More than one in five (21%) of consumer payments were made online in 2024, representing 36% of the total value spent, up from 28% just two years previously, according to the European Central Bank.

And around nine out of ten people made at least one digital payment last year — including on the web, in apps or using a digital wallet.

This surge in online transactions comes as web culture reaches a crossroads. Social media has shifted from social interaction to shopping and entertainment, AI snippets are throttling web traffic at the search engine stage, and established and traditional publishers are losing influence to, well, influencers — be they on social media, podcasts and newsletters or pairing up directly with trending brands.

In this moment of flux, online shoppers are looking for payment methods they can trust. But what options are online retailers offering? Merchant Machine discovered which payment methods are most commonly offered in every country and the top countries and states for each method.

Key Findings

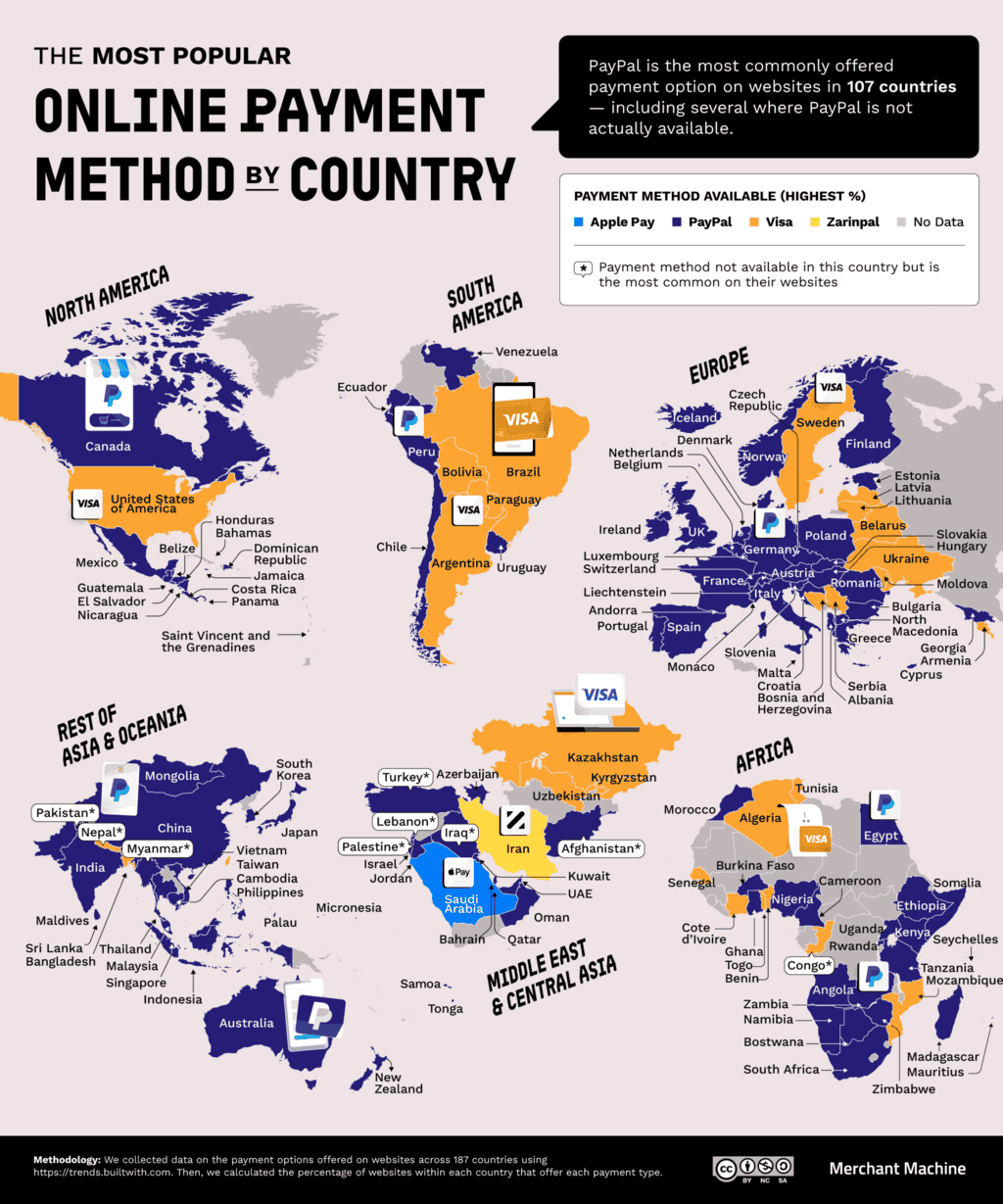

- PayPal is the most common payment option on websites in 107 countries.

