FastPay is a company that offers Facilities Management and Commercial Bureau Direct Debit Services to businesses of various sizes and industries.

Direct Debit is a way for businesses to automatically collect payments from their customers, while the function of the Bureau is to make the collections on behalf of Fast Pay’s clients.

Fast Pay was founded in 2008, and it is located in Manchester. Since then, the company has built a solid reputation in the banking industry. They cater to all businesses and organisations, from global corporations to sole traders and charities.

Prices/Fees

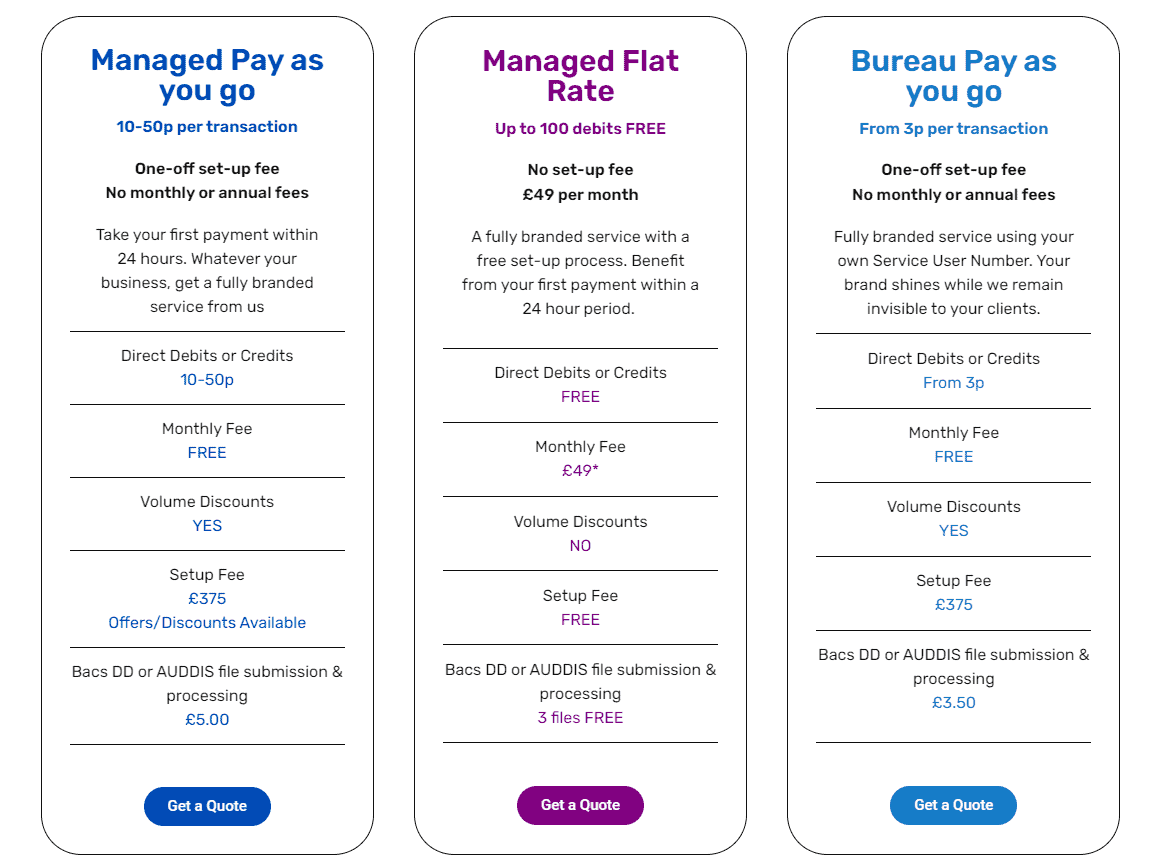

FastPay offers three pricing packages suited for diverse business models and requirements. Businesses wanting to learn more about their pricing system and possibilities can request a quote through their website for each pricing package.

Managed Pay as You Go

With the Pay-as-You-Go plan, businesses have the option to pay a one-off fee to set up the gateway and then pay for FastPay services per transaction. This service costs between 10 and 50 p. There is no monthly fee, and businesses can count on volume-based discounts.

