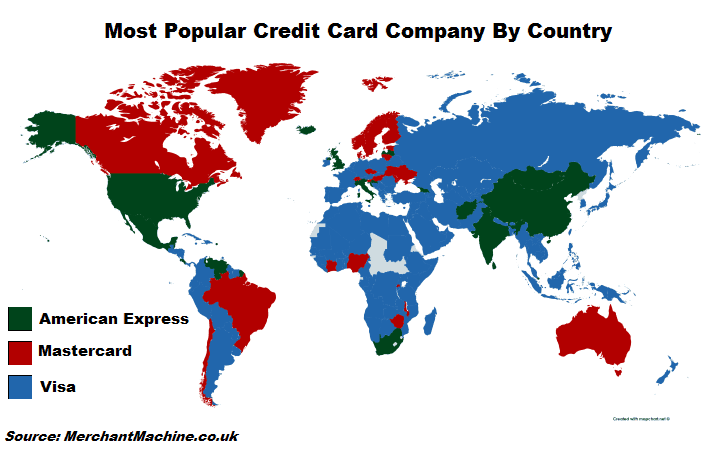

The map above shows which credit card company is the most popular in each country based on Google search data from Google Trends. It does not reflect the number of cards issued, nor transaction volume, simply the volume of searches for each company.

Overall, Google was able to provide data for 168 countries. Of those countries, Visa is the clear winner, being the most popular credit card company in 123 countries. Surprisingly, American Express (AMEX) is the most popular in 23 countries including the UK and US. Finally, Mastercard was the most popular company in 22 countries including Canada and Australia.

However, when you look at data on the biggest credit card networks, the data looks slightly different. Visa is the largest creit card issuer in the United States. According to CreditCards.com data, Visa has 304 million cards in circulation in the US and 545 million cards in circulation outside the US. Total transaction volume in the US was $1.2 trillion USD in 2014.

Mastercard has 191 million cards in circulation in the US and 576 million cards in circulation outside the US, which actually places it ahead of Visa globally (excluding US). However, US transaction volume is only $607 billion, around half of Visa’s total.

Finally, American Express is much smaller than the two giants with only 54.9 million cards in circulation in the US and another 57.3 million cards in the rest of the world. However, due to the affluence of their average customer, their transaction volume in the US is slightly higher than Mastercard’s at around $668 billion.

So why is Amex so popular in many countries, given it’s much smaller size?

This can likely attributed to the way Google collects search trends data. Data was for total searches for each company. And while Visa and Mastercard specialise in credit cards, American Express offers a variety of other services including insurance, travellers cheques and other travel and rewards services.

They also issue their own cards as opposed to Visa and Mastercard who issue their cards via banks, building societies, retailers and other financial services companies.

Also it should be noted that while we looked at China Unionpay, Discover Card and other credit card issuers, they were not included as there were no country where they were the most popular brand.

The reason why Unionpay was not the most popular brand in China is due to the fact data comes from Google, which only has around a 9% share of the Chinese search market and likely skews towards expats and those with an international focus.

The full list of countries by credit card company popularity is below:

The 123 countries where Visa is the most popular credit card company

- Albania

- Algeria

- Andorra

- Angola

- Argentina

- Armenia

- Austria

- Azerbaijan

- Bahrain

- Bangladesh

- Barbados

- Belarus

- Belgium

- Benin

- Bhutan

- Bolivia

- Bosnia Herzegovina

- Botswana

- Brunei

- Bulgaria

- Burkina Faso

- Burundi

- Cambodia

- Cameroon

- Colombia

- Congo (Democratic Republic)