- Visa is a payment option on 13.60% of merchant websites worldwide — only PayPal (26.24%) is on more.

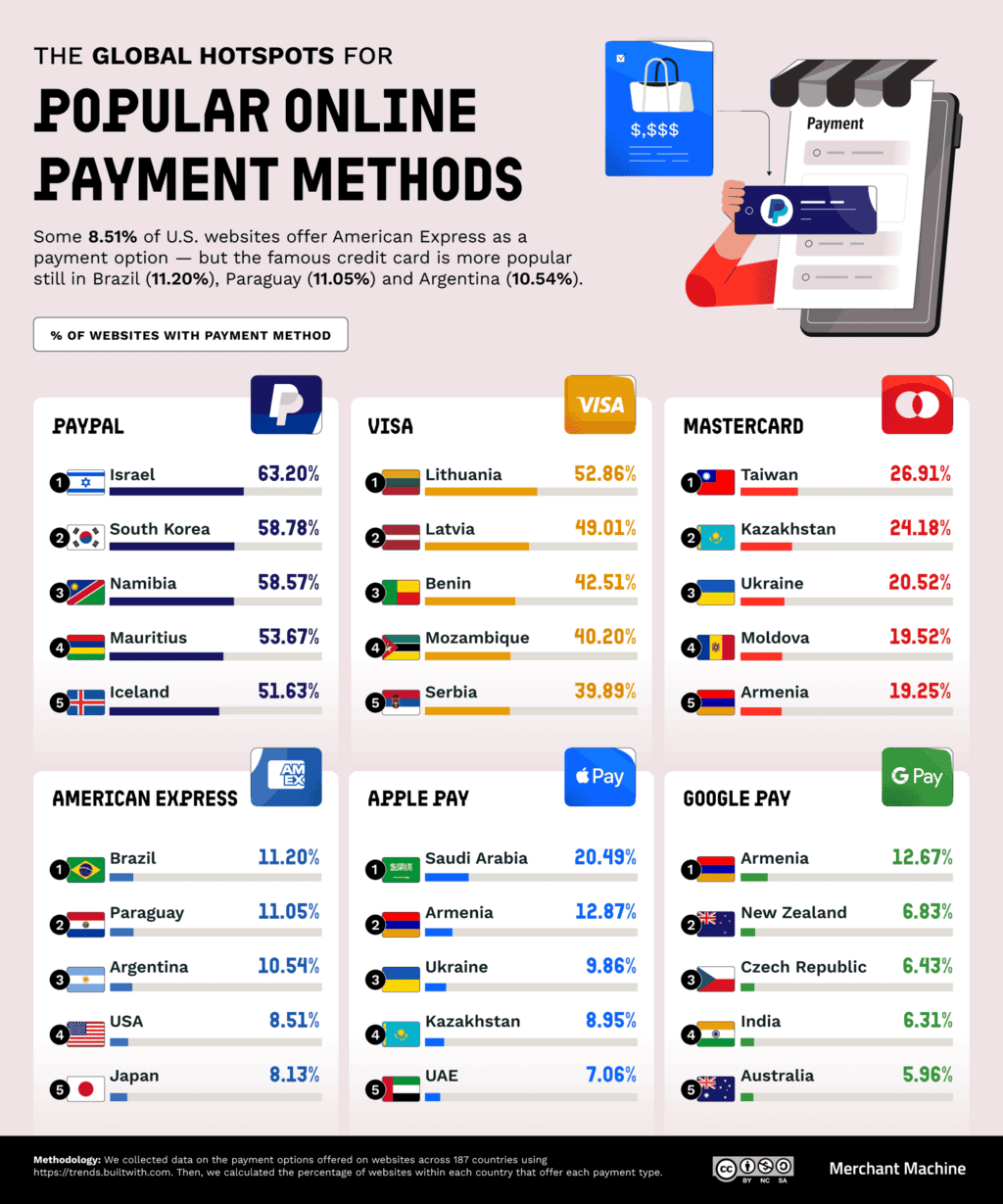

- Brazil has the highest proportion of merchant websites that take American Express (11.20%) — in the U.S., just 8.51% accept the card.

