Based in London, Expense on Demand is an expense management solutions provider for both domestic and international solo merchants, startups, and small and mid-sized companies. Their cloud-based platform is designed to streamline expense tracking, reporting, and reimbursement processes, while their corporate card management tools help businesses to efficiently monitor and control employee spending.

Here’s all you need to know about their products.

Expense on Demand Tools

Expense on Demand offers multiple tools and features to help you automate expense-related tasks and responsibilities.

Some tools are available via the cloud-based platform, which you can access by logging into your Expense on Demand account from the website, while others, such as the receipt scanning tool, are available only via the free mobile app for Android or Apple.

Here’s an overview of the essential tools and features for expense management.

Receipt Scanner Tool

The receipt scanner tool can be accessed via Expense on Demand’s mobile app. It uses the latest optical character recognition technology for scanning receipts. You can use it to organise and archive all of your payment receipts into multiple categories.

You can also upload existing receipt images and send your uploaded or scanned receipts to your email address.

Travel Expense Management Tool

The travel expense management tool lets you and your employees track all your business travel-related expenses. You can access it via the cloud-based platform and the mobile app.

These are some of its main features:

- Send reimbursements to your staff

- Scan or take images from receipts via Expense on Demand’s mobile app

- Create tailor-made workflows and allow multiple staff members to access them

- Send requests (employees)

- Approve requests (Expense on Demand admin account managers)

- Track and monitor mileage-related expenses

- Create expense categories

- Track expense-related trends

- Sync with third-party integrations

- Browse through budget-friendly accommodations, travel tickets, dining places, etc.

- Report Builder tool for tailoring expense reports

- Analyse and download in-depth data reports on various expense types, such as employee spending, customer-related expenses, travel budgets, etc.

Approval System

The approval system feature allows admin account users to approve specific requests by other employees. With it, you can:

- Create invoice approvals and submit them to admin user accounts

- Approve receipts submitted by employees

- Approve payment requests submitted by staff members

- Optimise business payrolls

- Track your staff’s payments

- Create customisable workflows

- Grant permission to employees in managing positions to approve certain expenses

Card Management Tool

The card management tool allows you to connect Mastercard, Visa, and American Express corporate cards to the expense management software. The corporate card data is 100% secure and compliant with GDPR and encryption regulations and protocols.

Only admin user accounts can access all the corporate card data from their dashboard. Employees who use a corporate card will only have access to their expenses processed via the card.

To connect corporate cards issued by other businesses, contact the company and submit your enquiry here.

You can use the card management tool to:

- Streamline and monitor all expenses made with corporate cards from the platform or the mobile app

- Download corporate card reports and track in-depth data analytics

- Use corporate card advanced features

- Process payments and receive money in multiple foreign currencies

Expense Analysis

The expense analysis software has multiple features for analysing expense-related operations and tracking employee spending. It updates all expense-related data in real time.

Its dashboard is straightforward and intuitive, and you can access it via the cloud-based platform or mobile app.

Key features include:

Expense reports: Select a specific expense category within a certain timeframe to download and review your expense analytics.

Multiple expense categories: Create various categories and filter out the specific expenses you’d like to review and analyse.

Budget monitoring: Monitor and analyse your company’s budgets for various teams, departments, employees, etc.

Spending patterns: The software analyses spending patterns and creates budget forecasts.

Workflows: Create automated expense workflows and share them with your employees.

Report Software

The report software tool allows you to create customisable reports and download them via the platform or the mobile app. The reports are updated in real-time, and you can select a specific type of report you’d like to download from the dashboard.

The software automatically creates monthly reports on your expenses, and you don’t need to filter out any specific expense category or timeframe.

Using this software tool, you can create reports by selecting one of the following categories:

- User accounts expenses

- Corporate card expenses

- Payment approvals and requests

- Accounts payable, i.e. invoices

- Company budgets for specific purposes (by department, travel, project, team, etc.)

Expense Management Tool

The expense management tool allows you to track and monitor all expenses created via Expense on Demand. It automatically updates all your real-time payments and incoming or outgoing money transfers while processed expenses are stored in its archive.

Key features include:

- Incoming and outgoing money analytics, updated in real-time

- Automated money transfers

- Bookkeeping and finance management tools, including third-party integrations

- Integrated features and tools for AP (invoice) management (customisable invoice templates, requests, approvals, sending accounts payable to vendors, etc.)

