When a global IT outage forced millions of computers offline in July 2024, the world didn’t stop turning — but many businesses ground to a halt.

The outage cost Fortune 500 companies alone an estimated $5.4 billion as card and phone payments and online banking were severely disrupted. But the 2024 outage may prove to be of good value if taken as a warning to prepare for other disruptions. “There will always be outages,” said Ron Delnevo, Chair of the Payment Choice Alliance (PCA). “But if there is no alternative, then the whole thing can collapse around you.”

Along with the risk of downtime, a largely cashless society deprives customers of choice and an element of privacy and security. But the pressure to go cashless is hard to avoid: ATM fees have reached record highs in the U.S., while in the UK, pay-to-use cash machines account for over a quarter of the country’s dwindling ATM fleet.

Businesses and consumers alike need to prepare for an increasingly electronic future. So, Merchant Machine has analyzed current trends in the reduction of ATM (automated teller machines) numbers around the world to see which countries and U.S. areas may go cashless first.

What We Did

We used World Bank data to find the number of ATMs available per 100k people in each country across the past 10 years of available data. Then, we ran a statistical model (ARIMA) to predict when each country would drop below one ATM (i.e., cashless) based on the current shrinkage rate. Finally, we found which countries and American states and cities struggle to access cash the most based on the number of “ATMs near me” searches on Google per one million internet users.

