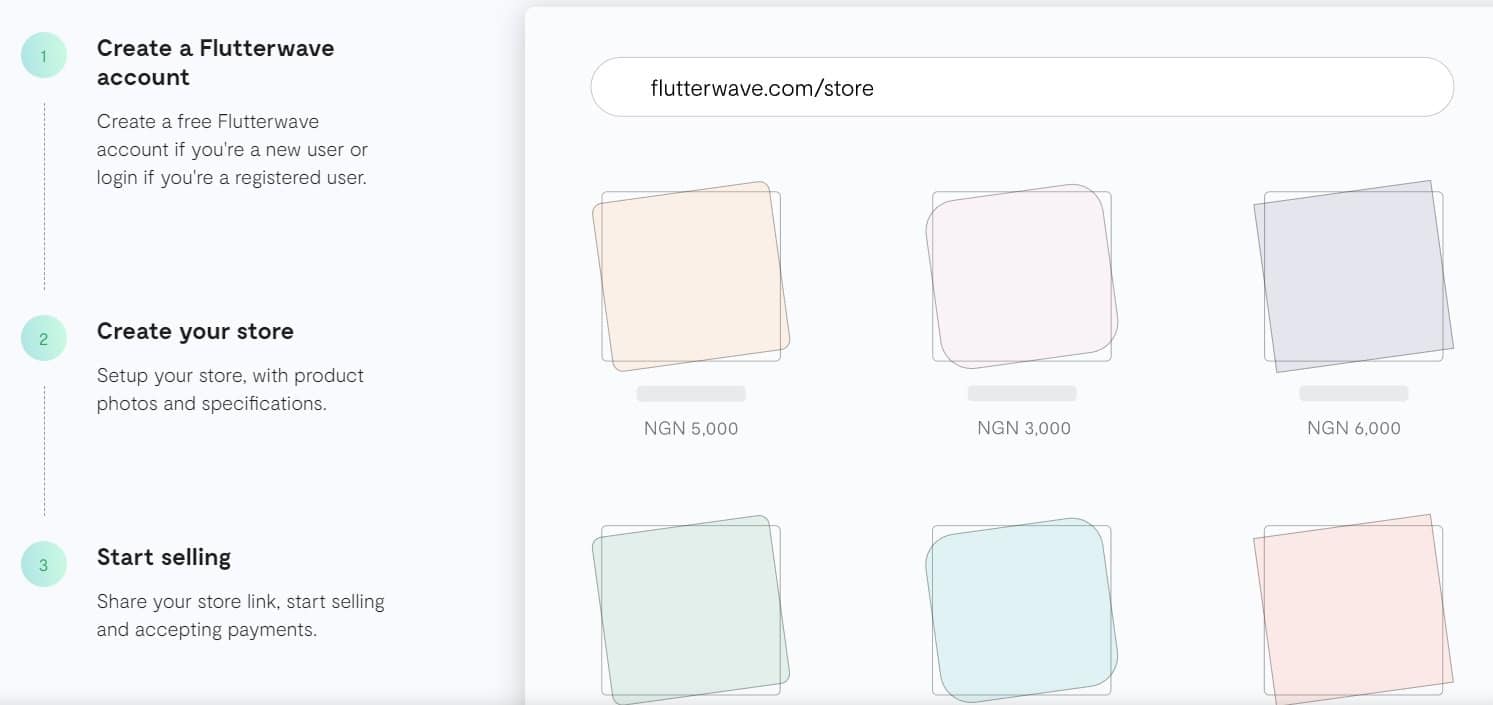

Store

Flutterwave also allows you to create an online store for free. Albeit a bit too basic, it might be just what you need to kickstart your e-commerce venture. Check out the Flutterwave store demo for more info.

Naturally, you’ll also be able to use Flutterwave’s payment infrastructure and receive payments from customers worldwide.

The best part, however, is that creating a store on Flutterwave is very straightforward — just three simple steps, as illustrated in the image above!

Payment Links

You can make sales online even without a website. It only takes a few seconds to generate a payment link, and you can then share that link with your consumers without needing to know any code.

Follow the instructions illustrated in the image above to start getting paid.