- Congo

- Cuba

- Cyprus

- Djibouti

- Dominican Republic

- Ecuador

- Egypt

- El Salvador

- Ethiopia

- Fiji

- France

- Gabon

- Gambia

- Germany

- Ghana

- Greece

- Guatemala

- Guinea

- Guyana

- Haiti

- Honduras

- Indonesia

- Iran

- Iraq

- Ireland

- Israel

- Jamaica

- Japan

- Jordan

- Kazakhstan

- Kenya

- Kosovo

- Kuwait

- Kyrgyzstan

- Laos

- Lebanon

- Liberia

- Libya

- Luxembourg

- Macedonia

- Madagascar

- Malaysia

- Mali

- Malta

- Mauritania

- Mauritius

- Montenegro

- Morocco

- Mozambique

- Myanmar

- Namibia

- Nepal

- Netherlands

- New Zealand

- Nicaragua

- Niger

- Oman

- Pakistan

- Palestinian territories

- Panama

- Papua New Guinea

- Paraguay

- Peru

- Philippines

- Poland

- Portugal

- Qatar

- Romania

- Russia

- Saudi Arabia

- Senegal

- Serbia

- Sierra Leone

- Slovakia

- Somalia

- South Korea

- Spain

- Sudan

- Suriname

- Syria

- Taiwan

- Tajikistan

- Tanzania

- Thailand

- Timor-Leste

- Togo

- Trinidad & Tobago

- Tunisia

- Turkey

- Turkmenistan

- Uganda

- United Arab Emirates

- Uruguay

- Uzbekistan

- Vietnam

- Yemen

- Zambia

The 23 countries where American Express (AMEX) is the most popular credit card company

- Afghanistan

- Bahamas

- Belize

- Bermuda

- China

- Costa Rica

- Croatia

- French Guiana

- Georgia

- Hong Kong

- Iceland

- India

- Italy

- Latvia

- Mexico

- Mongolia

- Puerto Rico

- Singapore

- South Africa

- Sri Lanka

- United Kingdom

- United States

- Venezuela

The 22 countries where Mastercard is the most popular credit card company

- Australia

- Brazil

- Canada

- Chile

- Côte d’Ivoire

- Czech Republic

- Denmark

- Estonia

- Finland

- Greenland

- Hungary

- Lithuania

- Malawi

- Moldova

- Nigeria

- Norway

- Rwanda

- Slovenia

- Sweden

- Switzerland

- Ukraine

- Zimbabwe

Use of this map: You are free to use this map on your own website BUT YOU MUST provide linked attribution back to this blog post and/or MerchantMachine.co.uk. Map created using MapChart.net.

For more see our guide to the best card machines for small business in the UK.

Enjoy this post? Please help us by sharing it:

Balder Dash says

I accept credit cards in my restaurant in Arkansas. I almost never see American Express, and my customer base is from six different states on a regular basis. Fake news.

GIRISH PAPEGOWDA says

Not even 1% of India uses American Express

SRK says

This is all BS. I am from India, I know of only few Star Hotels and Travel companies and upscale restaurantsaccepting Amex, that too in Metros primarily.

CartoGuy says

Rubbish – Amex is hardly even accepted in many places in the UK. Perhaps the Google searching was: “Where will someone accept Amex – please???”

Mo says

Whoever wrote this blog needs to get their facts checked, because less than 10 businesses accept American Express around South Africa. I havent ever seen an American Express card in my life, nor have I seen an ad for it on SOUTH AFRICAN television. We use VISA and MASTERCARD…

Christopher Graney-Ward says

Most places in the UK accept amex these days. Even Sunday markets stalls.

Marcov says

The Netherlands are mostly a debit card system, and the original Dutch debit card system has long since been merged with Mastercard’s. Thus several major banks offer Mastercard credit cards as part of their standard employee oriented banking offerings(*), and people can order them via their bank online. You don’t need to search for it.

Similarly, the most major automobile club peddles Visa.

I don’t think google searches will be very reliable. When forced I would gamble on Mastercard being more popular, but I’m not very sure.

