Moss is a Berlin-based fintech company that offers expense management solutions for small and medium-sized European businesses. Their offer also includes physical and virtual corporate cards issued by Mastercard.

Let’s learn more about Moss’s products, tools and features, prices, and company background.

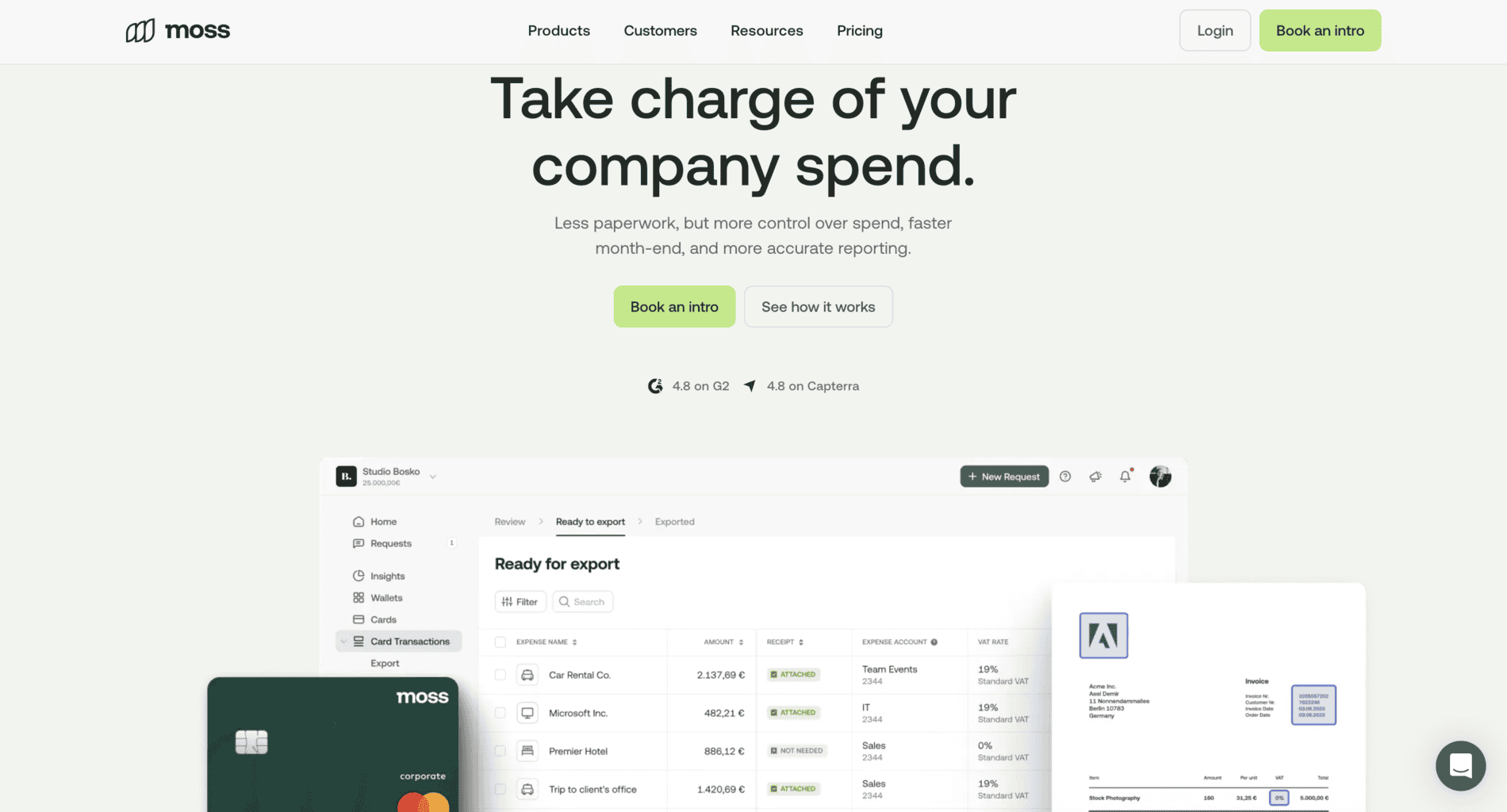

Moss Mobile and Desktop App

Moss provides businesses with a mobile and desktop app for expense and payment management that you can download on Google Play or Apple Store. With it, you can track all your payments and sales revenue, as well as streamline and improve your workflow.

