Founded in London in 2018, Payhawk is an international expense and payment management software provider. Its products are suitable for businesses of all sizes, from small startups to global enterprises, and can be tailored to meet the wants and needs of any type of company.

In addition to the expense management and multi-entity management platforms, the company issues credit and debit Visa corporate cards for European and US-based businesses.

Let’s learn more about Payhawk’s tools and features.

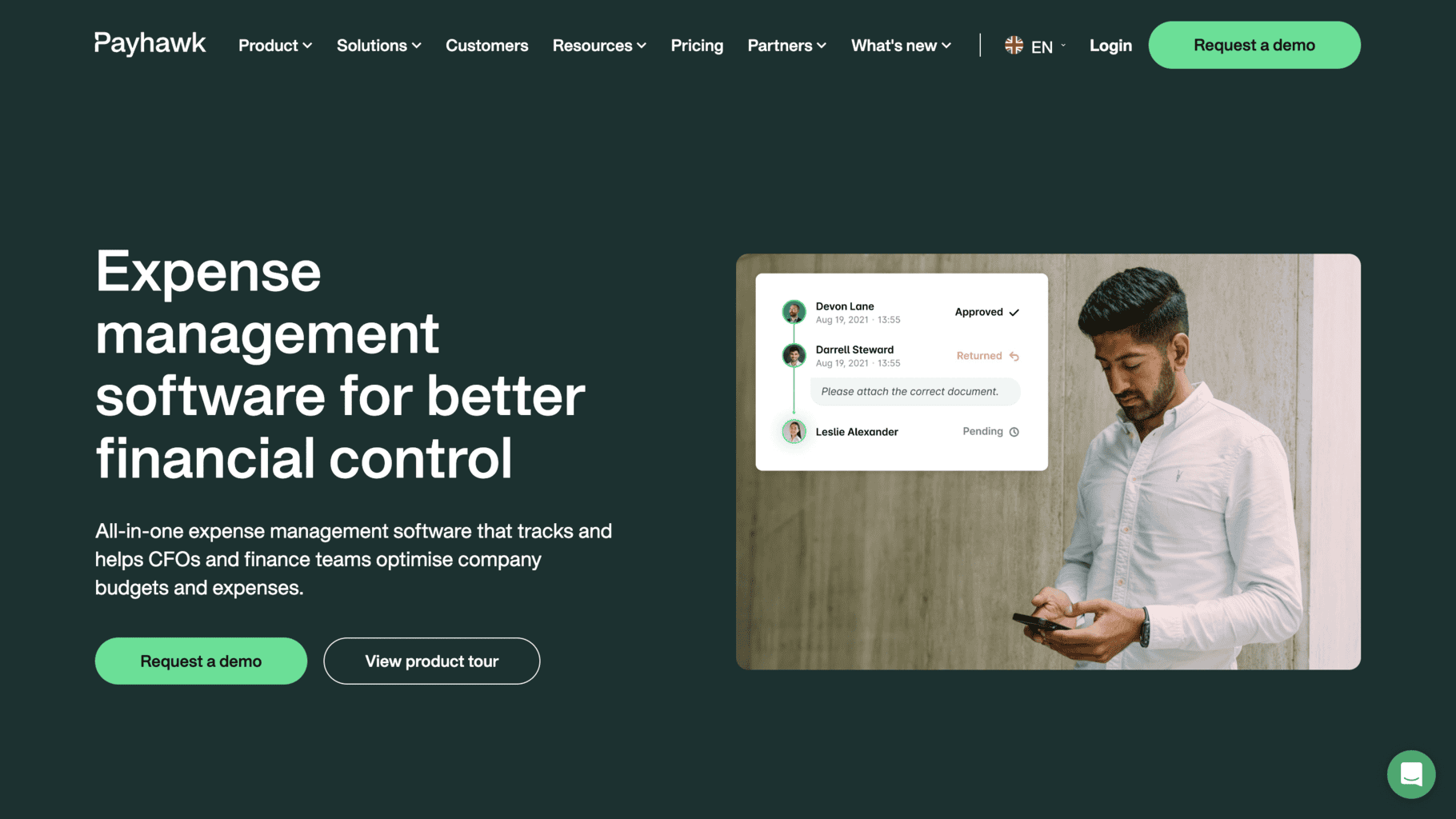

Payhawk Expenses Management Software

Payhawk’s expense and payment management software is the all-in-one solution finance staff and CFOs need to automate and optimise company funds, day-to-day expenses, and yearly budgets.

The software recognises over 50 international currencies, and you can use it to make transactions in more than 160 countries worldwide. The fund transfer rates and fees are always shared upfront, so there are no hidden expenses after transferring a specific sum of money.