- Payments and receiving funds in multiple foreign currencies

- In-depth data reports on various expense categories, updated in real-time

- Secure cloud-based storage of expense data

- Tool for analysing documents’ compliances with tax rules and guidelines compliance

In addition to the main expense management tool, this version is specifically created to automate the daily finance-related tasks of small-sized companies.

Expense Tracking Mobile App

The expense tracking mobile app lets you access most expense management software tools and features. It is GST and VAT compliant, and you can use it to:

- Process payments

- Review and download expense reports

- Scan receipts and snap receipt images (available only on the app)

- Receive and approve payment requests

- Manage company budgets

- Receive money in international currencies

Like the cloud-based platform, the mobile app can integrate third-party accounting, bookkeeping, HR, and finance management software solutions, such as Xero, Sage, Tally or Quickbooks. Once you add third-party apps, all the data will sync with the mobile app, and you can track all your expenses from one dashboard.

You can also connect the mobile app with a corporate card such as AMEX, Visa, or Mastercard and download reports on your expenses and payments on the go.

The app is free to download for Android via Google Play and iPhone via Apple Store.

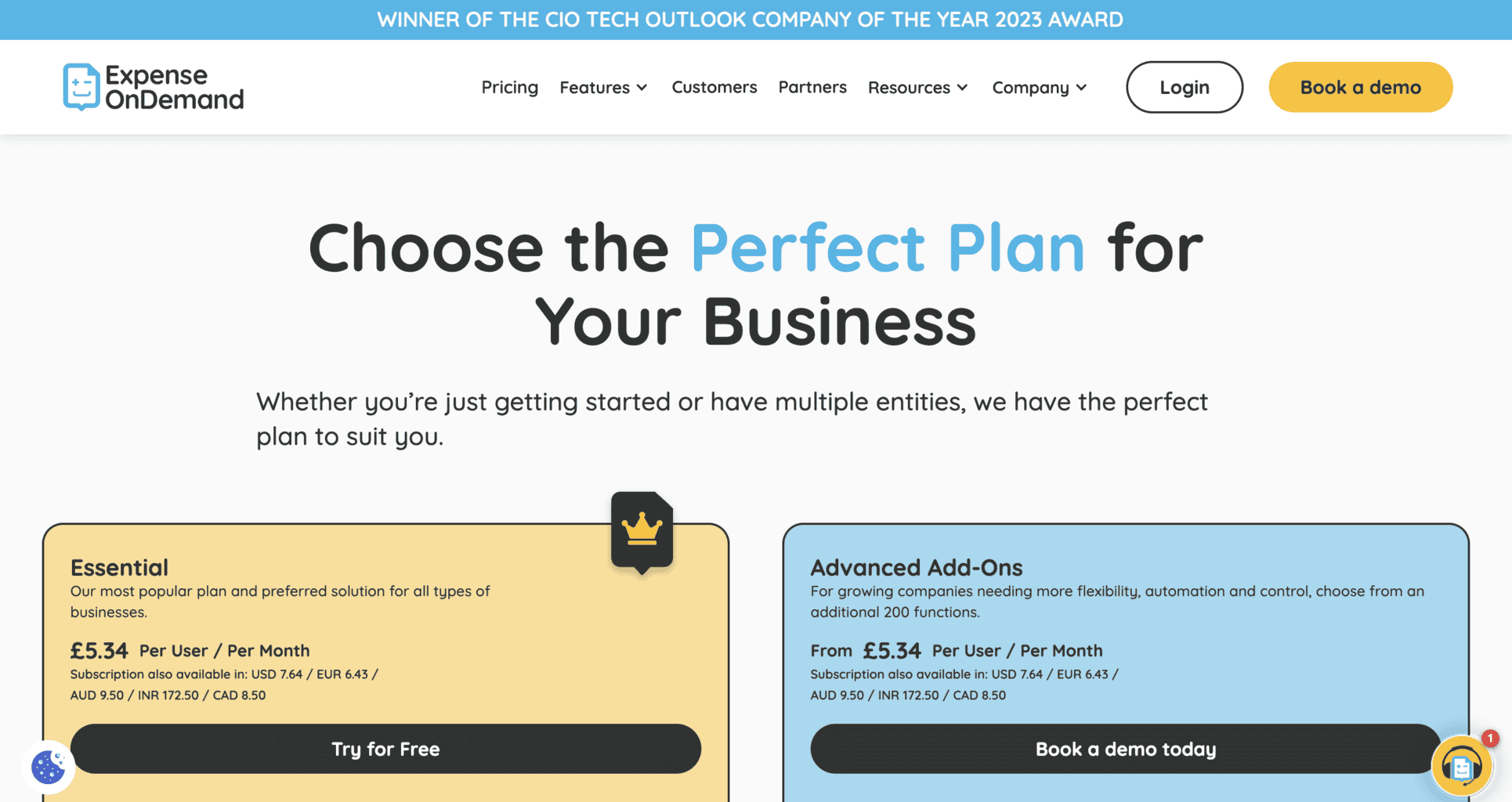

Prices and Fees

Expense on Demand offers two subscription plans – Essential and Advanced Add-Ons.

Here’s what’s included in both.

Essential Plan

The Essential subscription plan is suitable for small and mid-sized companies. It costs £5.34 monthly for one user, and you can add as many users as you like.

In addition to GDP, you can subscribe and pay in the following currencies: EUR, USD, CAD, INR, and AUD.

Here’s a list of what the plan contains:

- Multiple user account roles for managers and employees (you can create as many user accounts as necessary)

- Access to the cloud-based and mobile platform on Android and Apple devices, including smartphones, tablets, laptops, desktop computers, etc.

- Scanning tool that allows you to take snap photos of receipts or upload already existing images to the mobile app

- Set up alerts and notifications for payments, requests, approvals, new messages, etc.

- Receipt storage and data extraction

- Quick expense (payment, budget, orders, etc.) approvals via the cloud-based platform and the mobile app

- Customisable workflows that can be shared with and accessed by multiple employees

- User account categorisation

- Google-powered calculator for mileage + VAT expenses

- Real-time, in-depth data reports and analytics of multiple expense categories