You can easily connect the Moss corporate card with the app or add your existing business bank account. The app updates automatically every time there’s a new transaction via one of the bank accounts or credit/debit cards connected to the app. On top of that, it’s entirely PCI DSS compliant, so you don’t need to worry about the safety of your personal information.

Third-Party Integrations

You can customise the app by installing third-party integrations and syncing various accounting, HR, finance, email, or eCommerce software that can help you manage day-to-day tasks much faster than before.

Some of the third-party integrations you can add to Moss’ app include:

|

|

Approval Policies

The app can help you create individual approval policies for different employees and teams. You can create tailor-made flows and add thresholds, employee roles, and expense limits.

For example, you can allow a specific employee to spend up to a certain amount – let’s say up to €150. They must request approval if they have to spend more money on a particular service or product.

Also, you can edit the approval policies and increase or decrease the spending threshold whenever you want to. Access the “Advanced Approval” category on the dashboard and adjust the existing rules and limitations.

Data Reports, Reimbursements, and Invoices

The app allows you to send and archive receipts for fast access and budget control, and download data reports on your expenses, sales revenue, and daily, monthly, and yearly transactions. You can also process reimbursements and create invoices for customers.

There’s also an option to forward multiple receipts at once from the following digital service providers:

|

|

You can download the Moss mobile app via Google Play or Apple Store. If you’d like to download the desktop version, you will have to create a profile on the website.

Moss Corporate Cards

One of Moss’s main products is corporate cards for small and mid-sized businesses. You can use the Moss cards virtually or physically and connect them to the Moss mobile app to manage your expenses and track payments daily. You can order as many cards as you’d like for yourself and your employees.

Moss Card Advantages

Here’s a list of several advantages of using the corporate cards.

Receipts: The Moss mobile app automatically collects receipts for each transaction you or your employees make with the card. Your receipts will never go missing; you can download reports with all of them by filtering out specific dates you’re interested in.

Spending limit: Manually set up a daily spending limit so your employees won’t be able to overspend. The limit can always be adjusted, and the card can be immediately deactivated if necessary.

Credit and debit: There are no specific rules on how many cards you can order, but you’ll get a personalised offer from Moss after you submit your application for the corporate cards.

Digital wallet payment: You can use the cards in both digital and physical formats. Therefore, your staff can pay via their smartphones’ digital wallets, which can be connected to Google or Apple Pay. When they pay for a specific product or service, they can upload transactions and receipts on their smartphone or the app designed for PCs and laptops.

Real-time updates: Whenever someone makes a payment with a Moss corporate card, the mobile or desktop app automatically updates itself and adds the payment to the archive on the dashboard.

Security: Moss’ credit cards are secured with GDPR and fully compliant with PCI DSS, so they’re fully protected by the highest industry regulations and standards. Additionally, the cards accept the 3DS check, an additional security and verification layer for online payments. To be safe, Moss added this type of verification so they make sure you’re the person standing behind the transaction. You’ll receive a one-time password each time you want to pay with Moss.

Moss Credit Card

Moss can provide your business with a credit card issued by Mastercard. It comes with flexible and transparent payment rules and conditions and a spending limit of a maximum of €2.500.000 monthly.

When you apply for this type of card, Moss will inform you how to optimise it and connect it to the Moss mobile or desktop app and an Apple Pay or Google Pay digital wallet for an easy spending experience.

