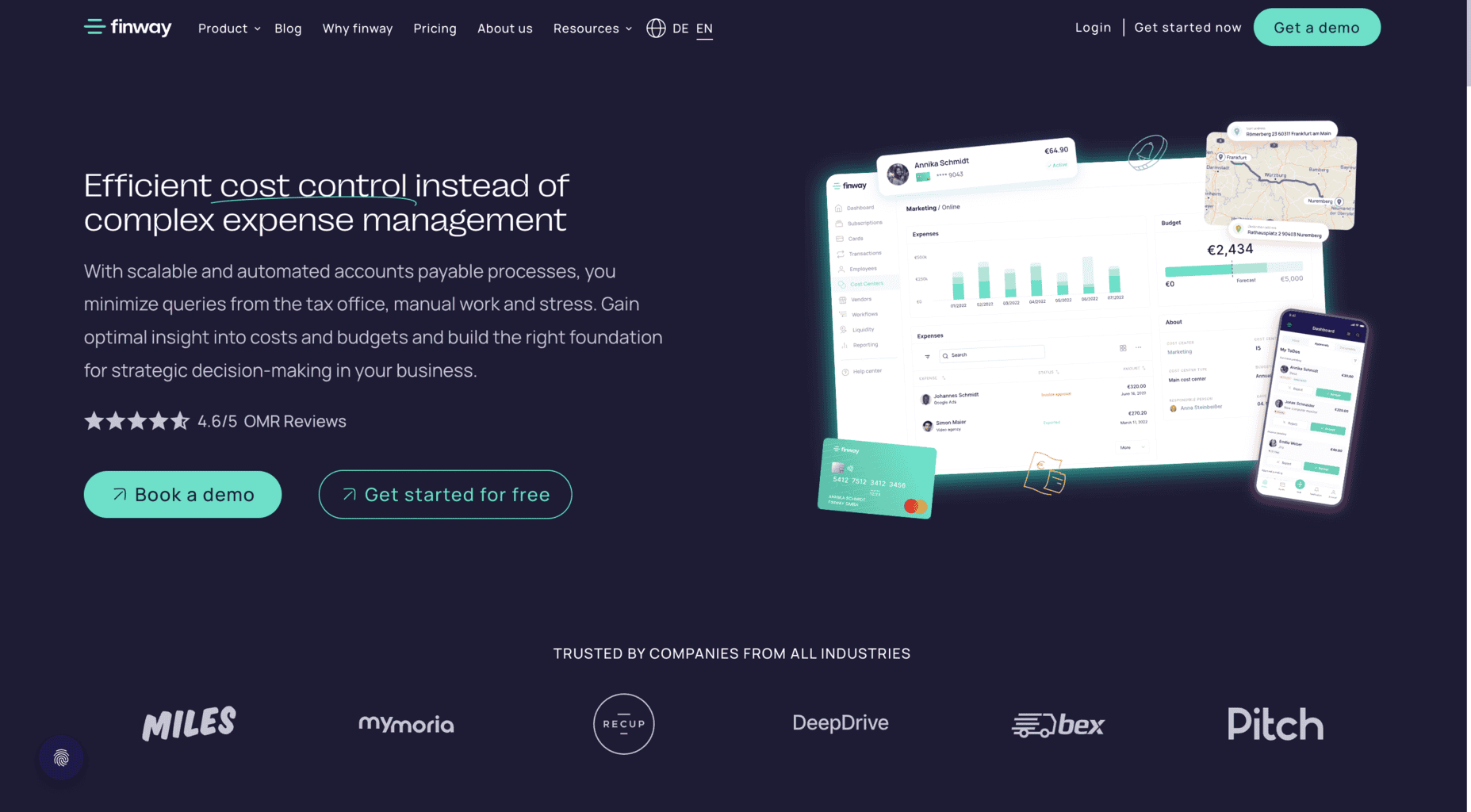

Finway is a Munich-based fintech startup that offers expense management solutions and corporate debit cards for small and mid-scale businesses. The company’s platform integrates spend management, accounting, and payment processes into a single, user-friendly system.

Let’s explore their products, pricing, and company background in more detail.

