AccessPay aims to simplify corporations’ payment processing systems by offering fintech solutions for businesses of all sizes to help them streamline their payments. The idea is to bring the 4th wave of digitalisation that individuals have been benefiting to business finance. This can make managing money more cost-effective in several ways.

Let’s explore the features offered by AccessPay together, so you can make an informed decision on whether it is the optimal solution for your business needs.

Prices/Fees

AccessPay operates on a fixed yearly fee, allowing your business to process any number of transactions without incurring any direct costs. The fee is on a one-year rolling contract and includes all platform upgrades, with no hidden transaction fees. This pricing model ensures transparency and cost-effectiveness for your business, giving you the freedom to scale your payment processing without any unexpected expenses.

Obviously, if it is a cost-effective solution or not depends on the yearly fee. AccessPay’s pricing and fees for its Direct Debit collection services aren’t fixed. Instead, your fee is tailored according to your business needs such as technical requirements, the value and volume of transactions you make on average, and administrative demand.

Having said that, it’s important to note that your bank or building society may still charge their own fees when you process domestic or international payments. These fees depend on how you connect to their portal, such as via H2H or SWIFT.

Fill out the form on their website to get a price for your business.

Product/Service Overview

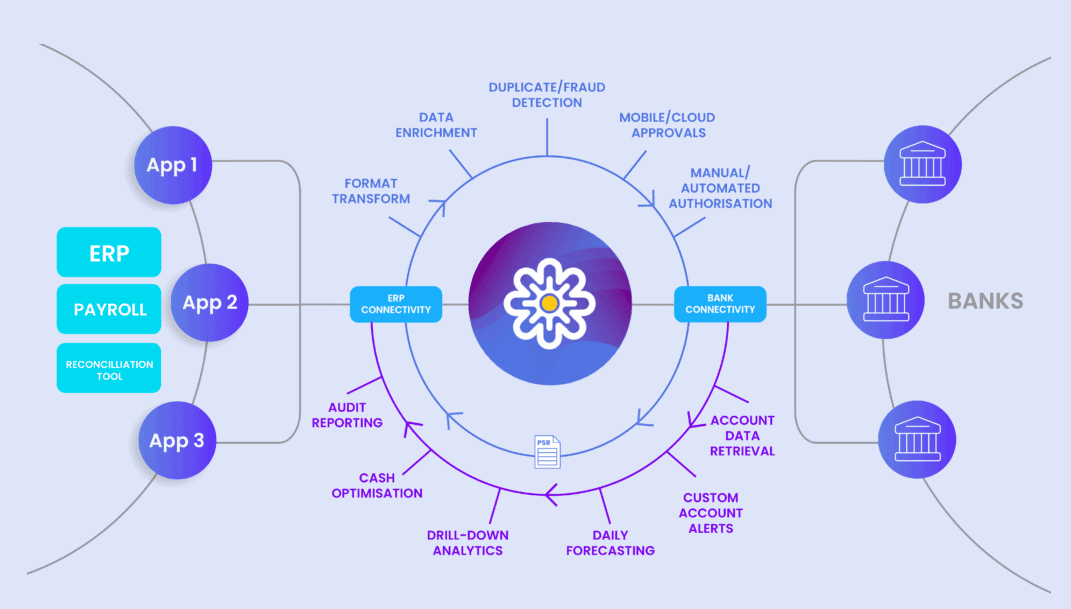

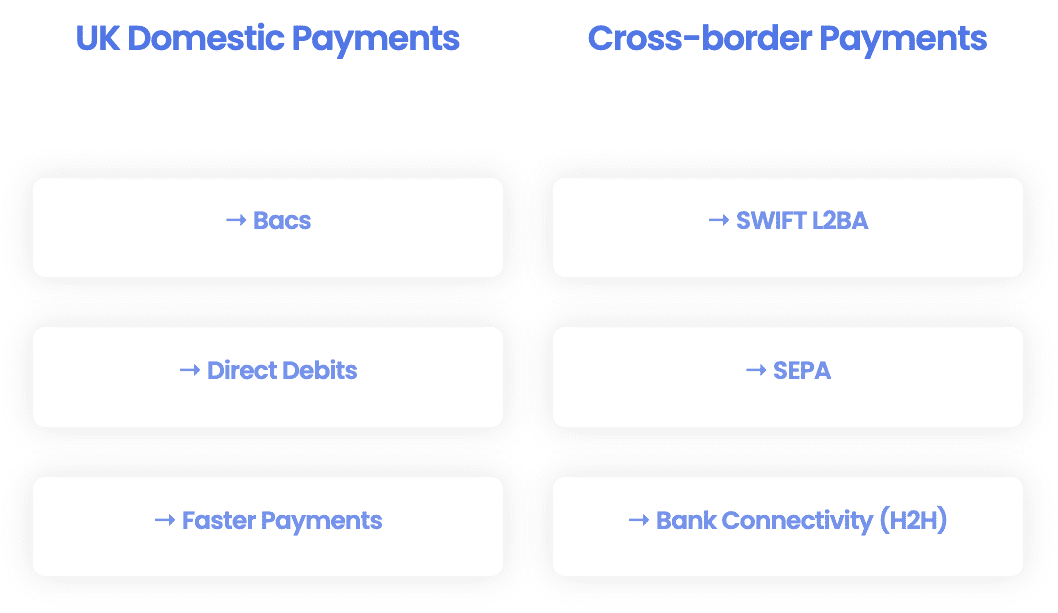

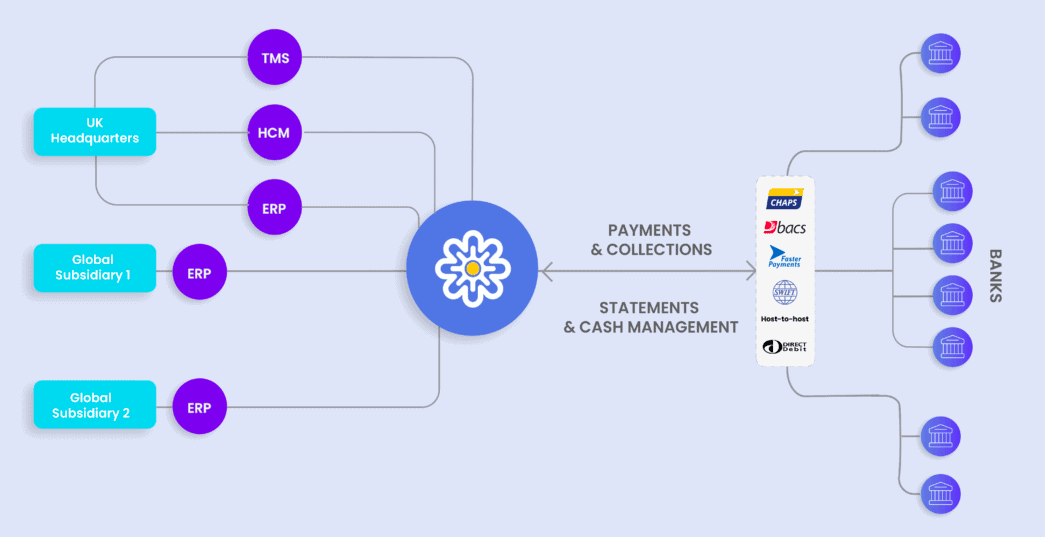

Access Pay is a Bacs-approved software provider. It connects your business directly to the banking network and through a comprehensive suite of payments and cash management services, including SEPA, SWIFT, Direct Debit, Faster Payments, and Multi-Bank Cash Management.

Bank Connectivity

Bank connectivity is about how companies and banks communicate important information with each other electronically. It includes payment details, account balances, and other crucial data that needs to be shared securely and efficiently.

AcessPay directly routes domestic and cross-border payments through the bank. This helps you to keep transaction costs low and enable straight-through processing.

By avoiding third-party intermediaries and using direct bank connections, it simplifies your payment workflows and ensures that transactions are processed quickly and securely.

You also receive regular Payment Status Reports (PSRs), so that you can keep track of your payments and draw data easily to audit.

Payment Automation

AccessPay enables businesses to send secure payments through various payment schemes or host-to-host banking connections, including Faster Payments, Swift, Bacs, and SEPA.

Automating the exchange of this information through electronic methods is a more efficient way than manual methods, and it lets you avoid potential human errors.