The set-up fee with this package is £375 while Bacs DD or AUDDIS file submission and processing cost £5.

FastPay is a white-label service provider meaning that their client’s brand is the only one visible on all documents.

Managed Flat Rate

Companies can experience seamless service with no upfront set-up costs with the managed flat rate price package offered by FastPay. However, after the setup, businesses are expected to pay a monthly fee of £49. Direct Debits or credits are free (no per-transaction charge), and there are no volume-based discounts. Businesses can count on 3 free Bacs DD or AUDDIS file submissions and processing.

The benefits of this package include up to 100 free debits and a fully branded service.

Bureau Pay as You Go

With the Bureau service, FastPay charges a 3 p fee per transaction and provides a fully branded service using the client’s Service User Number. This way, FastPay remains invisible to the client’s customers while regularly collecting payments.

To enjoy the Bureau service, users must pay a one-time fee of £375 for a hassle-free set-up process. There are no monthly or annual fees and businesses can count on volume-based discounts. Bacs DD and AUDDIS file submission and processing cost £3.50.

Payment Methods

Online payment methods ensure maximum speed, security, and convenience, which is why many businesses prefer them.

The Faster Payments scheme is one of the most popular electronic payment methods. It offers 24/7 service between 21 banks from the UK and building societies.

Businesses can choose from four Faster Payments methods, including single-immediate and forward-date payments, standing orders, and direct corporate access.

Single Immediate Payment

SIPs are the most common Faster Payment method. Customers initiate them as one-off payments through digital platforms or in the branch. The limit is £250,000 per payment, but this also depends on the bank’s limitations.

The receiver instantly gets the money on their account, or sometimes up to two hours. The confirmation of payment is issued to the sender in 15 seconds. In case of rejection, the receiver’s bank provides the reason.

Forward-Dates Payment

Forward-date payments are also one-off payments but are sent and received on a specific date set in advance. These payments are convenient for subscriptions, bills, rent, or other recurring expenses. The payment is initiated through mobile devices, in a branch, or via phone.

The limitation of £250,000 also holds for forward-dates payments. Furthermore, on weekends and holidays, some banks and building societies will only process the payment on the following working day.

Standing Orders

Standing orders are designed for recurring payments with pre-set amounts on regular, pre-arranged dates. The payment method can be selected through digital platforms, in a branch, or via phone.

The limit of £250,000 remains, but it’s not guaranteed that the payment will arrive in the recipient’s bank account immediately. Standing orders are usually processed by 6 am the next day at the latest.

Direct Corporate Access

Through a secure-IP solution, business customers can use this specialist service to deliver payments on the same day as bulk files. The service is available 24/7.

However, this is not available at all building societies and banks. Businesses should check with their bank representative whether this solution is available to them.

Product/Service Overview

With a sterling reputation as a financial services provider, FastPay caters to clients from all marketplace sectors, from IT, fitness, healthcare, and wellness, to telecommunication and accounting. With a deep understanding of the unique financial needs of each industry, FastPay is committed to providing tailor-made solutions that meet each client’s needs.

FastPay Bureau Service

Direct Debit Burau service includes Facilities Management and Commerical Bureau Direct Debit for businesses, charities, and non-profits. The Bureau streamlines the process of managing in-house Bacs payments. It allows clients to significantly reduce associated costs and devote more time and resources to their core business activities instead of squandering it on payment collection.

To get started, clients need only to provide their personalised Service User Number, and in less than 24 hours, they’ll be ready to charge their customers.

The Direct Debit Bureau offers many benefits, including a highly transparent pricing system with low fees tailored to meet the unique needs of each FastPay client.

The fee for the Bureau service is 3 p per collection.

In addition, FastPay offers white-label services and custom branding. All documents generated by the Bureau will feature the client’s business’s name and unique branding elements, allowing for increased visibility and recognition among customers.

Finally, Bureau’s cutting-edge service gives clients the freedom to focus on their core business activities instead of manual payment collection — the automation results in increased efficiency and higher turnover rates.