Flutterwave Card

Create both virtual and physical cards that can be used anywhere in the world. You can easily create, launch, and control your cards regardless of where you are.

Through the use of Flutterwave Issuing, you will have access to improved expenditure management as well as the possibility to establish new revenue streams and new enterprises.

You can make instant virtual Virtual Dollar & Nair cards by interacting with the Flutterwave APIs or using the interface provided by Flutterwave.

Click here to issue a card.

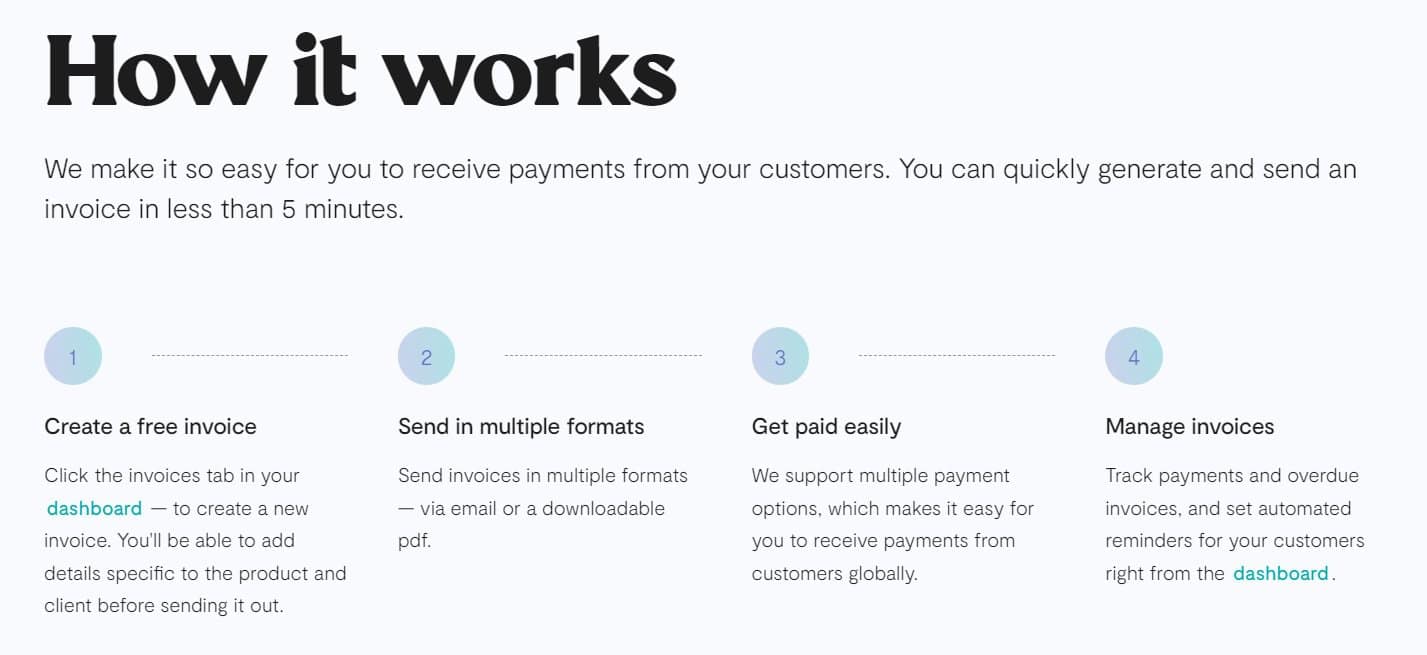

Invoices

With Flutterwave’s invoicing, you can quickly and simply create professional invoices, get reimbursed, and keep track of payments. Moreover, you can get paid from any location, send receipts using a number of different currencies, and make revenue and tax calculations.

In the image above, you can see the five simple steps that will help you generate and send invoices.

Capital

Your company can expand quickly with the help of Flutterwave Capital‘s convenient access to adaptable financing. No collateral is necessary.

At this time, Flutterwave Capital is only available to companies located in Nigeria that have a significant payment volume and a lengthy history of transactions with Flutterwave. In the future, the company intends to broaden the scope of the programme so that it can serve the needs of other enterprises.