Key Findings

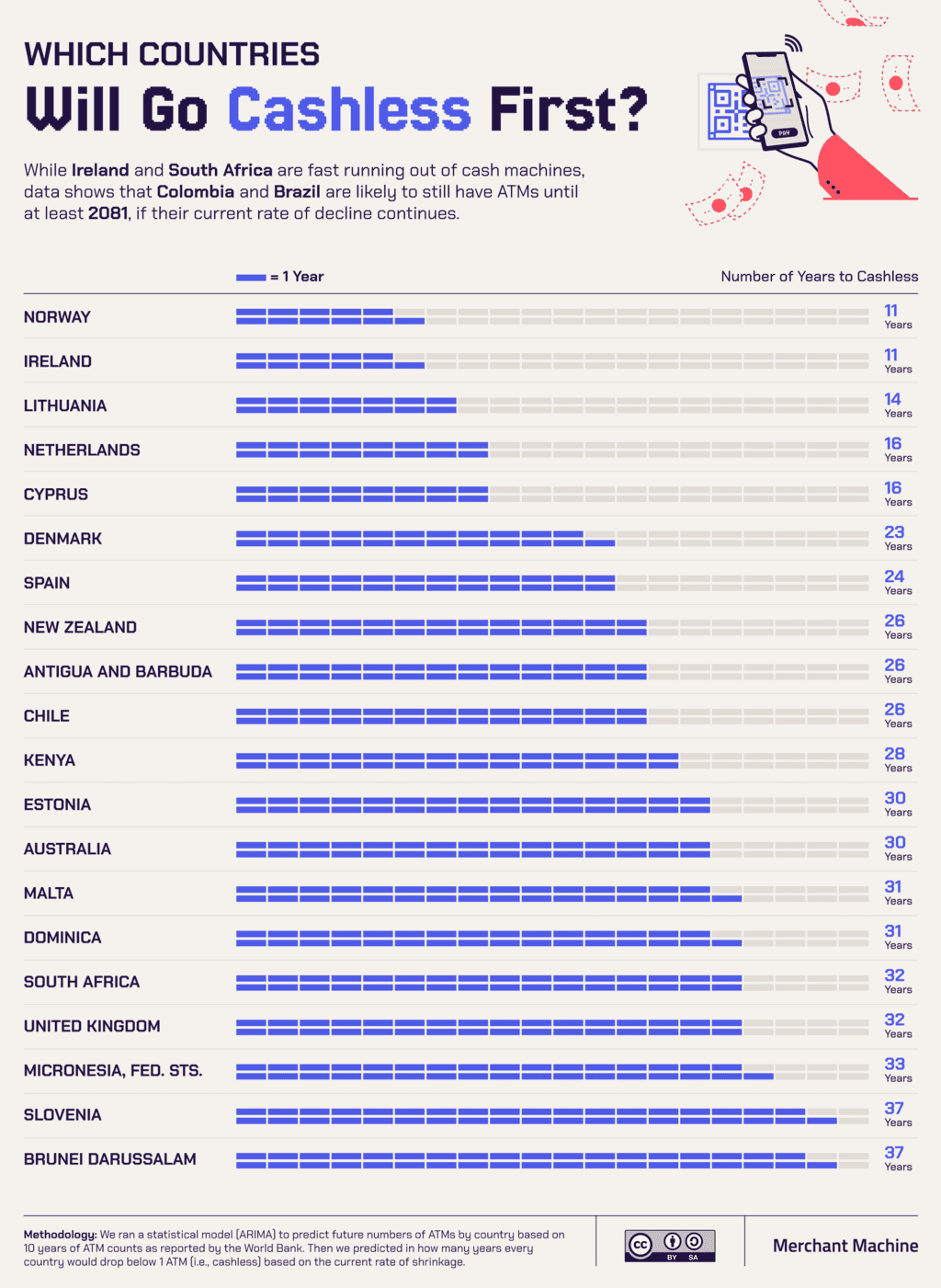

- Norway is projected to become the world’s first cashless country in 11 years if ATMs decline at the present rate.

- People in the United Arab Emirates struggle the most to find a cash machine, making 28,594 searches per million people for “ATMs near me.”

- Hawaii is the state where it’s toughest to find an ATM, with 2,508 searches per million people.

- The U.S. city with the hardest-to-find cash machines is Boston, with 5,506 searches per million people.

European Countries Are Losing ATMs the Fastest

First, we calculated how many years it will take for every country to reach zero cash machines if their decline continues at the same rate as the latest available figures (2020-21). The seven countries projected to be cashless first may lose their final ATM within a quarter of a century — and they’re all in Europe.

Norway (10.6 years) and Lithuania (11.3 years) are projected to close their final cash machines before any other country. In Norway, 98% of people have debit cards, and under 5% of transactions are made with cash. Electronic invoicing is the norm. And, in a country with a population of just 5.3 million, the mobile pay system Vipps has 2.1 million users making a quarter of a million transactions every day.

However, with around 600,000 people ‘locked out’ of Norway’s cashless services, the government has introduced legislation requiring retailers to accept cash or face sanctions. The country has also put the brakes on its transition to cashless in light of increasing cyber threats from neighbouring Russia. “If no one pays with cash and no one accepts cash, cash will no longer be a real emergency solution once the crisis is upon us,” said Justice and Emergencies Minister Emilie Enger Mehl. However, Norway’s central bank has also shown strong interest in developing a national cryptocurrency.