PayPal Dominates Online Payment Globally — But Newcomers Threaten This Dominance

PayPal is overwhelmingly the most common online payment method on merchant websites. It is available on the highest percentage of websites in 107 countries, followed by Visa, which is top in 29. Besides that, only Apple Pay (Saudi Arabia) and Zarinpal (Iran) are top in any country, and only one country each in both cases.

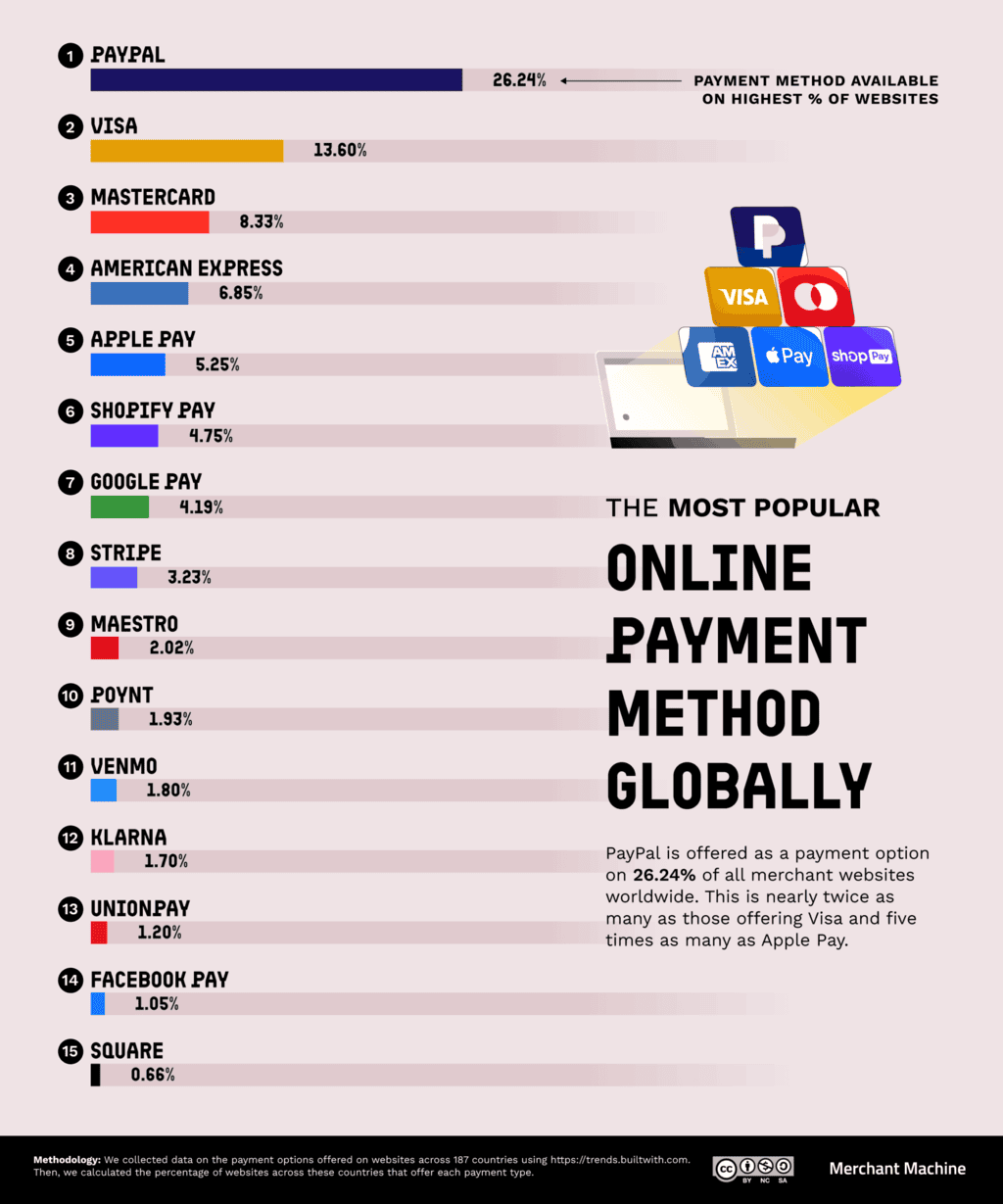

Since launching in 2000, PayPal has become available in over 200 countries or regions, going ‘mobile first’ in 2014 and making billionaires of Elon Musk and Peter Thiel. The company is now reputedly worth more than $220 billion. As our chart below shows, parallel to the vast number of countries where it is number one, PayPal is available on 26.24% of merchant sites worldwide. This is the highest proportion of any payment method and significantly more than second-placed Visa (13.60%).

However, despite some healthy signs following a recent shift in strategy, PayPal continues to face the challenge of ever-evolving competition. “Taking a step back, it’s hard not to ignore the intense competition which continues to be a problem for PayPal. Consumers increasingly use Google Pay or Apple Pay via their phones or watches,” Dan Coatsworth, an investment analyst at AJ Bell, told Reuters in February.

Although the four well-established brands of PayPal, Visa, MasterCard and American Express occupy the top four spots, the next four are occupied by newer, digital-first services. The fifth-placed method, Apple Pay, celebrated its tenth anniversary in 2024 and is “used by hundreds of millions of consumers in 78 markets,” according to Apple. According to the brand’s own survey, users rate Apple Pay highly for ease of use, privacy and security.

Visa is a Big Deal in the Baltics

Next, we looked at the countries where these payment methods are available on the highest proportion of merchant websites. Visa is particularly popular in some of Europe’s easternmost territories: it is an option on 52.86% of Lithuanian websites, 49.01% of Latvian ones and 39.89% of those in Serbia.

When asked why Visa is so interested in the Lithuanian market, the brand’s local Head of Visa Direct, Patrik Havander, told Nordic Fintech Magazine: “I think Nordic and the Baltics have a long history of being leading in payment innovation. I think the Baltics have also had a regulatory environment that has been supporting the ramp up of the fintech industry for EU passporting and things like that… Lithuania is the biggest fintech Hub in Mainland Europe, and of course, there are many fintechs that want to replicate others’ successes and learn from each other.”

American Express Option Varies Profoundly Across U.S.