- Access to the software for your accountant, auditors, and tax experts/inspectors

- VAT monitoring with various separately listed expense categories

- Tailor-made expense reports

- AI-powered training and onboarding help

- Customer support via email, Zoom video or chat

You can apply for a free trial before subscribing by submitting your application here.

Advanced Add-Ons Plan

The Advanced Add-Ons subscription plan is suitable for expanding businesses looking for flexibility, extensive monitoring, and automation of daily finance tasks. The monthly subscription costs £5.34 for one user, and you can add as many users as you’d like.

The plan contains all the tools and features included in Essential with a few additional ones, such as:

- Additional staff management tools

- Liability data reports

- Data sync with the following third-party integrations: Sage 50 and 200, Xero, QuickBooks, and Tally

- Additional mileage calculation features

- API templates

- Additional expense compliance and regulations

- Additional mileage + VAT expenses features

The Advanced Add-Ons subscription plan also offers a free demo trial, and you can submit your application via this link.

Company Background

Founded in 2003 by CEO Sunil Nigam, Expense on Demand is a London-based company that provides solo merchants, startups, small and mid-sized businesses with expense management software solutions.

Expense on Demand’s services are used by over 15,000 businesses worldwide.

In 2023, Expense on Demand won Company of the Year at the CIO Tech Outlook awards.

Some of Expense on Demand’s international clients are:

- Adobe

- City University of London

- Wessex Optical

- Yewdale

- Microsoft

- Stripe

- Zoom

Expense on Demand has multiple international partners, such as:

- Xero

- ScaleUp Arena

- App Advisory Plus

- Yes Bank

- NCF

- The SME Club

If you’re interested in becoming a partner with Expense on Demand, contact the London office by submitting your enquiries via the website or by sending an email to info@expenseondemand.com

The company’s headquarters are located at 3 Cumbrian House, 217 Marsh Wall, London, E14 9FJ, UK. In addition to the main office, Expense on Demand has branches in New Delhi, Sydney, and Phoenix Park (Singapore).

Follow their LinkedIn or Instagram pages to keep up with their latest social media updates and their blog for news updates.

Online Reviews

Expense on Demand has 47 reviews and an average score of 4.7 out of 5.0 stars on Xero. It also has 10 reviews on Techimply with a perfect average score of 5.0 out of 5.0 stars.

The mobile app has almost 600 reviews on Google Play, an excellent median score of 5.0 out of 5.0 stars, and over 100,000 downloads. It only has eight reviews on the Apple Store and an average score of 4.9 out of 5.0 stars.