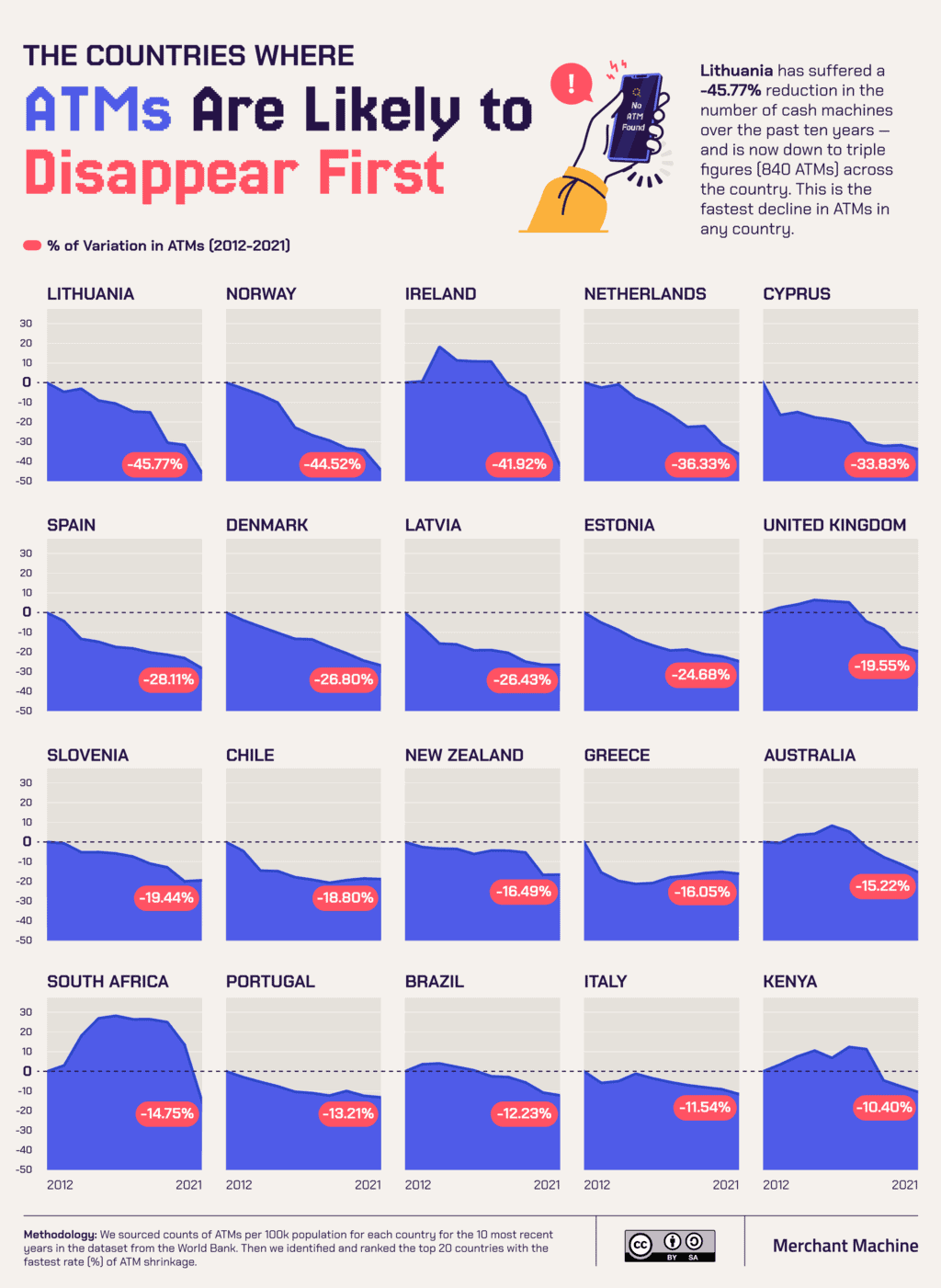

Our next graph shows the yearly ATM losses in the countries that have lost the most over the past ten years.

The UK has lost the tenth-most ATMs in the world over the past decade. The country lost -19.55% of its ATMs in the decade to 2021. Having lost -2.19% in 2021, the most recent year with available figures, the UK is projected to lose its final cash machine 32.5 years from then.

However, consumer action could still delay this. In 2024, Nationwide reported a second consecutive year of increased ATM usage, which the bank attributes to the decrease in ATMs provided by its competitors. The Nationwide report also suggests that households are responding “to the cost-of-living crisis by budgeting with physical money.”