Payhawk Expense Management Software Features

The software has multiple tools and features that ease and speed up the daily expense management process. You can use it by accessing your Payhawk account from the official website or downloading the mobile app on your Android smartphone or iPhone.

Here’s a list of the main features.

Expense tracking and monitoring: Track all your business transactions from one place. The transactions and expenses archive is automatically updated whenever you or your employees pay with the Payhawk card, and you’ll be notified on the dashboard in real time. You can also download expense reports at your convenience and filter out only the dates you’re interested in.

Business limits and budgets: Manage your budget and set specific limits for each Payhawk card. Each card can have a different budget limit, and you can easily adjust the limit amount via the platform’s dashboard.

Traceable transactions and payments: Use the dashboard to trace your employees’ transactions and payments.

Real-time access to project budgets: Access the project budget and funding in real-time, so you can plan spending and keep a close eye on their remaining expenses and available funds.

Scheduled payments: Schedule payments beforehand and set up regular payments for monthly subscriptions and similar recurring expenses. If you don’t have enough money in your account, Payhawk will notify you to upload more funds so the scheduled payment can be processed.

AI-powered data: You can set up various categories, VAT expenses, and cost-based centres via Payhawk’s dashboard to create recurring transactions or accounts payable. The software automatically collects the necessary data using an AI-powered tool.

Third-Party Integrations

Payhawk’s software can be customised with multiple third-party integrations to help you manage finances, accounting, VAT expenses, HR tasks, travelling expenses, authentication and security, etc.

Some of the integrations you can add to the software include the following:

|

|

|

Multi-Entity Management Platform

The multi-entity software is tailored to help businesses control and monitor their international expenses and cash flow. The Group Dashboard tool, which you can open from Payhawk’s multi-entity management platform, allows you to access the daily costs, expenses, and payments at all of your branches.

Multi-Entity Management Features

Here’s a list of the main features of this software.

Monitoring cash flow: Keep track of your company’s cash flow whenever you open the software. The dashboard updates automatically, so you can see whenever there’s a change in your company’s funds. You can also track all the international currencies used to receive or process payments and receive alerts whenever your corporate cards have low expenses.

Expense optimisation: Define and categorise expenses and payments in multiple groups. The software allows you to use the same categories for one or several branches simultaneously.

Workflow management: Simplify your daily workflow and create group schedules for one or more of your teams in different branches. Anyone with user access to the platform can manage the daily workflow and change the scheduled tasks and responsibilities.

Month-end management: Since most of your daily expense tasks are automated and scheduled through the platform, you can manage and end your month much faster. You won’t need to manually adjust tasks except for specific approvals, such as budget changes, payments, documents, etc.

Accounts payable management: Access your invoices, loans, inter-business transactions, and payments from the software’s dashboard. You can easily share and manage invoices between multiple entities from one dashboard, so there’s no need to subscribe and open separate accounts for each entity.

Staff onboarding: The software contains a module called Group Employee, which monitors and adjusts your staff’s overall number in all of your company’s branches. By accessing this module, you can also see how many active users are onboard at any moment. You can send invitations to selected team members, appoint some employees to managers, or allow them to approve specific transactions or budget levels.

Staff management: Manage multiple teams internationally by adding, deleting, and adjusting employee information, all from a single dashboard. You can also assign each team multiple daily tasks and appoint specific employees to become administrators of each staff group.

Smart Corporate Cards

In addition to expense management and multi-entity software solutions, Payhawk also issues credit and debit Visa cards for businesses. According to the company’s statistics, businesses that use Payhawk’s cards save approximately £2 million yearly since they get to reclaim their VAT expenses.

There are 0% fees for foreign exchanges, and businesses can save up to approximately £250.000 from blocked non-compliant spend. Also, all Payhawk card users can receive cashback for each transaction.

Corporate Cards Features

Here’s all you need to know about the features of the corporate cards.

Digital receipts: Payhawk’s credit or debit card automatically captures and reconciles receipts and transactions, which you can review anytime using the mobile app dashboard.

User-friendly cash flow management: You can manage cash flow straight from the dashboard. The dashboard also lets you track your company’s available funds on each credit or debit card by connecting it to your Payhawk account.

Fund limitations: Payhawk estimates and analyses each business before offering a subscription plan offer. The company sets up a fund limit of $1 million, €500.000, or £500.000. When you start your subscription, you can use your Payhawk card for the first 38 days without paying any interest rates.

International use: You can use Payhawk’s corporate cards internationally in 32 different countries and pay in multiple currencies. For seven select currencies, you don’t get to pay the foreign exchange fee; for the rest, you must pay 1.99% per transaction.

