Below we look at 17 of the best business expense cards for employees in the UK.

We include a brief summary of each of them below, and then if you want to know more we have a more detailed profile of each of them.

Wallester

Companies that use Wallester Business’ corporate cards get access to a cloud-based platform where they can manage their expenses and get in-depth reports on their payments.

Wallester Business financial solutions are ideal for businesses that need corporate cards and a simple yet robust platform where they can manage all their expenses. Some industries that would benefit the most from the services offered by Wallester Business include:

- FinTech businesses

- Loan providers

- Travel agencies

- eCommerce businesses

- Insurance companies

Now that we’ve covered the basics, let’s go over everything this provider has to offer. Read more about Wallester here.

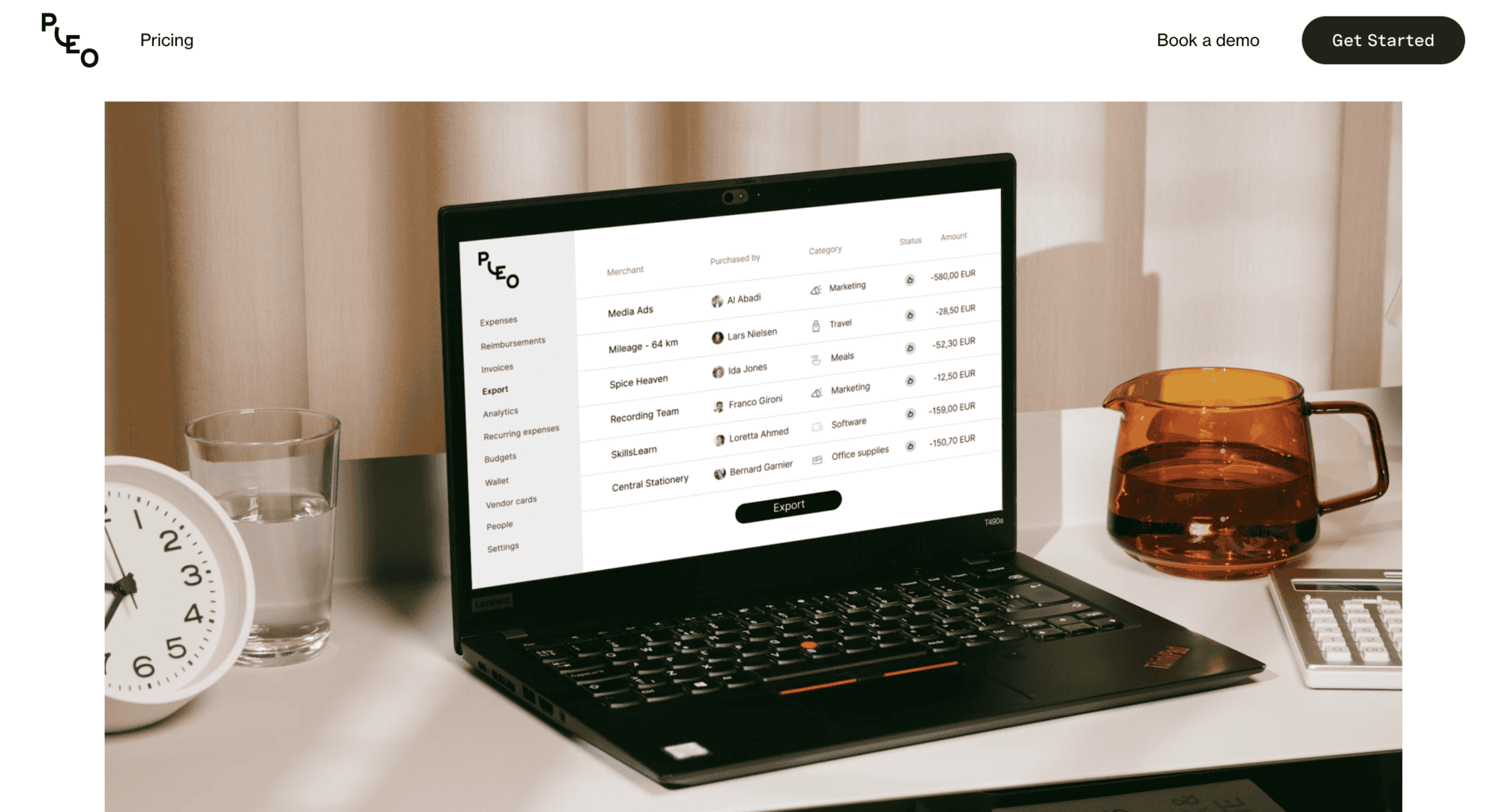

Pleo

Pleo’s expense management platform will help you track and monitor all of your company’s expenses from any location.

Accessing the platform is straightforward – simply log into your account via Pleo’s website on a PC or laptop. You can also use the mobile app on an Android or iPhone smartphone for quick access while on the move.

Let’s give you a brief rundown of the platform’s leading tools and features.

Transparency and visibility: Get a full and transparent overview of all of your expenses, sales revenue, and digital reviews.