Ireland and New Zealand Among Toughest Places to Withdraw Cash

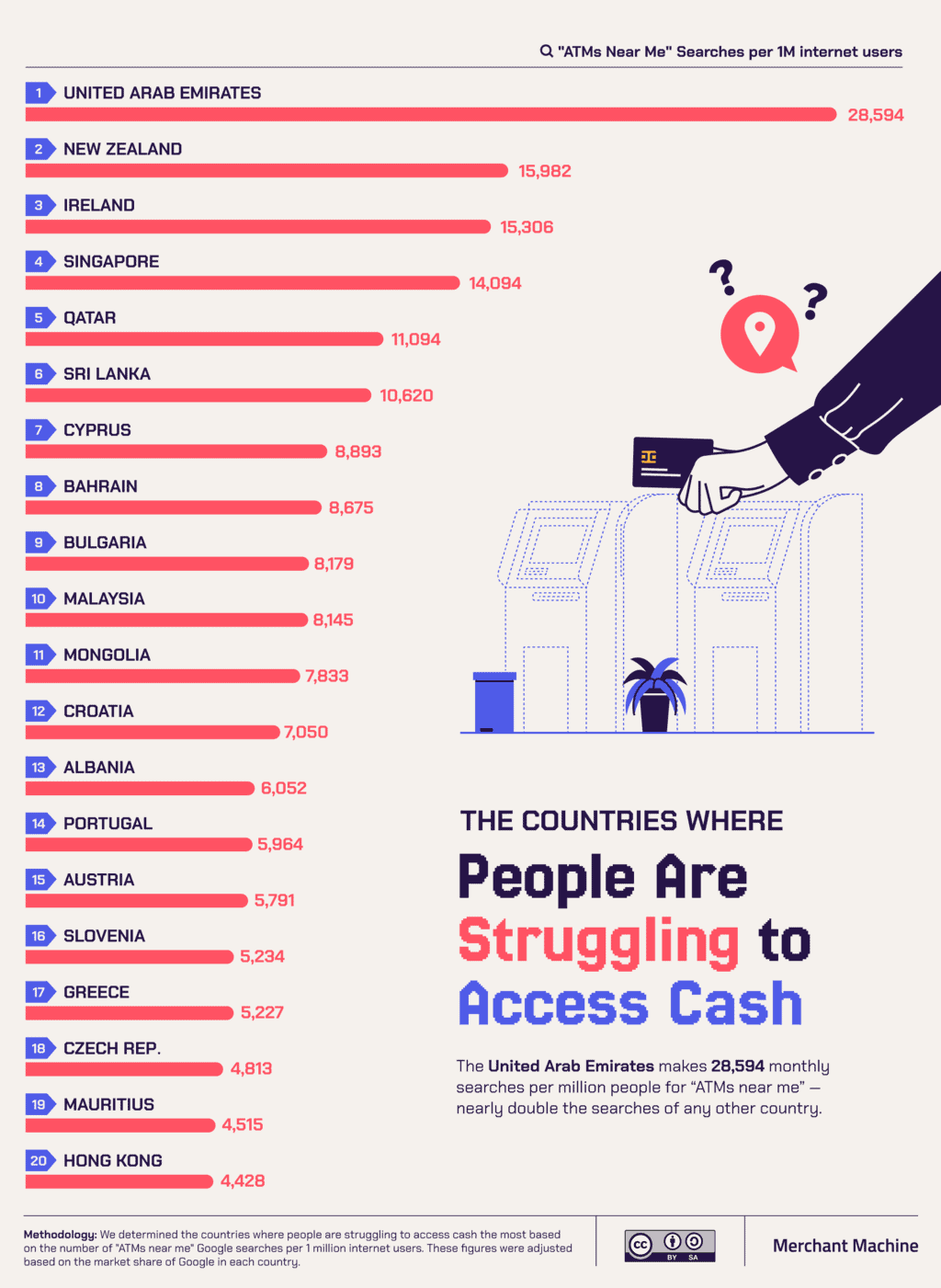

Next, we analyzed Google search volume data to find in which countries people most frequently search for “ATMs near me.” We found six countries with more than 10,000 searches per million people (adjusted based on Google’s market share in each country). Ten of the 20 countries with the most searches are in Europe, and none are in the Americas.

Ireland has the third most searches, with 15,306 per million people. Last year, the Irish government introduced new rules requiring certain retailers to accept cash to promote financial inclusivity. The legislation also requires banks to maintain a designated number of ATMs per 100,000 people and within certain geographic areas.

The United Arab Emirates makes nearly twice the number of searches than any other country, with 28,594 monthly searches per million people. The Middle Eastern country is the first to trial ‘Palm ID’ technology that scans a person’s palm veins to authenticate digital transactions — although this could also be used as verification at cash machines. The development comes as part of a region-wide drive towards cashless: neighbouring Saudi Arabia, which doesn’t feature among this top 20, is taking steps to make 70% of transactions cashless by 2030.