Expense Management Tools and Features

Finway offers multiple expense management tools and features that you can access by logging in to your account via the cloud-based platform on the website or via the free mobile app for both Android and Apple devices.

Here’s a list of their leading expense management solutions.

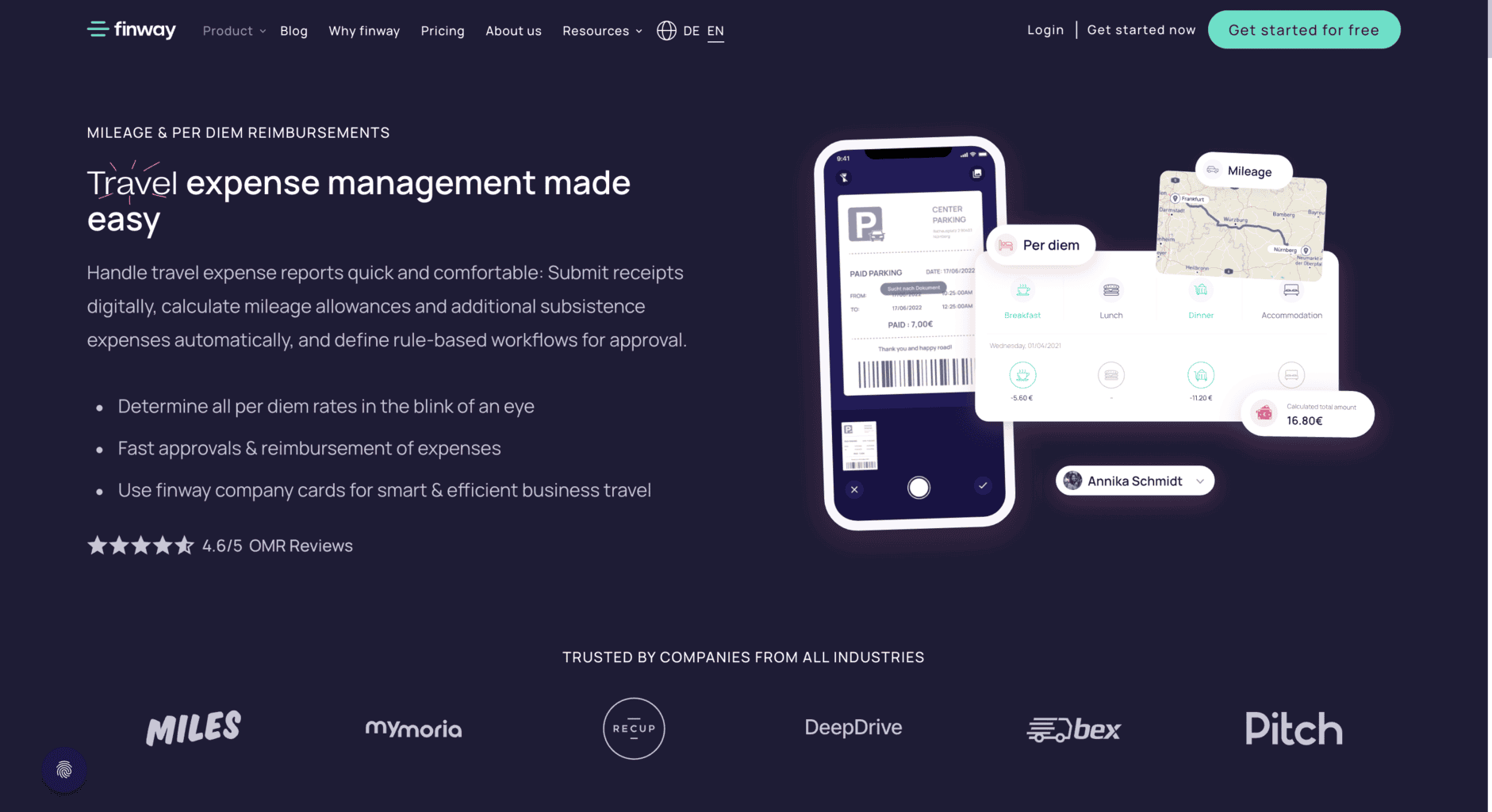

Travel Management Software Tool

The travel management software allows you to manage all your travel-related expenses on the go.