Travelling management tool: Use the management tool designed specifically for when you travel abroad. This tool follows your expenses and helps you monitor how much money from your business accounts is being spent daily.

Monitor and track daily spending: Monitor your company’s spending 24/7. The payments list is automatically updated whenever an employee buys something via the bank account connected to Pleo. If you have questions or are in doubt someone is misusing your account, you can always contact Pleo’s technical support.

Third-party integrations: Customise Pleo by adding multiple third-party integrations at once. There’s an option to tailor your account with over 50 software solutions that help businesses manage their financing and accounting. Some of the most popular integrations Pleo users install are Xero, Oracle Netsuite, DateV, etc.

Extra cashback: If you’re an eligible business for cashback, you’ll receive a fixed rate for each transaction. The cashback percentage can vary depending on your type of business, but it usually ranges between 0.5% and 1% per transaction.

Payhawk

Payhawk’s expense and payment management software is the all-in-one solution finance staff and CFOs need to automate and optimise company funds, day-to-day expenses, and yearly budgets.

The software recognises over 50 international currencies, and you can use it to make transactions in more than 160 countries worldwide. The fund transfer rates and fees are always shared upfront, so there are no hidden expenses after transferring a specific sum of money.

Payhawk Expense Management Software Features

The software has multiple tools and features that ease and speed up the daily expense management process. You can use it by accessing your Payhawk account from the official website or downloading the mobile app on your Android smartphone or iPhone.

Here’s a list of the main features.

Find out what they are here.

Tide

Tide is a fintech company founded in 2015 in London, UK.

Their financial platform offers bank accounts, loans, and various tools that help small and medium-sized companies manage their finances and business.

In addition to the cloud-based financial platform, Tide sells expense cards and card readers for companies in the retail and hospitality industries.

Let’s learn more about their products and pricing.

Moss

One of Moss’s main products is corporate cards for small and mid-sized businesses. You can use the Moss cards virtually or physically and connect them to the Moss mobile app to manage your expenses and track payments daily. You can order as many cards as you’d like for yourself and your employees.

Moss Card Advantages

Here’s a list of several advantages of using the corporate cards.

Receipts: The Moss mobile app automatically collects receipts for each transaction you or your employees make with the card. Your receipts will never go missing; you can download reports with all of them by filtering out specific dates you’re interested in.

Spending limit: Manually set up a daily spending limit so your employees won’t be able to overspend. The limit can always be adjusted, and the card can be immediately deactivated if necessary.

Credit and debit: There are no specific rules on how many cards you can order, but you’ll get a personalised offer from Moss after you submit your application for the corporate cards.

Digital wallet payment: You can use the cards in both digital and physical formats. Therefore, your staff can pay via their smartphones’ digital wallets, which can be connected to Google or Apple Pay. When they pay for a specific product or service, they can upload transactions and receipts on their smartphone or the app designed for PCs and laptops.

Real-time updates: Whenever someone makes a payment with a Moss corporate card, the mobile or desktop app automatically updates itself and adds the payment to the archive on the dashboard.

Security: Moss’ credit cards are secured with GDPR and fully compliant with PCI DSS, so they’re fully protected by the highest industry regulations and standards. Additionally, the cards accept the 3DS check, an additional security and verification layer for online payments. To be safe, Moss added this type of verification so they make sure you’re the person standing behind the transaction. You’ll receive a one-time password each time you want to pay with Moss.

More about Moss Corporate cards here.

Finway

Finway is a Munich-based fintech startup that offers expense management solutions and corporate debit cards for small and mid-scale businesses. The company’s platform integrates spend management, accounting, and payment processes into a single, user-friendly system.

More about Finway here.

Capture Expense

Capture Expense is a London-based expense management software provider for businesses of all sizes. The company’s cloud-based solutions streamline the process of tracking, managing, and reporting business expenses, helping businesses improve financial visibility and control.

Here’s all you need to know about Capture Expense’s software tools and features, and their prices and fees.

Read more about Capture Expense here.

PayEM

PayEm is a Tel Aviv-based fintech company that offers an expense and finance management platform for businesses of all sizes. Their offerings also include learning materials on finance management and business or corporate cards.

Here’s all you need to know about PayEm’s products, features, and costs.

Read more about PayEM here.

Emburse

Emburse is an award-winning fintech company founded in the US that provides international businesses with expense and travel management software, corporate cards, and an accounts payable automation tool.

Let’s learn more about its products, pricing, and company background.

More information about Emburse can be found here.

Expense on Demand

Based in London, Expense on Demand is an expense management solutions provider for both domestic and international solo merchants, startups, and small and mid-sized companies.

Their cloud-based platform is designed to streamline expense tracking, reporting, and reimbursement processes, while their corporate card management tools help businesses to efficiently monitor and control employee spending.

More about Expense on Demand here.

Dext

Dext is a London-based accounting and business expense management software provider for finance teams, accountants, and business owners.

Their services are available for international businesses of all sizes, offering tools that automate day-to-day expense management and simplify bookkeeping, finance, and accounting tasks.

Let’s learn more about Dex’s products and their main tools and features before we conclude with the available subscription plans, company background, and online reviews.