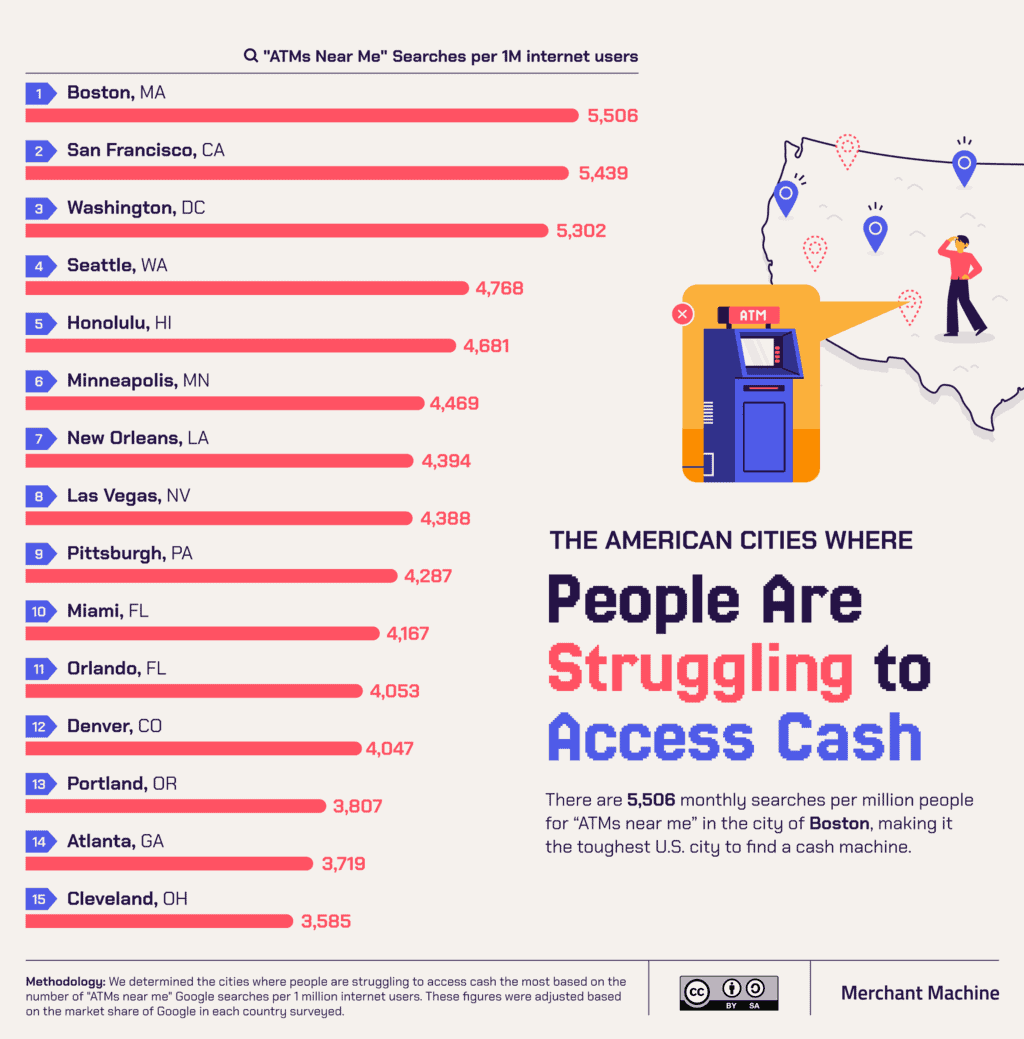

Boston and San Francisco Are Worst Spots for ATMs

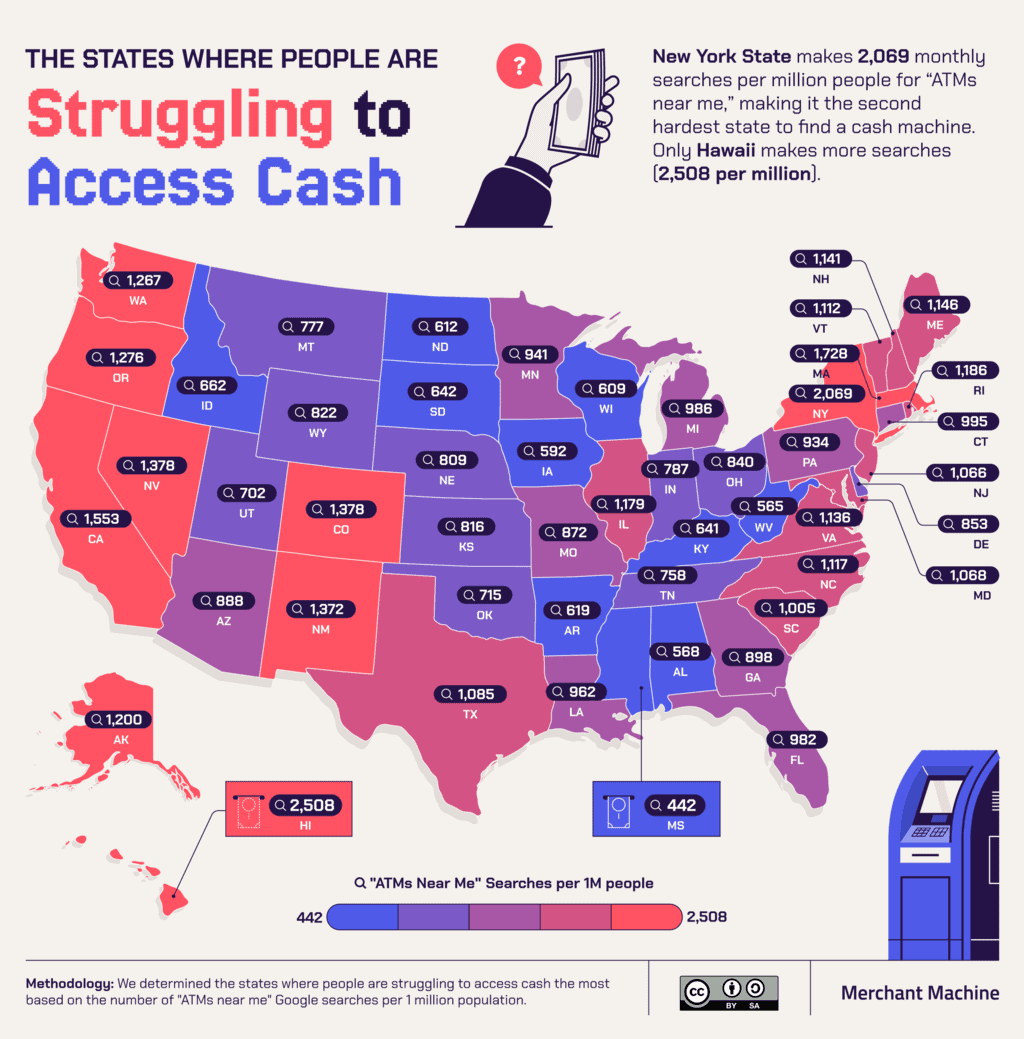

Finally, we crunched the numbers on search volume data in U.S. states and cities to see which places have the most searches for “ATMs near me.”

Hawaii (2,508 monthly searches per million people) and New York (2,069) are the states where people struggle the most to find an ATM. Last year’s Great New York State Fair was cashless, with many using reverse ATMs to put money onto a pre-paid Visa card. Such cards are designed as a convenience or to help out those who can’t access a traditional bank or credit card. However, the machines require a minimum cash input of $10. Users may end up with spare change stuck on the card, and some pre-paid cards also come with set-up or dormancy charges.

It is worth noting that despite Hawaii and New York being the top states where people struggle to access cash, no New York City features among the top 15 cities (below). This suggests that the lack of ATMs is more pronounced in rural or suburban areas of New York. However, Honolulu (4,681) is the fifth toughest U.S. city to find an ATM. The Bank of Hawaii alone closed 12 branches and removed 50 ATMs in 2021.

The cities where it is the most difficult to find an ATM are Boston (5,506 searches per million people), San Francisco (5,439) and Washington, D.C. (5,302). Boston state law requires that “no retail establishment … shall discriminate against a cash buyer. … All such retail establishments must accept legal tender [cash] when offered as payment.” However, several key Boston locations refuse cash, including Fenway Park and Gillette Stadium, which provide reverse ATMs instead.

During the pandemic, when retailers began to refuse cash as a hygiene measure, Boston’s Attorney General Maura Healey tweeted: “Businesses should take thoughtful measures to keep their employees and consumers safe, but let’s keep our economy open to everyone.”

A Hybrid Future