C02 monitoring: The Payhawk cards allow you to track and monitor your C02 emissions daily and access data reports on ESG.

Transparent spending: Track how employees spend company funds to prevent any fraudulent activities. You can either manage each Payhawk card separately or create a set of rules and guidelines that should apply to multiple cards at once.

Automated data processing: Payhawk’s software does not require manual data entry. Its AI tool will select necessary data and create reports on your expenses by reviewing the transactions on each corporate card. Since the transactions are automatically uploaded to the dashboard, you can always access all your transactions.

Additional Payhawk Features

In addition to the software and corporate cards, you can also benefit from partnering up with Payhawk or by using their APIs.

Partnerships

Payhawk has an ongoing call for companies interested in partnering with them. They partner up with businesses of all sizes that offer accounting services, work as enterprise resource planning integrators, or want to give referrals for Payhawk.

By becoming a partner with Payhawk, you’ll receive the following:

- Marketing campaigns

- Increased business revenue

- Account management

- Onboarding support by a Payhawk engineer

Payhawk APIs

Payhawk offers to share its already prepared APIs with all businesses that subscribe to their monthly plans. Their API solutions can help simplify and improve interactions by using HTTP and unified data formats such as JSON. You can check out the company’s API database here and browse through its APIs, which are ready for use.

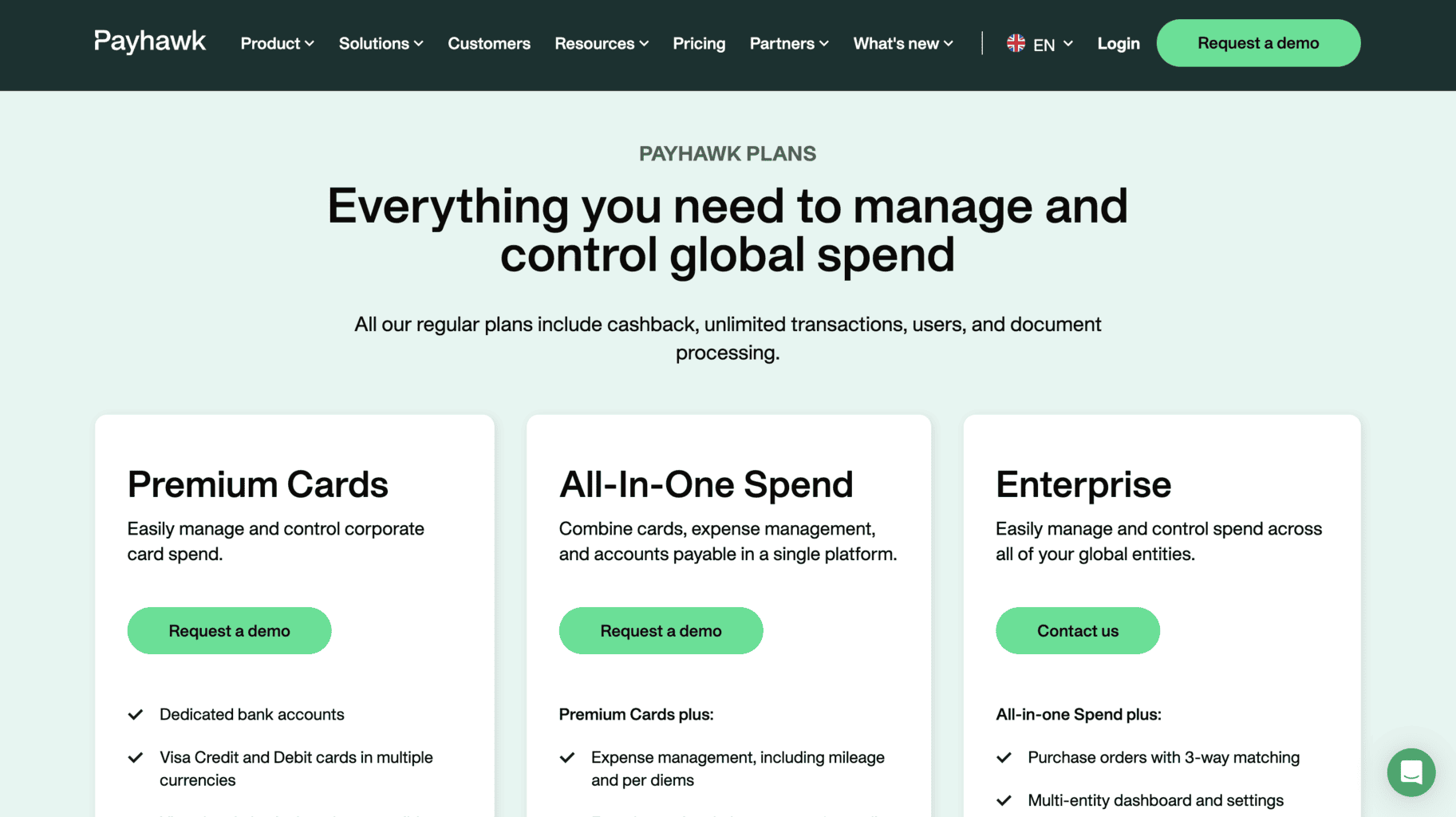

Payhawk Prices and Fees

Payhawk offers three subscription plans, but requesting a personalised subscription plan is also an option. To receive a personalised offer for each plan, you must submit an application via the company’s website.

In addition to the monthly subscription plans, the company provides a Growth program developed specifically for small businesses, which we’ll get to later.

The three main subscription plans come with the following features:

- Unlimited number of user accounts

- Unlimited number of daily transactions

- Unlimited document upload and data processing

- 24/7 access to the web and mobile app

- A Payhawk manager who helps the company during the implementation and onboarding process

- Multilingual customer support via chat

- AI-powered scanner for digital receipts in over 60 international languages

Let’s learn more about each of them.

Premium Corporate Card Plan

You can order one or more Payhawk debit or credit Visa cards that you can use only for your business. You’ll also receive access to Payhawk’s cloud-based software that can be customised with third-party integrations for finance and accounting management, such as Xero, Quickbooks, or Exact Online.

All-In-One Spend Plan

With this customisable subscription plan, you can manage all your payments, expenses, and invoices and connect your debit or credit cards to the Payhawk portal or mobile app. In addition to the features that are included in each plan, here’s what you’ll get with this one:

- Free of charge reimbursement within the country where you’ve opened the Payhawk account

- Supplier payment

- Accounts payable management

- Expense approvals

- A manager assigned by Payhawk to help you improve customer success

- Multiple credit or debit Payhawk cards issued by Visa

Enterprise Plan

As the name suggests, the enterprise plan is ideal for large-sized businesses operating globally. This plan contains all the tools and features that are included in the Premium Corporate Card and All-In-One Spend subscription plans, plus the following:

- A three-way optional matching for online or in-person purchases

- Access to a multi-entity platform

- Third-party integrations for enterprise-based financing and accounting, such as Microsoft Dynamics and NetSuite

- Third-party integrations for HR and business management

- SAML and SSO authentication

Payhawk for Small Businesses

Payhawk offers a Growth subscription program that allows you to use the company’s platform for two years.

The fixed rate for the Growth program is £99 monthly. To qualify for this monthly plan, you must be a single-entity company registered in the UK or EEA with no more than 50 staff members. Only businesses can sign up for this program.

The first seven days are free of charge, and if you decide to upgrade to one of their three subscription plans later on, you’ll receive a 50% discount.

Here’s what you’ll get if you sign up for the program:

- Up to ten user accounts

- Up to ten Visa debit cards

- Unlimited amount of documents for upload and processing

- Unlimited amount of transactions

You can apply for the Growth program using this link.

Company Background

Payhawk is a company that offers expense management software tools and corporate cards for businesses of all sizes. They provide services throughout Europe and the US.

The company was founded in 2018 in London by Hristo Borisov (CEO), Boyko Karadzhov (CTO) and Konstantin Djengozov (CFO). The address of Payhawk’s headquarters is WeWork, 1 Waterhouse Square, London, UK, EC1N 2ST.

The company also has offices in the following cities:

- New York City

- Berlin

- Barcelona

- Amsterdam

- Paris

- Sofia

- Vilnius

Some of Payhawk’s clients include:

|

|

In 2026, Payhawk received three recognitions by G2. They were classified as one of the leading companies in finance management and received the title Momentum Leader and High Performer.

You can contact the company’s UK customer support via phone +442033184187 or send them an email at:

Online Reviews

Payhawk has garnered over 750 reviews on Featured Customers and earned an average of 4.8 out of 5.0 stars.

They also have 260 reviews on Trustpilot and a high average score of 4.7 out of 5.0 stars. The reviewers praised the fast and responsive customer support that Payhawk offers during and after the onboarding process.

The company has 217 reviews on G2 with a median score of 4.5 out of 5.0 stars and 115 reviews on GetApp with a score of 4.5 out of 5.0 stars.

Payhawk’s mobile app has over 530 reviews on Google Play and a median score of 4.4 out of 5.0 stars. It also has 190 reviews on the Apple Store and an average score of 4.6 out of 5.0 stars.