Key features include:

- Daily rates estimations

- Accounts payable (invoice) management

- Payment requests and approvals

- Reimbursement requests and approvals

- OCR-powered receipt submission and scanning tool

- Mileage calculator tool

- Customisable rules

- Tailor-made templates

- Physical and virtual cards sync

Accounts Payable Approval Tool

According to Finway, the approval process is approximately 85% quicker if you digitise your invoice and use this tool to approve multiple invoices at once.

Key features include:

Employee limits: Create invoice limits for each Finway user account and delegate approval rights to specific employees.

Automated invoice approvals: Set up automated invoice approvals for recurring accounts payable. Instead of continuously approving the same type of invoice, you can use this option and receive an alert once the scheduled invoice is approved.

Tailor-made workflows: Create and share workflows with office departments and work teams. You can edit already-existing workflows and allow access only to specific employees.

Billing management: Manage billing and give access to specific employees and team members.

Supplier and vendor archive: Quickly access a vendor database to allocate account payables to specific suppliers. The list automatically updates when you send an invoice to a new vendor. The tool automatically connects the invoice per supplier and checks if it meets the regulations and terms you’ve agreed upon with the vendor.

Team communication: Write down questions and answers and leave comments and descriptions on accounts payable requests and image receipts. The tool will allow all employees or work teams with access to a specific invoice to communicate.

Subscription database: Access all your company subscriptions and create invoices in advance. You’ll be able to track each subscription and ensure they’re regularly paid by setting up automated payments for recurring ones.

Budget Management and Control

The budget management feature allows you to control and keep track of all your company budgets. The tool updates each budget in real time, so you can always stay updated on your finances. By updating them 24/7, you’ll be able to avoid unnecessary finance overruns and create more precise budget forecasts and plans.

Here’s what you can do with the help of this tool:

Expense reconciliation: Compare and contrast your pending or archived expenses with your current budgets.

Employee approvals: Allow specific employees to approve budgets or make changes. There’s an option to set up monthly budgets and allow staff members to keep track of them to keep track of your company’s spending.

Sub-cost budget centres: Manually plan and set up budget decisions in advance and on a granular level.

Whenever a budget is approved, you can keep track of its overall impact on your finances thanks to the in-depth budget reports. Download them via the dashboard and select the specific timeframe you want to review.

Preparatory Accounting Feature

This feature’s primary goal is to sort, track, and collect specific paperwork that you can use to receive VAT and tax, create expense statements every month, keep track of accounts payable, image receipts, etc.

It collects all documentation, archives it automatically, and prepares it for financial auditing or review by your internal bookkeepers and accountants.

Key features include:

Monthly data reports: Automatically create reports on all your expenses at the end of each month and allocate all your monthly transactions.

Bank sync: Import money transactions from your cards by syncing your bank or by uploading CSV files. The tool will automatically match and categorise each transaction with invoices and processed receipts. When an invoice is missing, you’ll get a notification to add it to the tool.

Invoice transfers: Sync your cards issued by over 2700 international banks, transfer money, and send accounts payable. You can also create open accounts payable and allow specific employees access.

Money reimbursements: Approve and reject money reimbursement in seconds. Staff members can create requests for money reimbursement and categorise multiple receipts at once. This tool can especially be helpful for travel-related reimbursements with various receipts and expenses that your employees can upload simultaneously.

G/L user accounts: Open the G/L user accounts to receive allocated money, add notes and comments on specific expenses, and keep track of all your transactions straight from the dashboard. This tool can help tax auditors and advisors review all your transactions daily.

DATEV Unternehmen Online: Export accounts payable data that your accounting team will need while preparing audit documentation. The tool automatically tracks data such as expense amounts, FX fees, accounts payable number, date of money transfer, VAT, G/L user account, etc.

Security: The software is 100% compliant with the German GoBD regulations and keeps all the data encrypted and safe from third-party breaches.

Digital and Physical Corporate Cards

In addition to the expense management solutions, you can order physical and virtual corporate cards issued by Mastercard.

You can order as many cards as you need since there’s no limit, regardless of your subscription. Use them to pay for your business-related expenses, receive regular cashback, and track your payments.