Direct Credit

Direct Credit is available as part of the Bureau Service. This service enables users to transfer funds to their payee’s bank account directly, making it easy to pay salaries, wages, employee expenses, dividends, insurance, or supplier invoices.

Because of this, Direct Credit is an excellent option for payroll companies or users who want to make payments using their Service User Number.

Direct Debit Management

FastPay’s Direct Debit Management service provides a hassle-free solution for managing Direct Debit collections. Clients can entrust FastPay to efficiently collect payments from their customers without setting up their own scheme or waiting for bank approvals. They don’t even need to obtain a Service User Number.

The Direct Debit Management service comes with a range of benefits, including the ability to delegate payment management to FastPay. What’s more, clients’ company names and branding are featured on all bank statements, thanks to their discreet approach.

In addition, the flat-rate collection fees, flexible payment processing dates, and funds available on clients’ accounts within minutes make FastPay’s Direct Debit Management service one of the leading competitors in the financial services industry.

In summary, Bacs Facilities Management offers a fully branded service, software integration, transaction fees only – no monthly or annual fees, fast set-up and free web portal access, as well as free proactive reporting.

Integrations and API

Developers at FastPay understand that businesses often use various software systems for different activities. So, FastPay ensures their solutions are easily integrated with other software systems, some of which include Sage, QuickBooks, and Xero.

Business Operations

FastPay is more than just a money-processing gateway. This company offers a range of business operations designed to make a safe, practical, and attractive option on the market.

Making Tax Digital

Making Tax Digital is a Her Majesty’s Revenue and Customs Services scheme geared at becoming entirely paperless regarding tax legislation. FastPay is keeping their service up-to-date and in line with the novel trends and governmental policies, which is why it offers paperless direct debit for its customers.

Security and Assurances

Bacs Approved and Direct Debit Guarantee

FastPay is a Bacs-approved Bureau operating strictly under Bacs regulations. Their core values are integrity, availability, compliance, and confidentiality. FastPay operates within the Data Protection Act guidelines and is protected by the Direct Debit Guarantee, which is among the most stringent rules in the world of banking.

All the money FastPay receives through the Managed Direct Debit Service go to the client’s trust account. Each trust account is a separate virtual account, a measure taken to prevent contamination between accounts. FastPay regularly audits these accounts.

Sponsoring Bank Failsafe Guarantee – Legally Binding Indemnity

FastPay has a failsafe guarantee with their sponsoring bank, which acts as funds safeguard for the received money. There are also contingency and disaster arrangements established according to Bacs standards.

Dual Server Policy

With cyber attacks and digital theft being a part of modern reality, many companies and individuals are sceptical toward online payments because of fears regarding data safety. To protect their clients’ money, FastPay uses a dual server, both on and off-site. So, whatever happens, the data is immediately retrievable and accessible.

Encryption

With 128-bit server encryption and multilayer passwords for servers that only the company directors are authorised to use, all online communication, payment details, and customer information are secure.

Customer Service

FastPay is proud of their exceptional customer service and flexibility. According to the company’s representatives, FastPay acquired around 50% of their clients through word-of-mouth marketing.

Company Background

FastPay was founded in 2008, and since then, they’ve built a sterling reputation in the banking and finance industry. Their headquarters are in Manchester, and the company offers Direct Debit solutions to hundreds of clients.

The company’s primary goal is to ease the pressure on clients when collecting payments, so they can focus on growing their businesses.

Because of this, FastPay caters to businesses of all sizes, as they say, “from sole traders to government to milkmen.” They work hard to provide high-quality individually-tailored service while prioritising confidentiality and security. They take exceptional pride in their knowledgeable and friendly staff and free lifetime phone and email support for clients.

Some top-tier clients of FastPay are NHS, Daily Mail, Premier League clubs, and several energy companies.

User Reviews From Around the Web

- Featured Customers – 4.8/5 (1088 ratings)

- Trust Pilot – 1.9/5 (132 ratings)

User Reviews

Review Summary

Recent Reviews

There are no reviews yet. Be the first one to write one.

Stephen johnstone says

Iv had a direct debit set up on my account , I don’t recognise it , it’s from MTR , I phoned bank o Scot , they have cancelled the dd, could you tell me who MTR are