Find out more about Dext here.

Navan

Headquartered in California, Navan equips businesses with travel management software and business cards. The company specialises in streamlined travel planning and efficient expense management solutions ideal for solo travellers and businesses of all sizes.

More about Navan’s solutions here.

Tipalti

Tipalti is a US-based fintech company that provides expense management software designed to meet the needs of businesses of all sizes.

Their software has various features to streamline financial operations, such as global money transfers, invoice and supplier management, procurement, etc. Tipalti’s services are available internationally, including in England and Wales.

More about Tiplati’s UK options here.

What are business expense cards?

A business expense card (sometimes also called a corporate card or company card) is a credit or debit card issued to a business and used by employees to pay for work-related expenses including: travel, meals, office supplies, software, client entertainment, etc.

The business, not the employee, is responsible for paying the bill.

What Is a Business Expense Card Used For?

Common uses include:

- Travel (flights, hotels, taxis)

- Meals and client entertainment

- Software subscriptions and online tools

- Office supplies and equipment

- Fuel and vehicle-related costs

Expense cards are usually connected to expense tracking software so spending can be monitored and categorized automatically.

Why Businesses Use Expense Cards

Simplifies Expense Management

Employees don’t need to pay out of pocket and request reimbursements.

Transactions are automatically recorded.

Improves Financial Control

Businesses can:

- Set spending limits

- Restrict where cards can be used

- Approve or block transactions in real time

Better Bookkeeping & Tax Reporting

Expense cards create clean, itemized records, making accounting, audits, and tax deductions easier.

Saves Time & Reduces Admin Work

Less paperwork, fewer reimbursement requests, and faster month-end reconciliation.

Employee Convenience & Morale

Employees don’t have to front their own money, which reduces stress and boosts trust.

Earn Rewards or Cashback

Some cards offer points, airline miles, or cash back, reducing overall business costs.

Pros of Business Expense Cards

- Financial Transparency: Every transaction is tracked, categorized, and time-stamped.

- Faster Expense Reporting: Automatic syncing with accounting tools speeds up reporting.

- Spending Controls: You can set daily limits, merchant restrictions, or per-employee budgets.

- Improved Cash Flow: Businesses can delay cash outflows until the card payment due date.

- Fraud Protection: Many providers offer real-time alerts and fraud monitoring.

- Scalable for Growing Teams: Easy to issue cards to new employees.

Cons of Business Expense Cards

- Risk of Employee Misuse: Without proper policies, employees may overspend or make non-business purchases.

- Requires Policy & Oversight: Companies need clear expense rules and someone to review transactions.

- Fees & Interest Some cards charge: Annual fees, Foreign transaction fees and/or Interest if balances aren’t paid in full

- Accounting Complexity if Not Integrated: If not connected to accounting software, tracking can become messy.

- Liability Risk If an employee leaves or misuses the card, it can create financial or legal issues.

Best Fit For Which Businesses?

Great for:

- Companies with traveling employees

- Remote or distributed teams

- Businesses with frequent client or vendor spending

- Growing start-ups and SMEs needing tighter cost control

Less ideal for:

- Very small businesses with minimal expenses

- Businesses without time to manage card oversight

Business Expense Card vs Business Credit Card What’s the Difference?

Business Expense Card are Designed specifically to manage employee spending and track company expenses.

Key purpose: Control, track, and simplify staff expenses

Best for: Companies with multiple employees making work purchases

Typical Features:

- Issued to employees

- Spending limits per user

- Category restrictions (e.g., travel only)

- Real-time tracking & approvals

- Integrates with expense/accounting software

- Focused on control and reporting, not borrowing

Business Credit Card are designed primarily for the business owner or company to pay for business costs and access credit.

Key purpose: Pay business expenses and borrow money short-term

Best for: Owners, start-ups, and small teams managing central spending

Typical Features:

- Usually held by business owners or finance teams

- Credit line to borrow money

- Rewards, cashback, travel points

- Fewer employee-level controls

- Focused on financing and rewards, not expense oversight

Simple Comparison Table

| Feature | Business Expense Card | Business Credit Card |

|---|---|---|

| Primary Purpose | Manage and control employee spending | Pay business costs & access credit |

| Who Uses It | Employees & teams | Business owner or finance department |

| Spending Controls | Strong (limits, categories, approvals) | Limited |

| Expense Tracking | Built-in & automated | Manual or basic |

| Credit / Borrowing | Usually no credit | Yes — offers a credit line |

| Rewards & Cashback | Sometimes | Common |

| Accounting Integration | Strong | Varies |

| Risk of Misuse | Lower (with controls) | Higher if many users share |

| Admin & Oversight | Higher | Lower |

| Best For | Medium–large teams, frequent employee spending | Small businesses, founders, general business use |

Quick Rule of Thumb

Use a Business Expense Card if:

- You have multiple employees spending company money

- You want tight spending control and tracking

- You want to reduce reimbursements and admin work

Use a Business Credit Card if:

- You want access to credit

- You manage most spending yourself

- You want rewards, cashback, or travel perks