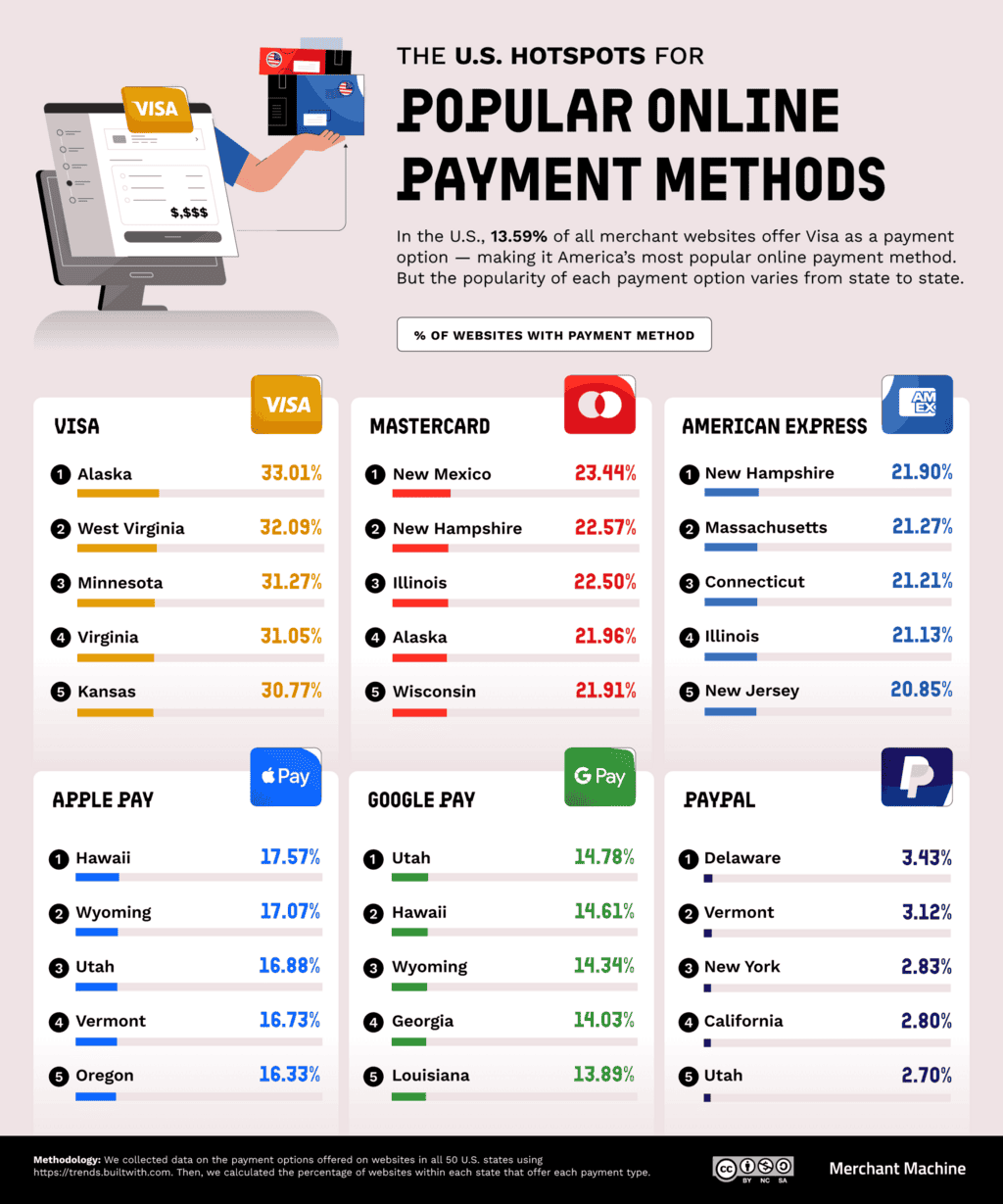

Finally, we looked at the American states with the highest proportion of websites offering each payment method. While American Express is only available on 8.51% of merchant sites countrywide, that figure rises to 20% or more in certain states, most notably New Hampshire, where 21.90% of websites offer Amex as an option.

In face-to-face scenarios, Amex has continued to operate as a status symbol, and even Gen Z wields the card to give the impression of being a high earner. Online, however, there is no such incentive to use the card, and retailers are wary of the transaction fees — which can be double that of Visa or Mastercard.

PayPal is actually poorly represented across U.S. merchant websites, peaking in Delaware, where it is an option on 3.43% of sites. This may be due to a combination of high transaction fees and the prevalence of alternative payment methods.

One such alternative is Google Pay, available on upwards of 14% of websites based in Utah, Hawaii, Wyoming and Georgia. However, it is not a local rival to PayPal — in fact, Google Pay was shuttered in the U.S. in 2024, meaning the service mainly remains on U.S. websites as an option for international customers.

The Best Option is the Plenty of Options

Emerging AI and blockchain technologies are touted to make paying for goods online safer and easier. Still, a large part of the consumer market continues to want the option to pay through a familiar, trusted service — as evidenced by the continued prevalence of Visa, MasterCard and American Express. However, with online retailers keen to avoid the dreaded abandoned cart, anything that makes paying frictionless promotes successful sales so that more of those carts make it home.

Methodology & Sources

To identify the most popular online payment methods around the world, we collected data on 717 payment options offered on websites across 187 countries and all 50 U.S. states using https://trends.builtwith.com. Next, we calculated the percentage of websites within each country and U.S. state that offer each payment option.

Note: this data shows the most commonly offered payment option on websites in each country/state and does not necessarily reflect the most popular payment method chosen by consumers in each location.

The data is correct as of March 2025.

Thomas Adamski says

The most popular online payment method in Brazil is by wide the PIX

https://www.poder360.com.br/poder-economia/pix-faz-5-anos-e-ja-movimentou-mais-de-r-60-trilhoes/

Neku says

Hey Ian, Fantsastic work on this article it was a great read.

Is there any way you could share your data set with me, looking to do some further analysis into this field

Ian Wright says

Thanks, I’ll have a look to see what, if anything, our partners still have.