Moss Debit Card

In addition to credit cards, Moss also issues Mastercard debit cards to businesses based in Europe. You don’t need a specific credit or funding underwriting to receive this card. You can simply add funds to your account whenever you want.

Like with the credit card, you can create spending limits and adjust the sum whenever needed. Unfortunately, you cannot use the debit card at ATMs.

Businesses that make a lot of money and have a very high revenue can also receive cashback monthly. If you’re interested in using this type of card and finding out if your business is suitable, you’ll have to contact Moss so they can prepare a personalised offer for you.

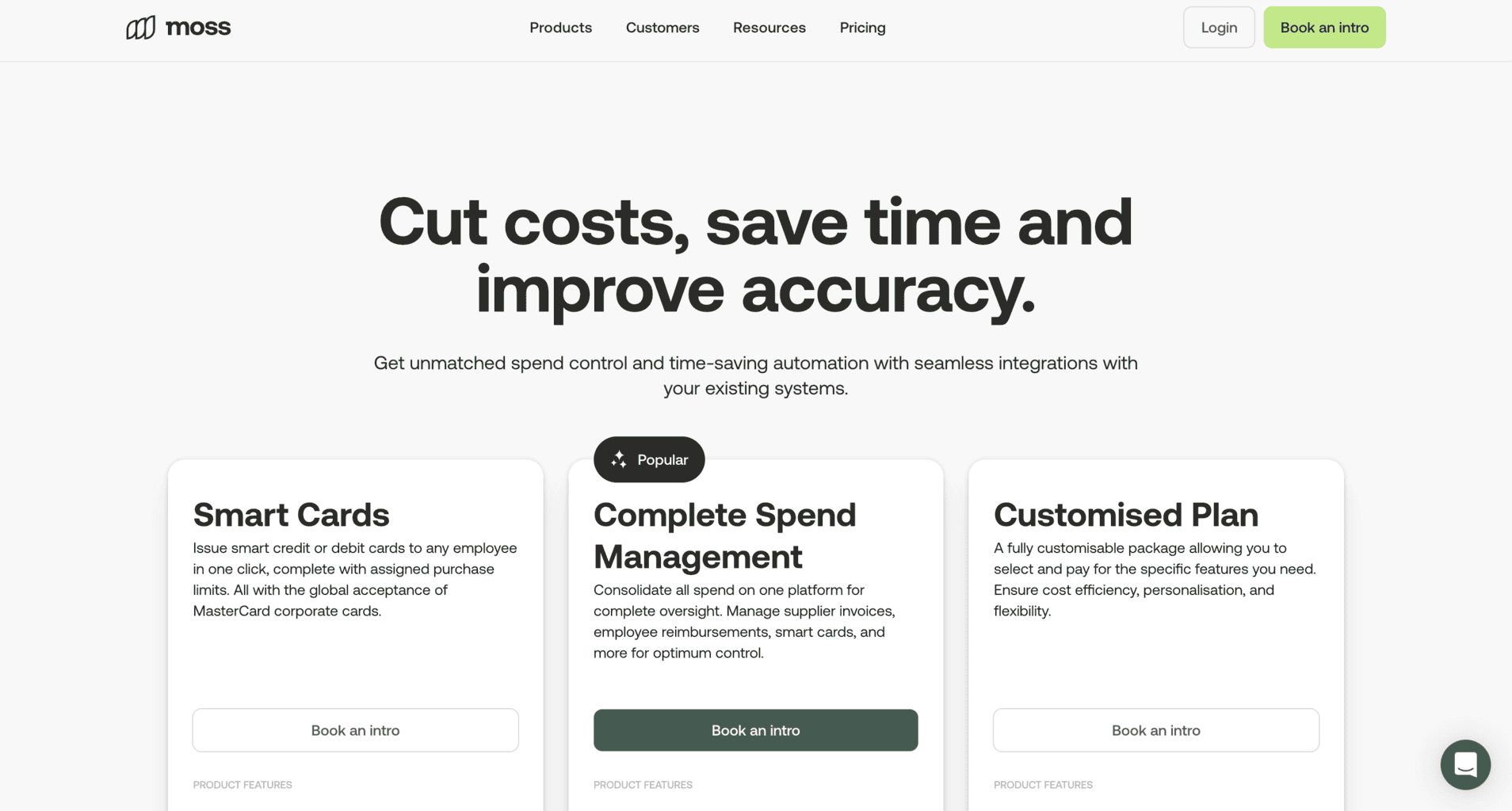

Moss Prices and Fees

Moss doesn’t share its prices and fees on the official website. The company offers personalised subscription plans for all its customers, so you’ll have to apply via the website to get a tailor-made price.

Here are the three subscriptions they offer.

Smart Cards

Moss offers debit and credit corporate cards for businesses that use the platform. The cards are issued by MasterCard and compliant with the highest security protocols.

Here’s a list of the features you’ll get with Moss’ smart cards:

- An unlimited amount of cards that contain spending monitoring, approval and limit options

- Automated accounting management

- Automated transaction and payment updates on Moss’ cloud-based platform in real-time

- Third-party integrations for accounting, expenses, email management, finance, etc.

You can submit an application for a free demo trial using this link.

Complete Spend Management

The Complete Spend Management plan allows you to have access to all of the tools and features on Moss’ cloud-based platform. You can enter your Moss account from a PC, laptop, tablet, Android smartphone, or iPhone.

These are the main features you’ll get to use with Complete Spend Management:

- Track and manage expenses, spending, reimbursements

- Manage multiple accounts payable

- In-depth data reports on expenses and transactions that you can download at all times and use them for audits

- Travel reimbursement

- Third-party integrations

Follow this link to book a free demo trial before applying for a personalised quote.

Customised Subscription Plan