Flutterwave partner institutions are the ones that are responsible for disbursing loans, and each loan is subject to credit clearance.

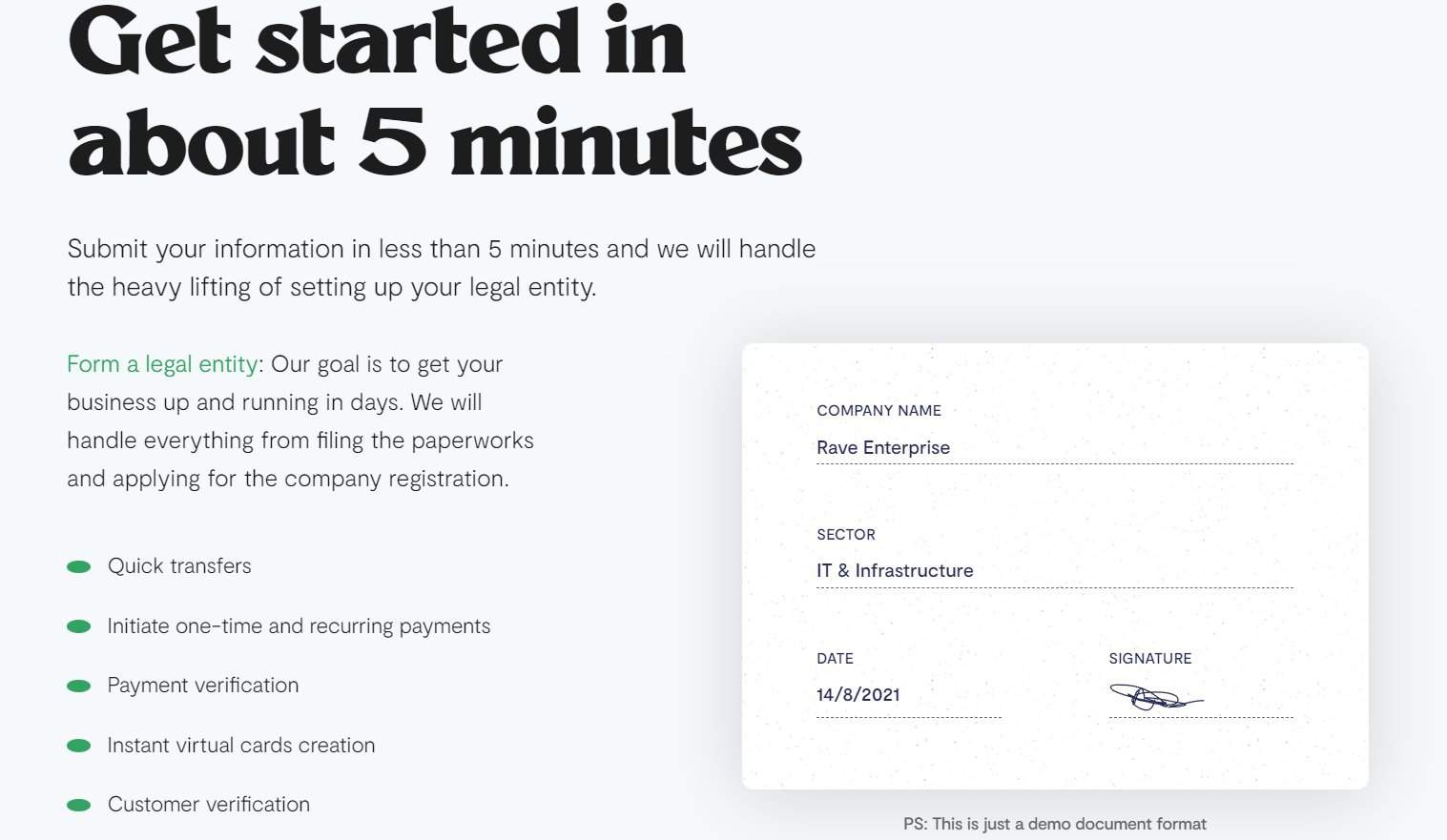

Flutterwave Grow

Flutterwave Grow makes the process of registering your business in the United States of America, the United Kingdom, and Nigeria from anywhere in the world much simpler and within three to five business days.