By connecting your back-office with AccessPay, your business can also automate Bacs Direct Debit collections from your customer base. You can also build custom payment workflows and retrieve Bacs reports through AccessPay to speed up reconciliation and reduce manual data processing.

Cash Visibility

With AccessPay’s cash visibility solutions, you can quickly consolidate your global banking operations and gain real-time insights into your cash positions.

AccessPay lets you streamline your business’ financial operations through its portal. This means no spreadsheets and no need to log in to multiple online banking portals, as the platform provides real-time reporting and analytics across all connected accounts. The solution also enables daily cash forecasting by comparing expected cash positions with actuals.

You can also set custom alerts to identify potential risks like overdrawn accounts, large cash inflows/outflows, late movements, and peak liquidity usage.

Bank Statement Feeds

AccessPay offers several solutions to automate banking operations, aiming to improve reconciliation times, consolidate global banking operations, and enable real-time reporting.

By allowing straight-through processing of statement feeds, it cuts processing times. You can link it to any bank, in any country through SWIFT connectivity or host-to-host bank connectivity, allowing your finance team to manage the entire corporate banking estate from one place.

Company Background

AccessPay was founded in 2012 by Ali Moiyed, who previously developed Primalink, a SaaS consultancy. It was the first company to bring cloud-based Bacs-approved software to the market, aiming to make it easier for corporations to send and receive money by replacing outdated systems and processes with modern technology.

In October 2013, AccessPay launched a payment and cash management application with SWIFT in the cloud.

In March 2014, AccessPay announced a new strategic partnership with Global Reach Partner Group for cross-border payments, aiming to ease the difficulties of cross-border foreign currency payments.

User Reviews From Around the Web

Despite the more than 10 years of history of the company, there aren’t a large number of reviews available on the web for AccessPay.

- Trustpilot – 4.3 / 5 (based on 24 reviews)

- G2 – 4.3 / 5 (based on 3 reviews)

- Capterra – 5 / 5 (based on 4 reviews)

Taking all reviews into account, AccessPay scores 4.4 / 5 out of a total of 32 reviews.

While AccessPay has a fairly long history, the number of online reviews and user experiences available is limited. As a result, the current 4.4 score out of 5 may not be a completely reliable indicator of the company’s performance. To establish a more accurate assessment of AccessPay’s reliability, the company would benefit from increased visibility in media coverage and user reviews.

User Reviews

AccessPay User Reviews

Review Summary

Recent Reviews

There are no reviews yet. Be the first one to write one.