The customised plan is tailor-made for each Moss user and contains only the features and tools you want to include. Moss is flexible on adding new tools to your subscription plan, but the price will change whenever they add something new.

With this plan, you’ll get onboarding technical support and a manager who will help you develop your business plan and improve your success among customers.

You can book a demo to experience the essential tools and features and learn more about the software before applying for a customised price.

Company Background

Launched in 2019 in Berlin, Moss is a mid-sized fintech company that provides various expense management solutions, credit cards, and payment management tools for startups and small and medium-sized companies.

The company was founded by Ante Spittler, currently Chairman of Moss’ board of executives; Anton Rummel, currently managing director of sales; Ferdinand Meyer, currently head of technology and product, and Stephan Haslebacher, director of operations.

Since 2020, the company has raised approximately €130 million from worldwide-known investors such as A-Star, Cherry Ventures, Valar Ventures, GFC, and Tiger Global.

The company has more than 250 employees and has issued over 266K credit cards in Europe.

Moss has offices in:

- UK (contact: +442045712718)

- Netherlands (contact: +31202414803)

- France (contact: +33411900115)

- Germany (contact: +493031193730)

- Austria: (contact: +43662281135)

- Belgium: (contact: +3228084561)

- Italy (contact: +390694502422)

- Spain: (contact: +34919015014)

The company’s official address is Nufin GmbH, Saarbrücker Street, number 37A, 10405 Berlin (Germany). You can contact the company via email at join@getmoss.com or info@getmoss.com. For international inquiries, you can also call +493031196512.

Online Reviews

Moss has over 130 reviews and an average score of 3.8 out of 5.0 stars on Trustpilot.

The company’s median score is higher on GetApp – 4.8 out of 5.0 stars and almost 70 reviews. Most reviewers mentioned Moss’s services are cost-effective and the customer support team is helpful.

The company also has over 70 reviews on G2, with an average score of 4.7 out of 5.0 stars, and 66 reviews with a median score of 4.8 out of 5.0 stars on Capterra.