Cards can be ordered for multiple work departments and teams at once or only for individual employees. Employees can have virtual (digital) and physical cards assigned to them by their names.

Key features include:

Multiple payment options: Use the physical card to withdraw money from domestic and international ATMs, pay contactless by connecting it to your Google or Apple digital wallets, pay via card readers, etc. You can use the Finway physical card in more than 22 million locations internationally, making it an excellent choice for business trips. You can also choose to withdraw money in the local FX currency.

Transaction archive: Access your transaction archive and keep track of all your payments and incoming or outgoing money transfers. Each transaction can also be allocated to match the specific receipt.

Spending limits: Adjust spending limits for specific cards to make sure your employees are not overspending company money. This optional feature gives you full control over payments, staff members’ accounts, and company budgets. Your employees can send payment requests whenever they need to surpass the limit, and you can set up an alert whenever there’s a new request.

Digital card ordering: Order digital cards via the platform and receive a unique number. After sending your request, Finway will review it and decide whether to approve it within minutes.

Subscription payments: Access your subscriptions’ database and set up automated payments for ongoing subscriptions. Create virtual cards per subscription and pre-set recurring payments to ensure they are paid on time.

Prices and Fees

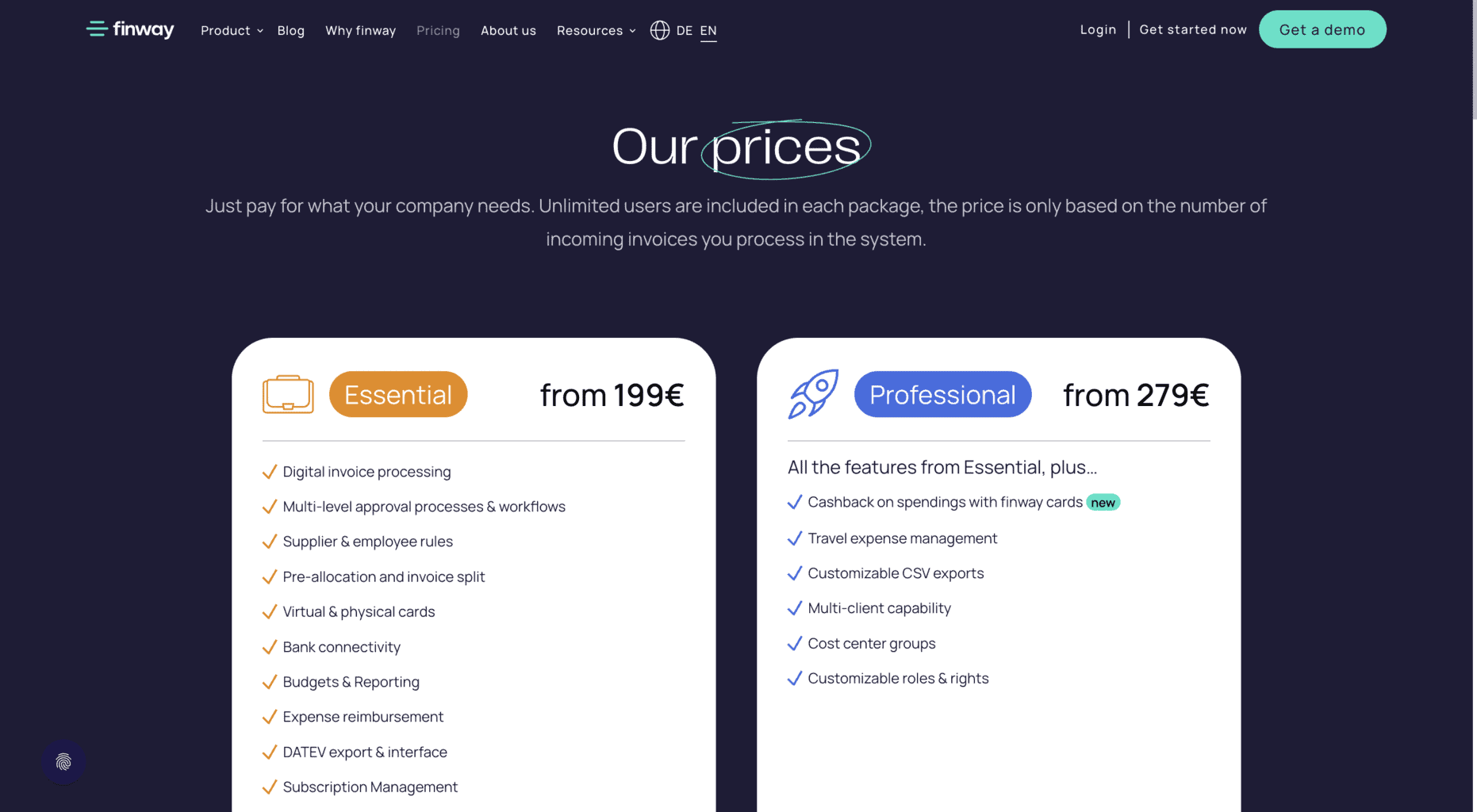

Finway offers two subscription plans – Essential and Professional.

Essential Plan

The Essential plan is an excellent choice for startups, solo merchants, and small and mid-scale businesses. It can be customised to suit your business’s wants and needs, and you can add accounting and bookkeeping integrations of your choice.

The starting monthly fee is €199.

This plan comes with the following tools and features:

- Accounts payable processing

- Customisable workflows

- Expense approvals

- Tailor-made regulations and policies for employees and vendors

- Accounts payable split and pre-assignment

- Virtual (digital) and physical debit cards

- Budget analytics

- In-depth data reports

- Bank app integration

- Reimbursements

- Interface and data export (DATEV)

- One-time or recurring subscription payments

- Android/Apple app

- Personio (third-party integration)

- Digital wallets (Google and Apple)

- Sign-on in Google and Azure

You can apply for a free demo trial via the pricing page or contact the company for subscription price enquiries via email at info@finway.de. To try out the software for free, send your application for a two-week trial.