(*) As in people with regular incoming thus overdrafts can be collected automatically

mohamed basheer says

its fake i am from sudan, mastercard and visa is not accepted in here it’s not legal

Richard says

In China most people use UnionPay instead of Visa, MasterCard, or AMEX.

Another characteristic is that a huge percent of cashless payment are made with mobile phone by scanning QR Codes through Alipay, WeChat Pay, Apple Pay, etc.

YOUJIN NIOU says

But now the America Express have been allowed to use in China

Finn says

The google trends statistics are not about the most popular cards, but about what people are most curious about.

Frederik Hirt says

The informative value of this approach is highly doubtful! Particularly with regards to the Visa google searches: I have googled the term “visa” myself several times within the past year. Not once did I think of the credit card company but the permit to reside of the same spelling.

paul lewis says

Absolutely nonsense.

Out of the transactions we process in the U.K 1-2% are Amex

J Stephen Sams says

Consumers in the United States are aware that American Express has their best interest in mind. Visa and MasterCard cater more to the merchant.

Shane says

You are right, for any online purchase I use AMEX, they protect the cardholder and make the merchant prove the charges are just.

what isit says

What does the bold font for certain countries in the list signify?

Amidou says

Visa dominates in Mali I doubt Mastercard existing and other card brands are totaly absent.

Micheal says

Can Amex prepared card be used in Nigeria

Jim Roberts says

While it’s true American Express’ biggest European market is the UK, I doubt it is the county’s No. 1 payment method. Outside of big UK cities you don’t see Amex.

CharlesC says

This is correct. Visa and Mastercard are both accepted in more places that American Express in the UK due to them also being issued to bank account holders as debit cards. Some vendors may still not except Amex. This was down to the vendor fees Amex charged and the lack of card holders.

Christian says

Maybe this is why Amex is cited as the number one Credit Card in the UK. All those Visa and Master debit card should technically not be counted. Amex does not have debit cards, so if we count only by credit, then maybe Amex does have more – or at least higher spend. It may be only in the cities, but their rewards are significantly higher than that of Visa or MC.

Joseph Swai says

It is frustrating to find how id difficulty for many african business to own and use Visa, Mastercard and American Express credit cards! Please can someone let me know how african businesses can be enrolled and get the benefit of these cards? I mean in both ways to pay and be paid online? Thanks

Prince says

@ Joseph most banks in Africa now issue VISA, Master debit cards, some of this banks and other emerging enterprises are providing online cards payment gateways for business in Africa.

Stephen Murray says

i travelled to Poland in April 2019, AMEX is not accepted there.

Niraj says

Am-Ex is as good as trash in India. You’re lucky if you find a merchant accepting Am-Ex. Visa, Rupay (India’s own card issuer) and Mastercard are dominant here.

MC says

MasterCard gives better FX rates, always.

HUSAIN YUSUF says

In Bahrain Visa Card, Master Card, JCB, and Amex are accepted everywhere. but I didn’t see yet someone using Amex card.

Emile says

This is about most searches but not the reality. Amex winner in China and India? Visa stronger than Mastercard in Europe? Really?

Alma Theresa says

I’m a proud owner of the AMEX platinum but I hail from switzerland, statistics here might still not be 100% accurate.

Christopher Graney-Ward says

Maybe overlooked here the fact that visa searches could’ve been for immigration visas.

Mharz says

Not having any issues with Amex here in the Philippines, it’s accepted almost everywhere. I use mastercard as well but Amex gives me better privileges and bigger cashbacks .

Nicholas says

I am from Singapore. Amex is not popular here compared to visa and mastercard.

This review is grossly inaccurate.

Youssef says

Mastercard is most popular in egypt 99% of banks use a mastercard

user says

This is totally fake data. Google Trends is about google searches, not about transaction count or revenue.

In Russia Visa and Mastercard had 0% of market in 2023. Most popular cards are Mir. And most popular payment system is SBP.

In China UnionPay that is most popular card. But most popular payment systems are WeChat and AliPay.