When you join Grow, you will immediately be provided with a corporate account as well as a complimentary international business card.

FaaS

Flutterwave provides everything necessary for you to incorporate financial services into your offering. Execute custom ACH, bill pay, and real-time transactions, all through a singular interface to manage your payment processing.

- KYC: Verification of your consumers’ identities can be completed in a single contact.

- Opening a new account: Using its developer-friendly application programming interfaces (APIs), consumers and businesses can open and administer customised deposit accounts.

- Debit cards: Instantaneous processing and issuance of customised debit cards for consumers and businesses

Fraud Protection

You will always be eligible to receive full reimbursement for transactions up to N10,000, provided that your payment situation is protected by their Payment Protection Promise.

What is covered:

- The Flutterwave Payment Protection Promise extends protection to any purchases and transactions that are initiated by Flutterwave and made to merchants to purchase products and services.

- Transactions for purchases of products that comply with their conditions of service.

- Transactions for the purchase of goods from Flutterwave retailers were handled through the Flutterwave interface.

- Payments for transactions must be made within the first sixty days after the date of the transaction.

- This regulation is only applicable to Flutterwave businesses located in Nigeria, i.e. businesses that conduct their financial transactions in Naira.

There are certain circumstances for which Flutterwave’s guarantee will not be able to provide coverage, such as the following:

- Transactions for products that break the conditions of service will not be accepted.

- Payments made to Flutterwave retailers for goods or services that were not handled through the Flutterwave interface.

- Transactions whose payments are completed more than sixty days after the transaction’s original date.

- If a customer changes their mind after making a purchase, but the time limit for the retailer’s guarantee to issue a return has passed.

- Payments for goods that were delivered precisely as the vendor described them.

- Payments for transactions that have in the past been contested by the reimbursement procedure carried out by your bank.

- Payments are made if the products are damaged or lost after they have been delivered to the destination that you specified to the vendor (including a freight forwarder).

Integrations

Flutterwave integrates with the following platforms:

- Shopify

- QuickBooks

- Zoho

- Sage

- Xero

- Squarespace

Click here for additional information.

API

By integrating with Flutterwave’s SDKs and API endpoints, you can easily create payment processes for any use, from online collections to payments and everything in between, such as the following list:

- Payment options

- Payment connections

- Send money:

- Transfers made only once

- Repeating monetary transactions

- Verification of the payment

- Bulk shipments

- Assistance with a personal touch.

- Split payments

- Bill reimbursements

Flutterwave has completed the fundamental interactions for payments, which means that your team will have no trouble integrating with our APIs and gaining access to a variety of payment functionalities.

What you get:

- Rapid money transfers

- Put both one-time and ongoing payments into motion.

- Verification of the payment

- Instantaneous generation of virtual cards

- Verification of customers

Extra Care On Customer Support

Flutterwave has an extensive list of frequently asked questions, which you can access at the following link.

To get in touch with assistance for additional questions, you can contact them by sending a direct message (DM) to @flwsupport on Twitter, calling 0700-FLUTTERWAVE (0700-35888379283), or sending an email to hi@flutterwavego.com.

Company History

Iyinoluwa Aboyeji, Adeleke Adekoya, and Olugbenga Agboola established Flutterwave in 2016, and it currently has its headquarters in San Francisco, California. The company also has offices in seven other countries across South Africa, Nigeria, Ghana, and Kenya.

Flutterwave appointed Nigerian Grammy award–winning international musician Ayodeji Ibrahim Balogun, better known by his stage name Wizkid, as its global ambassador in December 2021, with the intention of further pushing the company’s brand among Africans living in the diaspora.

User Reviews

Here’s a list of Flutterwave’s user ratings:

- G2: 4.6 out of 5 stars

- Trustpilot: 2.5 out of 5 stars

The average score that Flutterwave has, according to these user ratings, is 3.55 out of five stars.

User Reviews

Review Summary

Recent Reviews

There are no reviews yet. Be the first one to write one.