Professional Plan

The Professional plan is suitable for small and mid-sized companies. Just like Essential, it can be tailored by adding tools and features of your choice.

The starting price is €279 monthly, but it varies depending on the tools and third-party integrations you include in it.

The plan contains all of Essentials’ tools and features, including the following ones:

- Option to receive cashback percentage when paying with digital or physical cards issued by Finway

- Third-party integrations

- Travel management software (access via the cloud-based platform and mobile app)

- CSV data exports that you can optimise and tailor for your accounting and auditing purposes

- Multiple client accounts

- Revenue centre categories/groups

- Tailor-made user roles and regulations

To test the tools included in Professional before subscribing, you can submit a free demo trial application via the landing page.

Company Background

Founded in 2020 in Munich, Finway is a fintech startup that offers expense management solutions and corporate cards for small and mid-sized companies. Their services are only available to companies registered in Europe, but the corporate cards can be used internationally.

The company’s primary investor and founder is Felix Haas. Csaba Krümmer, Jennifer Dussileck, Christian Weisbrodt ,and Philipp Rieger are the company’s co-founders.

Some of their customers are Recup, DeepDive, Bex, Pitch, MyMoria, Miles, Cureosity, and many others.

In 2023, the company raised over USD 10 million, and in 2021, it received approximately EUR 2.1 million as seed funding.

Finway’s headquarters are located in Munich at GmbH Elsenheimerstr. 4180687. To get in touch, you can email them at info@finway.de or call 08938037708.

Follow their LinkedIn, YouTube, or Instagram to keep up with Finway’s latest social media updates. If you’re interested in finding out more about open job positions at Finway, check out their Career page.

Online Reviews

Finway has 30 reviews and an average score of 4.2 out of 5.0 stars on GetApp. Reviewers mentioned that the software is user-friendly and the onboarding process is straightforward. Some noted that customer support is helpful, and you can reach out any time during work hours.

The company has 30 reviews on Software Advice and an average score of 4.0 out of 5.0 stars. It also has 30 reviews on Capterra and a median score of 4.2 out of 5.0 stars and 41 reviews and an average score of 4.5 out of 5.0 stars on OMR.

The mobile app has eight reviews and an average score of 3.7 out of 5.0 stars on Google Play and has been downloaded over 1000 times. There are no reviews on the Apple Store.