Temporary IT outages are far from the only drawback of a cashless society. Cash helps people to budget, particularly among some vulnerable groups. According to the Bank of England, 31% of people without educational qualifications and 26% in poor health rely on cash to a “great or very great extent.” A reduction in cash services also makes it more expensive for those who choose or need to pay by cash, creating a “poverty premium.”

“Designed with usability in mind, cash is accessible to all, imposing no credit checks or age requirements that can limit other payment options,” says anti-cashless campaign site Cash Matters. “Its physical nature also incorporates features making them easily distinguishable (e.g. different sizes of banknotes or coins) to support people with visual impairments or learning disabilities.”

And then, there are the card processing costs absorbed by businesses and their customers. “Every month we pay about £700 on average for the card transactions,” says Muirhouse shopkeeper Urfan Hussain. “So that’s basically £700 out of your profits whereas cash, when people used to use cash every day it was great.”

The advantages of electronic transactions for merchants are manifold, even if the costs are unavoidable. But it’s important to remember that while cash may no longer be king, it still has a fundamental role to play in the lives of everyday people.

Methodology & Sources

We first sourced counts of ATMs per 100k population for each country for the 10 most recent years available in the World Bank dataset. Next, we cross-referenced these figures against the World Bank’s country population counts by year to calculate the number of ATMs reported each year. With all this past data in hand, we then ran a statistical model (ARIMA) to predict future numbers of ATMs based on the past data. Lastly, we predicted in how many years every country would drop below one ATM (i.e., cashless) based on the current shrinkage rate.

In addition, we determined which countries, states and U.S. cities are struggling to access cash the most based on the number of “ATMs near me” Google searches per one million internet users. These figures were adjusted based on Google’s market share in each country, as we sourced Google search volume data from Semrush as of December 2024.

Leave a Reply